What a brutal six months it’s been for Abercrombie and Fitch. The stock has dropped 43.5% and now trades at $81, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy ANF? Find out in our full research report, it’s free.

Why Does Abercrombie and Fitch Spark Debate?

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE: ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Two Positive Attributes:

1. Surging Same-Store Sales Show Increasing Demand

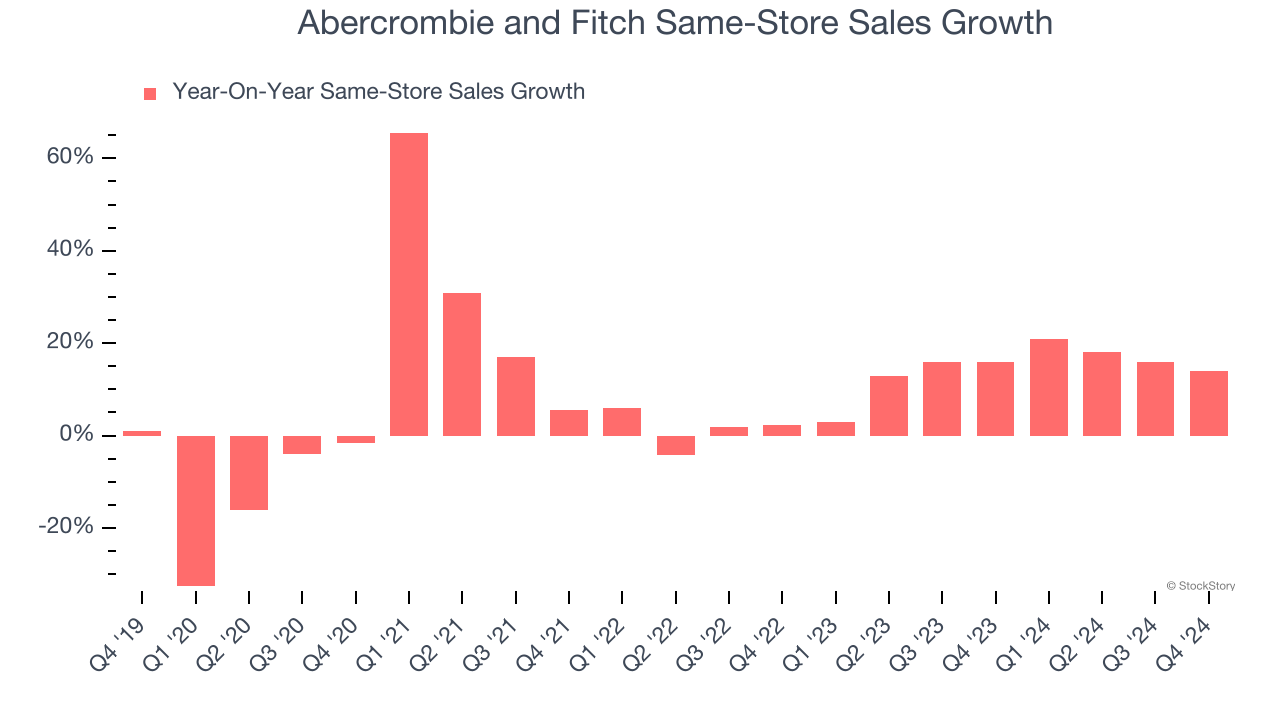

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Abercrombie and Fitch has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 14.6%.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

