Online real estate marketplace Zillow (NASDAQ: ZG) announced better-than-expected revenue in Q3 CY2024, with sales up 17.1% year on year to $581 million. Its non-GAAP profit of $0.35 per share was also 20.1% above analysts’ consensus estimates.

Is now the time to buy Zillow? Find out by accessing our full research report, it’s free.

Zillow (ZG) Q3 CY2024 Highlights:

- Revenue: $581 million vs analyst estimates of $555.2 million (4.7% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.29 (20.1% beat)

- EBITDA: $127 million vs analyst estimates of $107.6 million (18.1% beat)

- Q4 revenue guidance of $532.5 million, in line with expectations

- Q4 adjusted EBITDA guidance of $97.5 million, below expectations

- Gross Margin (GAAP): 75.9%, down from 77.8% in the same quarter last year

- Operating Margin: -7.7%, up from -10.7% in the same quarter last year

- EBITDA Margin: 21.9%, in line with the same quarter last year

- Free Cash Flow Margin: 33.9%, up from 8.1% in the same quarter last year

- Market Capitalization: $14.4 billion

Company Overview

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ: ZG) is the leading U.S. online real estate marketplace.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

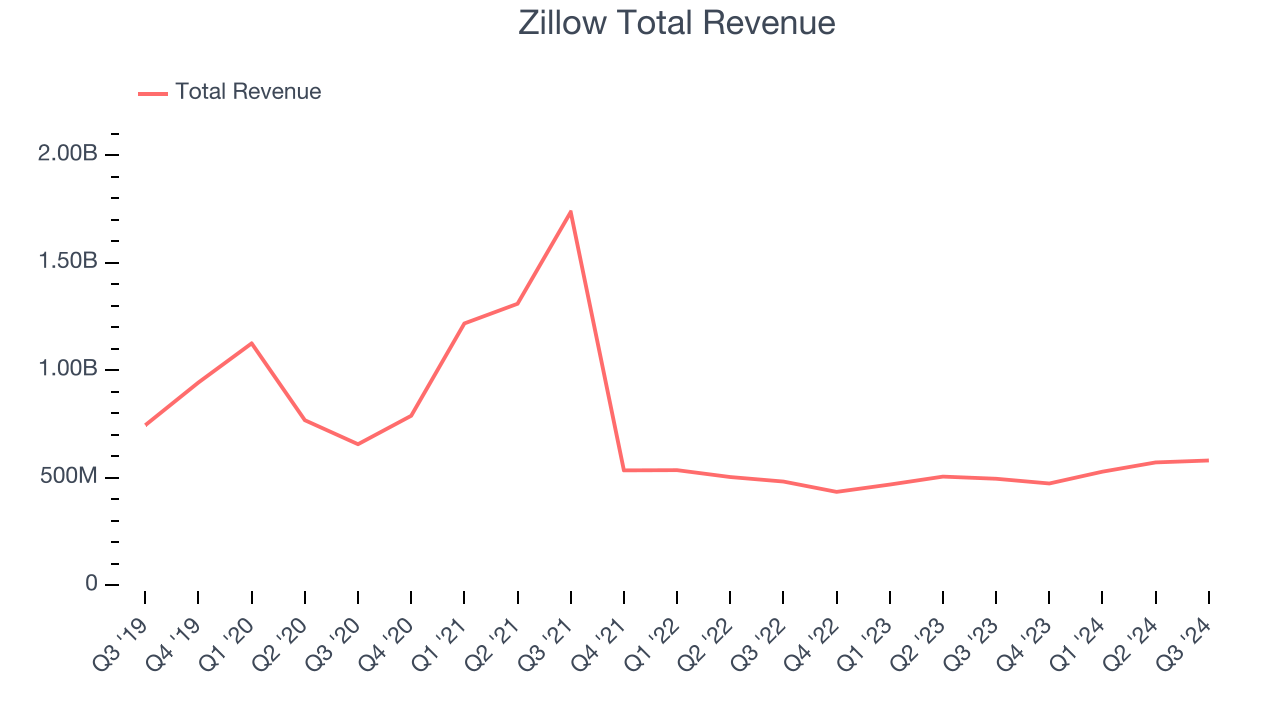

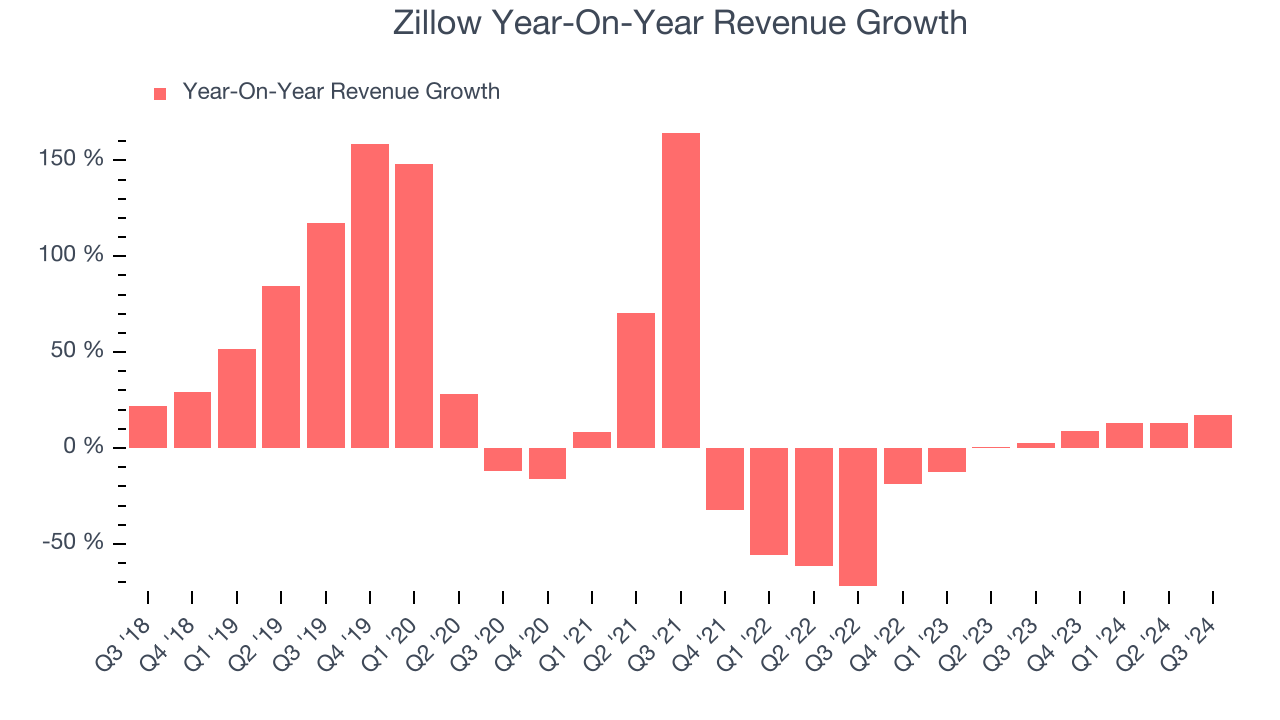

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Zillow struggled to generate demand over the last five years as its sales were flat. This is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Zillow’s annualized revenue growth of 