As the market continues to witness a resurgence in small-cap investments, led by a jump in investor optimism and speculation, there’s been a seemingly steady flow of capital back into traditionally riskier sectors.

Amidst this continuing trend of ascending small-cap stocks, characterized by climbing prices, surging trading volumes, and heightened attention, shares of LBPH have mainly stood out since the beginning of the year.

Shares of Longboard Pharmaceuticals (NASDAQ: LBPH) have sky-rocketed higher this week, up over 300% since the start of the year. Thanks to breaking news, the stock has swiftly emerged as the latest standout small-cap biotech stock to experience a rapid volume and price appreciation.

So, let's delve deeper into this standout performer to understand better whether it is a potential investment gem or merely riding the market's short-lived enthusiasm.

What is Longboard Pharmaceuticals?

Longboard Pharmaceuticals is a clinical-stage biopharmaceutical firm specializing in pioneering innovative treatments for neurological conditions. Its primary focus is on LP352, the leading product candidate currently undergoing Phase 1b/2a clinical trials targeting seizures linked with developmental and epileptic encephalopathies. In addition to LP352, the company's preclinical product pipeline includes LP659, designed to address various neurological disorders, and LP143.

The company has forged a licensing agreement with Arena Pharmaceuticals Inc., encompassing the development and commercialization of LP352, LP659, LP143, and other related compounds. Known initially as Arena Neuroscience, Inc., the company underwent a name change to Longboard Pharmaceuticals, Inc. in October 2020.

Its stock, trading under the ticker symbol 'LBPH,' boasts an average daily trading volume of 2.57 million shares and has a market capitalization of approximately $592 million. Thanks to the recent price action and breaking news, the stock is now trading at the high end of its 52-week range, last trading at $24.25.

The Catalyst Behind LBPH's Surge

Longboard Pharmaceuticals stock surged dramatically on Tuesday, reaching an all-time high. This surge followed the company's announcement of encouraging test findings regarding seizure treatment.

The company disclosed positive topline data from the PACIFIC Phase 1b/2a study, assessing bexicaserin (LP352) as a potential remedy for seizures associated with a broad spectrum of Developmental and Epileptic Encephalopathies (DEEs).

During the Pacific study, patients administered Longboard's drug exhibited a 32.5% reduction in seizures compared to those given a placebo. Moreover, according to the results, its drug bexicaserin, demonstrated good tolerance levels. Nearly 90% of patients receiving the high-dose maintenance treatment were able to continue using the drug.

Following the PACIFIC study outcomes results, Longboard initiated an underwritten public offering on Tuesday, aiming to issue and sell $150 million worth of its common stock. The offering will be overseen by Cantor and Citigroup, serving as joint lead book-running managers, while Wedbush PacGrow and H.C. Wainwright & Co. will take on the roles of lead managers.

Two analysts just increased their targets

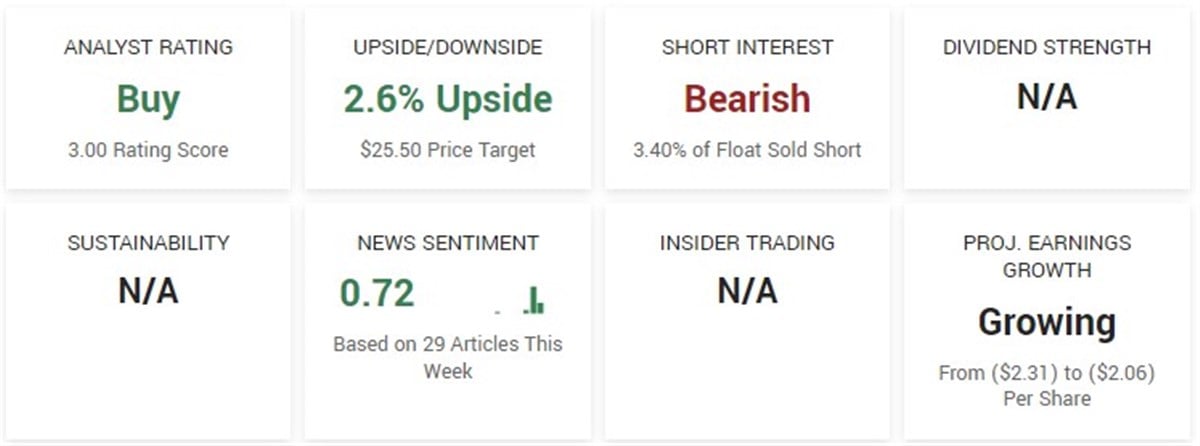

Analysts have long been bullish on the stock, having placed a consensus Buy rating on it for over a year. However, following the breaking news this week, two analysts boosted their price targets significantly. On January 2, Guggenheim and Cantor Fitzgerald increased their price targets for LBPH. Guggenheim raised its target from $16 to $32, and Cantor Fitzgerald boosted it from $35 to $55. The stock currently has a consensus price target of $25.50, with a high forecast of $55 and a low forecast of $11.

While the recent breakthrough in the PACIFIC study paints a promising picture for Longboard Pharmaceuticals, it remains crucial to underscore the significance of cautious risk management, especially in light of the extreme price surge and potential for further short-term price fluctuations in the stock.