Upscale restaurant company The One Group Hospitality (NASDAQ: STKS) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 147% year on year to $221.9 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $202.5 million was less impressive, coming in 2.4% below expectations. Its non-GAAP loss of $0.03 per share was significantly below analysts’ consensus estimates.

Is now the time to buy The ONE Group? Find out by accessing our full research report, it’s free.

The ONE Group (STKS) Q4 CY2024 Highlights:

- Revenue: $221.9 million vs analyst estimates of $217.7 million (147% year-on-year growth, 1.9% beat)

- Adjusted EPS: -$0.03 vs analyst estimates of $0.03 (significant miss)

- Adjusted EBITDA: $30.28 million vs analyst estimates of $29.89 million (13.6% margin, 1.3% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $852.5 million at the midpoint, beating analyst estimates by 0.5% and implying 26.6% growth (vs 102% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $105 million at the midpoint, below analyst estimates of $105.8 million

- Operating Margin: 5.7%, down from 6.8% in the same quarter last year

- Same-Store Sales rose 4.3% year on year (-4.3% in the same quarter last year)

- Market Capitalization: $91.94 million

“We were pleased that annual revenue and adjusted EBITDA reached the higher end of our guided ranges. These achievements were due to a sequentially stronger fourth quarter characterized by our best comparable sales of the year, positive transactions at STK, and improved sales performance at Benihana fueled by our new initiatives. For both the full year and recent quarter, adjusted EBITDA growth exceeded top-line growth, showcasing our capability to achieve greater profitability through the elimination of duplicate administrative costs, supply chain synergies, and tight cost management within our preexisting business. By year-end 2026, we intend to capture $20 million in total savings across these three areas,” said Emanuel “Manny” Hilario, President and CEO of The ONE Group.

Company Overview

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ: STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $673.3 million in revenue over the past 12 months, The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

