Over the past six months, Belden’s shares (currently trading at $116.03) have posted a disappointing 9.1% loss, well below the S&P 500’s 10% gain. This might have investors contemplating their next move.

Is there a buying opportunity in Belden, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Belden Not Exciting?

Even with the cheaper entry price, we're swiping left on Belden for now. Here are three reasons we avoid BDC and a stock we'd rather own.

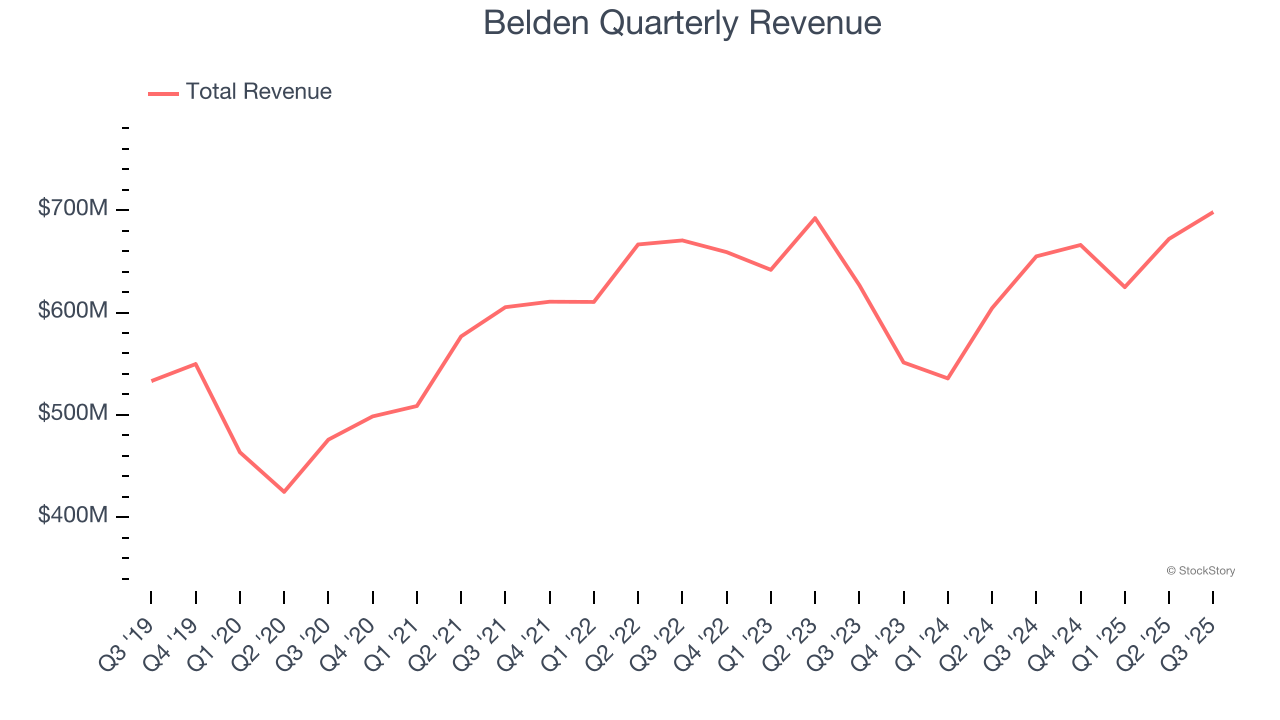

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Belden grew its sales at a mediocre 6.8% compounded annual growth rate. This was below our standard for the industrials sector.

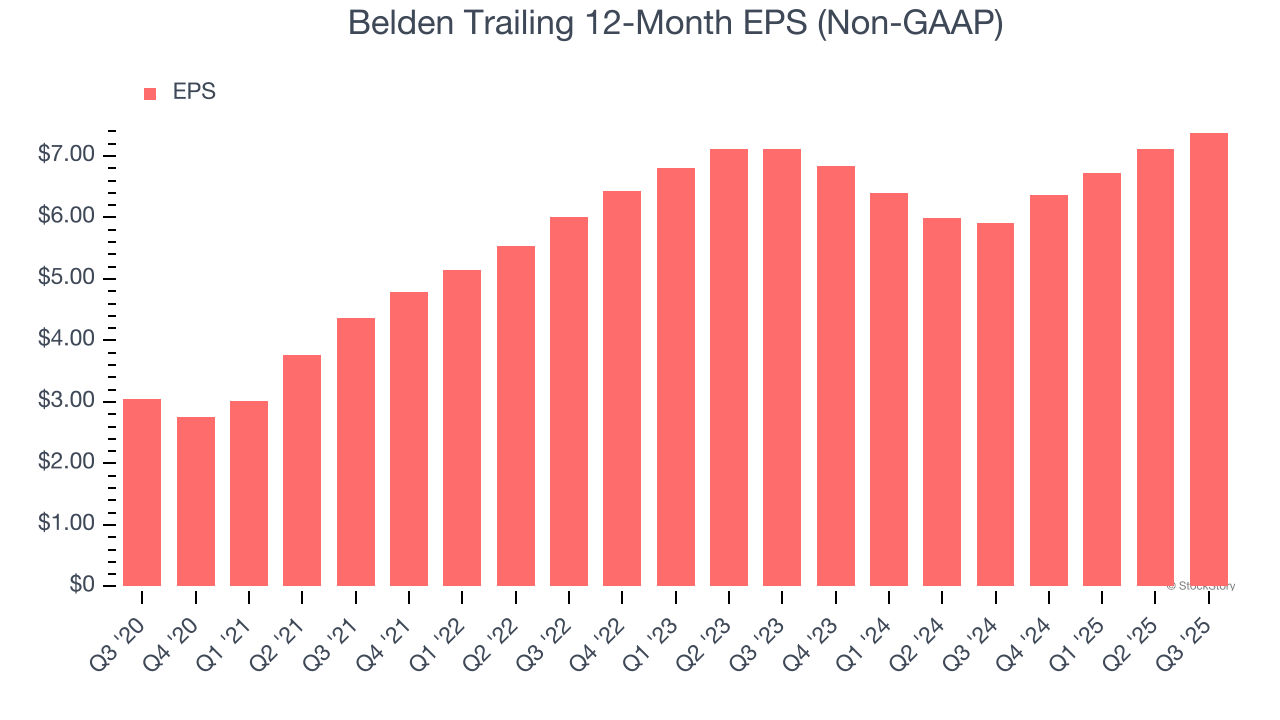

2. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Belden’s weak 1.8% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

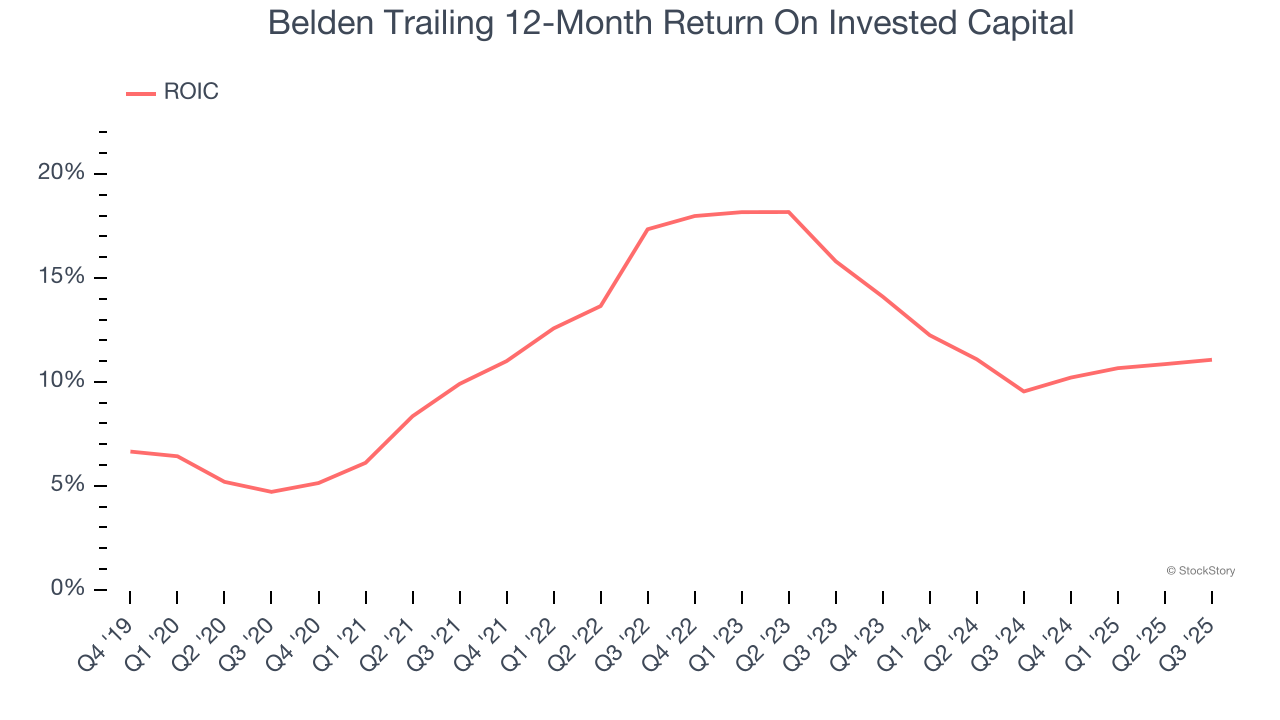

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Belden’s ROIC averaged 3.3 percentage point decreases over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Belden isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 15.2× forward P/E (or $116.03 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Belden

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.