Household products company Church & Dwight (NYSE: CHD) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 3.8% year on year to $1.51 billion. On the other hand, next quarter’s revenue guidance of $1.49 billion was less impressive, coming in 5.5% below analysts’ estimates. Its non-GAAP profit of $0.79 per share was also 15.8% above analysts’ consensus estimates.

Is now the time to buy Church & Dwight? Find out by accessing our full research report, it’s free.

Church & Dwight (CHD) Q3 CY2024 Highlights:

- Revenue: $1.51 billion vs analyst estimates of $1.50 billion (1% beat)

- Adjusted EPS: $0.79 vs analyst estimates of $0.68 (15.8% beat)

- EBITDA: $122.3 million vs analyst estimates of $299.6 million (59.2% miss)

- Revenue Guidance for Q4 CY2024 is $1.49 billion at the midpoint, below analyst estimates of $1.57 billion

- Management reiterated its full-year Adjusted EPS guidance of $3.43 at the midpoint

- Gross Margin (GAAP): 45.2%, in line with the same quarter last year

- Operating Margin: -6.1%, down from 17.6% in the same quarter last year due to a one-time impairment charge

- EBITDA Margin: 8.1%, down from 21.9% in the same quarter last year

- Free Cash Flow Margin: 15.8%, similar to the same quarter last year

- Organic Revenue rose 4.3% year on year, in line with the same quarter last year

- Sales Volumes were up 3.1% year on year

- Market Capitalization: $24.46 billion

Matthew Farrell, Chief Executive Officer, commented, “We are pleased to deliver another quarter of strong results. Our outstanding Q3 results reflect the strength of our brands, the success of our new products, and our continued focus on execution. Volume was the primary driver of organic growth, which we expect to continue in Q4. We increased the investment in our brands in the quarter. Marketing as a percent of sales increased 80 basis points driving consumption and share gains. Global online sales grew to 20.7% of total consumer sales in Q3. Finally, the combination of strong sales, margin expansion, and efficient working capital management resulted in strong cash flow generation through the first nine months, with over $1 billion of cash from operations expected in the full year.

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE: CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

