Gold is shining again. The most active February-dated gold futures (GCG26) briefly topped $5,100 on Jan. 26, while spot prices hit new highs. Even after easing back, gold is already up 28% year-to-date (YTD). It set fresh records as investors leaned into the metal’s safe-haven appeal. With global political tensions simmering, currencies under pressure, and policy uncertainty swirling, the environment is lining up neatly in gold’s favor, especially when confidence starts to wobble.

The rally is not being driven by just one group. Central banks continue to load up as they diversify reserves, exchange-traded fund (ETF) inflows have turned positive again, and a new wave of retail investors across Asia and Europe is stepping into precious metals for the first time. Add in that the Federal Reserve is expected to hold rates steady — while facing intense political scrutiny — and the setup remains supportive for a non-yielding asset like gold. After climbing by high teens this year already on top of last year’s massive gains, momentum clearly has not faded.

Wall Street thinks there may be more upside ahead. Some, like Societe Generale, anticipate the gold price to be $6,000 per ounce by year-end. Others, like Morgan Stanley, see the rally extending further, anticipating prices to be $5,700/oz.

That’s pushing investors to look beyond bullion itself and toward the “picks-and-shovels” of the trade — mining heavyweights like Vale S.A. (VALE) and Rio Tinto Group (RIO), both sitting at recent highs. With gold breaking records, is now the time to buy Barchart’s top-rated gold stocks, or wait for a better entry point?

Gold Stock #1: Vale S.A.

Founded in 1942 and based in Rio de Janeiro, Vale S.A. is one of the world’s heavyweight miners, with operations stretching across the Americas, Europe, and Asia. Best known for iron ore, Vale also plays a key role in nickel and copper, while producing valuable by-products such as gold, silver (SIH26), and platinum (PLJ26) group metals. Its reach goes well beyond the pit, running railways, ports, and terminals that keep materials moving. Through its energy transition segment, Vale is also investing in renewables, positioning itself for a more sustainable mining future.

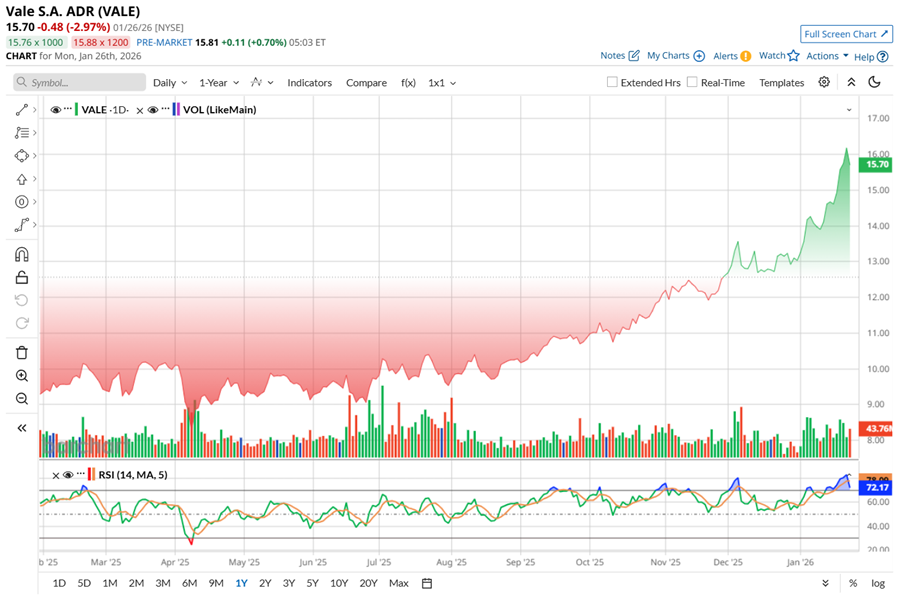

Valued at a market capitalization of $76 billion, shares of the gold mining stock had a stellar rally. VALE stock has surged 90% over the past 52 weeks, hitting a high of $17.34 recently. The rally looks even sharper when you zoom in — VALE has climbed 112% from its April low of $8.06. Momentum has not cooled much either, with gains of 46% over the past three months and another 33% rally in just the past month.

That said, VALE stock’s 14-day RSI now sits above 72, firmly in overbought territory, hinting that a pause or short-term consolidation would not be surprising after such a strong move.

From a valuation standpoint, VALE is not stretched. The stock is priced at about 7.7 times forward adjusted earnings, cheaper than the sector median, even if it’s a bit above its own historical average.

What really keeps investors around, though, is the dividends story. Vale has paid dividends for years and its hefty 5.3% yield far outpaces the SPDR S&P 500 ETF Trust’s (SPY) 1.05% yield.

Gold may be stealing the spotlight, but Vale’s latest numbers were impressive. When the Brazilian mining giant reported third-quarter results on Oct. 31, the performance quietly beat expectations across the board. Net profit came in at $2.69 billion, up 11% year-over-year (YOY), while net operating revenue climbed 9% annually to $10.4 billion, and jumped 18% sequentially. That momentum flowed straight to the bottom line, with adjusted EBITDA rising 21% annually to $4.4 billion, comfortably ahead of forecasts.

Cash generation was just as impressive. Recurring free cash flow reached $1.6 billion, roughly $1 billion higher than last year, driven by stronger operating earnings. Total free cash flow surged 337% YOY to $2.6 billion, lifting cash and equivalents to $5.9 billion by quarter-end. At the same time, expanded net debt edged slightly lower sequentially to $16.6 billion, reflecting disciplined capital management.

Operationally, Vale delivered. Iron ore, copper, and nickel sales rose 5%, 20%, and 6% YOY, respectively. Iron ore production hit its highest quarterly level since 2018, while copper posted its strongest third quarter since 2019. Nickel costs continued to improve, reinforcing Vale’s competitiveness across key metals, including gold by-products.

Capital spending totaled $1.3 billion, down modestly from last year and firmly on track with its 2025 guidance of a $5.4 billion to $5.7 billion range. The company also pushed ahead with growth initiatives under its New Carajás program and ramped up the second furnace at Onça Puma. With projects like Serra Sul and Bacaba copper on deck — and safety milestones reached — Vale looks increasingly well positioned for the next phase of the cycle.

Vale is set to release its results for the current fiscal year soon. EPS for the year is anticipated to rise 15% YOY to $2.09. Looking ahead to fiscal 2026, the bottom line is expected to rise 1% annually to $2.11 per share.

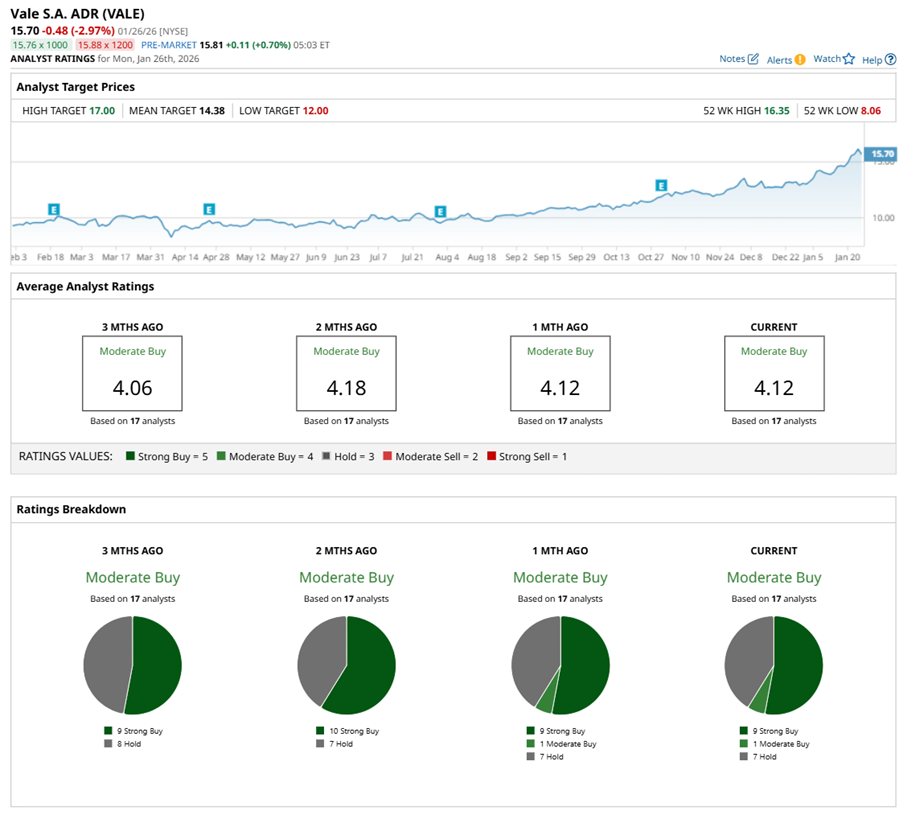

Analysts covering VALE are optimistic about the mining stock, with an overall “Moderate Buy” rating. Of the 17 analysts, nine are upbeat, giving a “Strong Buy” rating, one suggests a “Moderate Buy,” and the remaining seven analysts play it safe with a “Hold.”

VALE stock’s recent run has already lifted it above the average Street target of $14.65, indicating strong momentum. Still, the most bullish target of $18 leaves room for about 7% potential upside from here.

Gold Stock #2: Rio Tinto Group

Founded in 1873, London-based Rio Tinto is one of the world’s most established mining groups, with operations spanning every major region. The company’s portfolio runs deep, from iron ore in Western Australia to aluminum, copper, and a growing mix of critical minerals.

Along the way, Rio produces valuable by-products, such as gold and silver, while expanding into battery materials like lithium. With its own mines, smelters, refineries, and shipping assets, Rio Tinto controls the full value chain, giving it scale, resilience, and long-term relevance across commodity cycles. Its market capitalization currently stands at $117 billion.

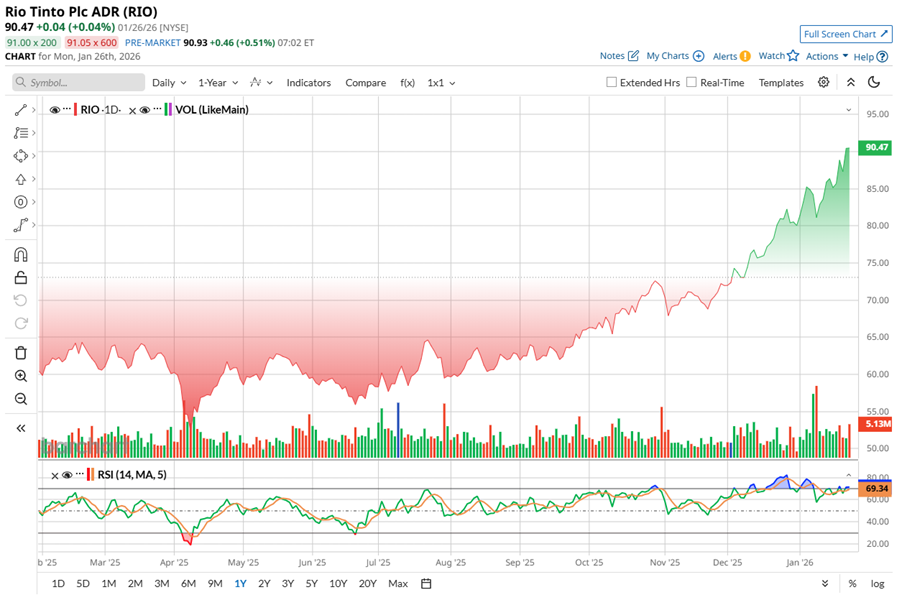

Rio Tinto’s shares have been building serious momentum. RIO stock is up 60% over the past 52 weeks and recently touched a high of $97.11. The move has not been stretched out either — over the past six months alone, the stock has surged 54%, reflecting strong investor confidence. Nearly a month into the new year, RIO is already up 20% on a year-to-date (YTD) basis, including a sharp 10% jump in just the past five days, helped by rising gold prices.

Technically, trading volume has been picking up, while the 14-day RSI just entered overbought territory, suggesting momentum remains strong but could cool in the near term.

Even after a strong rally, RIO’s valuation still feels reasonable. Priced at a forward adjusted earnings multiple of 12.5 times, the stock appears attractive compared to its sector average. A PEG ratio of 0.95 suggests earnings growth is keeping pace with valuation, leaving room for further upside if commodity prices, especially gold, stay supportive.

Meanwhile, Rio Tinto has not forgotten income investors. The miner has paid dividends semiannually like clockwork for years, rewarding patience along the way. Its latest $1.48 per-share payout in September brings annual dividends to $3.73, translating to a solid 4% yield, comfortably ahead of SPY’s yields.

Rio Tinto’s recent performance shows a company firing on multiple cylinders, blending steady financial execution with meaningful growth across its portfolio. For the first six months of 2025, Rio Tinto posted revenue of $26.9 billion, while operating profit reached a solid $7 billion and operating cash flow came to $6.9 billion. With aluminum and copper contributing a larger share of the mix, margins are starting to expand, giving the earnings profile a noticeable lift.

Cash flow strength has shown up in capital discipline. The miner maintained its long-standing practice of a 50% interim payout, declaring a $2.4 billion ordinary dividend, while still funding growth projects and protecting a strong balance sheet.

Operationally, momentum picked up. In January, Rio released Q4 production numbers that highlighted record iron ore output in the Pilbara, marking a strong rebound from earlier weather disruptions. Simandou also hit a major milestone with its first shipment, reinforcing Rio’s ability to deliver large-scale growth projects on time.

Copper remains a standout. Annual production rose 11% YOY, beating the top end of guidance, driven by the completed underground development at Oyu Tolgoi. Bauxite production reached record levels, aluminum operations showed resilience across the value chain, and lithium delivered record quarterly output from Argentina as Rio builds out its battery materials footprint.

Looking ahead, Rio expects production to grow at a 3% compound annual growth rate (CAGR) between 2024 and 2030. Lower unit costs, improving margins, and rising volumes point to stronger free cash flow and healthier credit metrics.

Rio Tinto is gearing up to release its fiscal 2025 earnings report on Feb. 19. Analysts monitoring the company anticipate its EPS to be around $6.53 for fiscal 2025, then rise by 13% YOY to $7.39 in fiscal 2026.

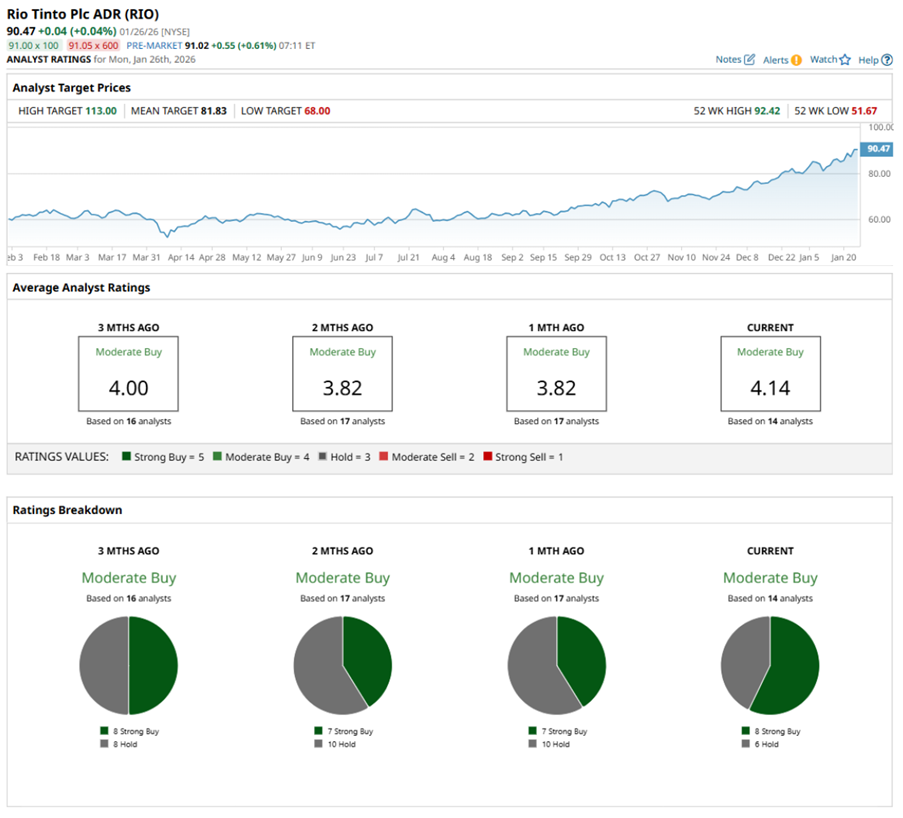

RIO stock has a “Moderate Buy” rating based on the consensus estimate of 14 analysts. Among these analysts, eight recommend a “Strong Buy” while six are on the sidelines with a “Hold” rating.

RIO stock is currently trading above the mean price target of $81.83. However, the Street-high target of $113 suggests that RIO could surge as much as 20% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart