Leggett & Platt has been treading water for the past six months, recording a small loss of 3% while holding steady at $11.28. The stock also fell short of the S&P 500’s 11.1% gain during that period.

Is now the time to buy Leggett & Platt, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We're swiping left on Leggett & Platt for now. Here are three reasons why there are better opportunities than LEG and one stock we like more.

Why Do We Think Leggett & Platt Will Underperform?

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

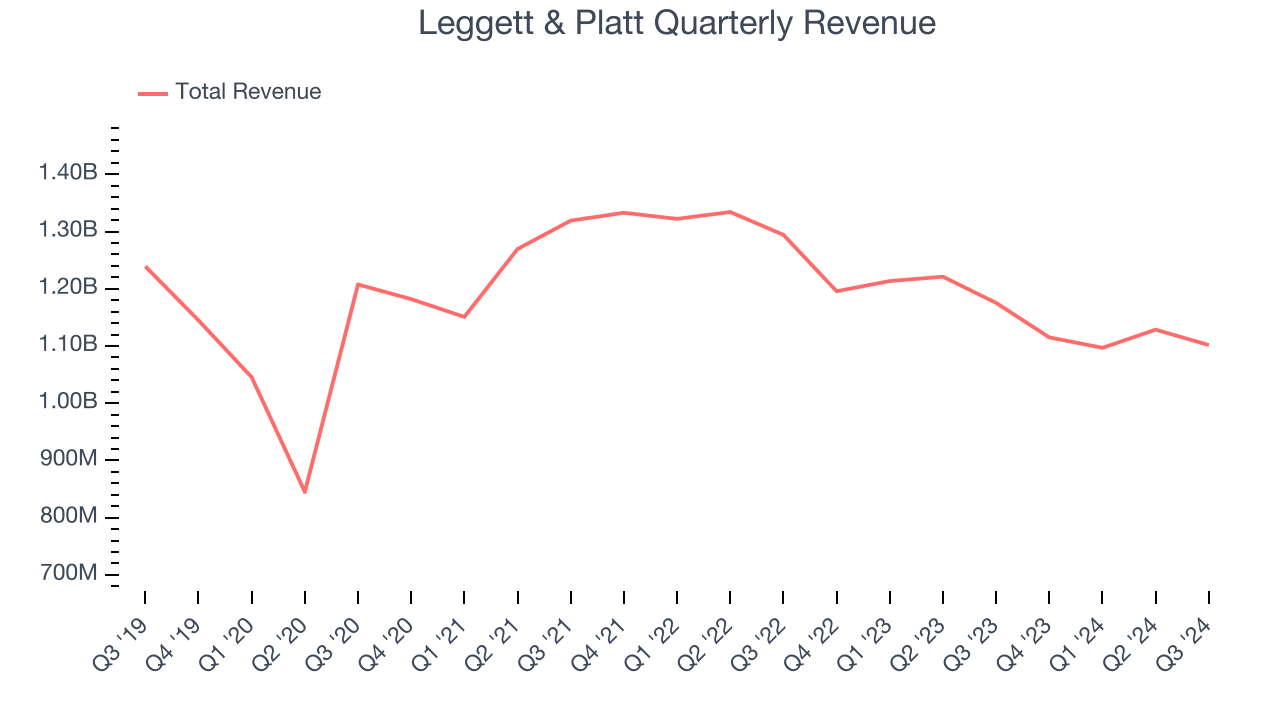

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Leggett & Platt struggled to consistently increase demand as its $4.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of poor business quality.

