While the broader market has struggled with the S&P 500 down 1.7% since October 2024, Gates Industrial Corporation has surged ahead as its stock price has climbed by 6% to $18.46 per share. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Gates Industrial Corporation, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why there are better opportunities than GTES and a stock we'd rather own.

Why Is Gates Industrial Corporation Not Exciting?

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE: GTES) offers power transmission and fluid transfer equipment for various industries.

1. Core Business Falling Behind as Demand Declines

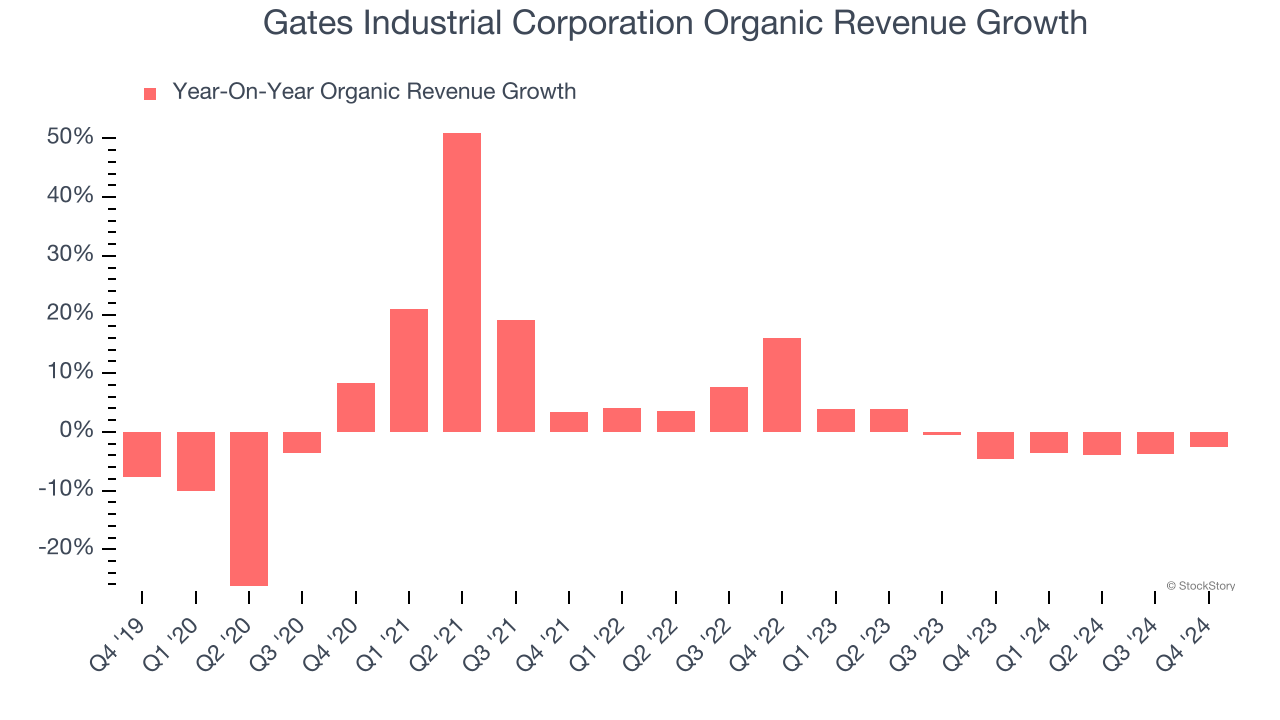

We can better understand Engineered Components and Systems companies by analyzing their organic revenue. This metric gives visibility into Gates Industrial Corporation’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Gates Industrial Corporation’s organic revenue averaged 1.4% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Gates Industrial Corporation might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Gates Industrial Corporation’s revenue to stall. Although this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

3. Previous Growth Initiatives Haven’t Impressed

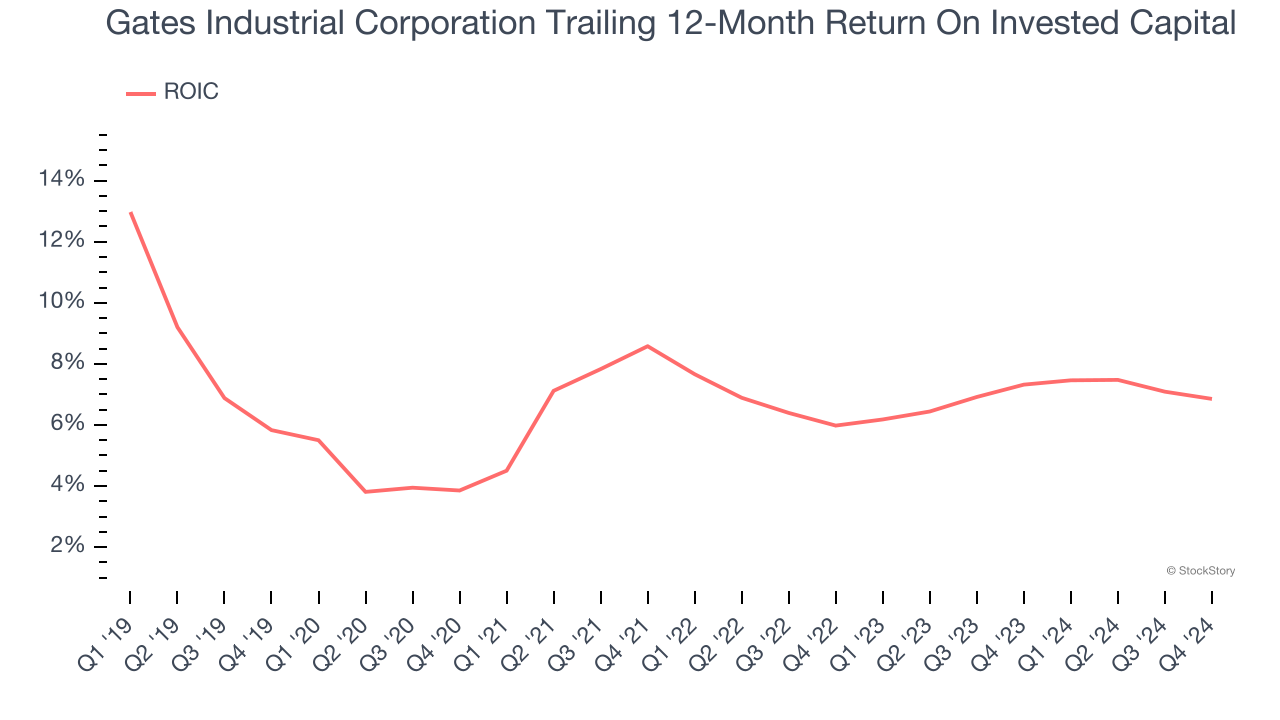

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Gates Industrial Corporation historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Gates Industrial Corporation isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 12.3× forward price-to-earnings (or $18.46 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Gates Industrial Corporation

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.