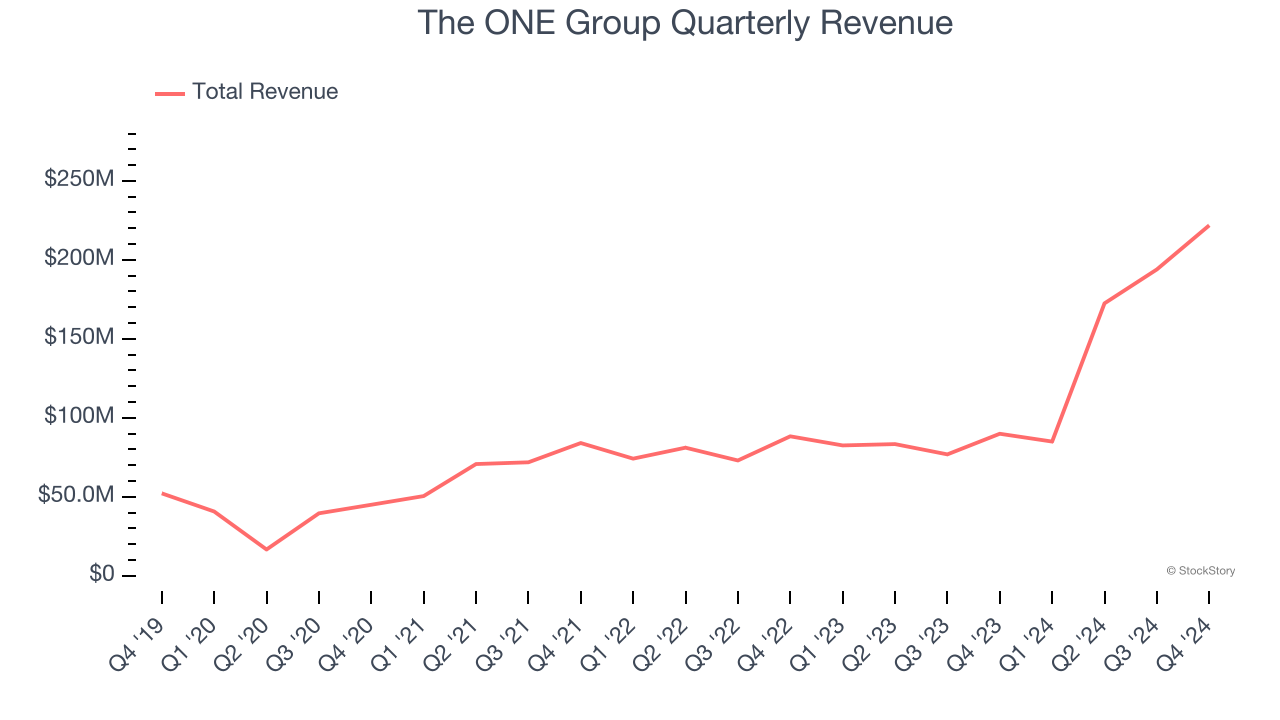

As you can see below, The ONE Group grew its sales at an incredible 41% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and expanded its reach.

This quarter, The ONE Group reported magnificent year-on-year revenue growth of 147%, and its $221.9 million of revenue beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 138% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 26% over the next 12 months, a deceleration versus the last five years. Still, this projection is commendable and suggests the market is baking in success for its menu offerings.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

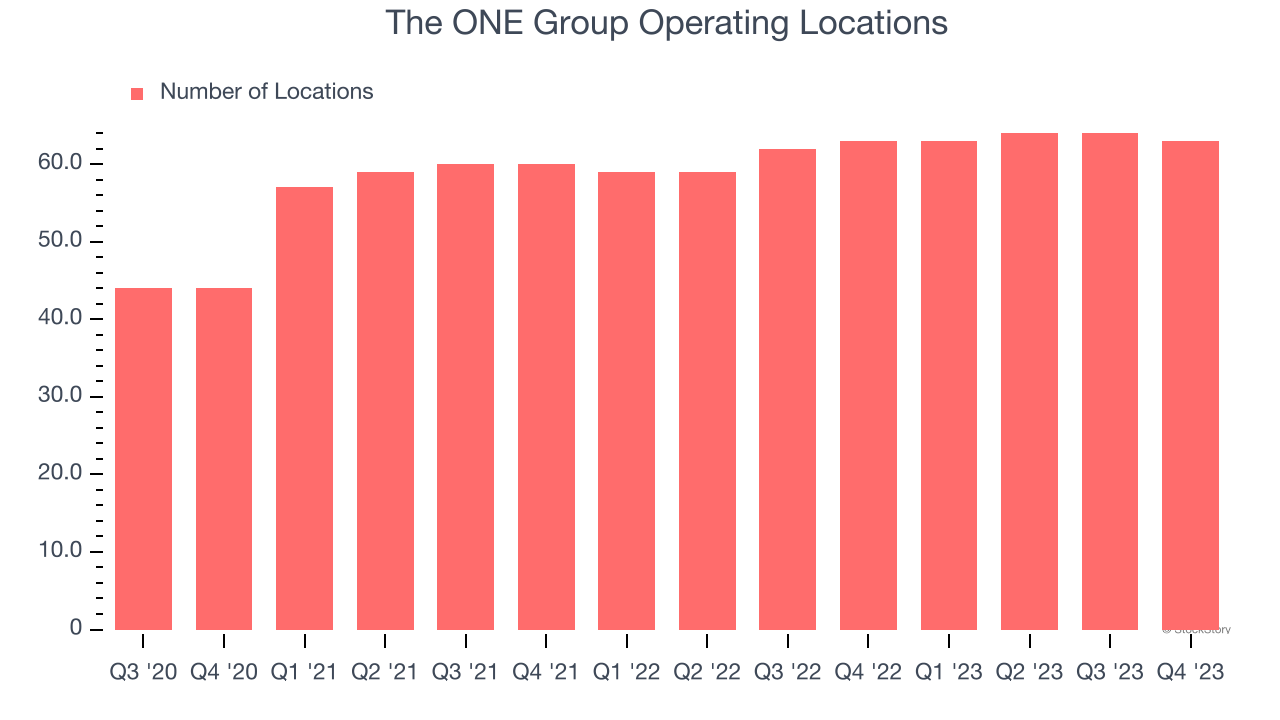

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

The ONE Group opened new restaurants at a rapid clip over the last two years, averaging 4.6% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Note that The ONE Group reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

