Over the past six months, Dime Community Bancshares’s stock price fell to $28.12. Shareholders have lost 10% of their capital, which is disappointing considering the S&P 500 has climbed by 7.1%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Dime Community Bancshares, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Dime Community Bancshares Not Exciting?

Despite the more favorable entry price, we're cautious about Dime Community Bancshares. Here are three reasons why DCOM doesn't excite us and a stock we'd rather own.

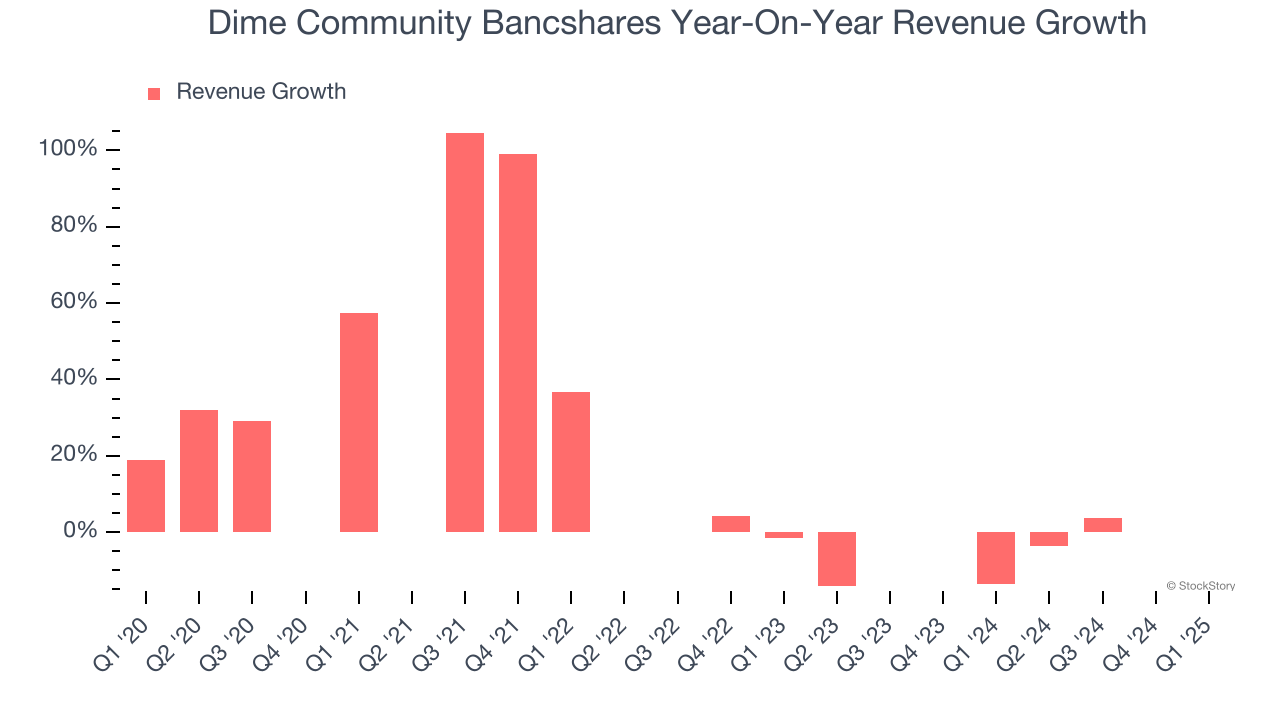

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Dime Community Bancshares’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 10.2% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

