As the U.S. Federal Reserve’s rate cuts continue to boost global liquidity, investors are seeking new, stable sources of yield. Bitcoin recently surged past $125,000, driven by massive ETF inflows and growing safe-haven demand amid a weakening U.S. dollar.

With traditional investments delivering diminishing returns, cloud mining thanks to its low entry barrier, stable yields, and sustainable model has re-emerged as the “new gold rush” for investors worldwide.

“In an era of low interest rates and abundant liquidity, cloud mining has become one of the most predictable and accessible outlets for capital.”

Senior Digital Asset Analyst, Leading European Investment Bank

Since its establishment in 2019, UK-based BC DEFI has emerged as a global pioneer in transparent, secure, and green-powered mining. With over 10 million users across 180+ countries, the platform is now recognized as one of the most trusted names in the cloud mining industry.

Why Choose BC DEFI

Zero Hardware Costs — No miners, no electricity bills, no maintenance

100% Renewable Energy — Solar, wind, and other sustainable power sources

Multi-Currency Support — BTC, ETH, SOL, ADA, XRP, DOGE, LTC, and more

Transparent & Flexible Returns — Daily settlements and multiple contract options

Regulated & Secure — UK-registered, EV SSL encryption, and DDoS protection

Reward Programs — $20 welcome bonus, referral commissions, and global partnerships

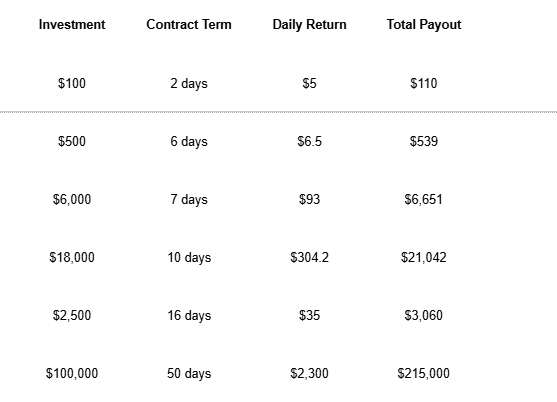

Profit Scenarios: Real Returns at Every Level

(Based on current BC DEFI contract terms, subject to change.)

Whether you’re a first-time investor, an experienced planner, or deploying institutional-level capital, BC DEFI’s tiered contracts are designed to deliver reliable passive income throughout the digital asset cycle.

What’s Driving Investor Demand

1. Rate Cuts Fuel Risk Assets

The Federal Reserve’s continued monetary easing has weakened the U.S. dollar, driving global investors toward higher-yielding, inflation-resistant assets such as Bitcoin and cloud mining.

2. Institutional Demand & ETF Inflows

BlackRock, Fidelity, and other asset management giants have reported record Bitcoin ETF inflows, propelling BTC to new highs and boosting market confidence.

3. The Halving Effect Reimagined

While Bitcoin’s next halving is expected in 2028, analysts note that institutional participation and liquidity cycles are already reshaping the traditional four-year pattern.

4. Green Mining as the Future Standard

With ESG standards tightening globally, BC DEFI’s 100% renewable energy model is setting a benchmark for sustainable crypto infrastructure.

5. Portfolio Diversification Amid Uncertainty

Equity markets remain volatile, gold recently topped $4,000/oz, and investors are increasingly turning to digital assets for balance and growth.

“BC DEFI’s green-energy-driven mining not only delivers consistent returns but also aligns perfectly with the world’s transition toward sustainable finance.”

— Representative, UK Blockchain Industry Association

Exclusive Onboarding Offer

$20 Welcome Bonus — Claim instantly upon registration

Daily Check-In Rewards — Earn extra just by logging in

Ready to start? Register Now

Conclusion

As macroeconomic conditions shift—with rate cuts, institutional inflows, and sustainability shaping the new digital economy—BC DEFI stands at the forefront of the global cloud mining revolution.

With low barriers, high transparency, and renewable-energy-powered operations, BC DEFI empowers users worldwide to achieve consistent, sustainable digital wealth.

Official Website: https://bcdefi.com

App Download: https://bcdefi.app/bcdefi

Business Inquiries: info@bcdefi.com

BC DEFI — Redefining Cloud Mining, Making Digital Wealth Accessible.

#crypto #cloudmining #bitcoin #passiveincome #defi #greencrypto #ETFinflows #web3