Valued at a market cap of $376.6 billion, The Home Depot, Inc. (HD) is the world’s largest home-improvement retailer, headquartered in Atlanta, Georgia. It operates a nationwide network of big-box stores across the U.S., Canada, and Mexico, offering a broad range of products for home renovation, construction, gardening, and maintenance, including building materials, tools, appliances, and décor.

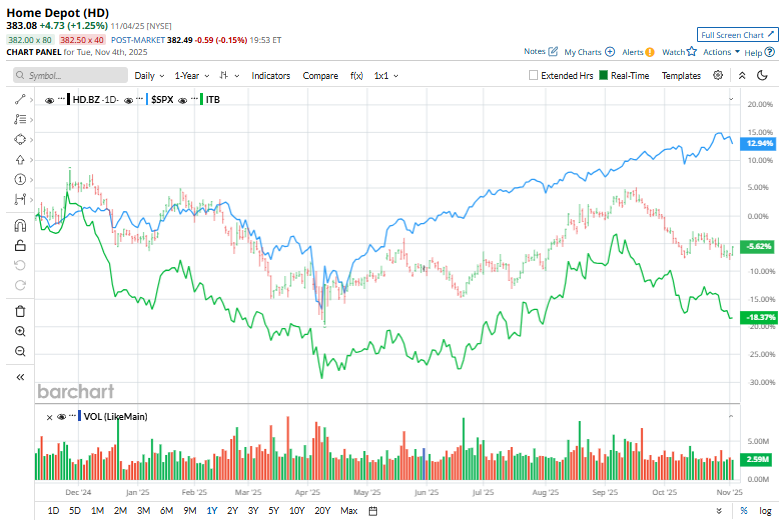

This home improvement giant has lagged behind the broader market over the past 52 weeks. Shares of HD have declined 3.2% over this time frame, while the broader S&P 500 Index ($SPX) has surged 18.5%. Moreover, on a YTD basis, the stock is down 1.5%, compared to SPX’s 15.1% uptick.

However, zooming in further, HD has outpaced the iShares U.S. Home Construction ETF’s (ITB) 16.9% loss over the past 52 weeks and 4.4% fall in 2025.

Home Depot’s stock gained 3.2% on Aug. 19 after releasing Q2 2025 results despite adjusted EPS of $4.68 and revenue of $45.28 billion falling short of estimates. The market responded positively to the retailer’s 4.9% year-over-year sales growth, a 1.4% lift in U.S. comparable sales, and management’s upbeat commentary about ongoing strength in smaller home-improvement projects.

For the current fiscal year, ending in January 2026, analysts expect HD’s EPS to decline 1.5% year over year to $15.01. The company’s earnings surprise history is mixed. It surpassed the consensus estimates in two of the last four quarters, while missing on two other occasions.

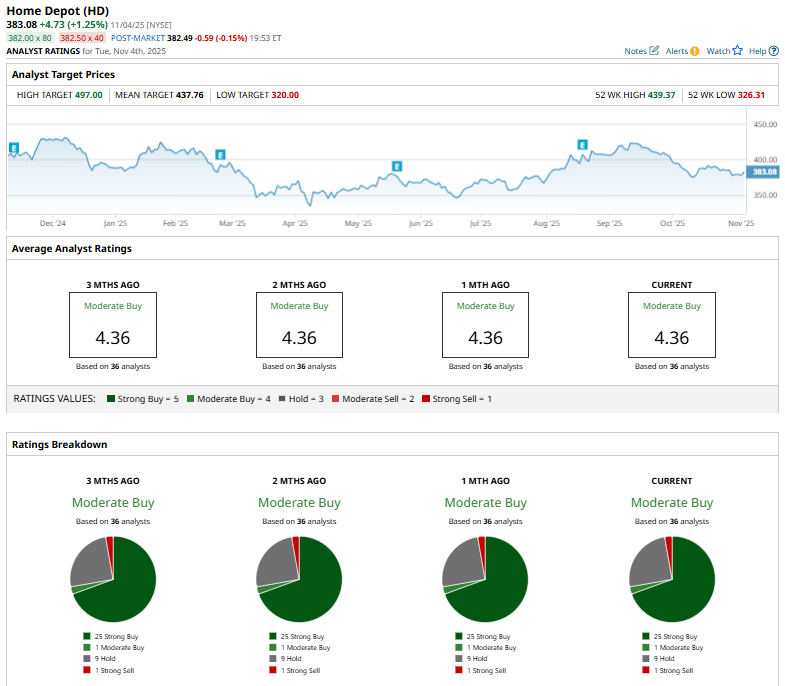

Among the 36 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 25 “Strong Buy,” one "Moderate Buy,” nine “Hold,” and one “Strong Sell” rating.

This configuration has been consistent over the past few months.

On Sept. 18, 2025, Wolfe Research initiated coverage on Home Depot with an “Outperform” rating and a $497 price target, marking Spencer Hanus’s first recommendation on the stock.

The mean price target of $437.76 represents a 14.3% premium from HD’s current price levels, while the Street-high price target of $497 suggests an upside potential of 29.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Volatility Alert: 10 Stocks Showing High IV Percentile

- Nasdaq Futures Slip on Weak Tech Earnings and Valuation Concerns, U.S. ADP Jobs Report in Focus

- This Dividend Stock Got Butchered After Q3 Earnings: Time to Buy the Dip?

- Beyond Meat Just Delayed Its Earnings Release. Should You Jump Ship in BYND Stock Now?