Urban air mobility has long lived somewhere between science fiction and city planning decks. Today, electric vertical takeoff and landing aircraft (eVTOLs) are slowly dragging that vision into reality. The promise is compelling – quieter skies, shorter commutes, and a new layer of transportation above gridlocked roads. For now, the market remains narrow, mostly serving high-value routes like airport shuttles for affluent travelers or time-critical medical missions.

That future is already shaping investor behavior. Cathie Wood, known for backing disruptive technologies well before they turn mainstream, has been steadily adding exposure to advanced air mobility. In early 2026, Wood’s ARK Space Exploration & Innovation ETF (ARKX) increased its stakes in the sector’s two top names - Joby Aviation (JOBY) and Archer Aviation (ACHR) – doubling down on a long-term bet rather than short-term hype.

Joby Aviation is taking the long road, blending aircraft development with real-world operations, manufacturing scale, and partnerships that put its tech in front of everyday users. Archer Aviation is moving with a sharper focus, leaning on airline alliances, military deals, and a clear urban launch playbook. Both are chasing the same destination from different angles.

So, let us take a closer look at Cathie’s fresh buys now.

Flying Car Stock #1: Joby Aviation

Founded in 2009, Santa Cruz, California-based Joby Aviation is building the foundation of next-generation urban air travel. The company designs quiet eVTOL aircraft capable of flying up to 100 miles while reducing noise and emissions. Joby’s vertically integrated model spans aircraft design, flight testing, manufacturing, pilot training, and certification.

In the U.S., the company plans to launch commercial services starting in New York City and Los Angeles, while Dubai is slated to be its first international market. Backed by strategic partners like Toyota (TM), Delta (DAL), and Uber (UBER), and powered by a team of more than 1,700 specialists, Joby is aiming to make aerial ridesharing a part of everyday life. The company currently carries a market capitalization of about $14.1 billion.

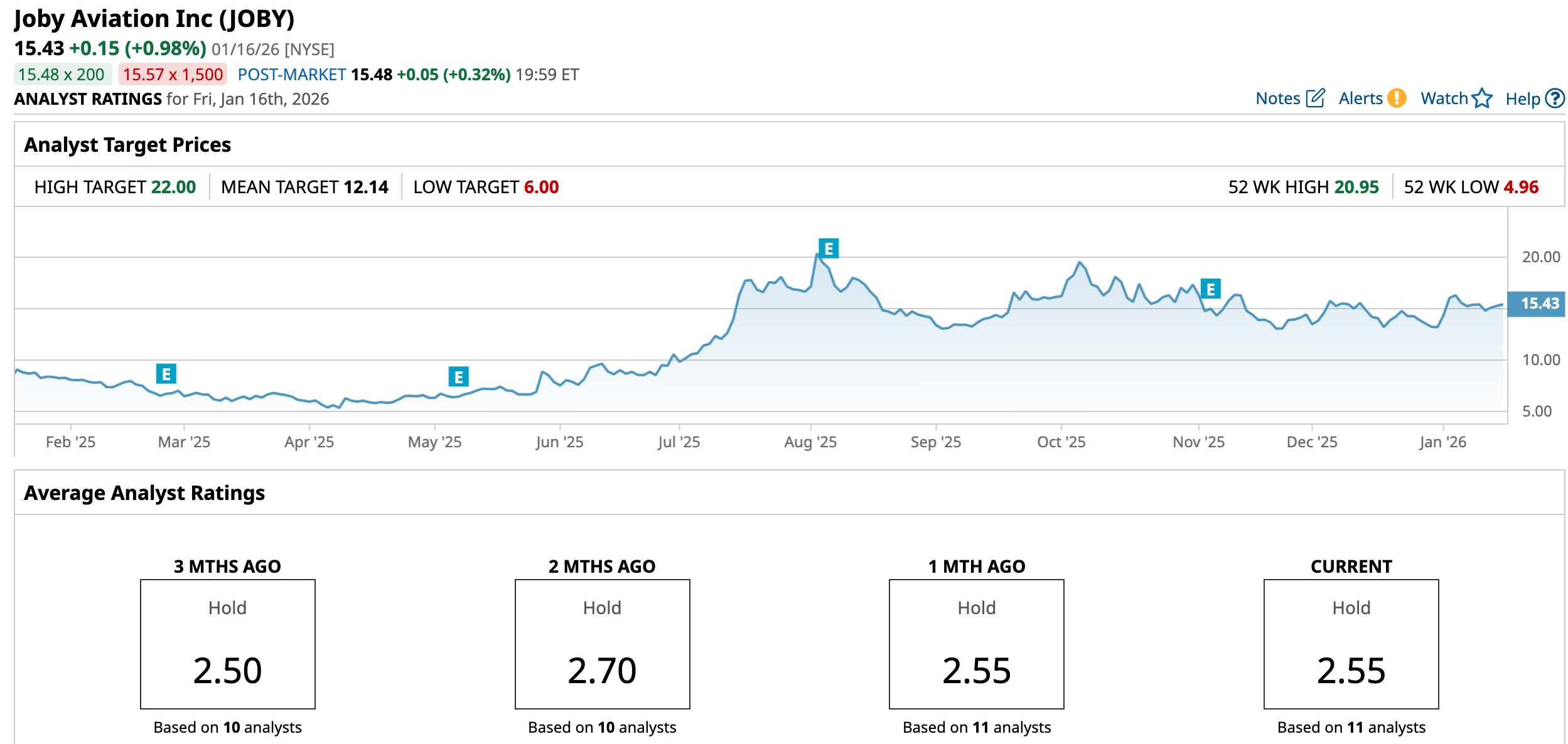

Back in April, shares of Joby were trading at a 52-week low of $4.96 as investors questioned timelines and patience wore thin. Then the tone changed. Momentum flipped, volume followed, and JOBY took off – rallying in August and hitting a high of $20.95. Since then, the stock has cooled, giving back about 36% of those gains. Still, zoom out, and the move is hard to ignore – from the lows, JOBY is up more than 200%, with roughly 84.4% gains over the past year.

The recent pullback has less to do with Joby itself and more with macro gravity. Hotter inflation data pushed rate-cut hopes further out, and that is never friendly for long-duration growth names. Companies like Joby, which are still pre-revenue, cash-burning, and dependent on future scale, feel that repricing quickly. Add in certification risk – Federal Aviation Administration (FAA) certification remains the big gate – and volatility comes with the territory.

Technically, though, the chart looks more like a pause than a breakdown. Volume exploded during the June-to-August breakout, confirming strong institutional participation. Since then, volume has faded, a normal sign of consolidation. The 14-day RSI has cooled from overbought levels and now sits in the low-to-mid 50s, signaling neutral momentum. Meanwhile, the MACD oscillator is steady again, with a bullish crossover and a positive histogram, indicating that momentum may be rebuilding beneath the surface.

With JOBY stock slipping recently, Cathie Wood stepped in and picked up 162,270 shares via the ARK Space Exploration & Innovation ETF, a roughly $2.6 million move. This buy gives Joby a 2.7% weighting in the ARKX fund. The timing was not random.

Joby has been quietly laying serious groundwork, announcing the purchase of a massive 700,000-square-foot manufacturing facility in Dayton, Ohio. It is part of a broader $61.5 million push to scale production in the state. The goal is to turn eVTOL ambition into assembly-line reality, with the Ohio setup aimed at rolling out four aircraft a month by 2027.

On Nov. 5, Joby reported mixed third-quarter 2025 results, with losses widening and missing expectations, which is not shocking for a company still deep in certification mode. The company posted a $0.48 per-share loss, more than double last year’s $0.21, a reminder that building, certifying, and scaling an electric air taxi is not cheap.

But for the first time in a while, revenue showed up in a meaningful way. Quarterly revenue jumped to $22.6 million from just $0.03 million in the year-ago quarter, thanks largely to the August acquisition of Blade’s passenger business. That move instantly put Joby into real-world operations. During the quarter, roughly 40,000 passengers flew on Blade routes, including Ryder Cup fans who skipped long drives for quick 12-minute hops. It is not massive scale yet, but it is proof that the model can work outside a slide deck.