2.4% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Zillow reported year-on-year revenue growth of 17.1%, and its $581 million of revenue exceeded Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, an improvement versus the last two years. Although this projection shows the market believes its newer products and services will spur better performance, it is still below average for the sector.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

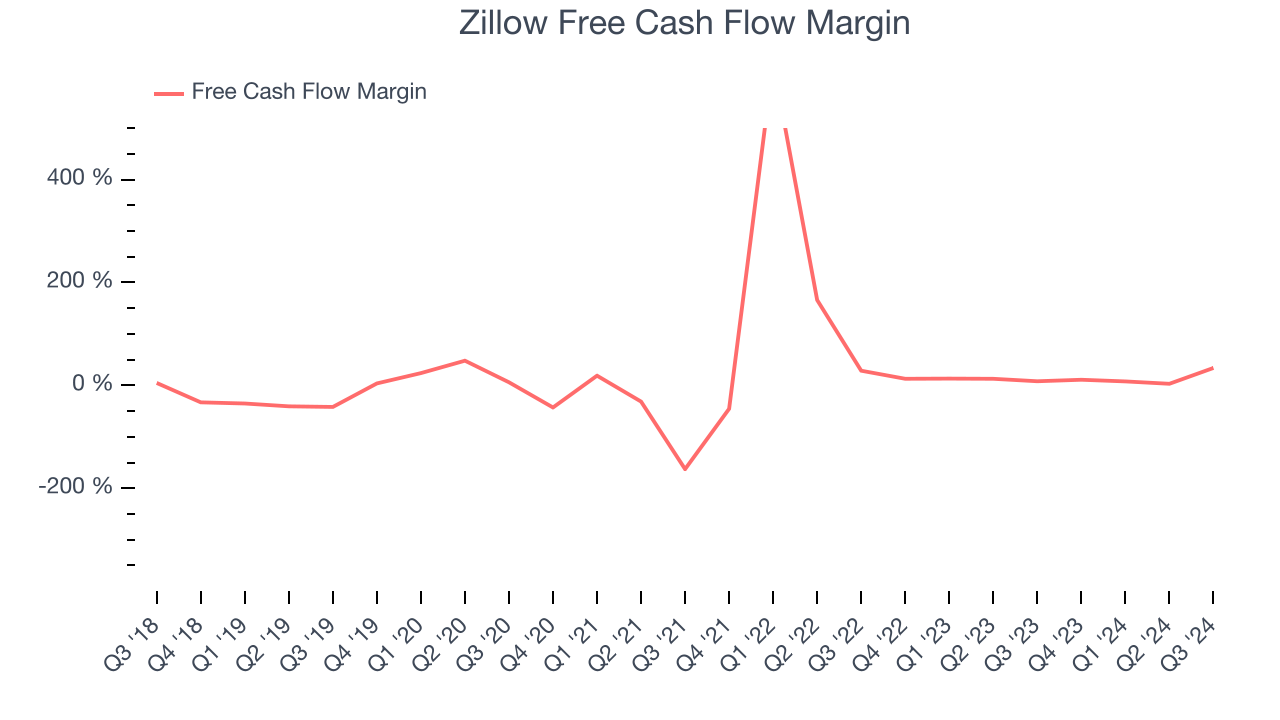

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Zillow has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.1% over the last two years, better than the broader consumer discretionary sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Zillow’s free cash flow clocked in at $196.9 million in Q3, equivalent to a 33.9% margin. This result was good as its margin was 25.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Zillow’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 14.3% for the last 12 months will increase to 24%, it options for capital deployment (investments, share buybacks, etc.).

Key Takeaways from Zillow’s Q3 Results

We enjoyed seeing Zillow exceed analysts’ revenue, EBITDA, and EPS expectations this quarter. Q4 guidance was mixed, with revenue in line while EBITDA came in below. Zooming out, we think this was a solid quarter, and the market seems to be focusing on the quarterly beats. The stock traded up 14.5% to $64.20 immediately after reporting.

Zillow had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.