Footwear and apparel conglomerate Deckers (NYSE: DECK) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 9.1% year on year to $1.43 billion. On the other hand, the company’s full-year revenue guidance of $5.35 billion at the midpoint came in 2% below analysts’ estimates. Its GAAP profit of $1.82 per share was 15.2% above analysts’ consensus estimates.

Is now the time to buy Deckers? Find out by accessing our full research report, it’s free for active Edge members.

Deckers (DECK) Q3 CY2025 Highlights:

- Revenue: $1.43 billion vs analyst estimates of $1.42 billion (9.1% year-on-year growth, 0.8% beat)

- EPS (GAAP): $1.82 vs analyst estimates of $1.58 (15.2% beat)

- EPS (GAAP) guidance for the full year is $6.35 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 22.8%, in line with the same quarter last year

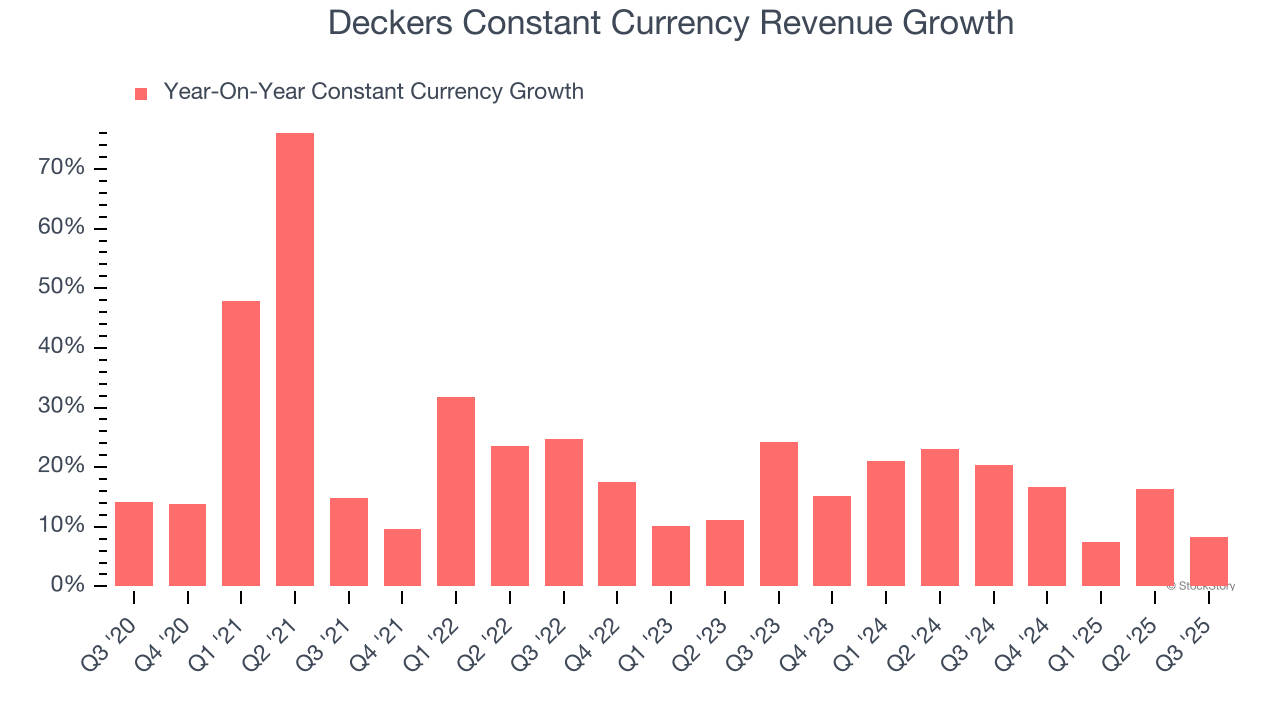

- Constant Currency Revenue rose 8.3% year on year (20.4% in the same quarter last year)

- Market Capitalization: $14.97 billion

“HOKA and UGG again delivered double-digit growth in the second quarter, reflecting strong performance and international momentum for these powerful brands,” said Stefano Caroti, President and Chief Executive Officer.

