Private label food company TreeHouse Foods (NYSE: THS) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $905.7 million. On the other hand, next quarter’s revenue guidance of $792.5 million was less impressive, coming in 3.3% below analysts’ estimates. Its non-GAAP profit of $0.95 per share was 2.2% below analysts’ consensus estimates.

Is now the time to buy TreeHouse Foods? Find out by accessing our full research report, it’s free.

TreeHouse Foods (THS) Q4 CY2024 Highlights:

- Revenue: $905.7 million vs analyst estimates of $907.3 million (flat year on year, in line)

- Adjusted EPS: $0.95 vs analyst expectations of $0.97 (2.2% miss)

- Adjusted EBITDA: $118.3 million vs analyst estimates of $119.5 million (13.1% margin, 1% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $3.37 billion at the midpoint, missing analyst estimates by 1.5% and implying 0% growth (vs -1.8% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $360 million at the midpoint, below analyst estimates of $368.6 million

- Operating Margin: 8.9%, up from 4.6% in the same quarter last year

- Free Cash Flow Margin: 27.4%, up from 9.6% in the same quarter last year

- Organic Revenue was flat year on year (-8% in the same quarter last year)

- Sales Volumes rose 3.8% year on year (-3.9% in the same quarter last year)

- Market Capitalization: $1.69 billion

"We closed a challenging 2024 with sequentially improved net sales trends, gross profit margin, and Adjusted EBITDA margin, all of which were in-line with our updated expectations," said Steve Oakland, Chairman, Chief Executive Officer, and President.

Company Overview

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE: THS) produces a wide range of private-label foods for grocery and food service customers.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.37 billion in revenue over the past 12 months, TreeHouse Foods carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

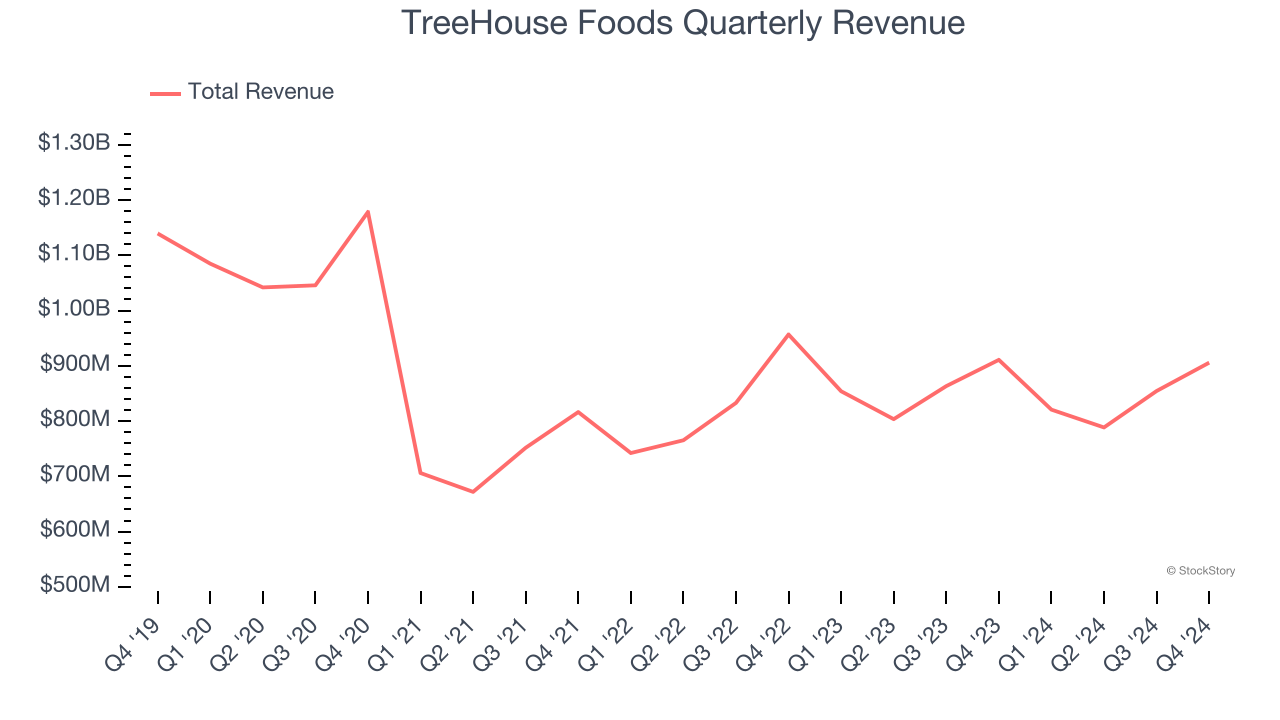

As you can see below, TreeHouse Foods’s 4.6% annualized revenue growth over the last three years was tepid as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, TreeHouse Foods’s $905.7 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 3.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Volume Growth

