AXIS Capital trades at $103.18 and has moved in lockstep with the market. Its shares have returned 7.4% over the last six months while the S&P 500 has gained 10%.

Is there a buying opportunity in AXIS Capital, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is AXIS Capital Not Exciting?

We're swiping left on AXIS Capital for now. Here are three reasons we avoid AXS and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

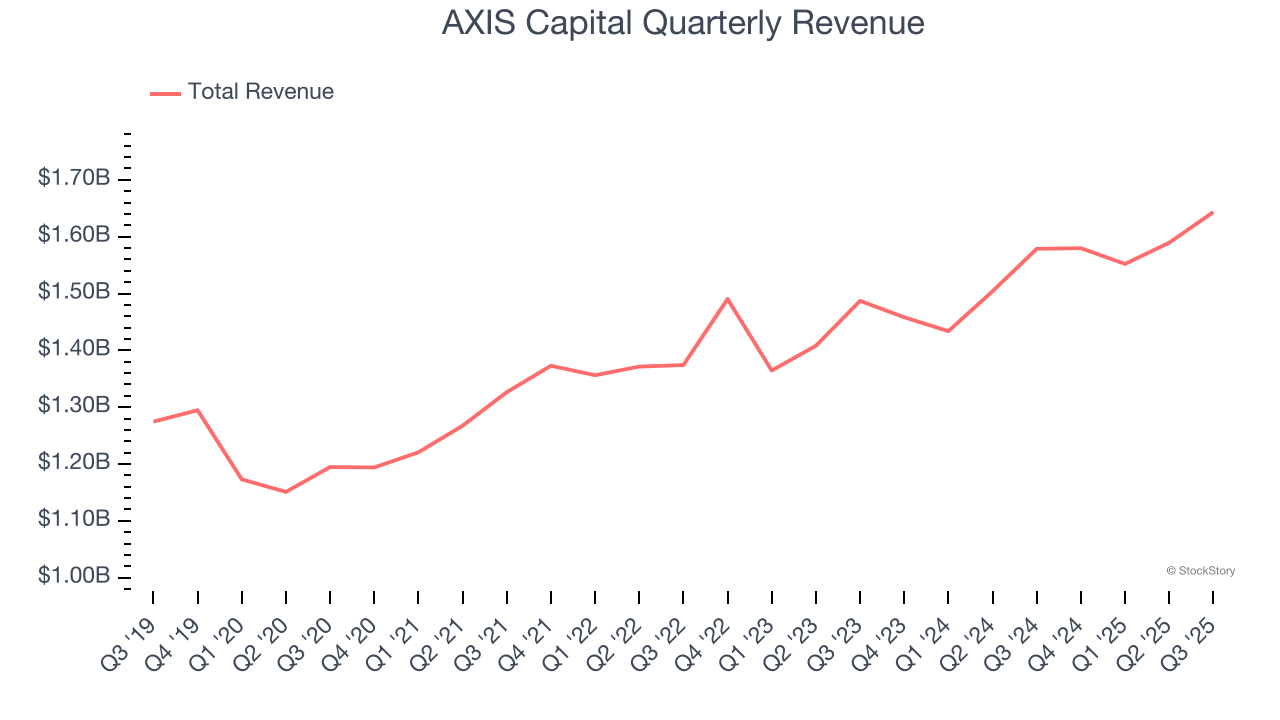

Insurance companies generate revenue three ways. The first is the core insurance business itself, represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected but not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from policy administration, annuities, and other value-added services.

Over the last five years, AXIS Capital grew its revenue at a tepid 5.7% compounded annual growth rate. This fell short of our benchmark for the insurance sector.

