MUFG today announced that it has decided to introduce a share-based compensation plan using the ESOP[1] trust structure as a stock incentive plan (the “Plan”) for employees in management positions who satisfy certain requirements (the “Eligible Employees”) at three MUFG subsidiaries (MUFG Bank, Ltd., Mitsubishi UFJ Trust and Banking Corporation, and Mitsubishi UFJ Morgan Stanley Securities Co., Ltd., hereinafter collectively referred to as the “Covered Companies”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240328186928/en/

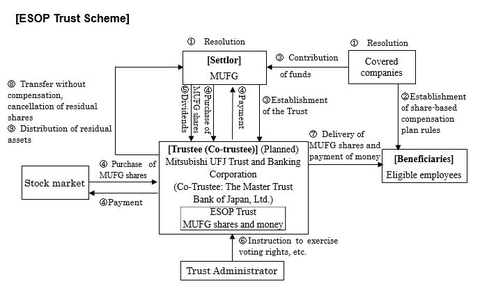

ESOP Trust Scheme (Graphic: Business Wire)

1. Purpose of introducing the Plan

(1) Defining its purpose as being “Committed to empowering a brighter future,” MUFG positions human capital as one of the most important types of capital and aims to become a global financial group capable of contributing to society and our customers by empowering each employee to play an active role and thrive.

(2) To realize this vision, MUFG’s human capital management is centered around strengthening business competitiveness and fostering a culture of taking on challenges and transformation. In order to enhance the well-being of our employees and achieve sustainable growth for both individuals and the organization, MUFG has decided to introduce the Plan, setting our sights on reinforcing the virtuous cycle of increasing MUFG’s corporate value and human capital management, and improving employee engagement and retention.

2. Contents of the Plan

(1) The Plan adopts a scheme called an employee stock ownership plan (the “ESOP Trust”). The ESOP Trust, similar to performance share plans or restricted stock plans prevalent in the U.S., would be a stock incentive plan under which MUFG shares and money equivalent to the liquidation value of MUFG shares are delivered or paid to Eligible Employees who satisfy certain requirements based on predetermined share-based compensation plan rules.

(2) The Plan is expected to enable the Eligible Employees to benefit financially from MUFG’s growth by holding shares in the company, to encourage each employee to strive to improve corporate value and ROE from a medium- to long-term perspective by better demonstrating their leadership. In addition, making the Eligible Employees shareholders is expected to increase their job satisfaction and pride in working for MUFG, as well as boosting retention by diversifying their incentives.

(3) Further details, including the acquisition of shares by the ESOP Trust, will be announced when they are resolved.

[1] Abbreviation of Employee Stock Ownership Plan

① |

MUFG shall make the resolution necessary for the introduction of the ESOP Trust. Each Covered Company shall make resolutions necessary for the introduction of the Plan. |

② |

Each Covered Company shall establish share-based compensation plan rules regarding the Plan. |

③ |

Each Covered Company shall contribute funds to MUFG, and as the Settlor, MUFG shall entrust the contributed funds to the Trustee and set up an ESOP Trust for the Beneficiaries, defined as Eligible Employees who satisfy the relevant requirements. |

④ |

The ESOP Trust shall, in accordance with instructions from the Trust Administrator, utilize the money contributed to the Trust in ③ above to acquire MUFG shares from the stock market or from MUFG (via disposal of treasury shares). |

⑤ |

Dividends on MUFG’s shares in the ESOP Trust shall be distributed in the same manner as dividends on other MUFG shares. |

⑥ |

The voting rights of the MUFG shares in the ESOP Trust shall not be exercised throughout the trust period. |

⑦ |

During the trust period, the Beneficiaries shall be awarded a certain number of points after a period of three years, in accordance with the Plan’s rules. MUFG shares equivalent to a certain percentage of the points accumulated shall be awarded to Beneficiaries who satisfy certain requirements, in principle, after the end of the three-year period. MUFG shares equivalent to any remaining points shall be converted into cash within the ESOP Trust in accordance with the provisions of the trust agreement, and the Beneficiaries shall receive money equivalent to the liquidation value of the MUFG shares. |

⑧ |

In the event that MUFG shares remain upon the expiry of the trust period, MUFG can continuously use the ESOP Trust as an incentive plan similar to the Plan by revising the trust agreement and entrusting additional funds. If the ESOP Trust is instead terminated, residual shares shall be transferred from the ESOP Trust to MUFG at no charge as shareholder returns, and MUFG will cancel the shares so acquired. |

⑨ |

Dividends remaining in the ESOP Trust after distribution to the Eligible Employees upon the expiry of the trust period shall be used as funds for purchasing shares. However, in the event the ESOP Trust is not extended upon the conclusion of the trust period, the amount exceeding the trust expense reserve shall be donated to an organization with no interest in the participating companies. |

- End -

(Reference)

[Outline of the Trust Agreement]

(i) |

Trust type |

A money trust other than an individually-operated designated money trust (third party benefit trust) |

(ii) |

Trust purpose |

To provide incentives to eligible employees |

(iii) |

Settlor |

MUFG |

(iv) |

Trustee |

Mitsubishi UFJ Trust and Banking Corporation (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

(v) |

Beneficiaries |

Eligible employees satisfying the beneficiary requirements |

(vi) |

Trust administrator |

A third party that does not have any interest in the Covered Companies (certified public accountant) |

(vii) |

Trust agreement date |

May 2024 (planned) |

(viii) |

Trust period |

From May 2024 (planned) to August 31, 2027 (planned) |

(ix) |

Start date |

July 1, 2024 (planned) |

(x) |

Exercise of voting rights |

No exercise |

(xi) |

Type of acquired shares |

Ordinary shares of MUFG |

(xii) |

Amount of trust money |

Unspecified (to be disclosed upon resolution) |

(xiii) |

Timing of acquisition of shares |

Unspecified (to be disclosed upon resolution) |

(xiv) |

Method of acquisition of shares |

Unspecified (to be disclosed upon resolution) |

(xv) |

Holder of vested rights |

MUFG |

(xvi) |

Residual assets |

Residual assets that can be received by MUFG, as the holder of the vested rights, shall be within the limit of the trust expense reserve calculated by deducting the cost for acquiring the shares from the Trust from the trust money. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240328186928/en/

Contacts

MUFG Bank, Ltd.

Toshinao Endou +81-3-3240-1111

Managing Director, Head of Documentation & Corporate Secretary Department

Corporate Administration Division