Packaged food company Simply Good Foods (NASDAQ: SMPL) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 13.8% year on year to $381 million. Its non-GAAP profit of $0.51 per share was in line with analysts’ consensus estimates.

Is now the time to buy Simply Good Foods? Find out by accessing our full research report, it’s free.

Simply Good Foods (SMPL) Q2 CY2025 Highlights:

- Revenue: $381 million vs analyst estimates of $380.5 million (13.8% year-on-year growth, in line)

- Adjusted EPS: $0.51 vs analyst estimates of $0.50 (in line)

- Adjusted EBITDA: $73.85 million vs analyst estimates of $72.17 million (19.4% margin, 2.3% beat)

- Operating Margin: 15.6%, down from 17.6% in the same quarter last year

- Free Cash Flow Margin: 17.9%, down from 21.5% in the same quarter last year

- Market Capitalization: $3.27 billion

“I am pleased with the continued momentum on our business, with net sales up 14% highlighted by approximately 4% organic net sales growth. Consumption increased double-digits again for both Quest and OWYN which, in aggregate, represent about 70% of net sales today, while Atkins remained under pressure, as expected," said Geoff Tanner, President and Chief Executive Officer of Simply Good Foods.

Company Overview

Best known for its Atkins brand that was inspired by the popular diet of the same name, Simply Good Foods (NASDAQ: SMPL) is a packaged food company whose offerings help customers achieve their healthy eating or weight loss goals.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.46 billion in revenue over the past 12 months, Simply Good Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

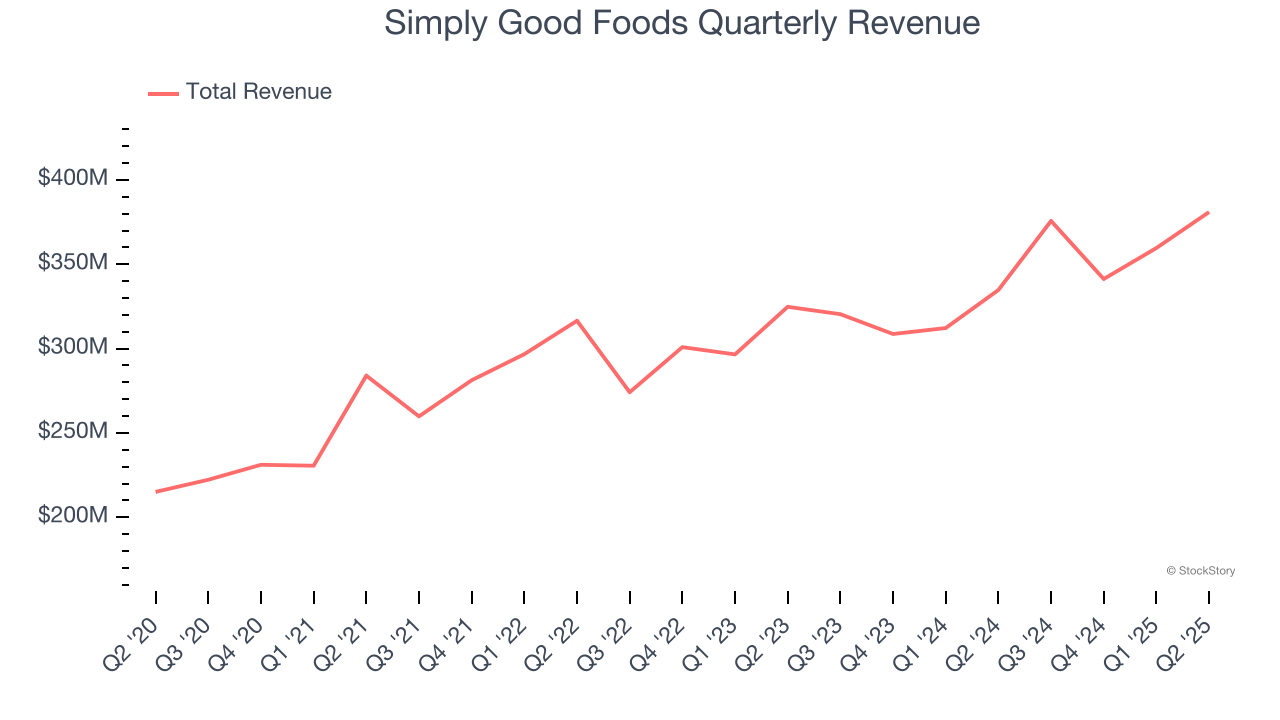

As you can see below, Simply Good Foods grew its sales at a decent 8.1% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Simply Good Foods’s year-on-year revenue growth was 13.8%, and its $381 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