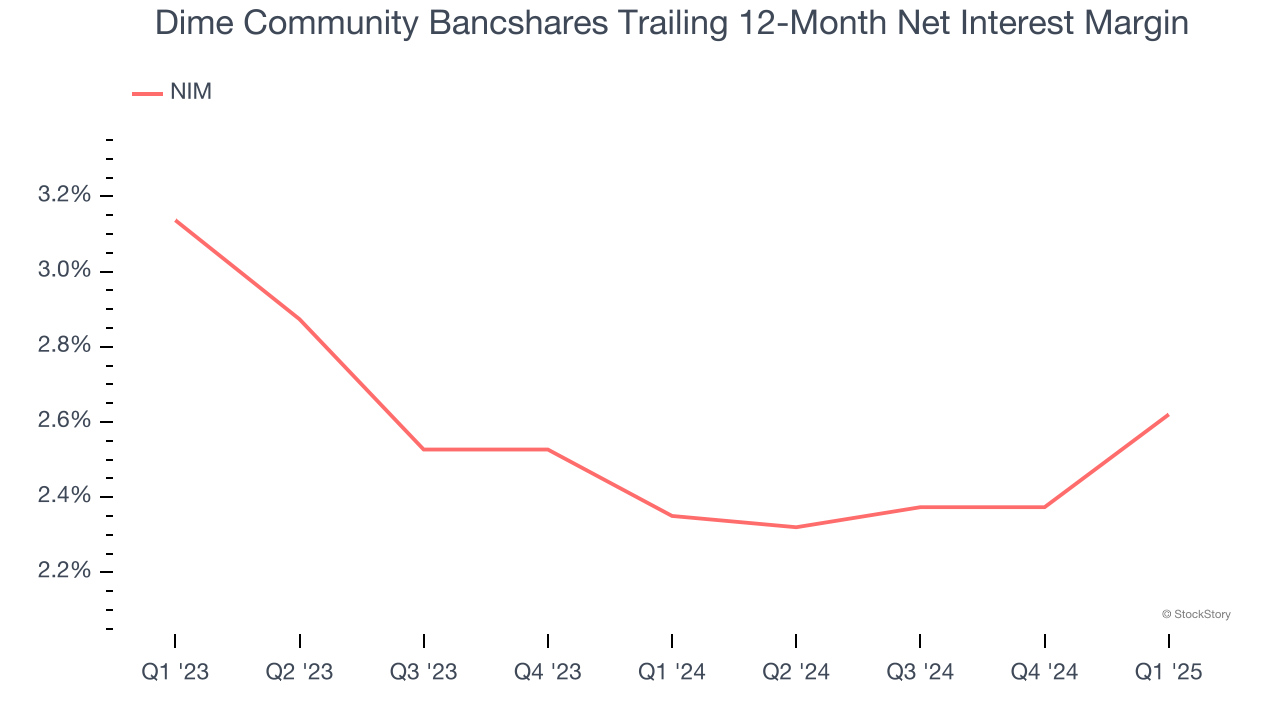

2. Net Interest Margin Dropping

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, Dime Community Bancshares’s net interest margin averaged 2.5%. Its margin also contracted by 51.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean Dime Community Bancshares either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

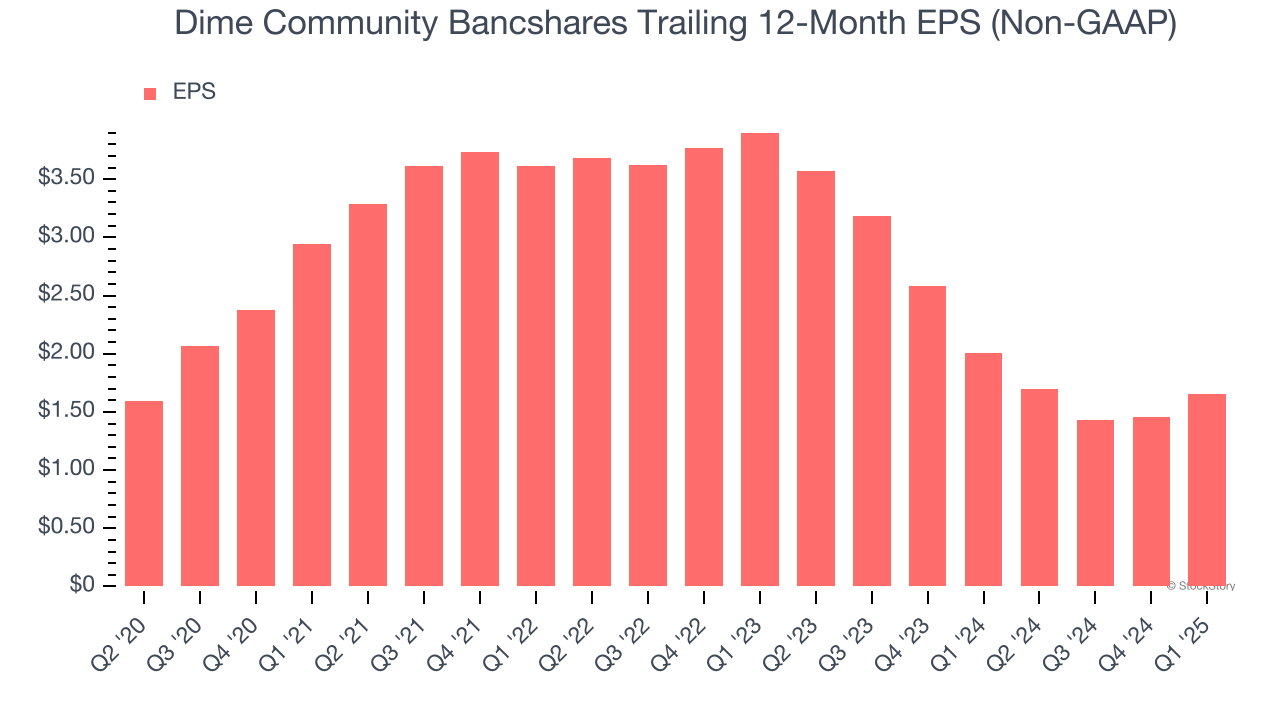

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Dime Community Bancshares, its EPS declined by more than its revenue over the last two years, dropping 35%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Dime Community Bancshares’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 0.9× forward P/B (or $28.12 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Dime Community Bancshares

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.