Company Overview

Established in 1973, Deckers (NYSE: DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

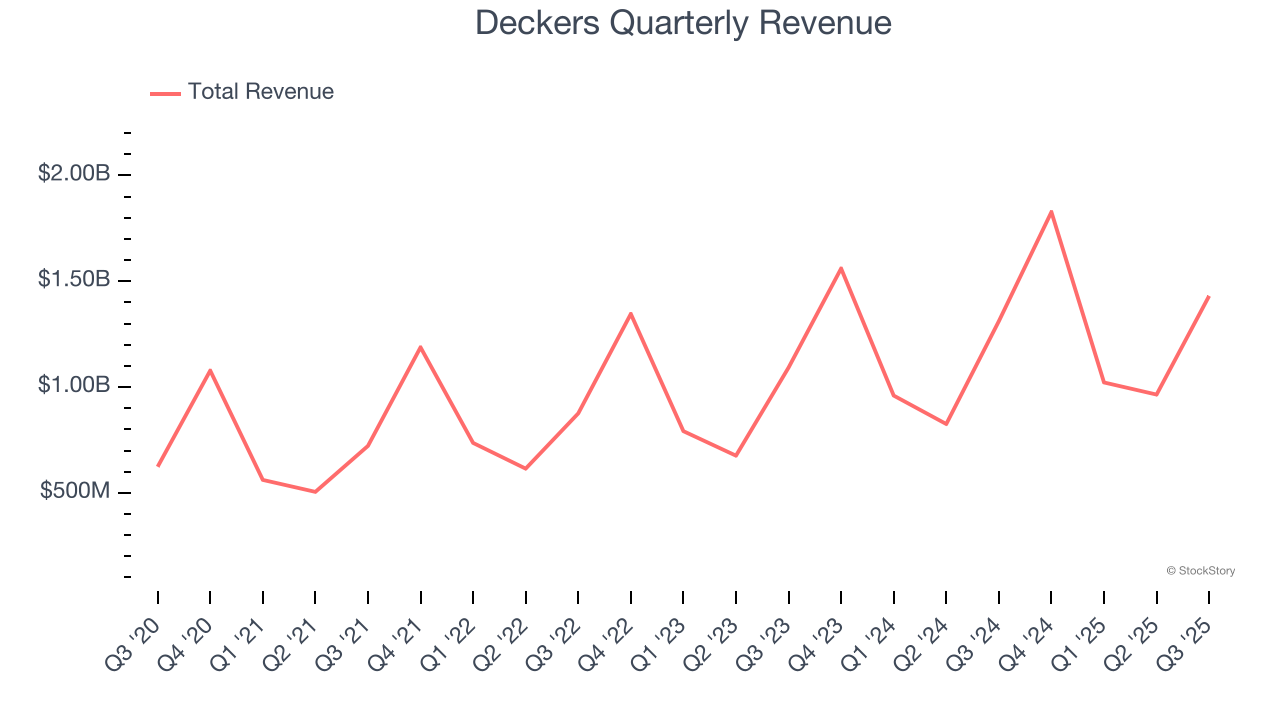

Revenue Growth

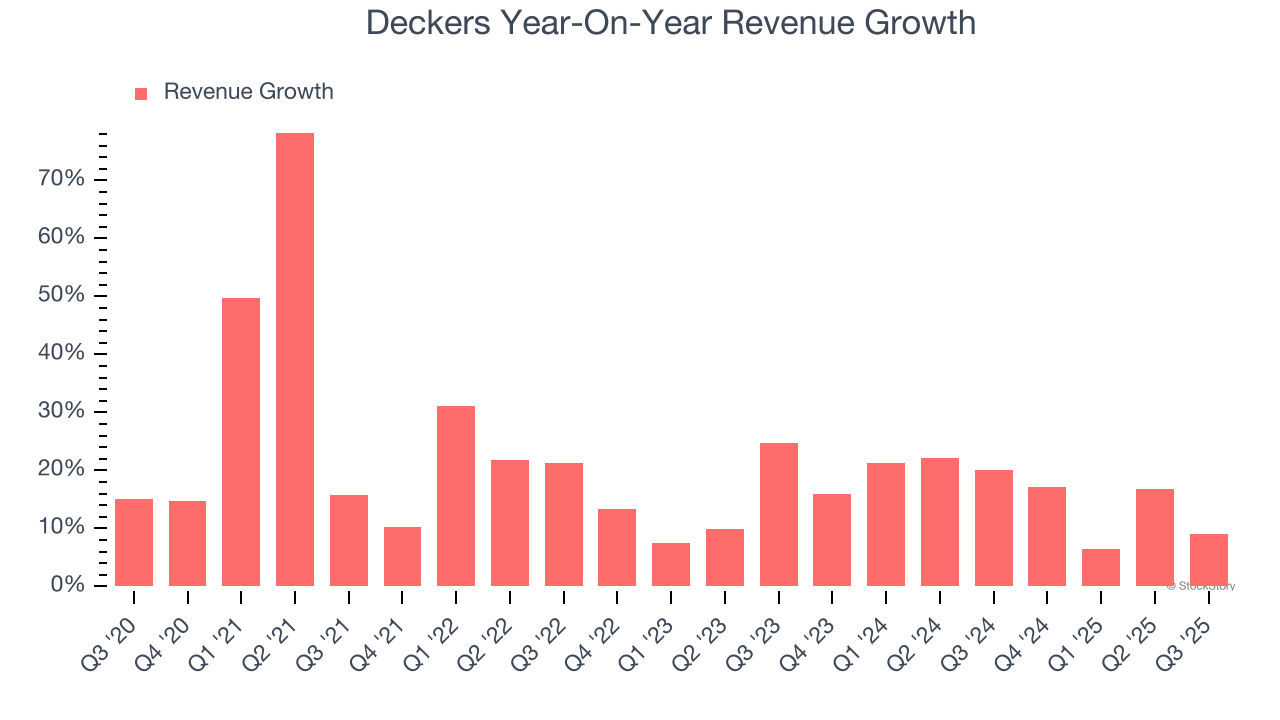

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Deckers grew its sales at a solid 18.8% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Deckers’s annualized revenue growth of 15.9% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 16% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Deckers has properly hedged its foreign currency exposure.

This quarter, Deckers reported year-on-year revenue growth of 9.1%, and its $1.43 billion of revenue exceeded Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

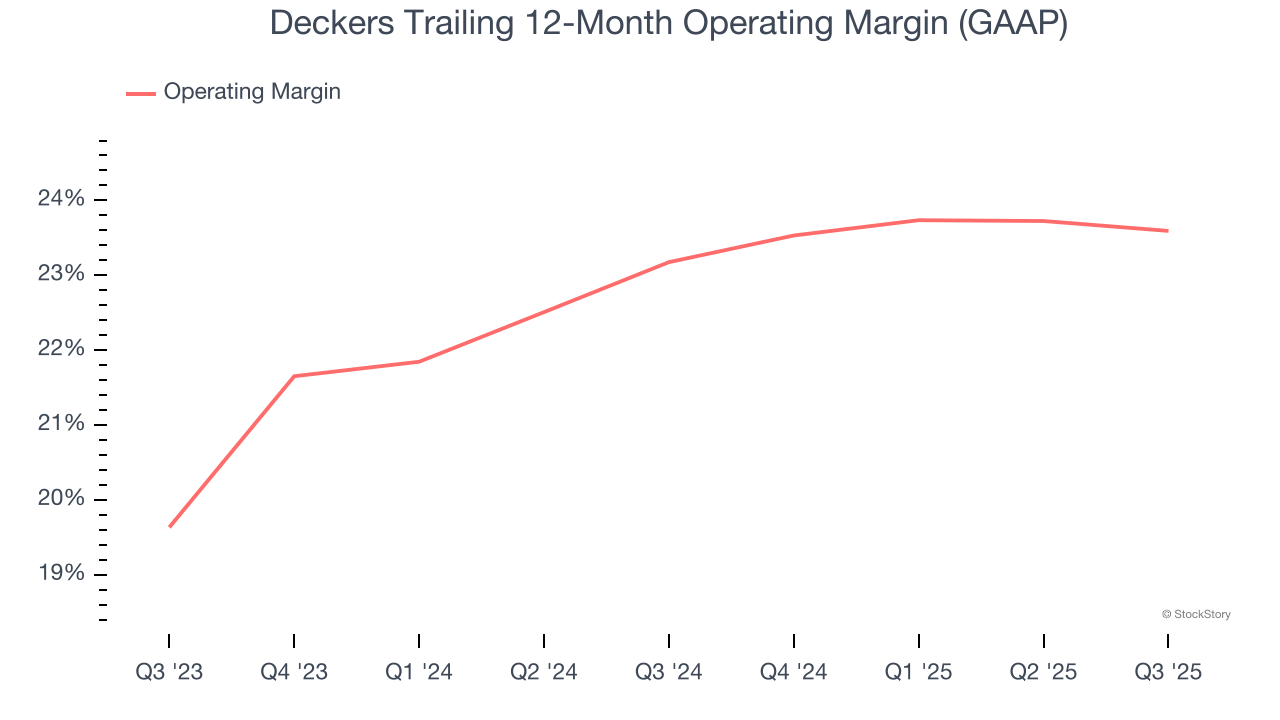

Operating Margin

Deckers’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 23.4% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q3, Deckers generated an operating margin profit margin of 22.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

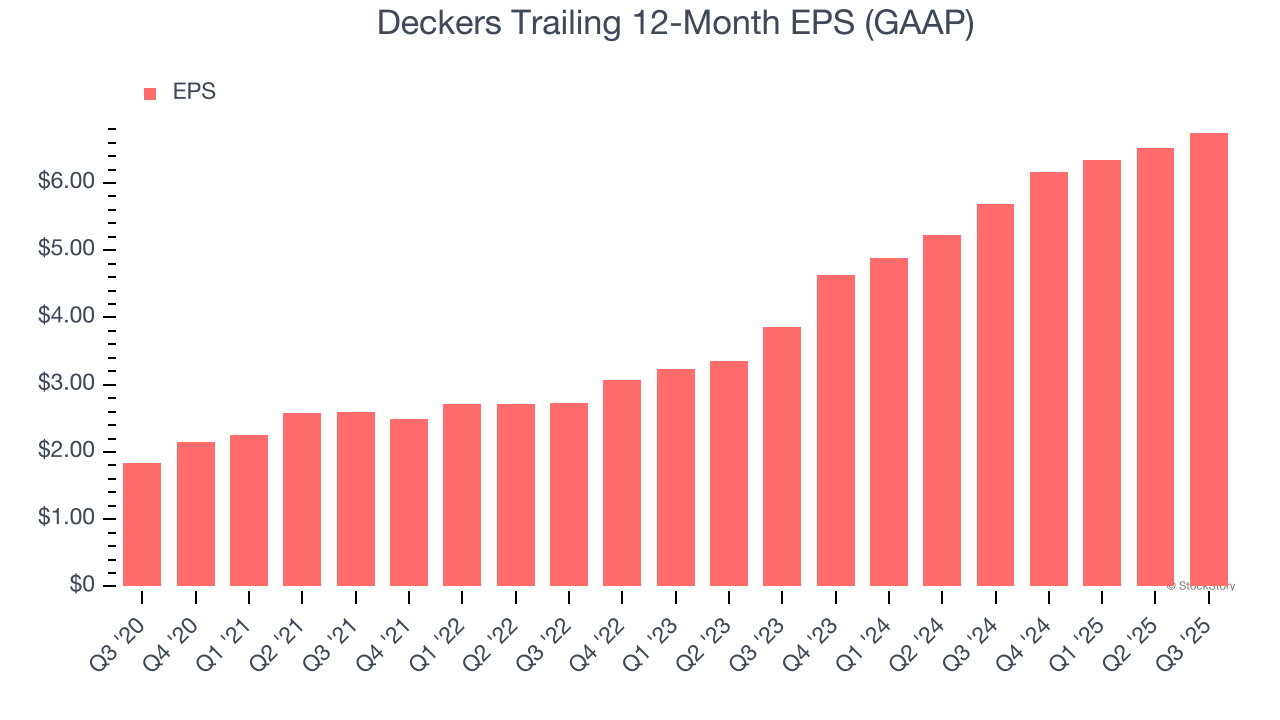

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Deckers’s EPS grew at an astounding 29.8% compounded annual growth rate over the last five years, higher than its 18.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Deckers reported EPS of $1.82, up from $1.59 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Deckers’s full-year EPS of $6.75 to shrink by 3.9%.

Key Takeaways from Deckers’s Q3 Results

It was good to see Deckers beat analysts’ EPS expectations this quarter. We were also happy its constant currency revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed. Overall, this was a softer quarter. The stock traded down 8% to $94.30 immediately after reporting.

So do we think Deckers is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.