Autonomous driving (AD) has quietly shifted from science fiction to live traffic in just a few quarters. Even Tesla (TSLA) CEO Elon Musk has tied his compensation to launching 1 million robotaxis, calling autonomous fleets "the largest asset value increase in human history."

Meanwhile, industry research now pegs the global robotaxi market at well under $1 billion in 2025 but sees it swelling into the mid‑$100 billion range by 2033, as commercial services scale across major cities worldwide. Together, these signals have brought self‑driving car stocks back into sharp focus.

Legendary investor Cathie Wood appears to be making her move now. Last week, Wood added to her positions in three pure‑play autonomous driving names that sit at very different points of the value chain, signaling that her conviction extends well beyond Tesla to more specialized operators.

If Wood is right and autonomous services are about to shift from proof‑of‑concept to serious revenue generators, could these three stocks be where the next wave of outperformance is hiding? Let's find out.

Self-Driving Car Stock #1: Pony AI Inc (PONY)

Pony.ai (PONY) is a Guangzhou, China and Fremont, California based autonomous driving firm developing Level 4 robotaxi systems and software for large‑scale commercial self‑driving services in major cities. PONY stock sits at $16.47 with a year-to-date (YTD) gain of 14% and a 52‑week advance of 24% currently.

With a market capitalization of $6.38 billion, PONY stock trades at 74.5 times sales and a price-to-book ratio of 7.44 times, sitting well above sector medians. That highlights how much the market is willing to pay for perceived leadership in autonomous mobility.

Pony.ai deepened its industrial base on Jan. 8 by expanding its partnership with BAIC BJEV to co‑develop and mass produce next‑generation robotaxi models, tightly pairing its autonomous stack with BAIC’s dedicated electric vehicle (EV) platforms. Pony.ai's strategy also pushes further into capital efficiency through a November 2025 agreement with Sunlight Mobility to implement an asset-light model. Through the agreement, Sunlight will take on vehicle ownership and fleet management while Pony.ai concentrates on technology, operations, and commercialization.

The latest financial snapshot from Pony.ai shows how that commercial push is filtering into the numbers without eliminating losses yet. For the quarter ended Sept. 30, 2025, the company saw a per‑share loss of $0.16 as spending stayed focused on engineering and fleet rollout.

Pony.ai generated $25.4 million in sales for the period, a 72% increase year-over-year (YOY), indicating that paid robotaxi and related services are beginning to scale. Still, the quarter produced a net loss of $61.6 million.

Pony.ai is expected to report next on March 24, with fiscal 2025 guidance pointing to a narrower full‑year loss and an average EPS estimate of -$0.08 versus -$2.45 in the prior year. That implies a forecast 97% YOY improvement.

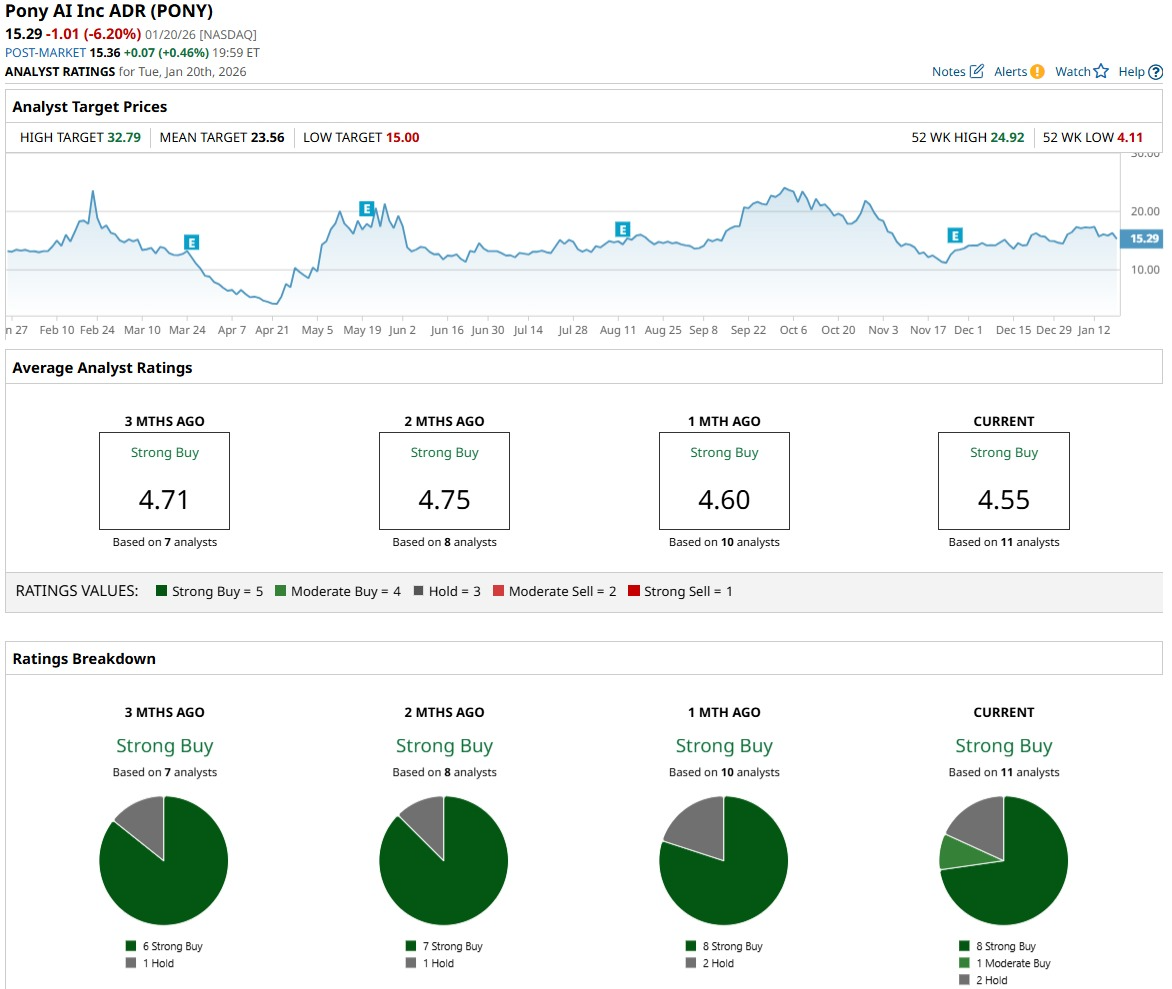

This outlook is supported by a consensus “Strong Buy” rating from 11 analysts and an average price target of $23.56. That target implies roughly 42% potential upside from the current price.

Self-Driving Car Stock #2: WeRide (WRD)

With a market cap of $2.93 billion, WeRide (WRD) is a Guangzhou, China-based autonomous mobility firm developing self‑driving technology for robotaxis, robobuses, and robo‑vans across Asia, the Middle East, and beyond. As of Jan. 23, WRD stock changed hands for about $9 per share with a YTD gain of 3% and a 52‑week drop of 38%.

WRD stock trades at 38.5 times sales versus a sector median of 1, showing a rich premium for its diversified autonomous‑ride and logistics network.

WeRide took a major strategic step in late 2025 by teaming up with Uber (UBER) to launch autonomous robotaxi rides in Dubai. The partnership gives Uber a new AV option in a forward‑leaning jurisdiction while giving WeRide a high‑visibility showcase that can support future deals and regulatory discussions in other markets.

The latest earnings picture helps explain why Cathie Wood is willing to look past near‑term red ink. WeRide reported a loss of $0.15 per share for the quarter ended Sept. 30, 2025, as the company continued to prioritize R&D and fleet rollout across multiple formats. That said, the business generated $24 million in sales, representing 144% YOY growth and confirming that commercial robotaxi, robobus, and logistics programs are scaling from a small base.

This same period delivered a net loss of $43.2 million, yet the 24% improvement in net income growth versus a year earlier highlights that costs are not rising as fast as revenue. That dynamic feeds into estimates calling for fiscal 2025 EPS of -$1.27 and fiscal 2026 EPS of -$1.22, compared with prior‑year losses of -$2.77 and -$1.27. That implies expected YOY improvements of 54% and 4%, respectively, as operating leverage builds.