Meanwhile, operating costs rose 30% year-over-year (YOY), driven by heavier R&D spend and a sharp increase in SG&A as Joby preps for manufacturing and integrates Blade. Adjusted EBITDA came in at -$132.8 million, reflecting that this is still very much an investment phase.

The balance sheet, though, tells a calmer story. Joby ended the quarter with $208.4 million in cash and followed up in October with an equity raise that brought in about $576 million. That capital gives management room to push through certification, scale production, and line up a commercial launch without constantly watching the clock.

Strategically, Joby kept building quietly. It expanded its partnership with Uber, integrated Blade into the Uber app, logged more than 600 flights in 2025, flew point-to-point in California, and ran scheduled operations in Osaka during World Expo 2025. It’s still early and expensive, but the pieces are starting to connect.

For 2025, management expects to generate cash, cash equivalents, and short-term investments at the upper end of the $500 million to $540 million range.

Wall Street analysts are keeping their guard up when it comes to Joby Aviation’s road to profitability. Near-term pressure is expected to build, with analysts forecasting the current quarter’s loss per share widen 5.3% YOY to -$0.20. For the full fiscal year, losses are seen growing by 7.6% annually to around -$0.85 per share. But looking further ahead to fiscal 2026, estimates begin to level out, with loss projected to narrow by 11.8% to -$0.75 per share.