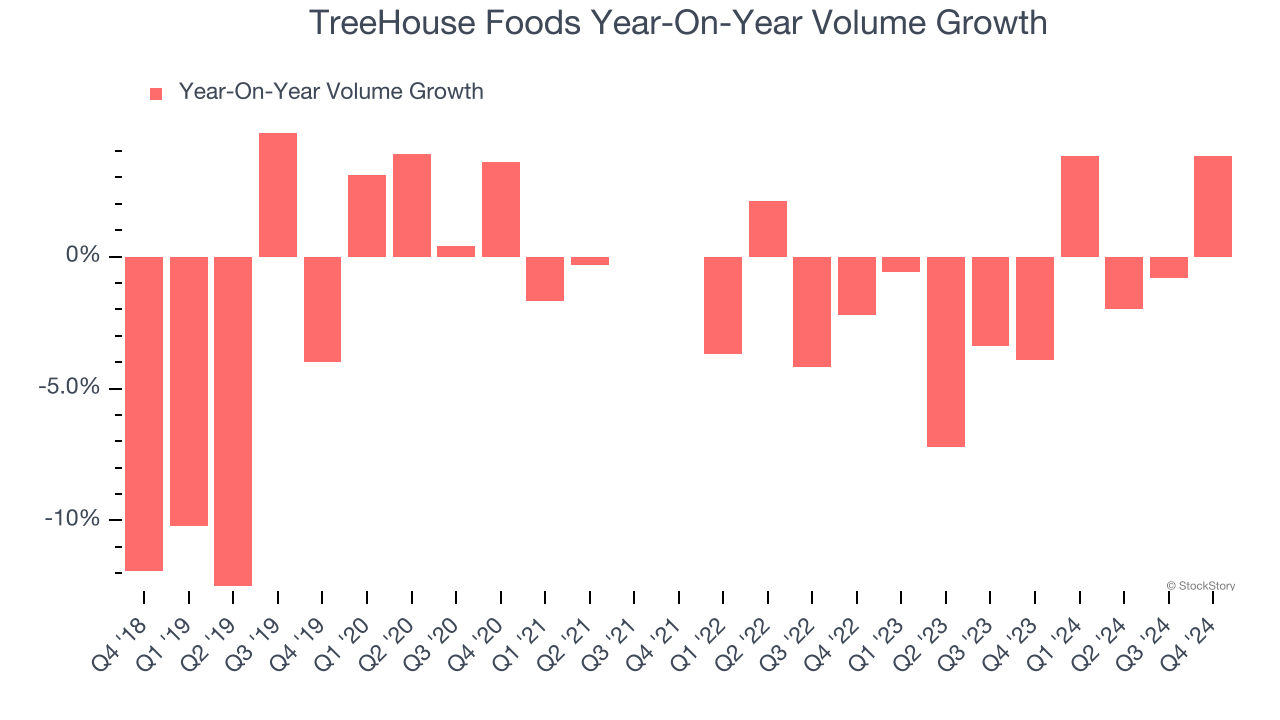

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether TreeHouse Foods generated its growth (or lack thereof) from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, TreeHouse Foods’s average quarterly sales volumes have shrunk by 1.3%. This isn’t ideal for a consumer staples company, where demand is typically stable.

In TreeHouse Foods’s Q4 2024, sales volumes jumped 3.8% year on year. This result was a well-appreciated turnaround from its historical levels, showing the company is heading in the right direction.

Key Takeaways from TreeHouse Foods’s Q4 Results

We struggled to find many positives in these results. Its EBITDA guidance for next quarter missed significantly and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter, but it seems expectations were low. The stock traded up 1.9% to $33.89 immediately following the results.

So do we think TreeHouse Foods is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.