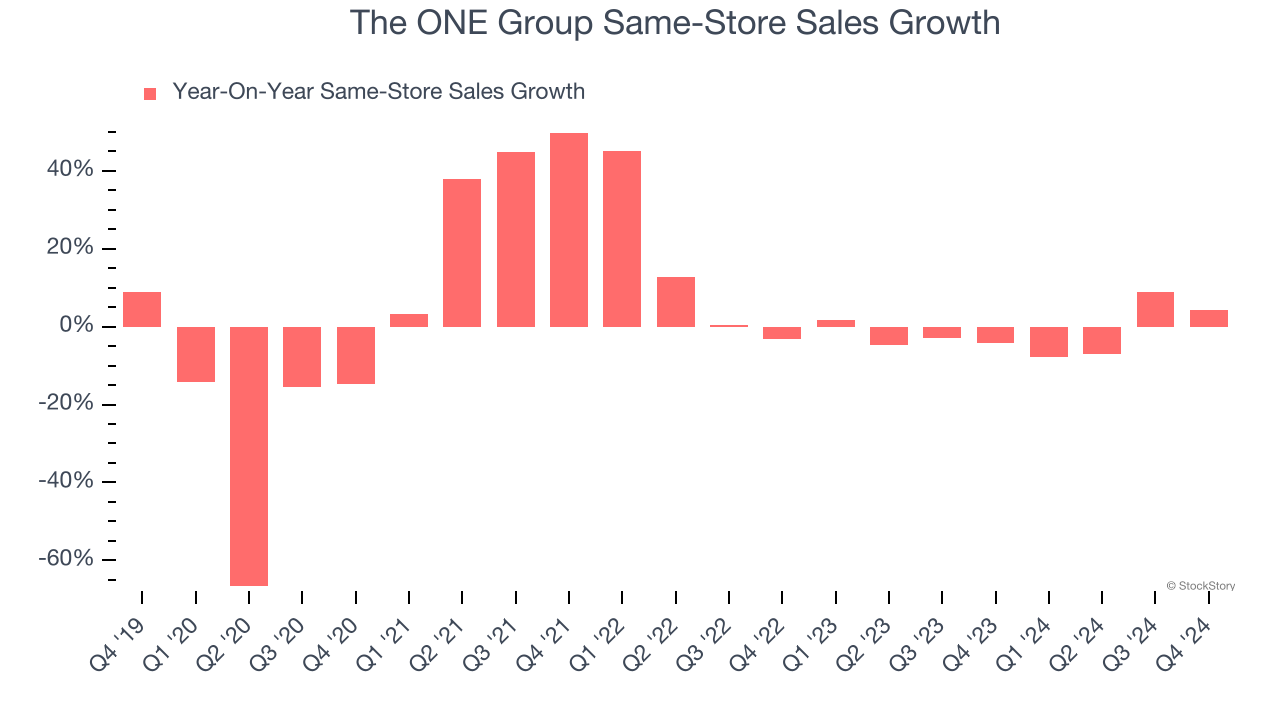

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 1.5% annual declines. This performance is concerning - it shows The ONE Group artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, The ONE Group’s same-store sales rose 4.3% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from The ONE Group’s Q4 Results

We enjoyed seeing The ONE Group beat analysts’ revenue and EBITDA expectations this quarter. We were also happy its full-year revenue guidance outperformed Wall Street’s estimates. On the other hand, its EPS and full-year EBITDA guidance fell short. Overall, this was a softer quarter. The stock remained flat at $2.90 immediately after reporting.

So do we think The ONE Group is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.