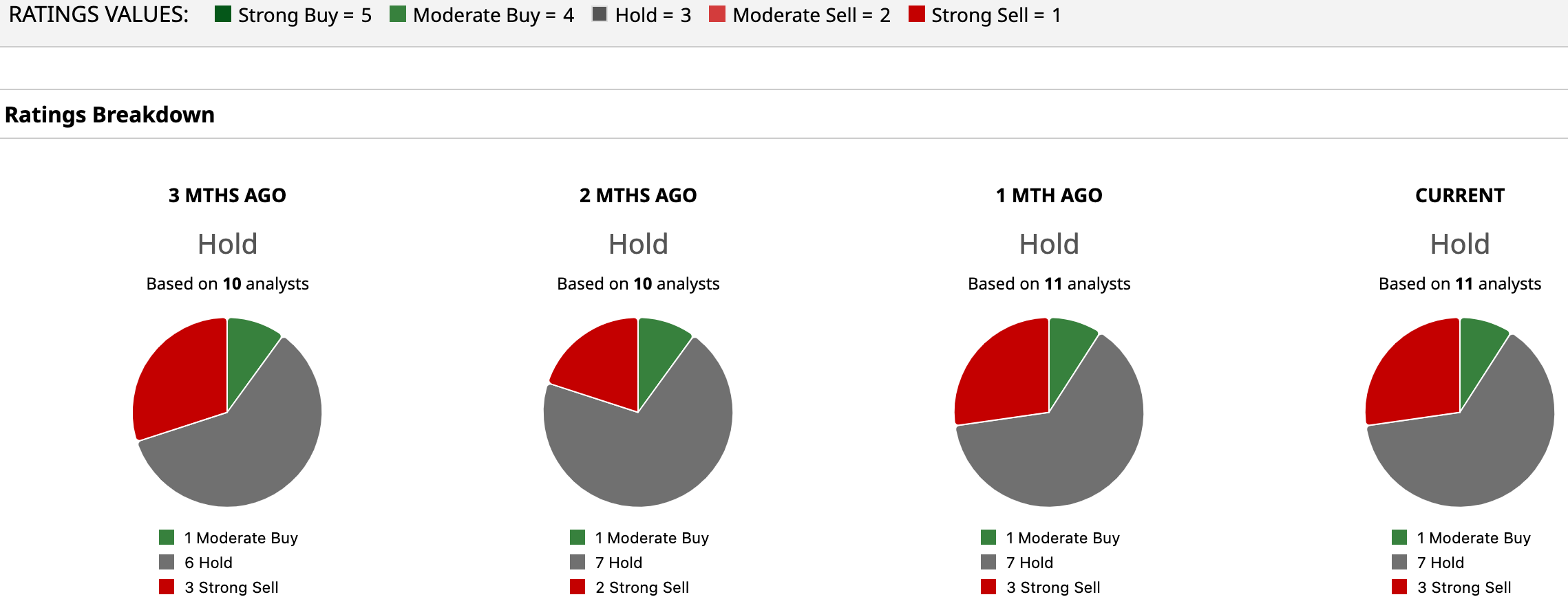

Wall Street analysts recommend caution at the moment, giving a consensus “Hold” rating overall. Of the 11 analysts rating the stock, one analyst has a “Moderate Buy” rating, seven analysts take a middle-of-the-road approach with a “Hold,” and the remaining three have a “Strong Sell” rating.

JOBY’s rally this year has pushed the stock above the consensus price target of $12.14, but the Street-high price target of $22 indicates 42.6% potential upside from here.

Flying Car Stock #2: Archer Aviation

Founded in 2018 and based in California, Archer Aviation is taking aim at short-haul urban travel with its eVTOL aircraft, Midnight. Built for quick 20-50 mile trips, the four-seat air taxi is designed to turn long city drives into quiet, sub-20-minute flights.

Valued at a market capitalization of $5.8 billion, Archer is pairing commercial air mobility ambitions with growing defense and airline partnerships. As it advances through certification and manufacturing, the company is positioning Midnight for an anticipated commercial rollout in the near term, pushing urban aviation closer to everyday reality.