2. Net Premiums Earned Point to Soft Demand

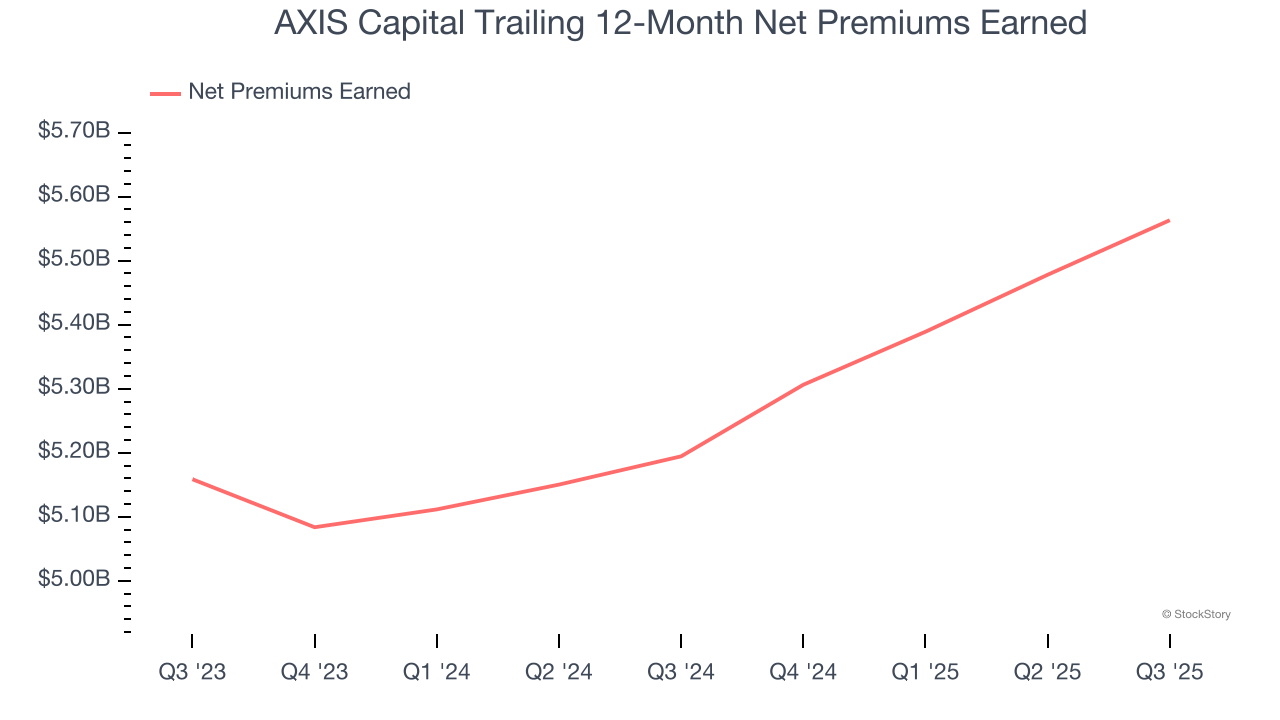

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

AXIS Capital’s net premiums earned has grown at a 3.8% annualized rate over the last two years, worse than the broader insurance industry and slower than its total revenue.

3. Previous Growth Initiatives Haven’t Impressed

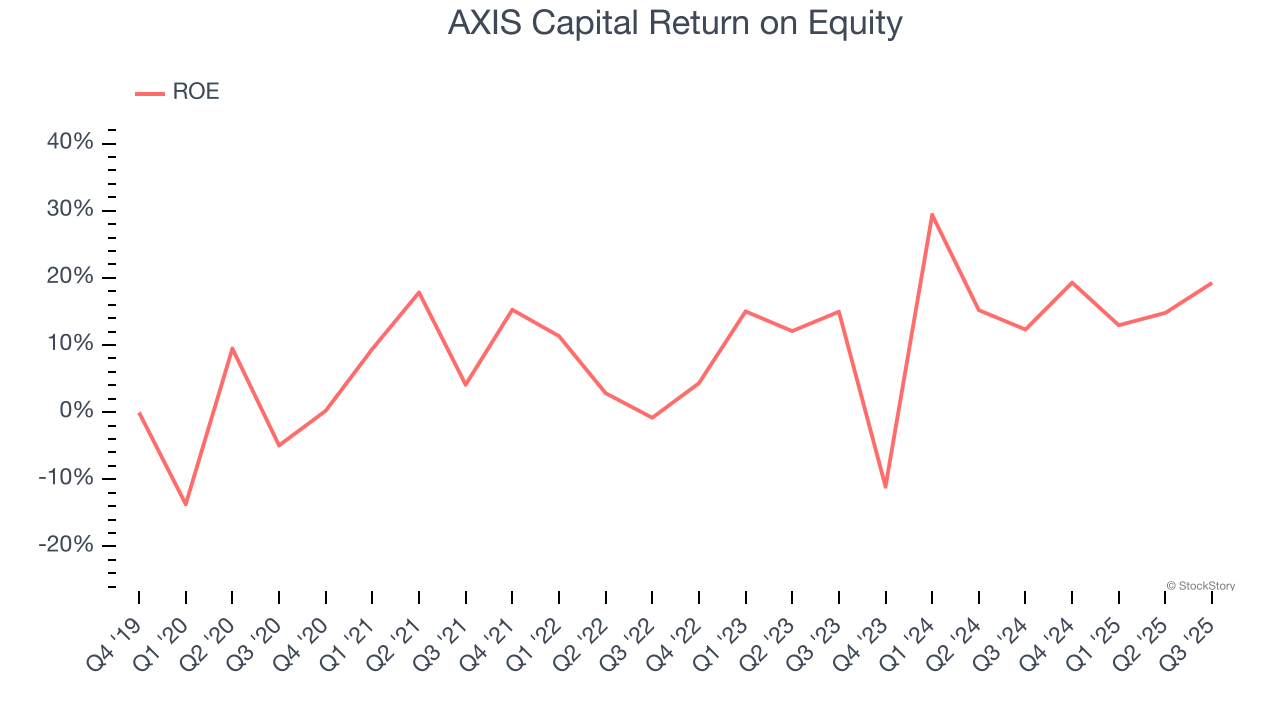

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, AXIS Capital has averaged an ROE of 10.9%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

AXIS Capital’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.3× forward P/B (or $103.18 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than AXIS Capital

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.