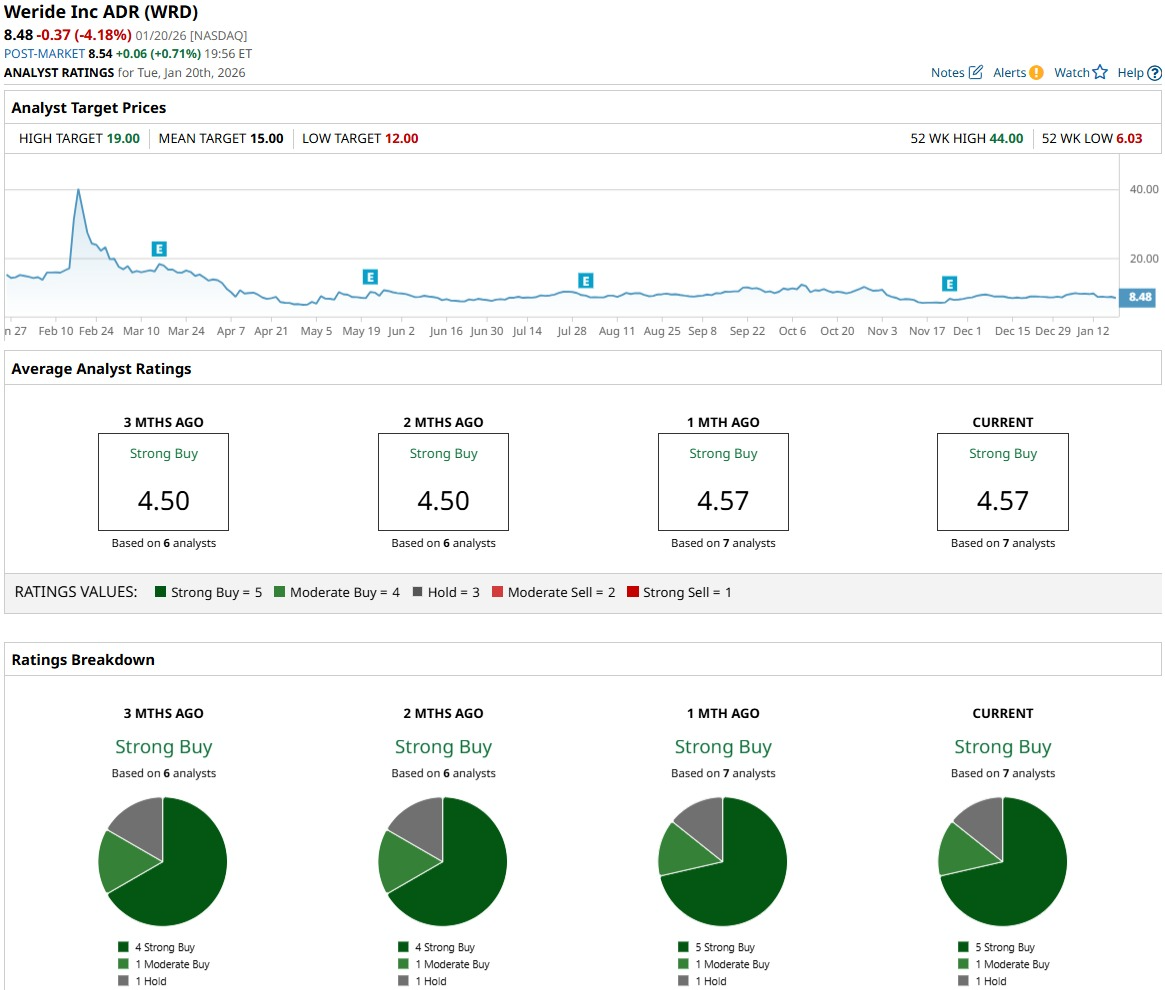

WRD stock carries a consensus “Strong Buy” rating from seven analysts. The average price target of $15 points to roughly 67% potential upside from the current price.

Self-Driving Car Stock #3: Kodiak AI (KDK)

Headquartered in Mountain View, California with operations in Texas, Kodiak AI (KDK) is an autonomous freight firm developing self‑driving technology, hardware, and software for long‑haul Class 8 trucking across key U.S. freight corridors. KDK stock trades at $9.44 as of Jan. 23 with a YTD decline of 14% and a 52‑week loss of 15%, leaving the stock in negative territory even as its commercial partnerships deepen.

With a $1.66 billion market cap, KDK stock is valued at 22.1 times cash flow, far above the sector median, showing that investors are assigning a steep premium for its potential.

This year brought a notable milestone for KDK via a strategic agreement to scale Kodiak’s autonomous trucking hardware and sensor solution together with Bosch, including redundant braking, steering, and power systems designed for highway‑speed autonomy. The company then reinforced the ecosystem angle with a separate partnership with Verizon (VZ), which is providing connectivity and IoT services to link autonomous trucks, cloud systems, and fleet operations in real time.

Kodiak’s latest financial update saw a Q3 2025 loss per share of $0.49 versus the $0.16 loss consensus estimate. That $0.33 shortfall shows how aggressively Kodiak is still investing. Released on Nov. 12, the same Q3 report also detailed operating cash flow of -$70.2 million during the quarter, a 3,292% deterioration YOY as R&D and deployment spending accelerated. This negative operating cash flow was offset by net cash flow of $129.5 million, a 15,515% improvement driven largely by financing activities that bolstered the balance sheet.

