The U.S. government has proposed a $1.5 trillion defense budget for 2027, signaling a major push to upgrade America’s military. That effort is not limited to tanks and aircraft. It also covers advanced aerospace programs and space capabilities. The market has reacted quickly, with defense stocks surging sharply this month as investors priced in the possibility of higher long-term defense spending. As a result, many of the biggest aerospace contractors are being lifted along the way.

NASA's Artemis II mission is now in its final stretch, with the Space Launch System rocket and Orion spacecraft on the launch pad and a launch window that could open as early as Feb. 6. The four-astronaut crew is preparing for humanity’s first return to lunar space in more than 50 years, a milestone built on years of engineering, testing, and system integration work across the aerospace and defense supply chain.

Three of the biggest potential beneficiaries are Lockheed Martin Corporation (LMT), which built the Orion spacecraft, Boeing (BA), which leads the Space Launch System program, and Northrop Grumman (NOC), a key partner across integrated defense and space systems.

Can these three aerospace giants convert their Artemis II exposure and expanding defense budgets into sustained outperformance before the Feb. 6 launch window?

Lockheed Martin Corporation

Lockheed Martin is a global aerospace and defense prime built on long-cycle government contracts across aeronautics, missiles and fire control, rotary systems, and a fast-growing space business.

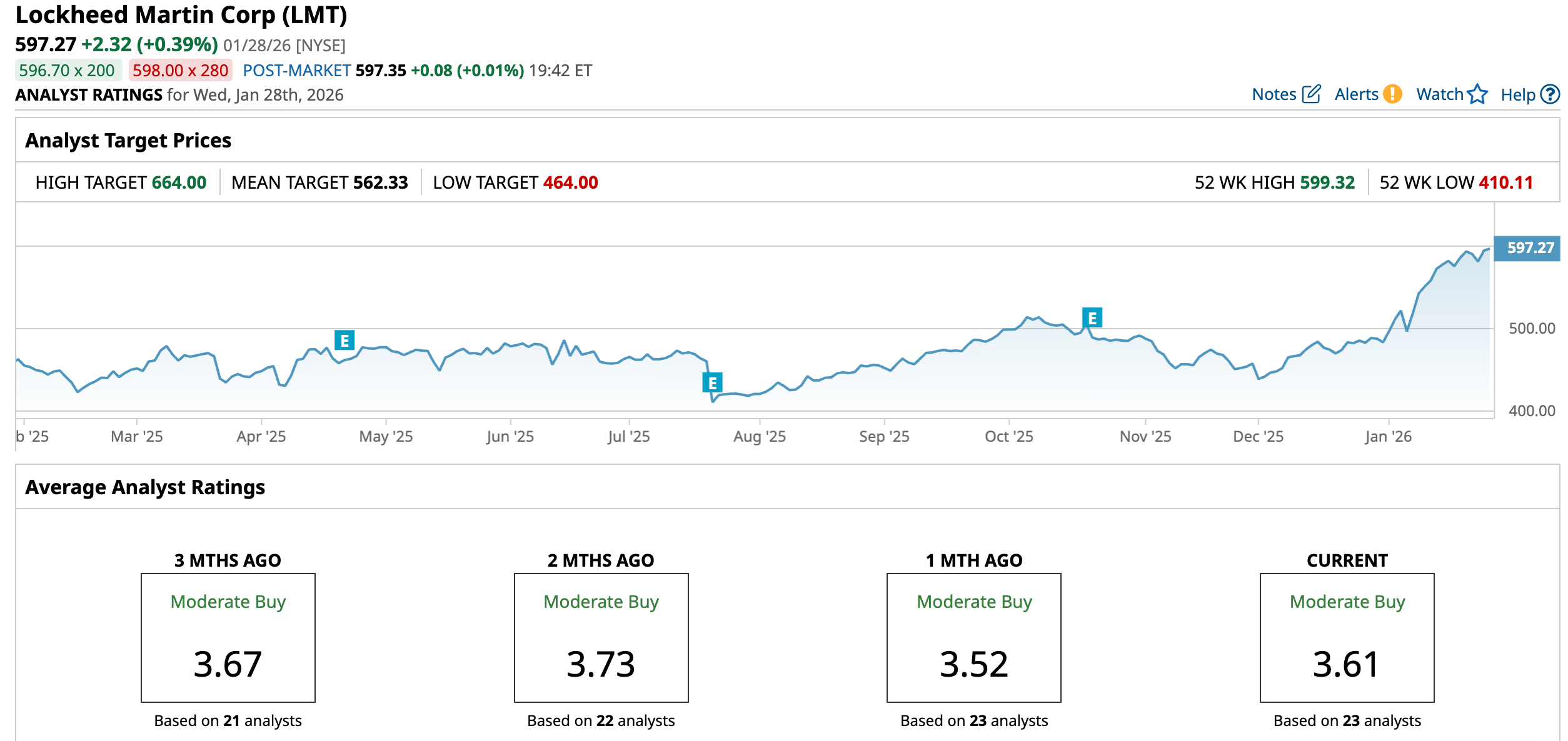

The stock has already rewarded early believers, rising 30.57% over the past 52 weeks and 23.49% year-to-date (YTD).

Even after that run, its forward P/E of 19.68x is still below the broader aerospace and defense sector’s roughly 22.5x, which suggests investors are not paying an outsized premium for its growth and backlog visibility. Add in a dividend yield around 2.3%, backed by 23 straight years of dividend increases, a forward payout ratio under 50%, and ongoing buybacks under a roughly $9 billion repurchase authorization.

The financials support the setup. In Q3 2025, Lockheed Martin posted $18.6 billion in sales, $1.6 billion in net earnings, $6.95 in EPS, and $3.3 billion in free cash flow, while backlog climbed to a record $179 billion and full-year revenue guidance moved into the mid $74 billion range.

Beyond results, the company also signed a new framework agreement with the U.S. Department of Defense to raise annual PAC 3 MSE interceptor output from roughly 600 to 2,000 units over seven years, and won a Space Development Agency award worth about $1.1 billion for 18 Tranche 3 Tracking Layer satellites, adding more visibility to its missile defense and space revenue path into the 2030s.

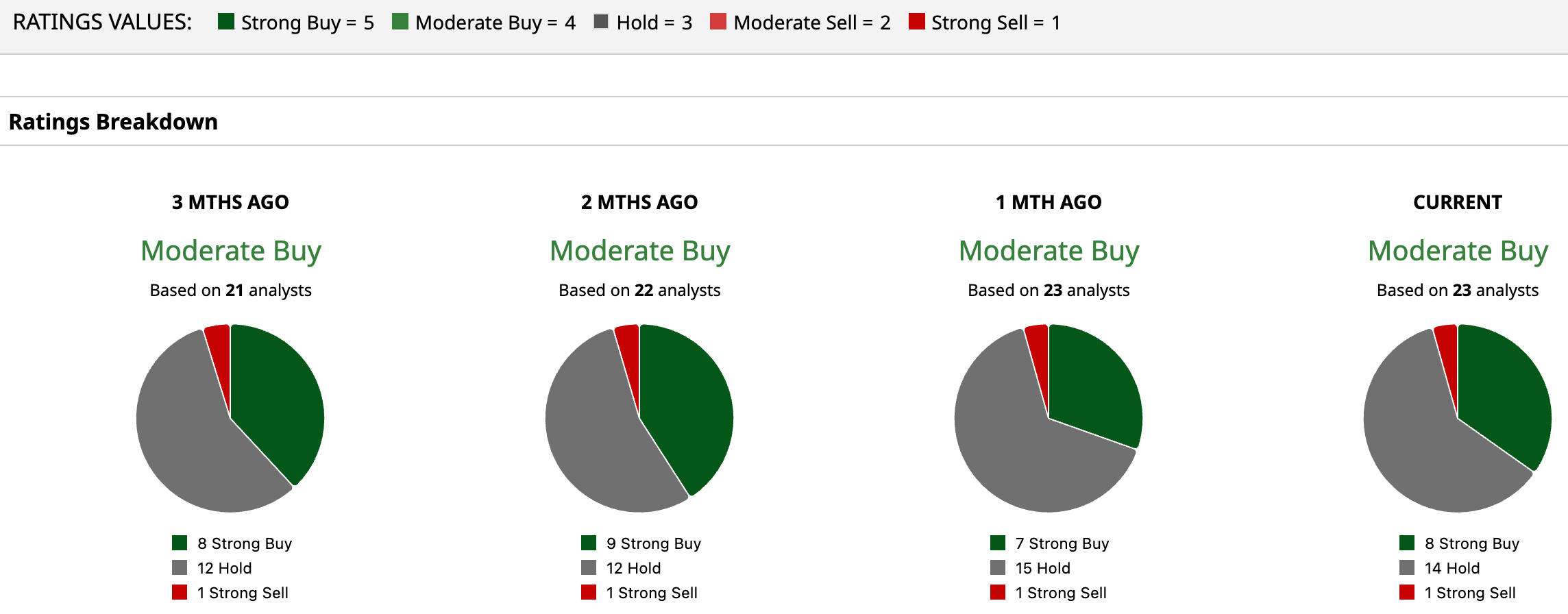

Analysts are paying attention; 23 covering firms rate the stock a consensus “Moderate Buy,” with an average target of $562.33 even as shares trade quite a bit above that level.

The Boeing Company (BA)

Boeing is a global aerospace leader with three big pillars in its business: commercial jetliners, defense programs, and a meaningful space operation. On the space side, it helps build NASA’s Space Launch System, including the core stage and upper stages that will support Artemis missions to the Moon.

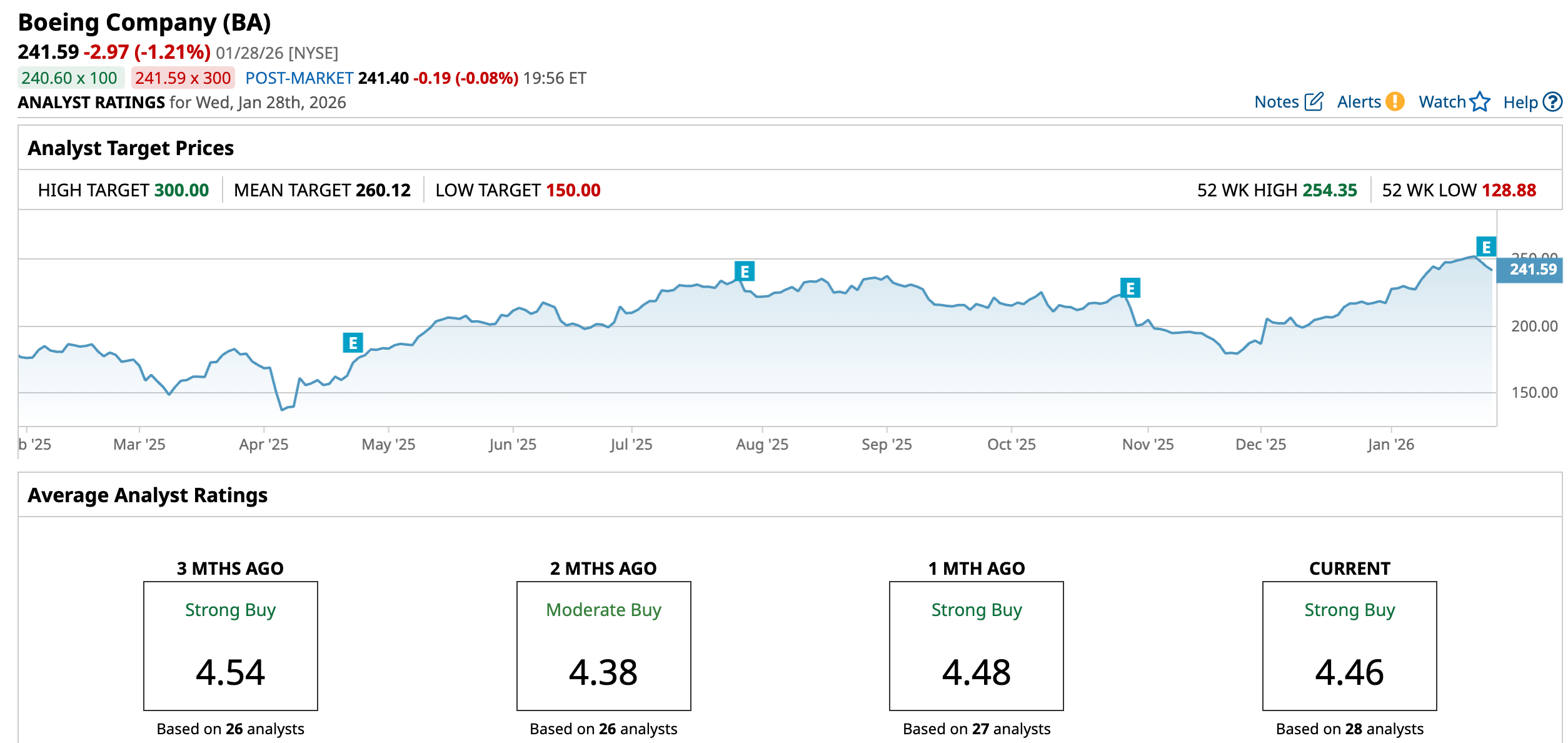

After a difficult stretch, the stock has bounced back strongly, up 35.89% over the past 52 weeks and 11.27% YTD as investors focus on a longer recovery.

The valuation shows that optimism is now baked in, with a forward P/E of 221.66x versus about 22.47x for the sector.

Boeing’s latest quarter also showed signs of real improvement. Revenue rose to $23.3 billion on 160 commercial deliveries, 737 production stabilized at 38 per month with an FAA agreement to move up to 42, and backlog increased to $636 billion, representing more than 5,900 airplanes.

The company still posted a loss because of a $4.9 billion charge tied to updated 777X certification timing. But cash flow turned positive with $1.1 billion in operating cash flow and $0.2 billion in free cash flow, supporting expectations for a full return to profitability by 2026.

The completed acquisition of Spirit AeroSystems brings key fuselage and structures work for the 737, 767, 777, and 787 in-house, expands Boeing’s aftermarket and MRO footprint, and should help reduce supply chain risk as production increases. Additionally, Boeing is building out digital services through products like the Virtual Airplane Procedures Trainer, powered by Microsoft’s platforms, which can add to its core aircraft business.

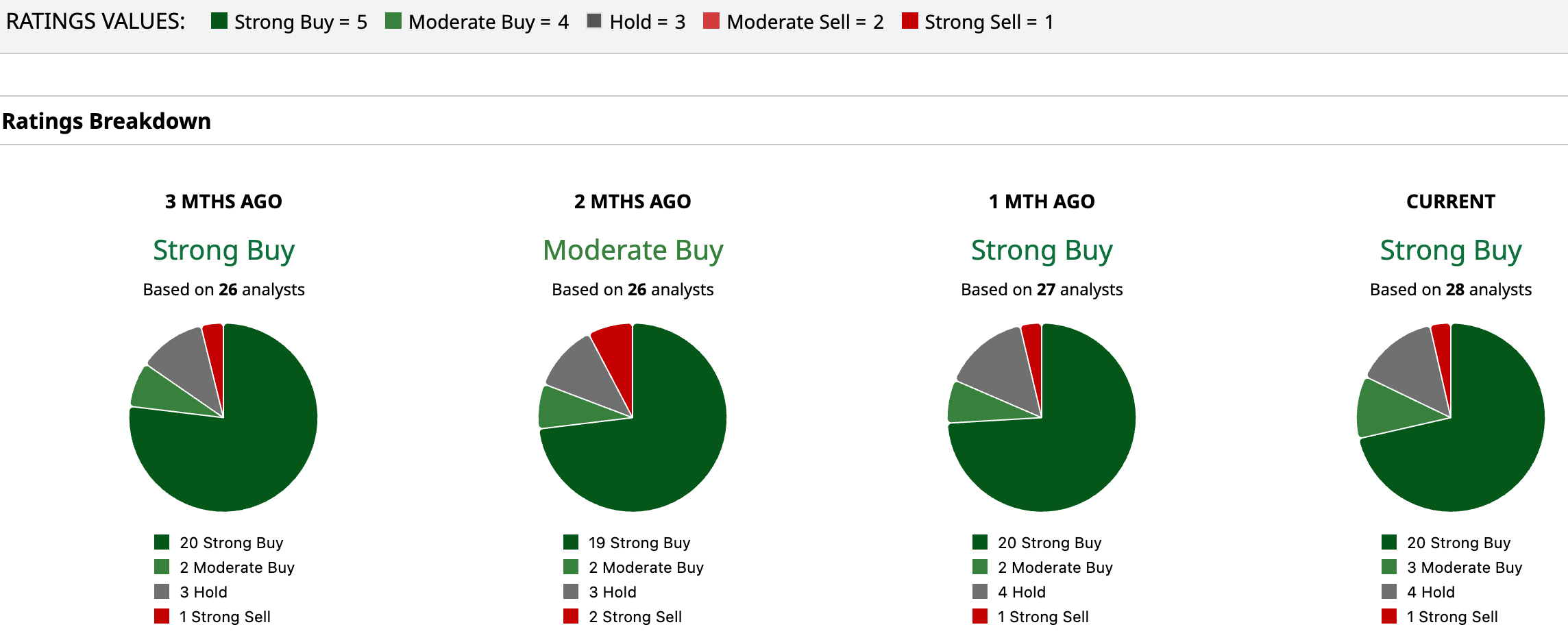

Analysts are leaning into the turnaround. All 28 surveyed rate the stock a consensus “Strong Buy,” with an average target of $260.12, which implies about 7.68% upside from its current price.

Northrop Grumman Corporation (NOC)

Northrop Grumman is a major defense and aerospace contractor with sturdy businesses across aeronautics, mission systems, defense systems, and a fast-growing space unit. In space, it is building the HALO habitation module for NASA’s Lunar Gateway as part of the Artemis campaign.

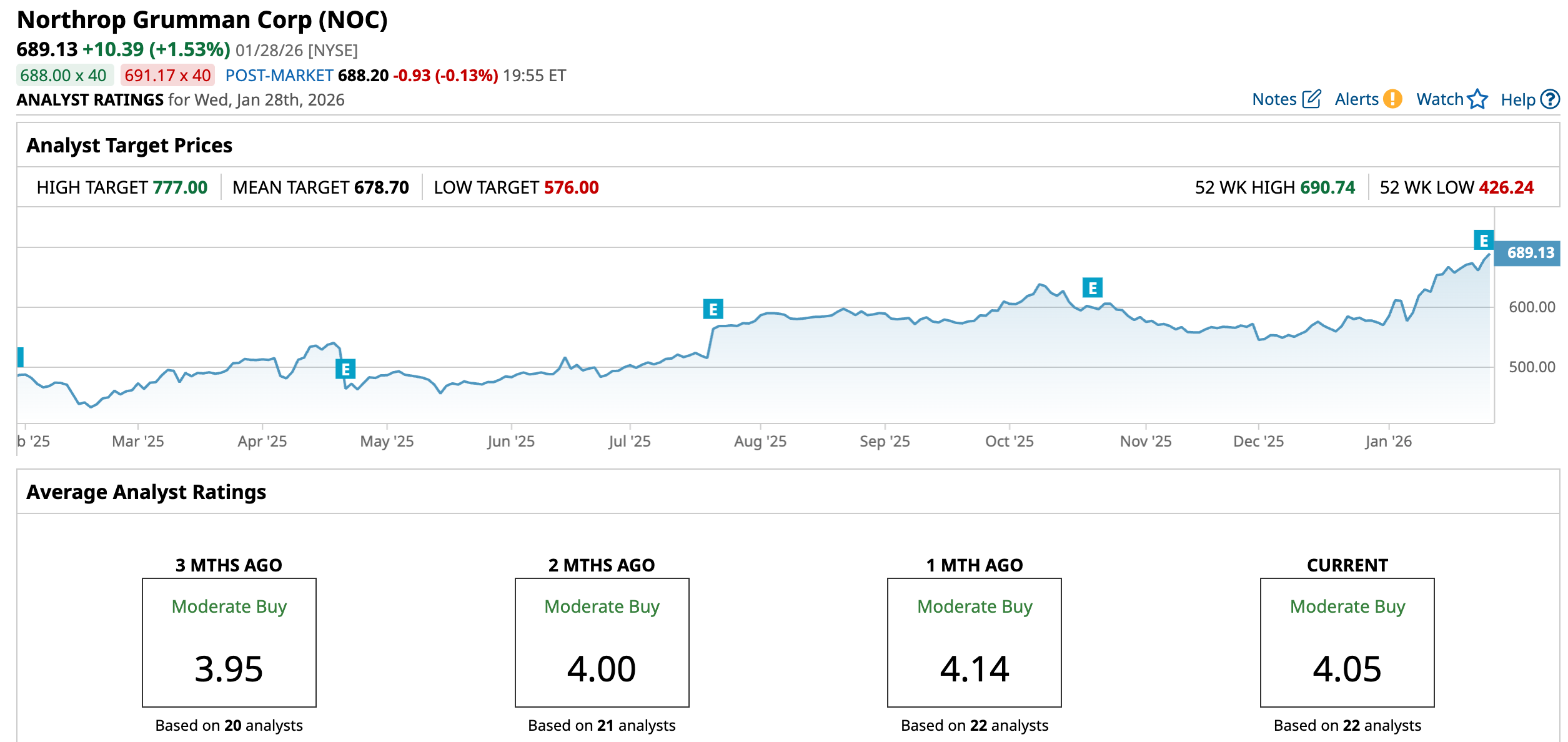

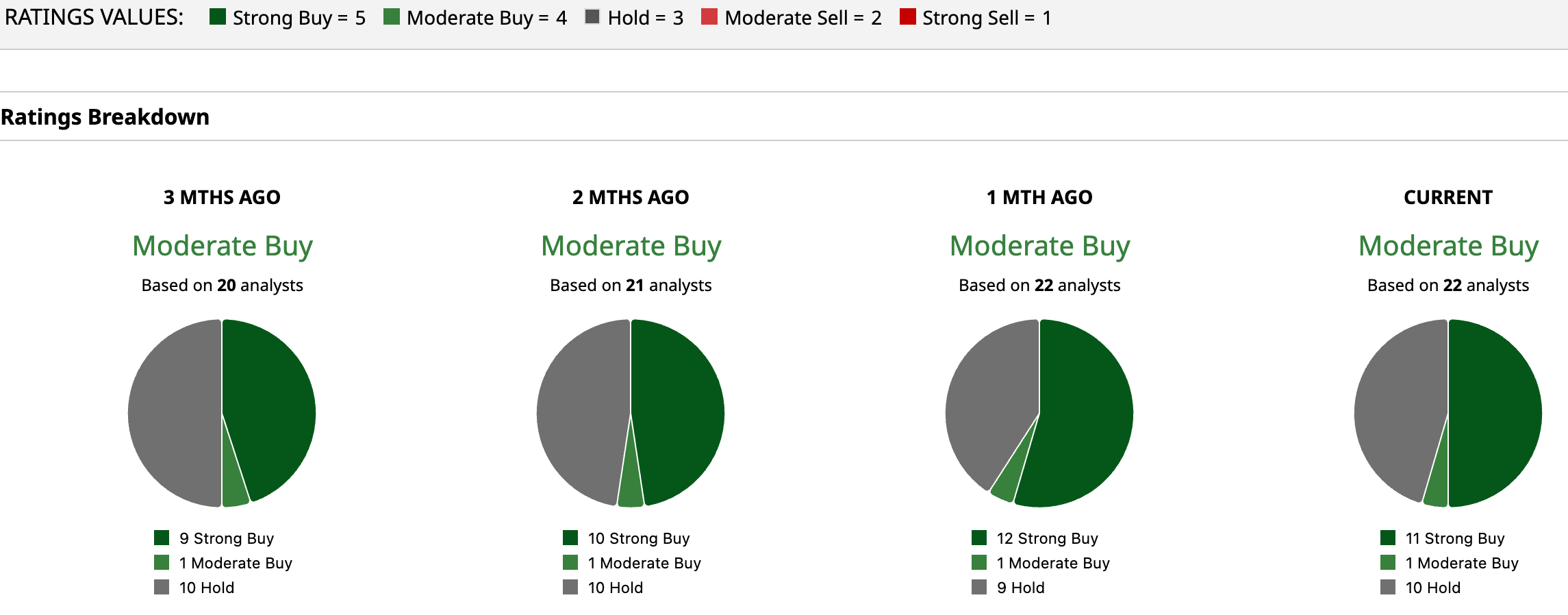

The stock has steadily moved higher, up 41.61% over the past 52 weeks and 20.86% YTD, as investors continue to reward its consistent execution and space-driven growth.

On valuation, its forward P/E of 22.97x is slightly above the sector’s 22.47x, which points to the market paying a small premium for NOC’s earnings strength and visibility. It also pays a quarterly dividend of $2.31 per share, or about a 1.34% yield, supported by a 31.90% forward payout ratio and 22 straight years of dividend increases, which leaves room to keep funding growth while returning cash to shareholders.

In Q3 2025, sales rose 4% YOY to $10.4 billion, net earnings came in at $1.1 billion, and diluted EPS increased 10% to $7.67, with segment operating margin at 12.3% and overall operating margin at 11.9%. Management then raised 2025 MTM adjusted EPS guidance by $0.65 to a range of $25.65 to $26.05, pointing to improving profit expectations.

On the innovation front, the Beacon testbed ecosystem is emerging as a powerful differentiator: partnerships with Red 6 and Merlin to integrate ATARS augmented‑reality training and Merlin’s autonomous “pilot” into the Beacon platform position Northrop at the center of next‑generation autonomous flight, synthetic training, and crewed‑uncrewed teaming, aligning with the Pentagon’s push for collaborative combat aircraft and autonomy heavy missions.

Analysts remain constructive. All 22 surveyed rate the stock a consensus “Moderate Buy,” with the current price a fair amount above the price target of $678.70, but showing upside potential of 12.75% based on a Wall Street high of $777.

Conclusion

Artemis II and the 2027 defense‑spending push are giving Lockheed Martin, Boeing, and Northrop Grumman a rare overlap of cyclical momentum and long‑cycle contract visibility. So the market has already started to price that in. For investors looking at the Feb. 6 launch window, these three aren’t speculative moonshots so much as liquid, large‑cap ways to ride a multi‑year space and defense upgrade cycle. Barring a major program setback or macro shock, the path of least resistance for all three remains higher over the next 12 to 24 months, with any pullbacks looking more like buying opportunities than exit signals.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.

- Analysts Love These 2 Picks-and-Shovels Gold Stocks. Should You Buy Them as Gold Prices Hit New Record Highs?

- Here’s a Critical Pick-and-Shovel Trade to Invest in the NIMBY Backlash Against AI Data Centers

- CFO David Zinsner Is Buying Intel Stock. Should You?