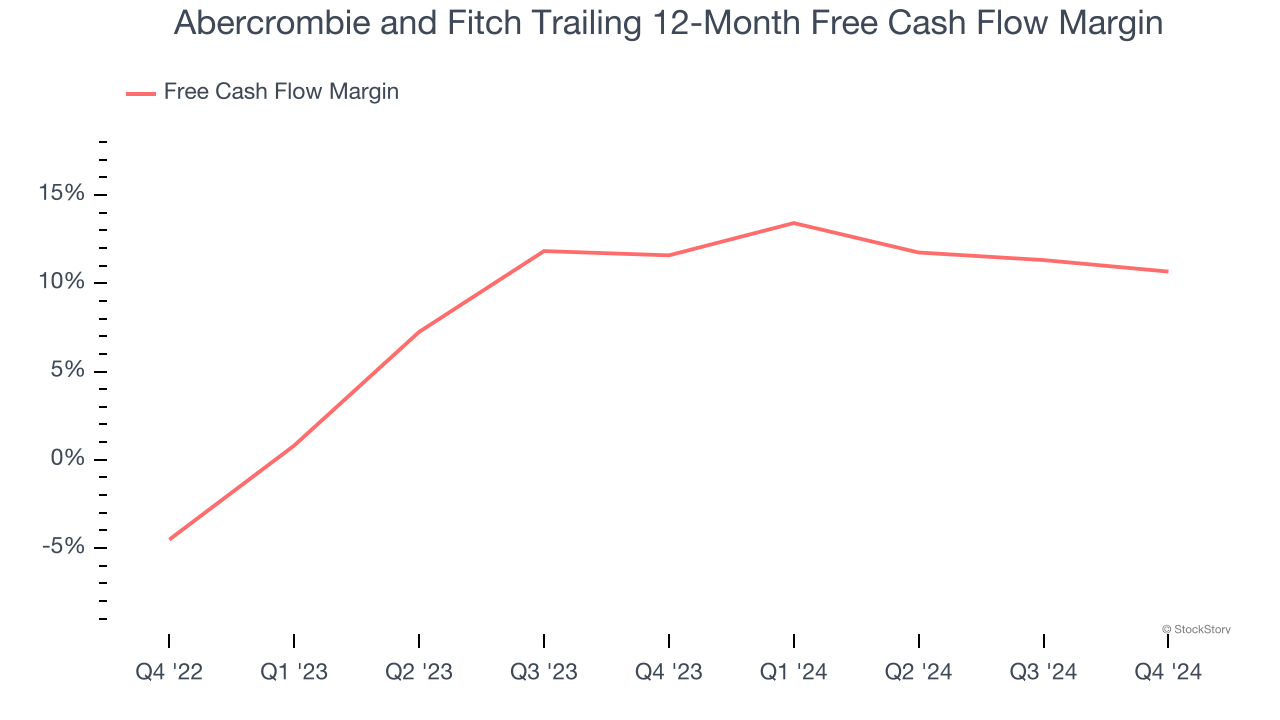

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Abercrombie and Fitch has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer retail sector, averaging 11.1% over the last two years.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

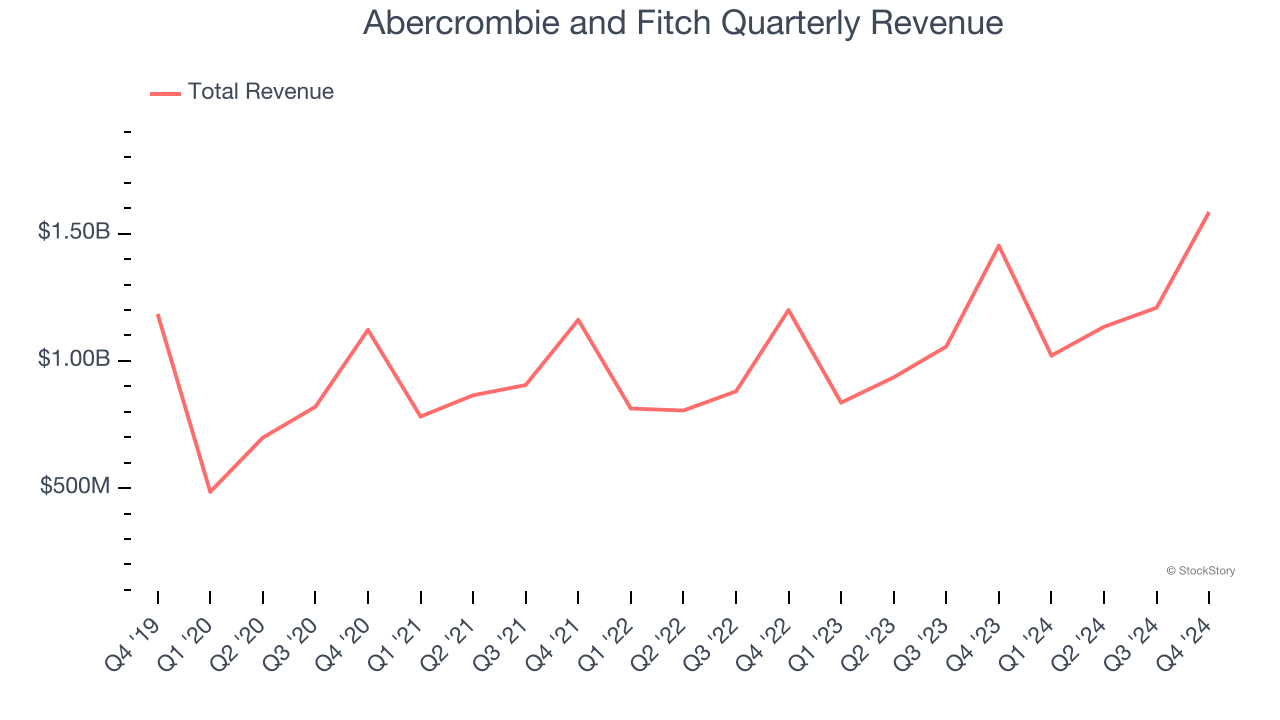

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Abercrombie and Fitch grew its sales at a tepid 6.4% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Abercrombie and Fitch.

Final Judgment

Abercrombie and Fitch’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 7× forward P/E (or $81 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.