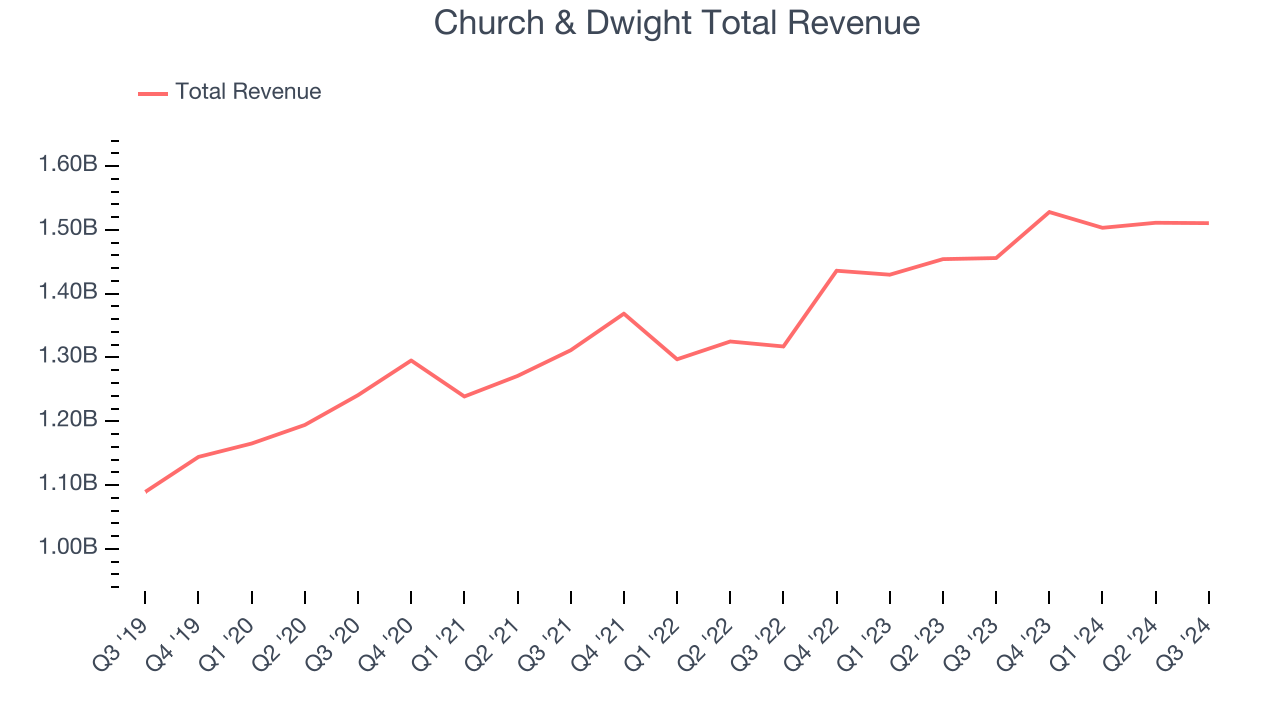

As you can see below, Church & Dwight’s 5.8% annualized revenue growth over the last three years was mediocre, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 1%. Management is currently guiding for a 2.8% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and indicates the market thinks its products will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Organic Revenue Growth

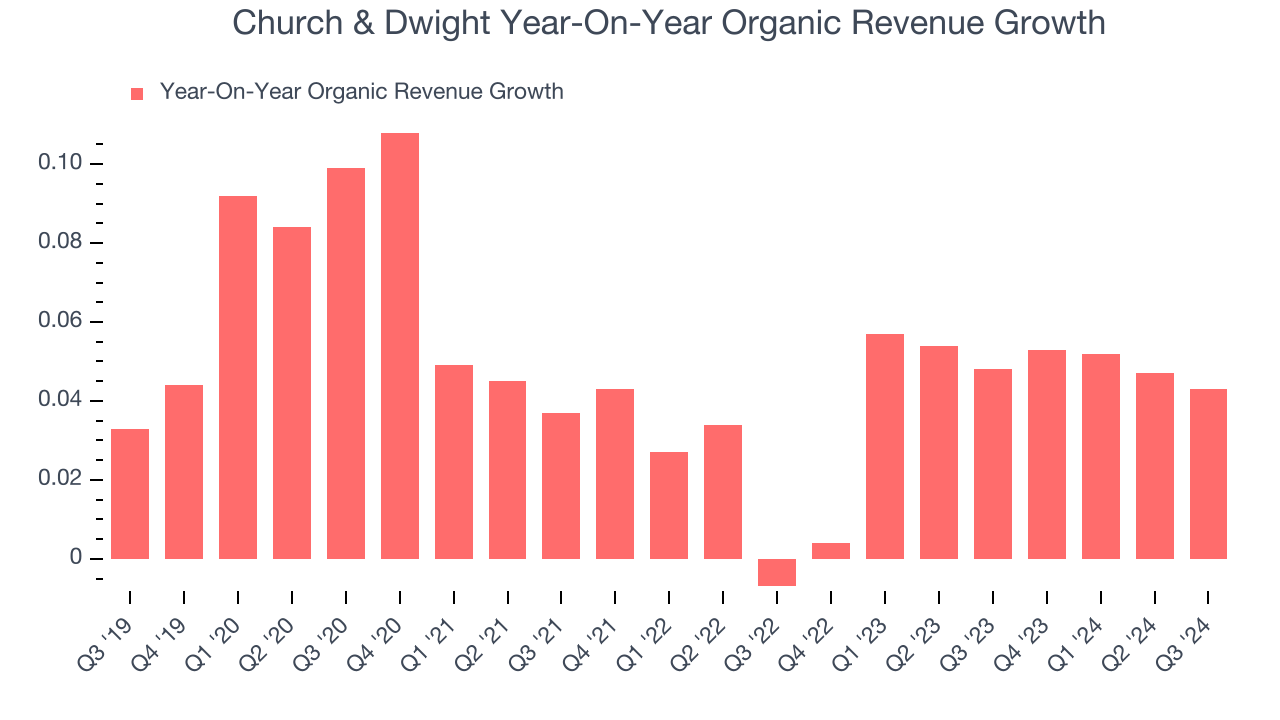

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Church & Dwight’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.5% year on year.

In the latest quarter, Church & Dwight’s organic sales rose 4.3% year on year. This growth was a deceleration from the 4.8% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Key Takeaways from Church & Dwight’s Q3 Results

We were impressed by how significantly Church & Dwight blew past analysts’ organic revenue growth expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 1.6% to $101.50 immediately following the results.

Big picture, is Church & Dwight a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.