Estimates ahead of the next earnings release call for Q4 2025 EPS of -$0.16 and a full‑year 2025 loss of -$4.15 versus prior‑year EPS of $0.42. Those same forecasts then see earnings improving sharply to an expected -$0.77 in fiscal 2026, an implied 81% YOY gain in earnings power if Kodiak can execute.

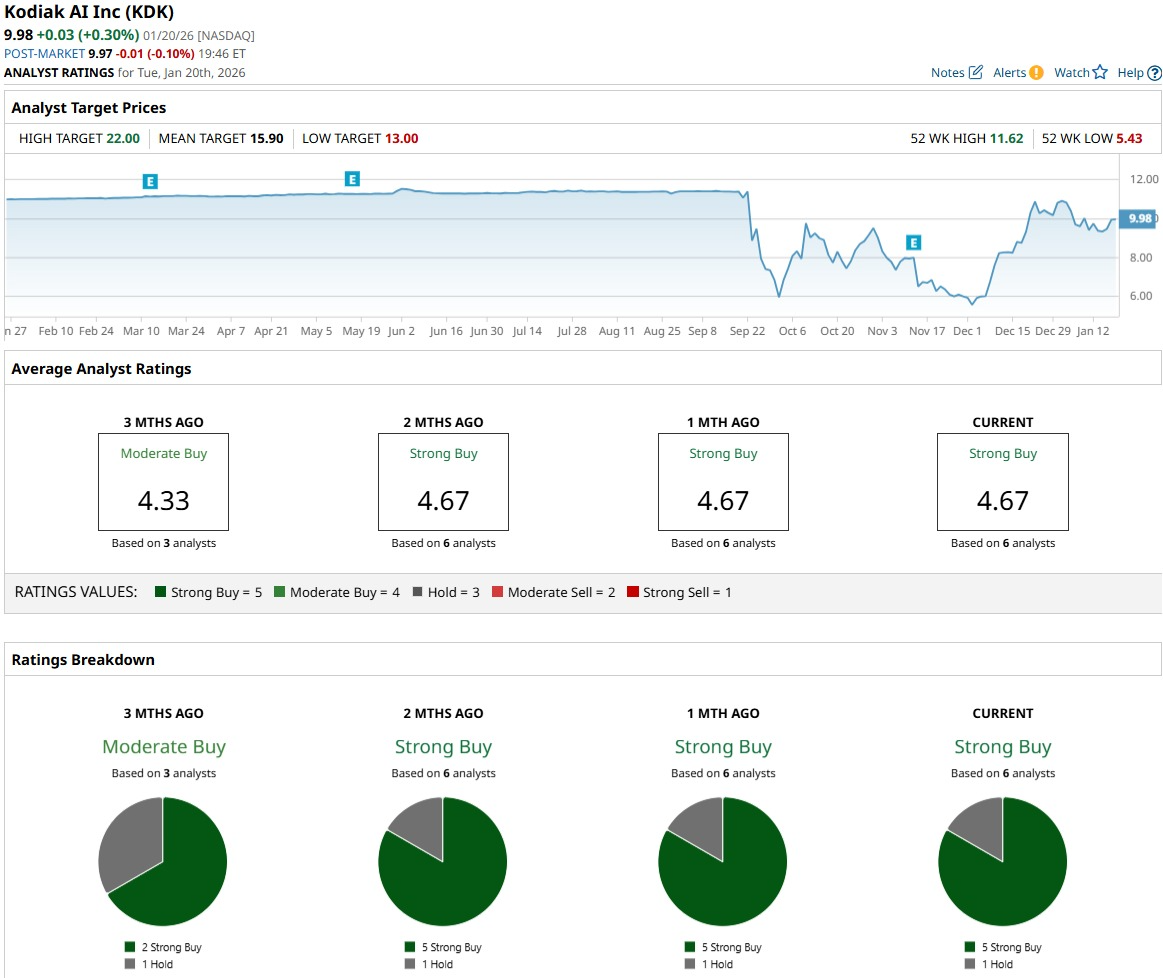

KDK stock carries a consensus “Strong Buy” rating from six analysts and an average price target of $15.90. That suggests roughly 67% upside from the current price.

Conclusion

Cathie Wood is making a clear statement that PONY, WRD, and KDK are her next‑gen autonomy conviction names. Together, these stocks give focused exposure to robotaxis, global robo‑mobility, and AI freight at a stage when real contracts and citywide deployments are finally starting to show up. Over the next few years, the odds still lean toward choppy upside rather than a straight line, with execution and regulation likely to decide who really breaks out. If Wood's thesis lands anywhere close to plan, though, these three picks look more likely to grind higher than quietly fade away.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart