Expand Energy Corporation (EXE) is an Oklahoma-based energy company primarily focused on the exploration, development, and production of natural gas. Valued at $23.8 billion by market cap, the company operates a high-quality portfolio of shale assets, with a strong presence in major U.S. gas basins such as the Haynesville and Marcellus, positioning it as a leveraged participant in North American natural gas markets.

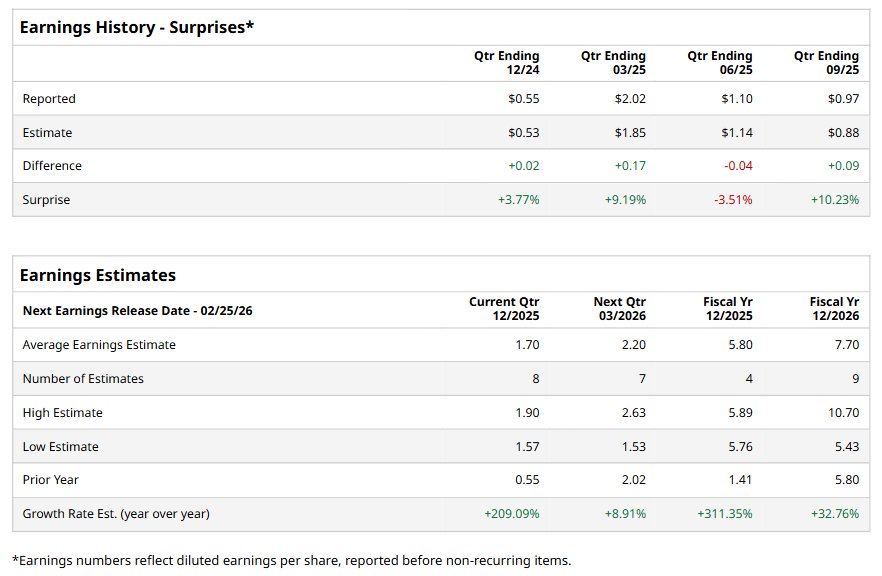

The independent natural gas production company is expected to announce its fiscal fourth-quarter earnings soon. Ahead of the event, analysts expect EXE to report a profit of $1.70 per share on a diluted basis, up 209.1% from $0.55 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For FY2025, analysts expect EXE to report EPS of $5.80, up 311.4% from $1.41 in fiscal 2024. Its EPS is expected to rise 32.8% year over year to $7.70 in fiscal 2026.

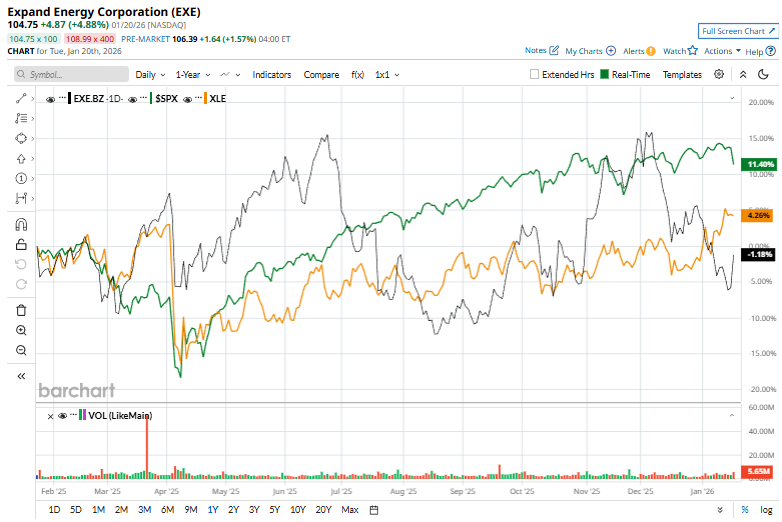

EXE shares have decreased 1.5% over the past year, underperforming the S&P 500 Index’s ($SPX) 13.3% gains and the Energy Select Sector SPDR Fund’s (XLE) 1.3% rise over the same time frame.

Expand Energy shares rose more than 4% on Jan. 20, outperforming peers as U.S. natural gas prices surged over 26% to a three-week high, driving broad strength across natural gas–focused producers.

Analysts’ consensus opinion on EXE stock is bullish, with a “Strong Buy” rating overall. Out of 29 analysts covering the stock, 24 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and three give a “Hold.” EXE’s average analyst price target is $132.44, indicating an ambitious potential upside of 26.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart