Over the past six months, Workiva has been a great trade, beating the S&P 500 by 15.1%. Its stock price has climbed to $86.29, representing a healthy 26.4% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Workiva, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Workiva Not Exciting?

We’re glad investors have benefited from the price increase, but we're cautious about Workiva. Here are two reasons you should be careful with WK and a stock we'd rather own.

1. Operating Margin Rising, Profits Up

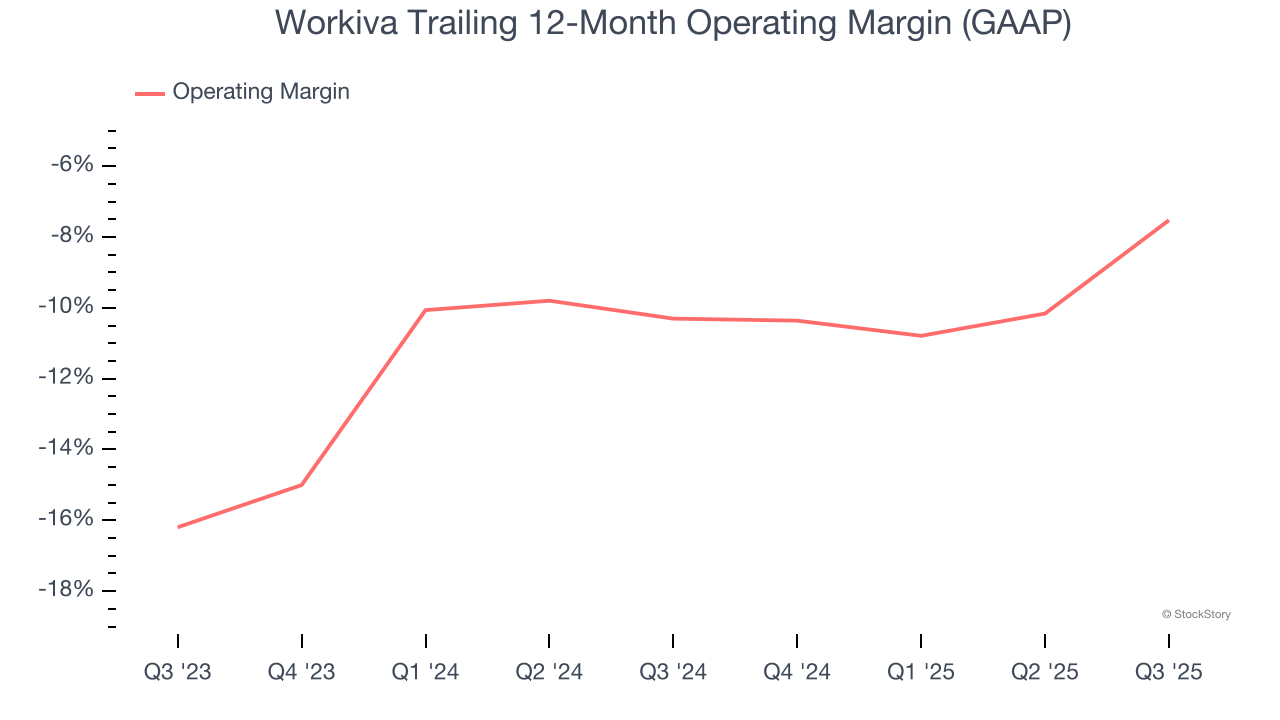

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Over the last two years, Workiva’s expanding sales gave it operating leverage as its margin rose by 2.8 percentage points. Its operating margin for the trailing 12 months was negative 7.5%, and it must keep making strides to one day reach sustainable profitability.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Workiva’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.4% for the last 12 months will decrease to 14.1%.

Final Judgment

Workiva isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 5.1× forward price-to-sales (or $86.29 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Workiva

While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.