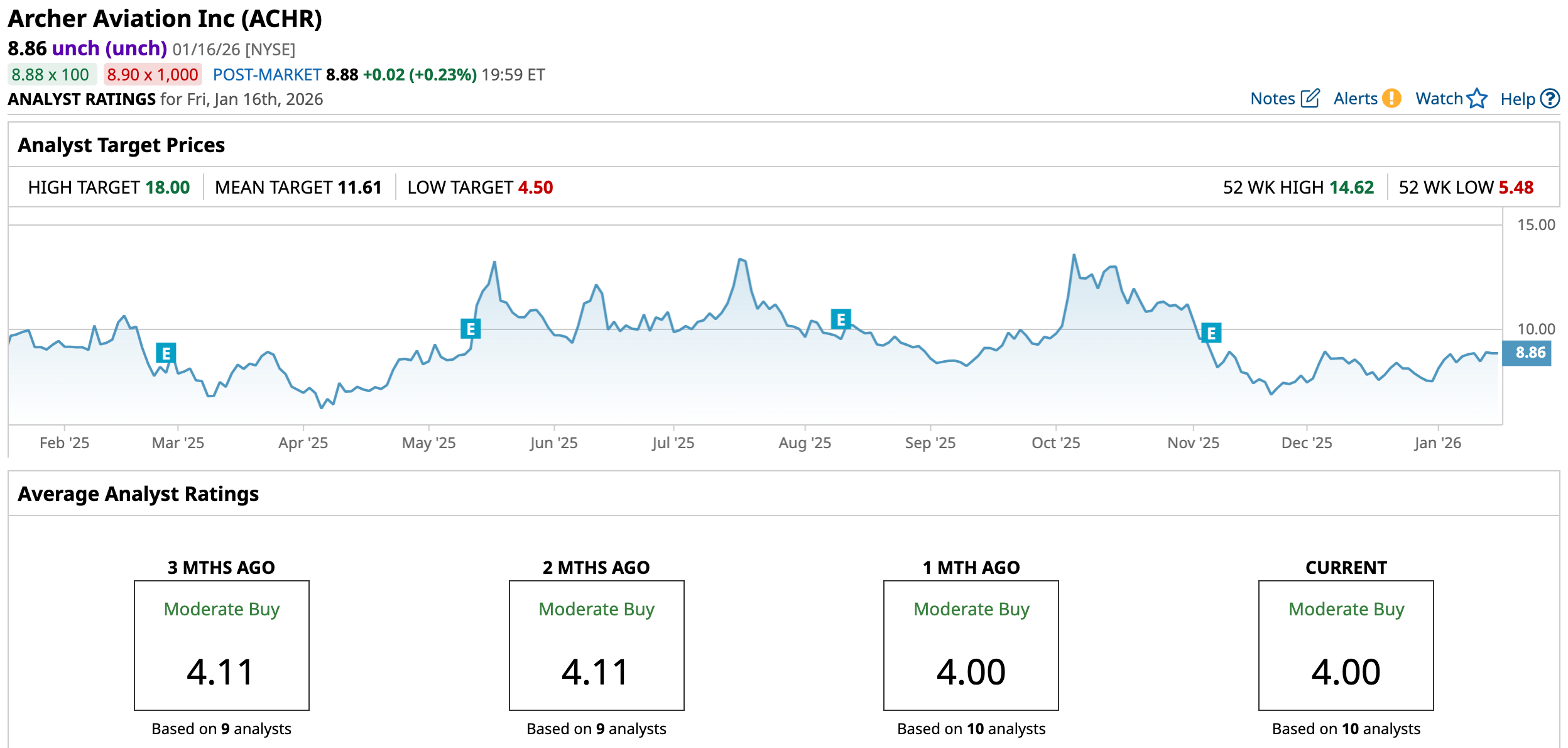

After a rough 2024, ACHR finally found steadier air in 2025. Shares bottomed out at a 52-week low of $5.48 in April, then staged a sharp comeback, climbing about 62.3% from those depths. That kind of rebound does not happen quietly. The ride has not been smooth, though.

Over the past six months, the stock dipped roughly 26.72%, a reminder that patience is mandatory in pre-revenue aviation plays. ACHR peaked near $14.62 in October before cooling off. A mid-October dip of about 9% followed news of its €18 million patent acquisition from Lilium, as investors balanced long-term strategic value against near-term cash burn and profitability timelines.

Short-term momentum, however, has turned steady again. Shares are still up 11.45% over the past month and have gained about 17.83% into 2026. The rally was driven by record-setting test flights, expanding partnerships across Japan and the Middle East, and Archer’s headline role as the official air-taxi provider for the 2028 Los Angeles Olympics.

Technically, the setup looks healthy. The 14-day RSI sits at 56.34, cooling from overbought levels but trending higher, suggesting room for further upside. The MACD oscillator has stabilized with a MACD line over the blue signal line and a positive histogram, signaling momentum in the future.

After Archer rolled out its Nvidia (NVDA) partnership recently, plugging serious AI muscle into future aircraft, Cathie Wood did not hesitate, scooping up 73,097 of Archer’s shares. This gives Archer a 4.97% weighting in the ARKX fund. The market nodded in approval, pushing ACHR up 3.4% on the headline.

On Nov. 6, Archer Aviation reported its third-quarter numbers, and the company did not generate any revenues again. No surprise there, but spending stayed mostly in line. Operating expenses climbed 43.2% YOY to $174.8 million, though they dipped slightly from Q2, suggesting costs are starting to stabilize rather than spiral. Losses widened from last year but improved sequentially, with adjusted EBITDA at -$116.1 million. Meanwhile, net loss came in at $129.9 million, or -$0.20 per-share loss.

The real story, though, sits on the balance sheet. Archer ended the quarter with a hefty $1.64 billion in cash and short-term investments, plus an additional $7.3 million in restricted cash. That gives it plenty of runway to keep pushing toward certification without having to tap markets anytime soon.

Archer has inked deals with the U.S. military and major airlines, locked in its role as the official air taxi for the 2028 Los Angeles Olympics, and even bought a regional airport to make that moment count. It’s still pre-revenue, but the destination is clearly mapped.