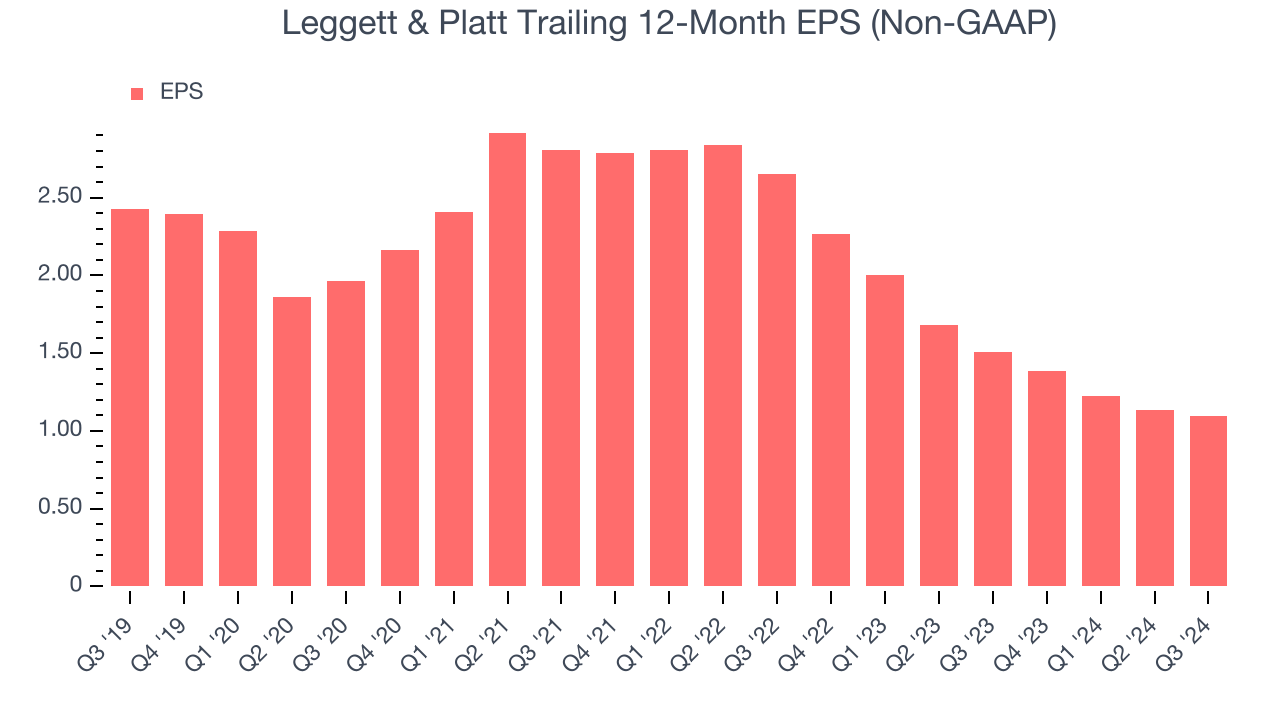

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Leggett & Platt, its EPS declined by 14.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

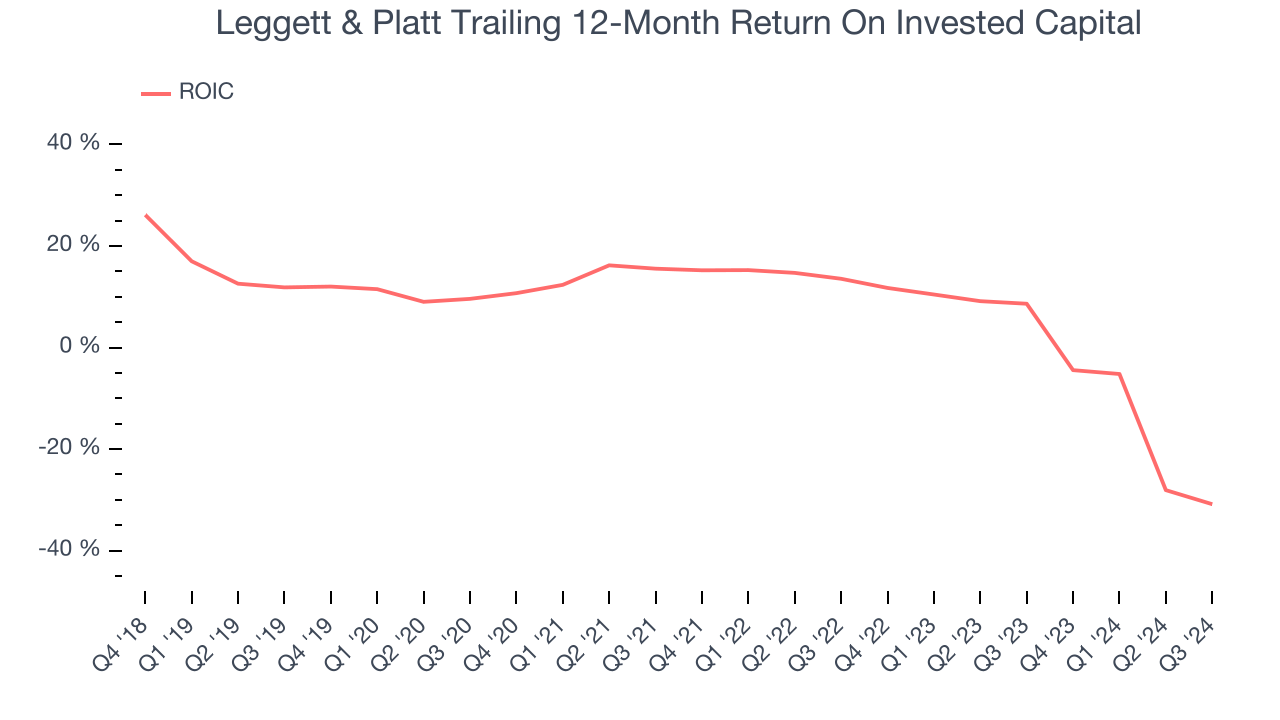

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, Leggett & Platt’s ROIC has decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Leggett & Platt falls short of our quality standards. With its shares underperforming the market lately, the stock trades at 9x forward price-to-earnings (or $11.28 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. We’d recommend taking a look at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Like More Than Leggett & Platt

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.