Purchase, New York-based PepsiCo, Inc. (PEP) manufactures, markets, distributes, and sells a broad range of beverages and convenient foods. It is valued at a market cap of $222.7 billion.

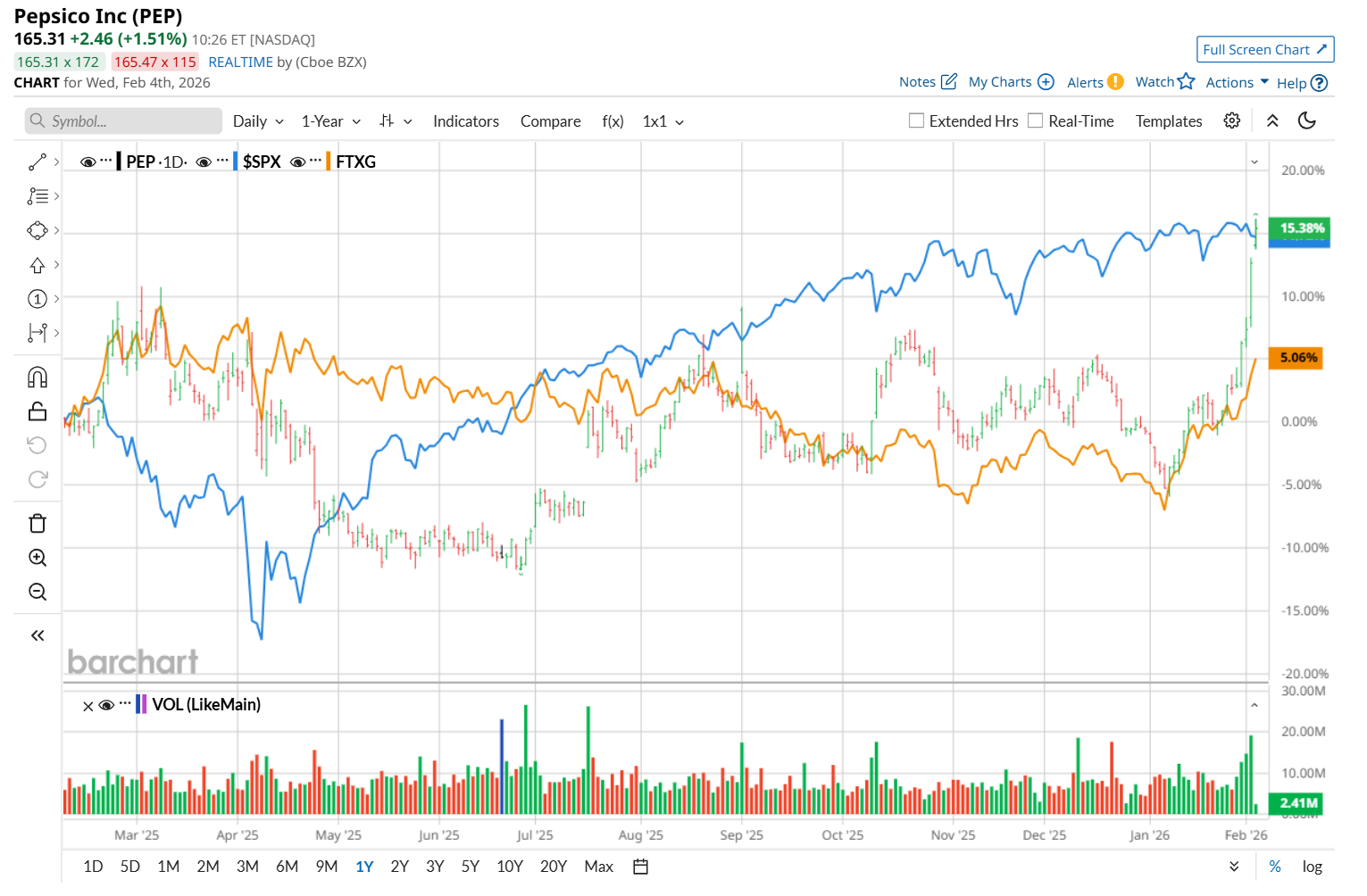

This food and beverage giant has outpaced the broader market over the past 52 weeks. Shares of PEP have rallied 16.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.4%. Moreover, on a YTD basis, the stock is up 16.5%, compared to SPX’s 1.1% return.

Zooming in further, PEP has also outperformed the First Trust Nasdaq Food & Beverage ETF (FTXG), which rose 5.3% over the past 52 weeks and 10.1% on a YTD basis.

On Feb. 3, shares of PEP rose 4.9% after it delivered better-than-expected Q4 earnings results. The company’s net revenue increased 5.6% year-over-year to $29.3 billion, surpassing consensus estimates by 1.2%. Moreover, its adjusted EPS came in at $2.26, up 15.3% from the same period last year and marginally ahead of Wall Street estimates. Moreover, PEP announced that it is cutting prices on Lay's, Doritos, Cheetos and Tostitos chips to win back customers exasperated by years of price hikes.

For fiscal 2026, ending in December, analysts expect PEP’s EPS to grow 5% year over year to $8.55. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

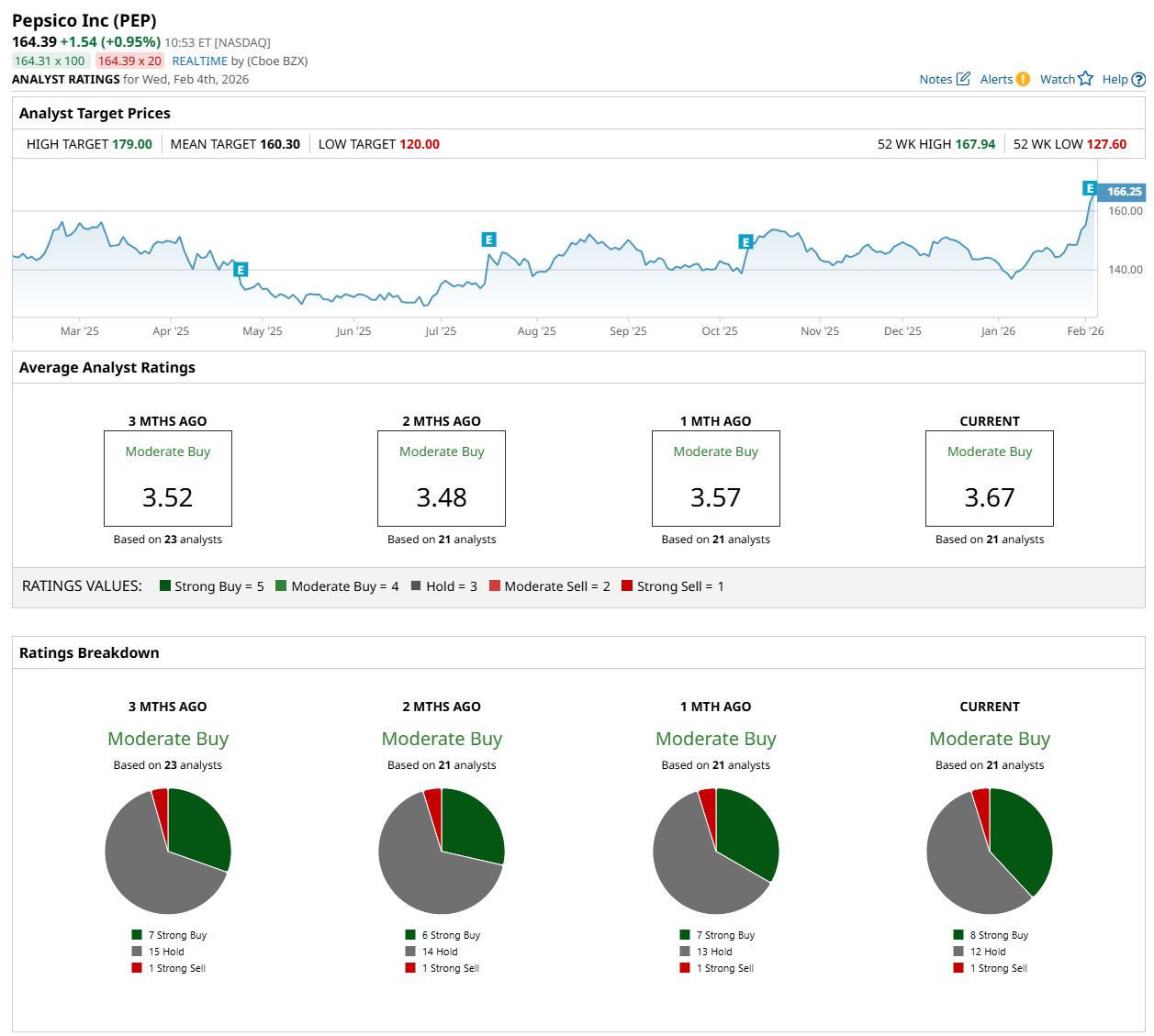

Among the 21 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” 12 “Hold,” and one "Strong Sell.”

The configuration is more bullish than a month ago, with seven analysts suggesting a "Strong Buy” rating.

On Feb. 4, DBS analyst Zheng Feng Chee maintained a “Hold” rating on PEP and set a price target of $175, indicating a 6.5% potential upside from the current levels.

While the company is trading above its mean price target of $160.30, its Street-high price target of $179 suggests an 8.9% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 52-Week Extremes: 4 Stocks You’ll Want in Your Portfolio

- Amazon’s ‘Melania’ Film Earns $7 Million Opening Weekend, But The Benefits For Shareholders Could Be Billions

- Dear Qualcomm Stock Fans, Mark Your Calendars for February 4

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?