At CES 2026, the company raised the bar again, unveiling plans to build its next generation of AI-powered aircraft systems on NVIDIA’s IGX Thor platform. The partnership, in the works since early 2025, brings real-time, safety-critical AI into Archer’s future aircraft, sharpening pilot awareness, smoothing airspace integration, and laying the groundwork for autonomy. The debut will happen at Archer’s Hawthorne airport hub in LA, doubling as both its air-taxi nerve center and a live test bed for what AI-first aviation could look like next.

Wall Street analysts tracking Archer are finding a small bright spot – the company appears to be tightening the gap on its losses. For the current quarter, losses are expected to decrease 52.8% YOY to -$0.25 per share. For the current year, losses are projected to decline 27.5% YOY to -$1.03 per share, followed by another 7.8% annual reduction to -$0.95 per share in fiscal 2026.

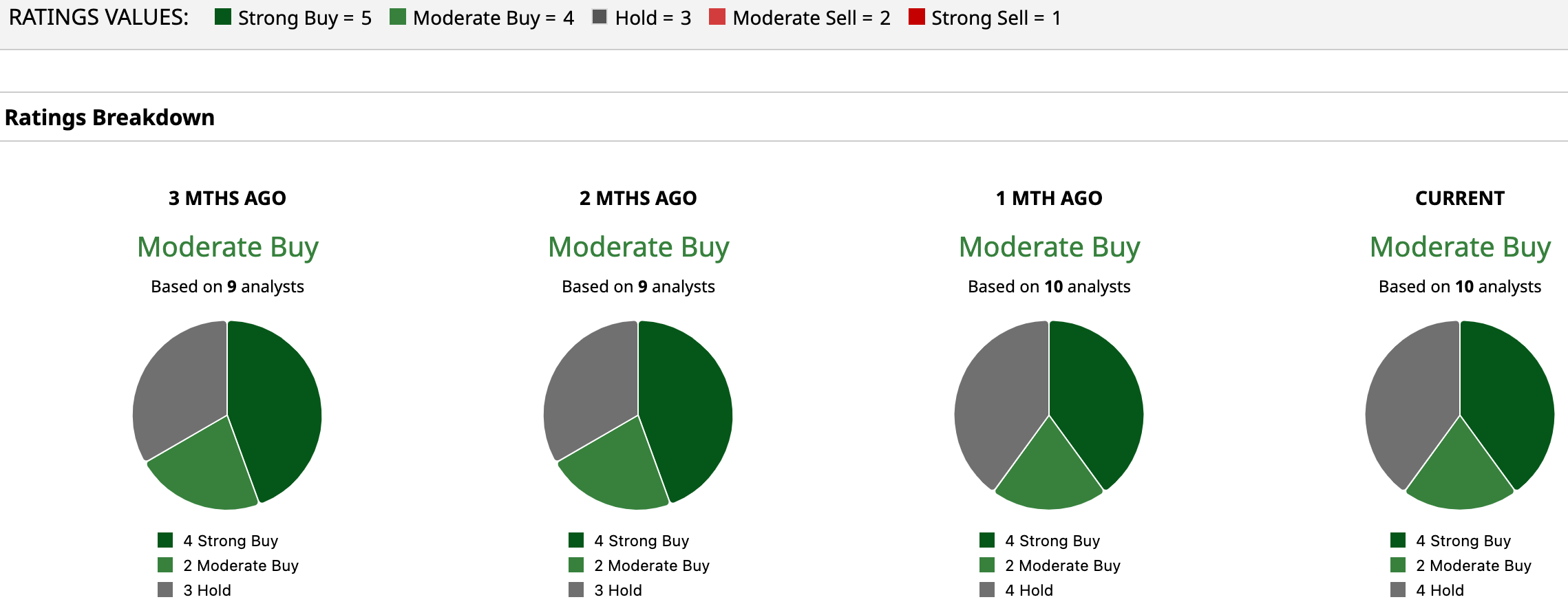

ACHR stock has a consensus “Moderate Buy” rating overall. Of the 10 analysts covering the stock, four recommend a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining four play it safe with a “Hold” rating.

The mean price target of $11.61 suggests the stock has an upside potential of 31% from the current level. The Street-high of $18 implies ACHR could rally as much as 103%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart