With a market cap of $76.5 billion, Elevance Health, Inc. (ELV) is one of the largest U.S. managed healthcare and health-insurance companies, providing medical, pharmacy, behavioral, and care-delivery services through a diversified portfolio of brands and subsidiaries. Headquartered in Indianapolis, Indiana, the company operates in four segments: Health Benefits, CarelonRx, Carelon Services, and Corporate & Other.

Elevance Health’s stock has struggled to keep pace with both the broader market and its healthcare peers. ELV stock has declined 11.4% over the past 52 weeks and 1.7% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 11.9% over the past year and declined marginally in 2026.

Narrowing the focus, ELV has also lagged behind the State Street Health Care Select Sector SPDR Fund’s (XLV) 8.7% fall over the past 52 weeks and 1.7% rise this year.

On Jan. 28, ELV shares popped 5.9% after the company released its Q4 2025 earnings. Its operating revenue rose 10% year over year to $49.3 billion, and adjusted EPS stood at $3.33, beating expectations, supported by premium increases, Medicare Advantage growth, and strong momentum in the Carelon services segment. Moreover, the benefit expense ratio was 93.5%, an increase of 110 basis points compared to the prior year period, reflecting higher medical cost trend primarily in our Affordable Care Act health plans and heightened Medicare Part D seasonality driven by Inflation Reduction Act changes.

For the current year ending in December, analysts expect ELV’s EPS to decrease 15.6% year over year to $25.57. Moreover, the company has surpassed or met analysts’ consensus estimates in three of the past four quarters, while missing on one occasion.

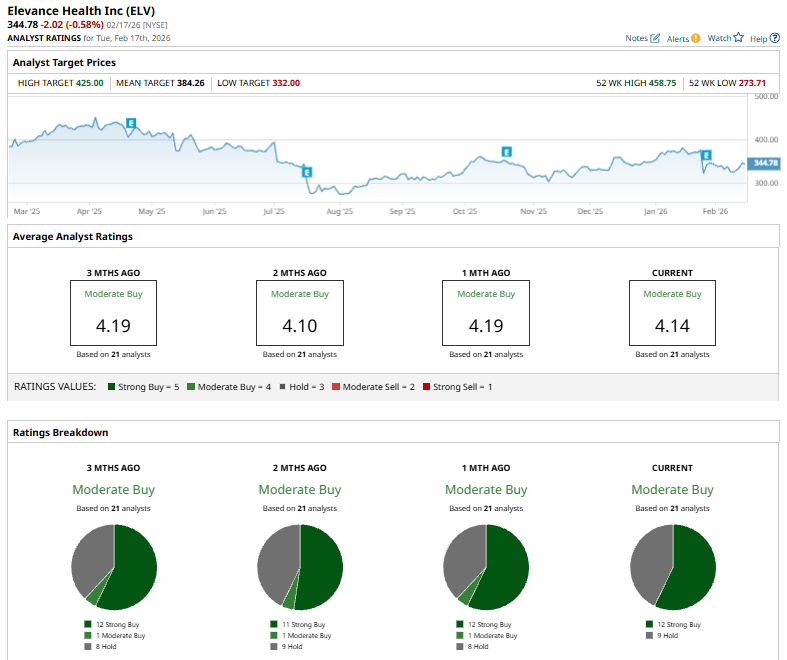

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings and nine “Holds.”

The current consensus is more bullish than two months ago, when it had 11 “Strong Buy” suggestions.

On Feb. 2, JPMorgan analyst Lisa Gill modestly increased her price target on Elevance Health to $397 from $394, while reiterating an “Overweight” rating on the shares.

ELV’s mean price target of $384.26 indicates a premium of 11.5% from the current market prices. Its Street-high target of $425 suggests a robust 23.3% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever