As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the transportation and logistics industry, including FedEx (NYSE: FDX) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for transportation and logistics companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Companies that win in this space boast speed, reach, reliability, and last-mile efficiency while those who do not see their market shares diminish. Like other industrials companies, transportation and logistics companies are at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs influence profit margins.

The 7 transportation and logistics stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.5%.

While some transportation and logistics stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.5% since the latest earnings results.

Best Q3: FedEx (NYSE: FDX)

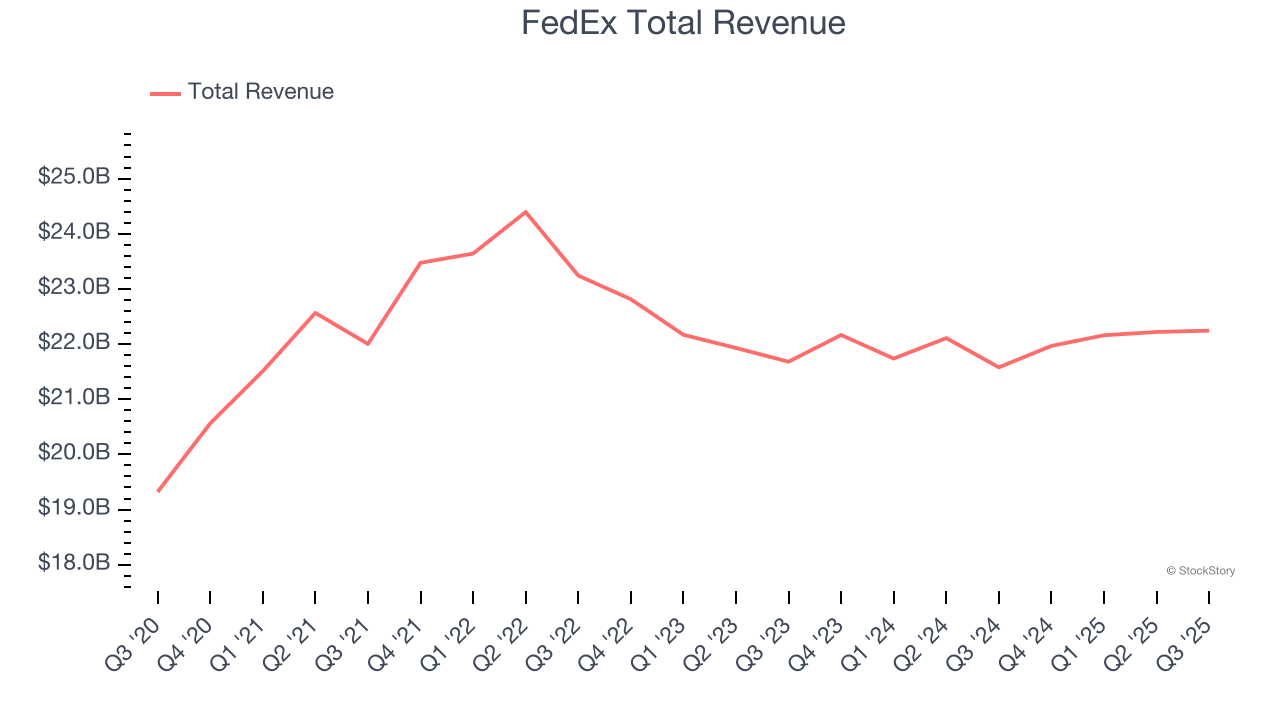

Sporting one of the largest air cargo fleets in the world, FedEx (NYSE: FDX) is a global provider of parcel and cargo delivery services.

FedEx reported revenues of $22.24 billion, up 3.1% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income and revenue estimates.

FedEx scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 5.3% since reporting and currently trades at $238.80.

Is now the time to buy FedEx? Access our full analysis of the earnings results here, it’s free for active Edge members.

Ryder (NYSE: R)

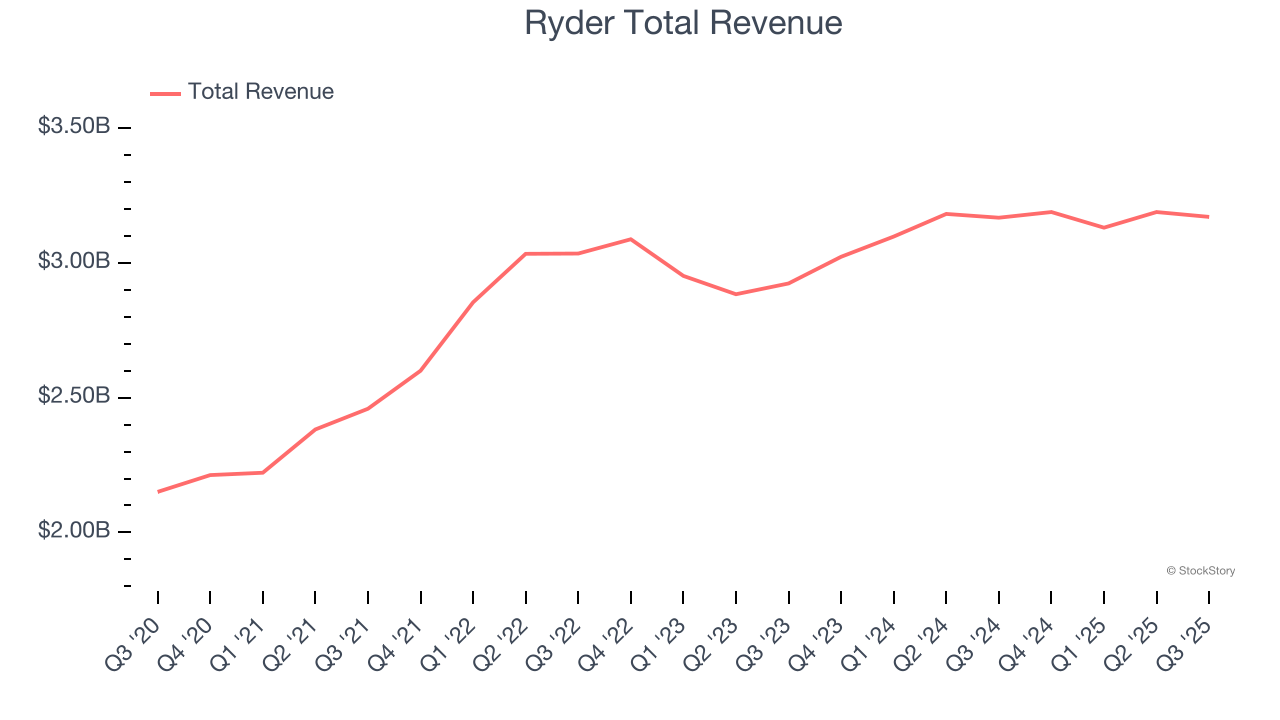

As one of the first companies to introduce the idea of leasing trucks, Ryder (NYSE: R) provides rental vehicles to businesses and delivers packages directly to homes or businesses.

Ryder reported revenues of $3.17 billion, flat year on year, falling short of analysts’ expectations by 0.7%. The business performed better than its peers, but it was unfortunately a slower quarter with a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11.9% since reporting. It currently trades at $161.

Is now the time to buy Ryder? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Knight-Swift Transportation (NYSE: KNX)

Covering 1.6 billion loaded miles in 2023 alone, Knight-Swift Transportation (NYSE: KNX) offers less-than-truckload and full truckload delivery services.

Knight-Swift Transportation reported revenues of $1.93 billion, up 2.7% year on year, exceeding analysts’ expectations by 1.7%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates and EPS guidance for next quarter missing analysts’ expectations significantly.

As expected, the stock is down 5.9% since the results and currently trades at $44.58.

Read our full analysis of Knight-Swift Transportation’s results here.

CSX (NASDAQ: CSX)

Established as part of the Chessie System and Seaboard Coast Line Industries merger, CSX (NASDAQ: CSX) is a transportation company specializing in freight rail services.

CSX reported revenues of $3.59 billion, flat year on year. This result was in line with analysts’ expectations. Overall, it was a satisfactory quarter as it also produced a decent beat of analysts’ adjusted operating income estimates.

CSX had the slowest revenue growth among its peers. The stock is down 1.2% since reporting and currently trades at $35.52.

Read our full, actionable report on CSX here, it’s free for active Edge members.

Norfolk Southern (NYSE: NSC)

Starting with a single route from Virginia to North Carolina, Norfolk Southern (NYSE: NSC) is a freight transportation company operating a major railroad network across the eastern United States.

Norfolk Southern reported revenues of $3.10 billion, up 1.7% year on year. This print met analysts’ expectations. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ EPS and EBITDA estimates.

The stock is flat since reporting and currently trades at $283.83.

Read our full, actionable report on Norfolk Southern here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.