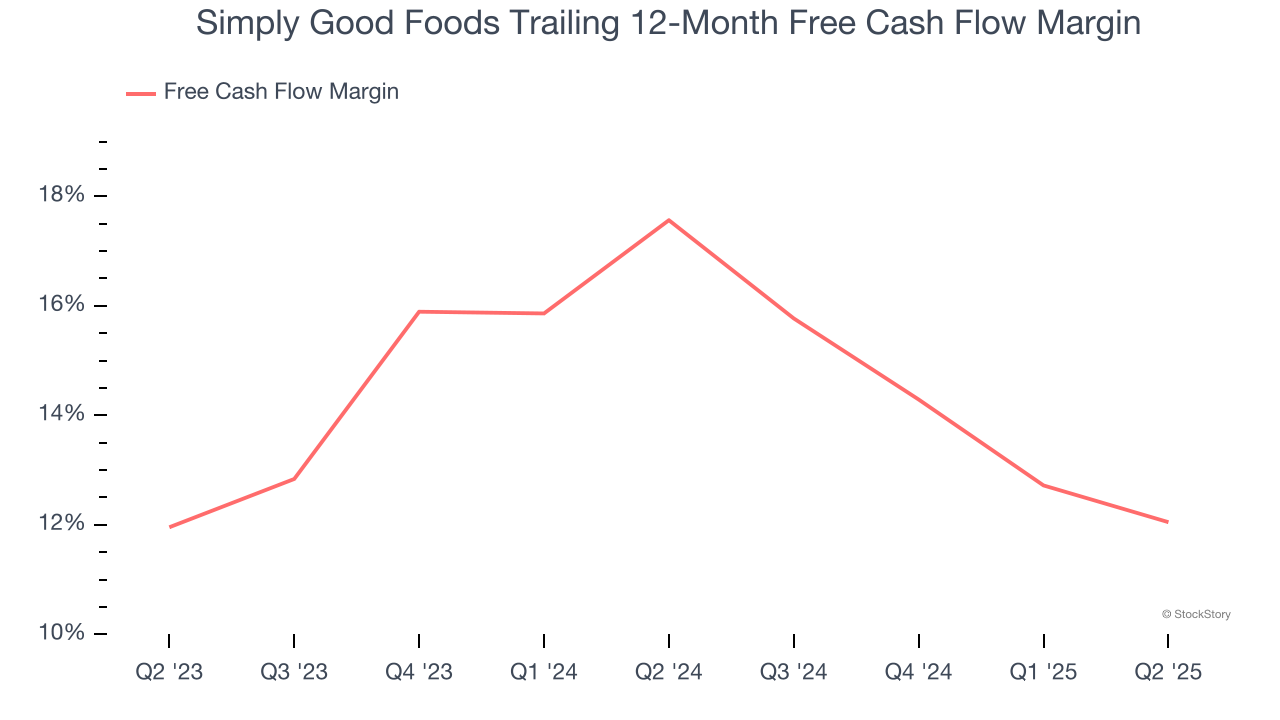

Simply Good Foods has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 14.6% over the last two years.

Taking a step back, we can see that Simply Good Foods’s margin dropped by 5.5 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity.

Simply Good Foods’s free cash flow clocked in at $68.11 million in Q2, equivalent to a 17.9% margin. The company’s cash profitability regressed as it was 3.6 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Simply Good Foods’s Q2 Results

It was encouraging to see Simply Good Foods beat analysts’ EBITDA expectations this quarter. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.7% to $31.82 immediately following the results.

Big picture, is Simply Good Foods a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.