Tesla Inc. (TSLA) out-of-the-money puts have attractive premiums over the next month. I discussed this in a Barchart article three weeks ago, and short-sellers of OTM puts have made money. Tesla will release results on Wednesday, Jan. 28, after the market closes.

TSLA is down slightly today at $445.89, although up from a recent closing low of $419.25 on January 20. It hit a three-month low of $391.09 on Nov. 21.

Short-Put Investment Returns Over the Last 2 Months

That was about a month after Tesla released its Q3 earnings on Oct. 22, 2025. I discussed this in a Dec. 2, 2025, Barchart article and a Jan. 4, 2026, Barchart article, “Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts.”

An investor could have made $10.68 in premium from shorting a $405.00 strike price put expiring Jan. 2, 2026. That option expired worthless, and the full premium would have been earned.

In addition, an investor could have collected $13.23 in premium on Jan. 4 for a Feb. 6 expiry put at the $410.00 TSLA strike price. Today, that put option has a midpoint premium of $4.40. So, today, if closed out (by a “Buy to Close” trade), the investor would have a profit of $8.83 ($13.23 - $4.40).

And if TSLA closes over $410 on Feb. 6, the full premium will have been made, as this put contract will expire worthless.

So, over the last 2 months, an investor could have made between $19.51 and $23.91 (if it expires worthless). The average cost would have been $407.50 (i.e., $405 and $410). So, the 2-month potential return would be between 4.79% and 5.86%.

That is much better than what an investor in TSLA stock would have made. For example, on Dec. 2, TSLA was at $430.46, implying a return of just $15.43 over the last 2 months or +3.59%. That is lower than the +4.8% to +5.9% potential returns from shorting 1 month puts over the last two months.

In fact, it makes sense, ahead of earnings on Jan. 28, to roll the trade over to a new one-month expiry period.

Shorting One-Month OTM TSLA Puts

Tesla reported lower total deliveries on Jan. 2, 2026, than Wall Street expected, CNBC reported. The company delivered 418,227 vehicles vs. market forecasts of 426,000, according to StreetAccount.

That likely is why TSLA stock has faltered, down from a pre-release peak of $489.88 on Dec. 16, 2025.

That presents a good opportunity for investors willing to buy TSLA stock at out-of-the-money (OTM) put option strike prices (i.e., well below today's price).

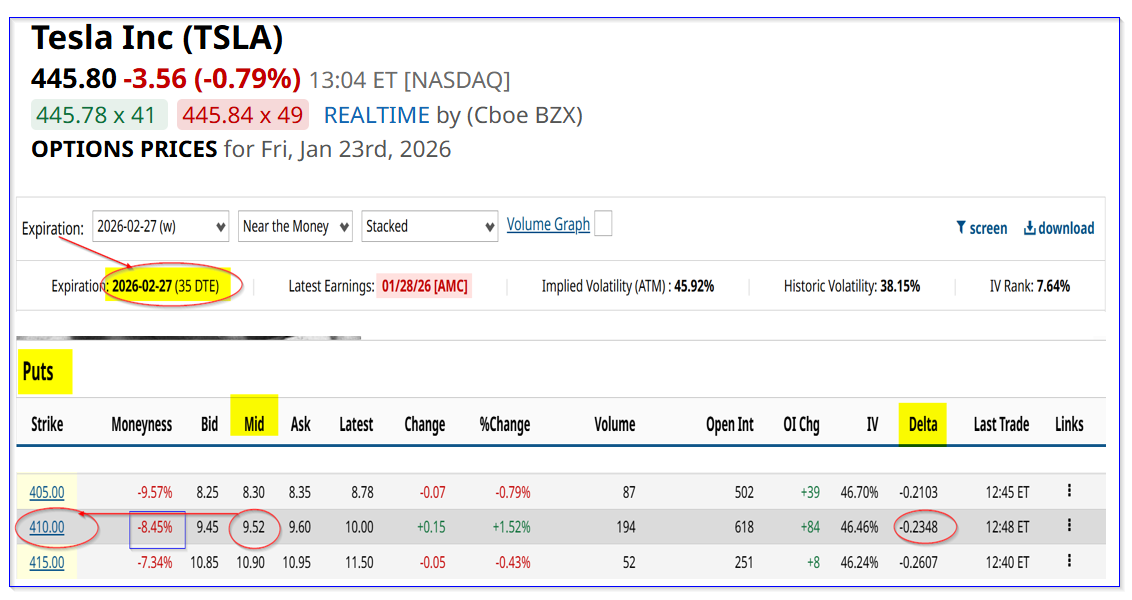

For example, look at the Feb. 27, 2026, expiry period for OTM put strike prices. It shows that the $410 strike price, which is 8.0% below today's price of $445.84, has a midpoint premium of $9.52.

That provides an immediate yield of 2.32% (i.e., $9.52/$410.00) for an expiry period that is just over one month from today (i.e., 35 days to expiry or DTE).

This means an investor who secures $41,000 with their brokerage firm can make $952 in their account by entering an order to “Sell to Open” one put contract expiring Feb. 27.

That also means that, even if TSLA falls to $410 on or before that date, the investor's actual breakeven point is just over $400 per share:

$410 - $9.52 = $400.48 breakeven (BE)

That is -10.1% lower than today's price. In other words, it leaves plenty of room for TSLA stock to fall after it releases earnings a month earlier on Jan. 28. (Remember I noted above that TSLA stock tanked and hit a low point one month after its Q3 earnings release).

Moreover, by that point, an investor following my articles over the last three Barchart articles since last quarter's earnings release would have collected $29.03 by shorting 1-month OTM puts.

That works out to $2,903 on an average investment of $41,000 over 3 months, or 7.08%. That works out to an annualized expected return (ER) of 28.32%, assuming these one-month returns can be repeated each quarter.

That is a good ER for most investors. It also provides a way for existing TSLA stock investors to potentially lower their average cost, either through income or lower potential average cost buy-ins.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Just Flashed on 3 Stocks: 2 Bull Calls, 1 Bull Put Income Play

- Tesla Inc Put Options Still Look Attractive to Short-Sellers Before Earnings Next Week

- Find Out How Covered Call Option Traders Can Use RSI and Bollinger Bands to Gain an Edge

- Power Up for a Larger Rally in 1 of 2026’s Winning AI Stocks with a Bull Call Spread