I recently wrote about the largest semiconductor equipment provider in the world, ASML (NASDAQ: ASML). Now, I’ll cover the second largest, Applied Materials (NASDAQ: AMAT). The two stocks have performed very differently over the past three years. ASML has provided a total return of -10% over that time, while the figure sits at +43% for Applied Materials, outperforming the S&P 500 by 10%. So, how does Applied Materials differ from ASML, and is it the best semiconductor manufacturing equipment stock in the market?

Comparing ASML and Applied Materials Essential Products

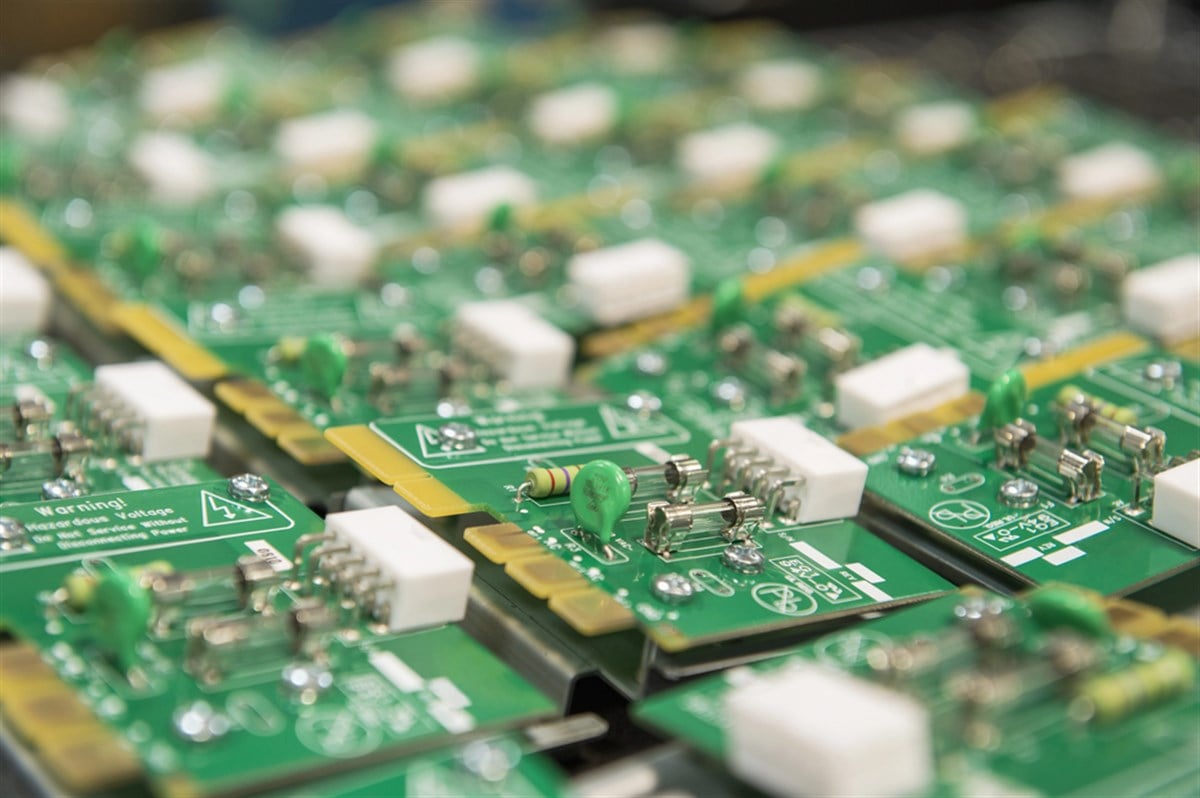

Applied Materials provides equipment to semiconductor firms, like Taiwan Semiconductor Manufacturing (NYSE: TSM). Manufacturing a semiconductor has many steps. Each needs specialized equipment. ASML provides a brief overview of these steps. ASML and Applied Materials differ in their equipment. ASML makes tools for one specific step in the process. Applied Materials makes tools for a much wider range of steps.

ASML specifically focuses on lithography. It makes the most advanced lithography equipment, where it has a "complete monopoly." It faces more competition in less advanced lithography equipment. Notably, although Applied Materials does operate across most of the semiconductor equipment ecosystem, it doesn’t make lithography equipment. In this sense, the companies are not true competitors. However, their business models compete in deciding which stock is better to own.

When thinking about the difference between these two firms' products, there are positives and negatives for each. ASML’s specialization can give it immense pricing power, affording it higher gross margins. Its specialization means it relies on lithography equipment sales for growth. In a slowdown, it can't fall back on other types of equipment.

The opposite is true for Applied Materials, as it has more types of equipment it can sell but doesn’t have as much power within any one of them. Looking at the gross margins of each firm, ASML has an advantage but not an overly egregious one. Its 51.1% gross margin over the last twelve months is around 375 basis points higher than that of Applied Materials.

Applied Offers Smoother Changes in Revenue While ASML Tends to Spike

Another key point of differentiation between these two firms comes in the variability of their revenue growth. Since 2021, ASML has experienced two massive spikes in revenue growth. In April of both 2021 and 2023, the company experienced a near 90% increase in year-over-year revenue growth. Subsequently, growth dropped off massively. Applied Materials also faces fluctuations in its revenue growth, but these changes happen much more gradually over time.

These huge spikes in revenue show that the industry may buy lithography equipment largely at the same time. Then, they don't buy more until they need to upgrade to stay competitive with advancements in the industry. This leads to somewhat higher volatility in the returns of the stock for ASML compared to Applied Materials. Still, it's hard to argue with ASML’s 20% compound annual growth rate (CAGR) in revenue over the past 5 years. Applied Materials' revenue CAGR was only 13%.

Applied Materials May Have More Room for Tech Advancement, But ASML Is Not Going Away

The last differentiation I want to point out is in terms of the differences in technological advancement. ASML has made such advanced equipment that it may have outpaced advancements in other types of equipment. Evidence of this comes from an MIT Technology Review article talking about the geopolitical importance of lithography equipment. It says that the lack of access to ASML's extreme ultraviolet (EUV) machines is "the biggest choke point for China's chip industry" amid U.S. and Dutch sales restrictions.

EUV machines are ASML's most advanced equipment. China has yet to even develop technology comparable to ASML’s deep ultraviolet (DUV) machines, which are not nearly as advanced as EUV machines.

There may be more potential for tech advances in other semiconductor equipment, like those made by Applied Materials. Applied provides some evidence to back this idea up. Slide 14 of its recent earnings presentation shows that, as chips get more advanced, it expects spending on "materials engineering" to rise relative to lithography spending.

"Materials engineering" is a broad term for much of what Applied’s machines do. Over time, this helps Applied Materials and hurts ASML, relatively speaking. However, lithography will still be massively important, meaning ASML will be too.

To me, these companies work in harmony, not against each other. They provide exposure to different sides of the same coin. I expect both to be very strong players for years to come and to complement each other well.