Aerospace and defense company Hexcel (NYSE: HXL) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $456.2 million. On the other hand, the company’s full-year revenue guidance of $1.88 billion at the midpoint came in 1.4% below analysts’ estimates. Its non-GAAP profit of $0.37 per share was in line with analysts’ consensus estimates.

Is now the time to buy Hexcel? Find out by accessing our full research report, it’s free for active Edge members.

Hexcel (HXL) Q3 CY2025 Highlights:

- Revenue: $456.2 million vs analyst estimates of $443.1 million (flat year on year, 3% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.38 (in line)

- Adjusted EBITDA: $67.9 million vs analyst estimates of $77.34 million (14.9% margin, 12.2% miss)

- The company dropped its revenue guidance for the full year to $1.88 billion at the midpoint from $1.92 billion, a 1.8% decrease

- Management lowered its full-year Adjusted EPS guidance to $1.75 at the midpoint, a 10.3% decrease

- Operating Margin: 7.9%, down from 11.5% in the same quarter last year

- Free Cash Flow Margin: 21.2%, up from 16.1% in the same quarter last year

- Market Capitalization: $5.07 billion

Chairman, CEO and President Tom Gentile said, “Hexcel’s third quarter sales and adjusted EPS were in line with expectations as we experienced seasonally slower third quarter sales combined with the expected commercial aerospace destocking, particularly with the Airbus A350. As we consider tariffs, inflation and the fourth quarter 2025 impact of some lingering destocking, we expect to be at the bottom end of our 2025 sales guidance and we have reduced our EPS guidance. Looking forward to 2026, we are seeing strong orders from the commercial aerospace OEMs to support the production rate increases they are forecasting for their key programs. With the supply chain stabilizing, we are increasingly confident in the outlook for commercial aerospace original equipment build rates. Once Airbus and Boeing hit their publicly announced peak build rates, Hexcel expects to benefit with an additional $500 million in incremental annual revenue from existing contracts. These increasing sales in 2026 and beyond will drive higher capacity utilization, unlocking the volume leverage that will fuel future margin expansion. With the incremental revenue Hexcel is expected to generate more than $1 billion in free cash flow over the next four years.”

Company Overview

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE: HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Revenue Growth

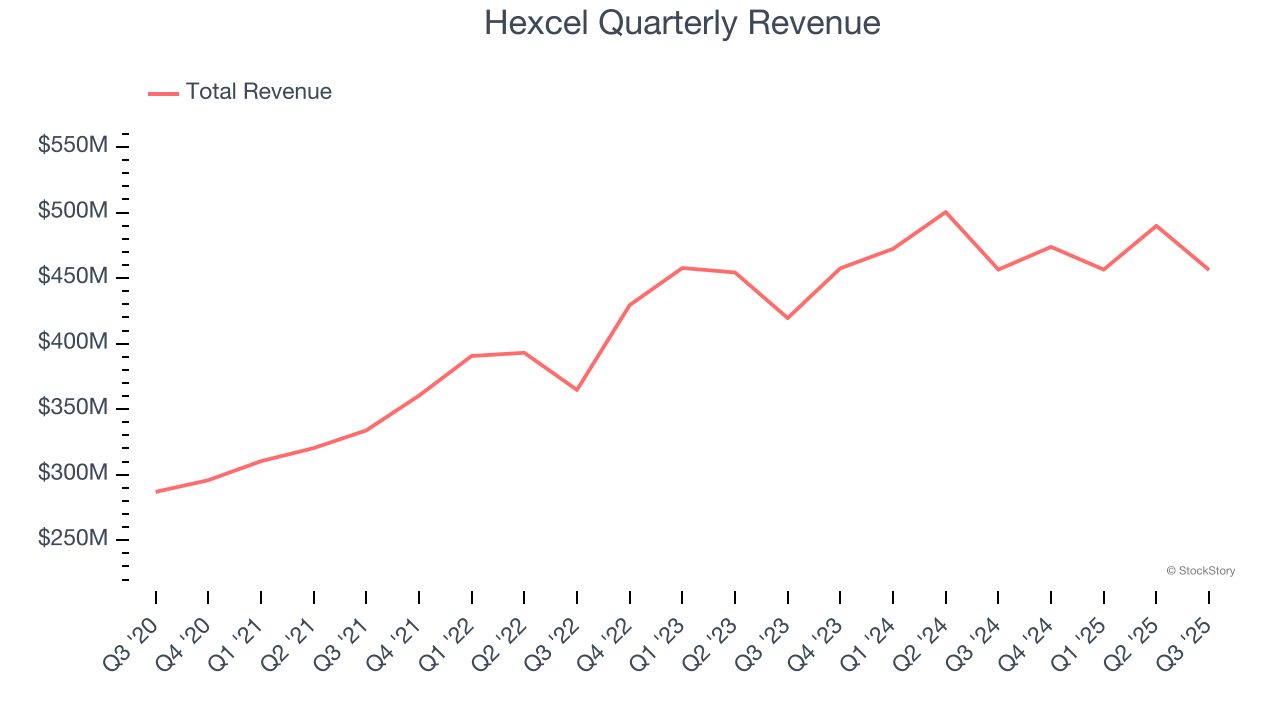

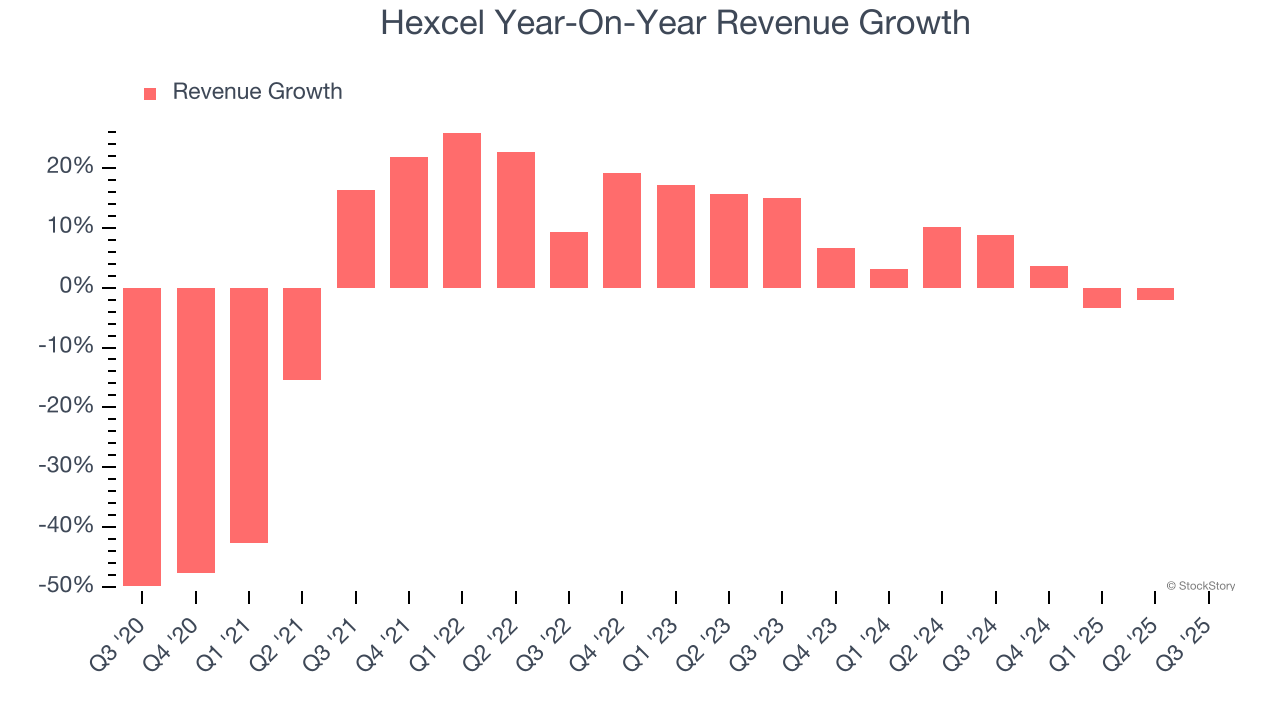

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Hexcel’s 1.2% annualized revenue growth over the last five years was weak. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hexcel’s annualized revenue growth of 3.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

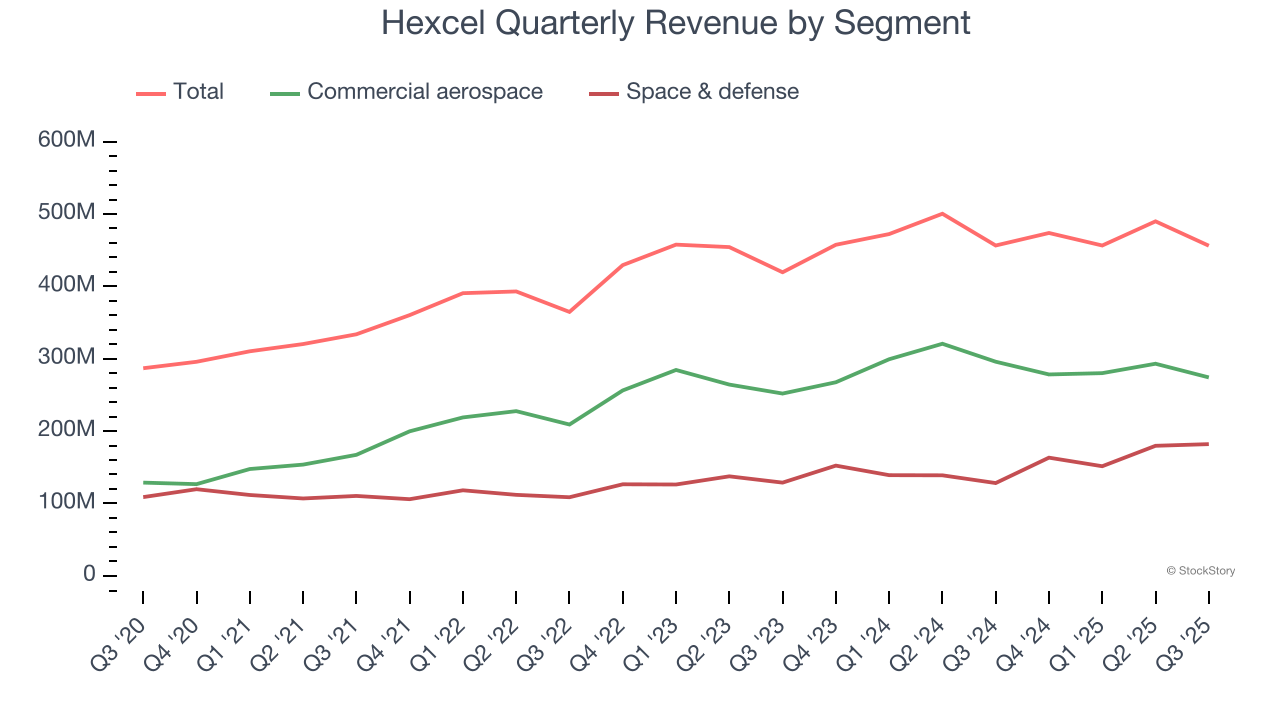

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Commercial aerospace and Space & defense, which are 60.1% and 39.9% of revenue. Over the last two years, Hexcel’s Commercial aerospace revenue (customers like Airbus, Boeing) averaged 3.8% year-on-year growth while its Space & defense revenue (government customers) averaged 14.8% growth.

This quarter, Hexcel’s $456.2 million of revenue was flat year on year but beat Wall Street’s estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 9.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will spur better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

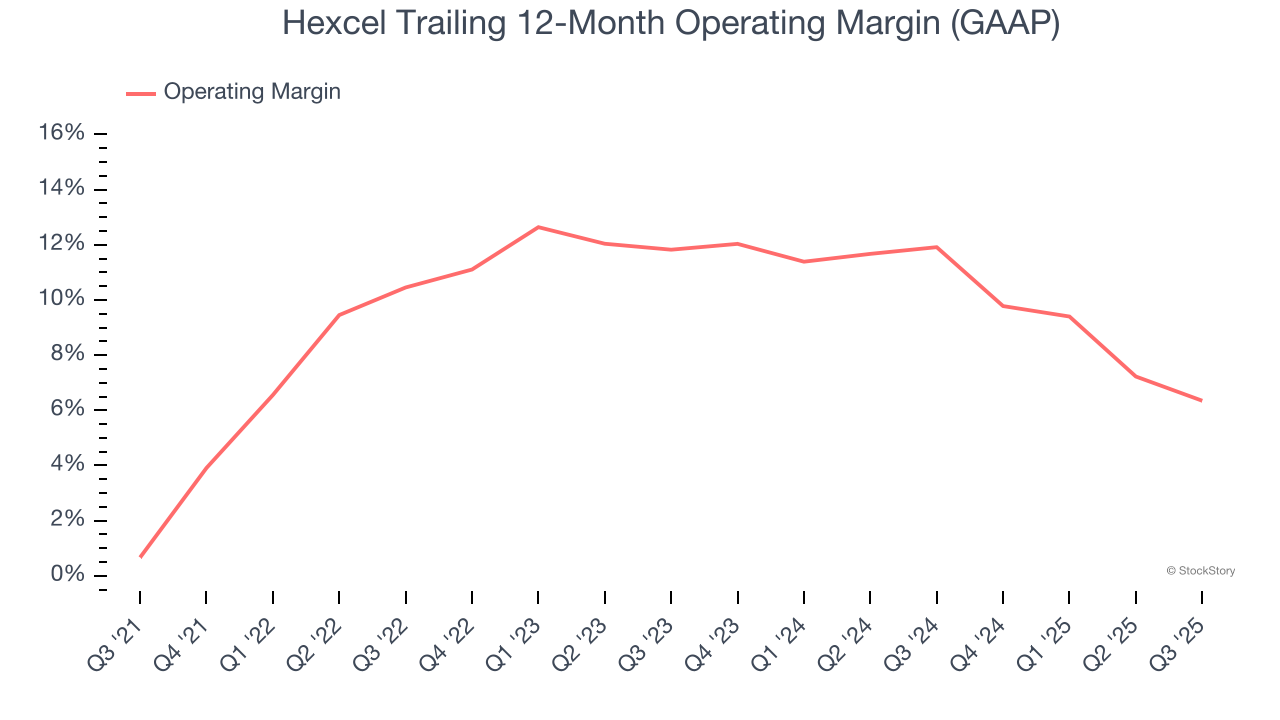

Hexcel has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.7%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Hexcel’s operating margin rose by 5.7 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Hexcel generated an operating margin profit margin of 7.9%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

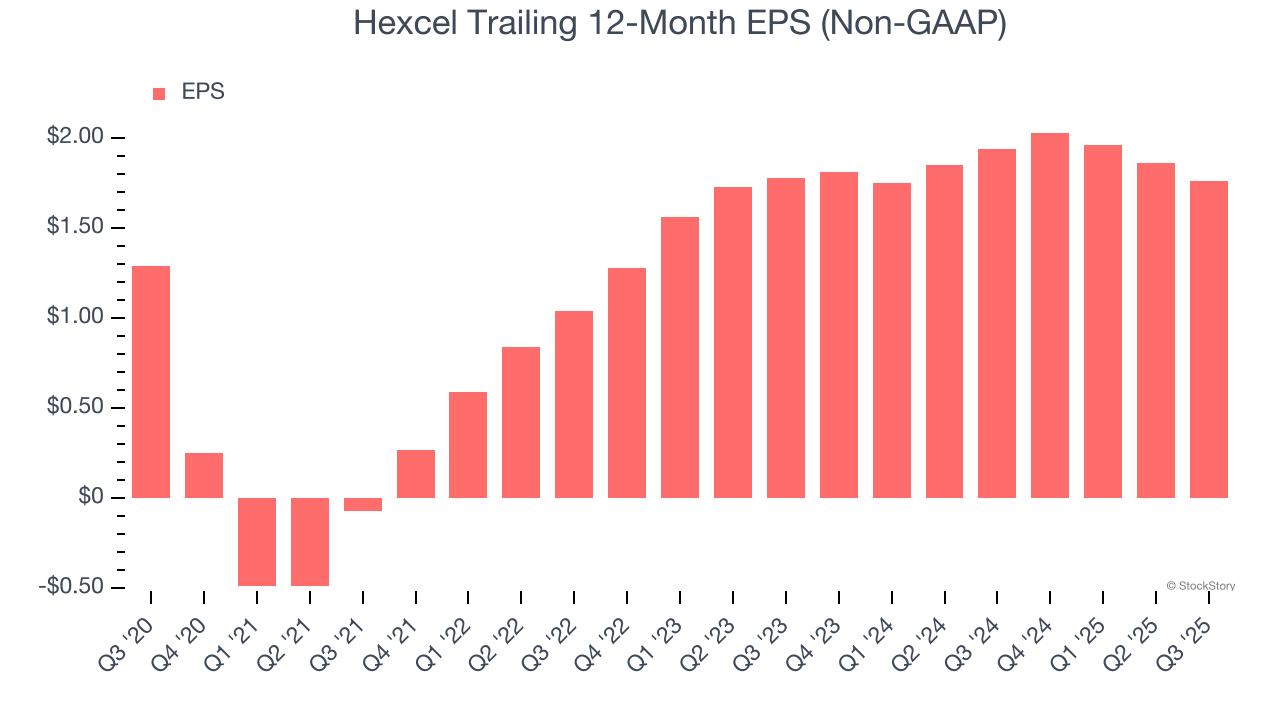

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

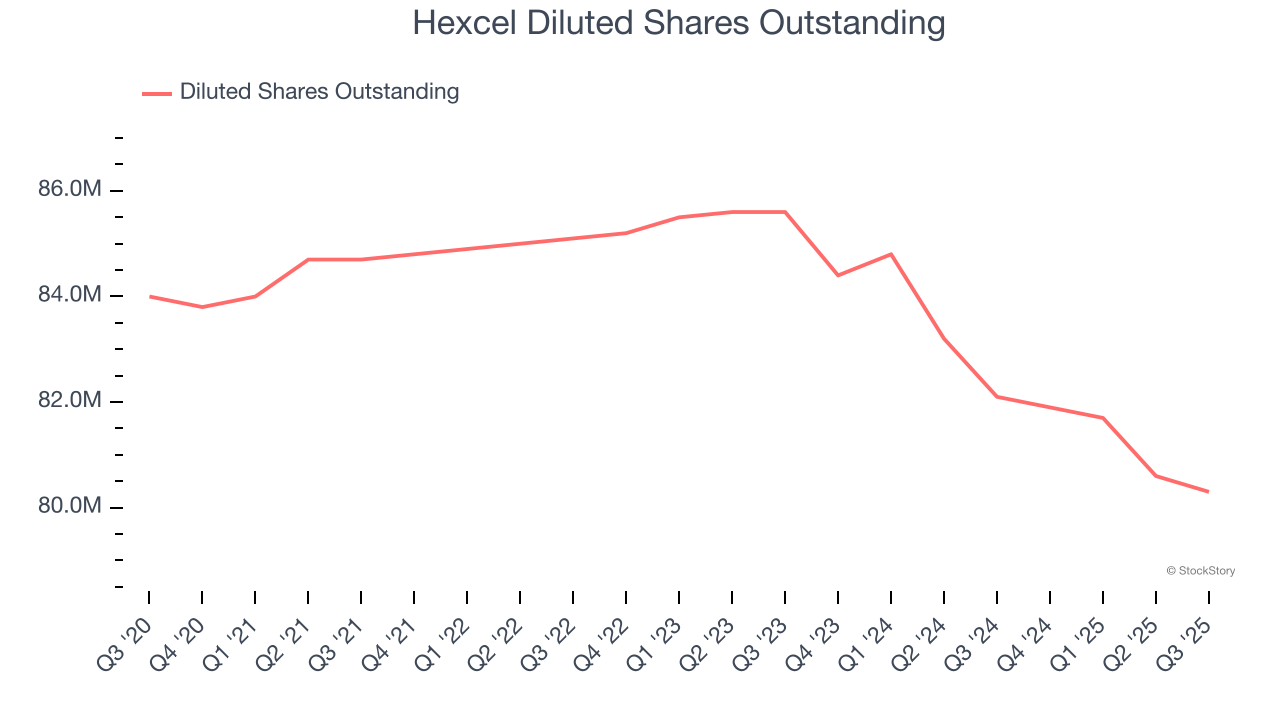

Hexcel’s EPS grew at an unimpressive 6.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Hexcel’s earnings can give us a better understanding of its performance. As we mentioned earlier, Hexcel’s operating margin declined this quarter but expanded by 5.7 percentage points over the last five years. Its share count also shrank by 4.4%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Hexcel, EPS didn’t budge over the last two years, a regression from its five-year trend. We hope it can revert to earnings growth in the coming years.

In Q3, Hexcel reported adjusted EPS of $0.37, down from $0.47 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hexcel’s full-year EPS of $1.76 to grow 34.6%.

Key Takeaways from Hexcel’s Q3 Results

We were glad Hexcel's revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance was lowered and full-year EPS guidance missed. Overall, this quarter was mixed, with the company's financial outlook as a key negative. The stock traded up 1.9% to $64.99 immediately following the results.

Is Hexcel an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.