Adjust’s Mobile App Trends 2026 report finds integrated measurement a top priority for marketers in 2026, as AI transforms from strategic tool to core infrastructure

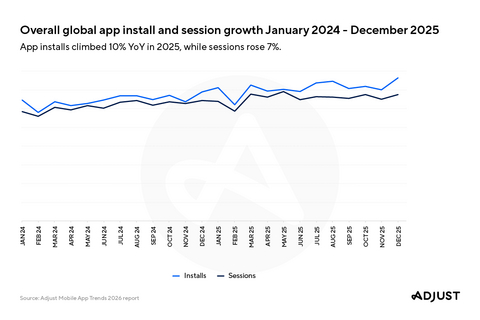

Leading measurement and analytics company Adjust released today its annual Mobile App Trends report for 2026, revealing continued global growth in app adoption and on-the-go engagement with business, commerce, and entertainment. Global app installs increased 10% year-over-year (YoY) in 2025, while sessions rose 7%, illustrating sustained momentum in mobile app usage. Adjust predicts consumers will become increasingly multi-platform in 2026, driving demand for integrated analytics and measurement solutions.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260218837408/en/

Adjust's latest report finds global app installs climbed 10% YoY, while sessions rose 7%.

“Sustainable app growth will depend on capturing user journeys across web, app and other connected environments. It’s no longer sufficient to view users in device silos when we know that conversion is influenced by multiple touchpoints,” noted Tiahn Wetzler, director of marketing at Adjust. “Uncovering what those touchpoints are, the amount of influence they hold, and how you can seamlessly guide users between them will empower effective budget allocation, better ROI, and real business impact from marketing.”

Mobile App Trends 2026 equips marketers with data from thousands of apps across the gaming, e-commerce, and finance verticals to help benchmark performance and forecast goals, providing contextual analysis of market trends from last year.

Highlights include that:

- Almost 5 years on, global ATT opt-in rates among iOS users who permit tracking requests continue climbing. Into Q1 2026, the global industry average for opt-in rates increased to 38% from 35% in Q1 2025. Gaming led with 39%, while publications recorded one of the largest gains, rising from 18% to 26%.

- Casual games recorded 19% install growth along with a 37% boost in sessions. Hyper casual installs and sessions grew 4% and 31%, respectively. Session lengths for casual games increased to 26 minutes, up 15%.

- Global e-commerce app sessions increased 5% YoY in 2025, hitting 10% above average by November and +5% in December.

- Finance app sessions rose 21% YoY in 2025, LATAM’s numbers were highest (+76% installs, +57% sessions). MENA followed (+42%, +10%), while APAC combined 5% install growth with a 50% boost in sessions.

The report also details three ways AI has transformed from a strategic tool to core infrastructure: data analysis assistants, smart audience segmentation and the utility phase of generative AI. Rather than functioning separately from marketing and measurement systems, AI can be embedded to help coordinate channel spend, segment users by predicted value and adapt experiences in real time.

For additional takeaways, trends and predictions, download the full report here.

About Adjust

Adjust, an AppLovin (NASDAQ: APP) company, is trusted by marketers around the world to measure and grow their apps across platforms. Adjust works with companies at every stage of the app marketing journey, from fast-growing digital brands to brick-and-mortar companies launching their first apps. Adjust's powerful measurement and AI-powered analytics solutions provide visibility and insights, while deep linking and engagement solutions help to drive ROI.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260218837408/en/

"It’s no longer sufficient to view users in device silos when we know that conversion is influenced by multiple touchpoints,” noted Tiahn Wetzler, director of marketing at Adjust.

Contacts

Media Contact

Adjust

Tiahn Wetzler

pr@adjust.com