Data protection software company Commvault (NASDAQ: CVLT) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.5% year on year to $313.8 million. The company expects next quarter’s revenue to be around $306.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.17 per share was 19.2% above analysts’ consensus estimates.

Is now the time to buy Commvault? Find out by accessing our full research report, it’s free.

Commvault (CVLT) Q4 CY2025 Highlights:

- Revenue: $313.8 million vs analyst estimates of $299.1 million (19.5% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.17 vs analyst estimates of $0.98 (19.2% beat)

- Adjusted Operating Income: $61.46 million vs analyst estimates of $55.71 million (19.6% margin, 10.3% beat)

- Revenue Guidance for Q1 CY2026 is $306.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 6.3%, up from 5.2% in the same quarter last year

- Free Cash Flow Margin: 0.6%, down from 26.6% in the previous quarter

- Annual Recurring Revenue: $1.09 billion vs analyst estimates of $1.08 billion (22% year-on-year growth, in line)

- Billings: $369.4 million at quarter end, up 24.1% year on year

- Market Capitalization: $5.70 billion

"Commvault delivered another quarter of healthy growth and profitability driven by record customer engagement and adoption," said Sanjay Mirchandani, President and CEO, Commvault.

Company Overview

Born from the need to create ironclad protection in an increasingly dangerous digital world, Commvault (NASDAQ: CVLT) provides data protection and cyber resilience software that helps organizations secure, back up, and recover their data across on-premises, hybrid, and multi-cloud environments.

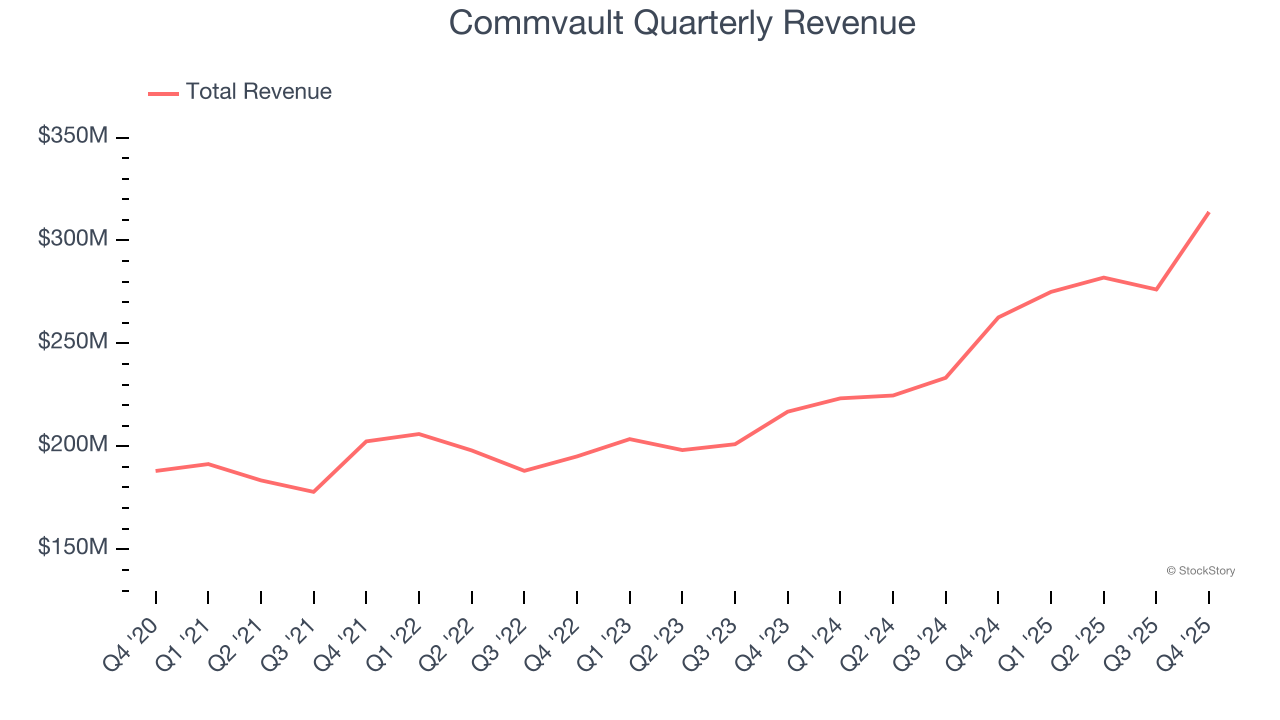

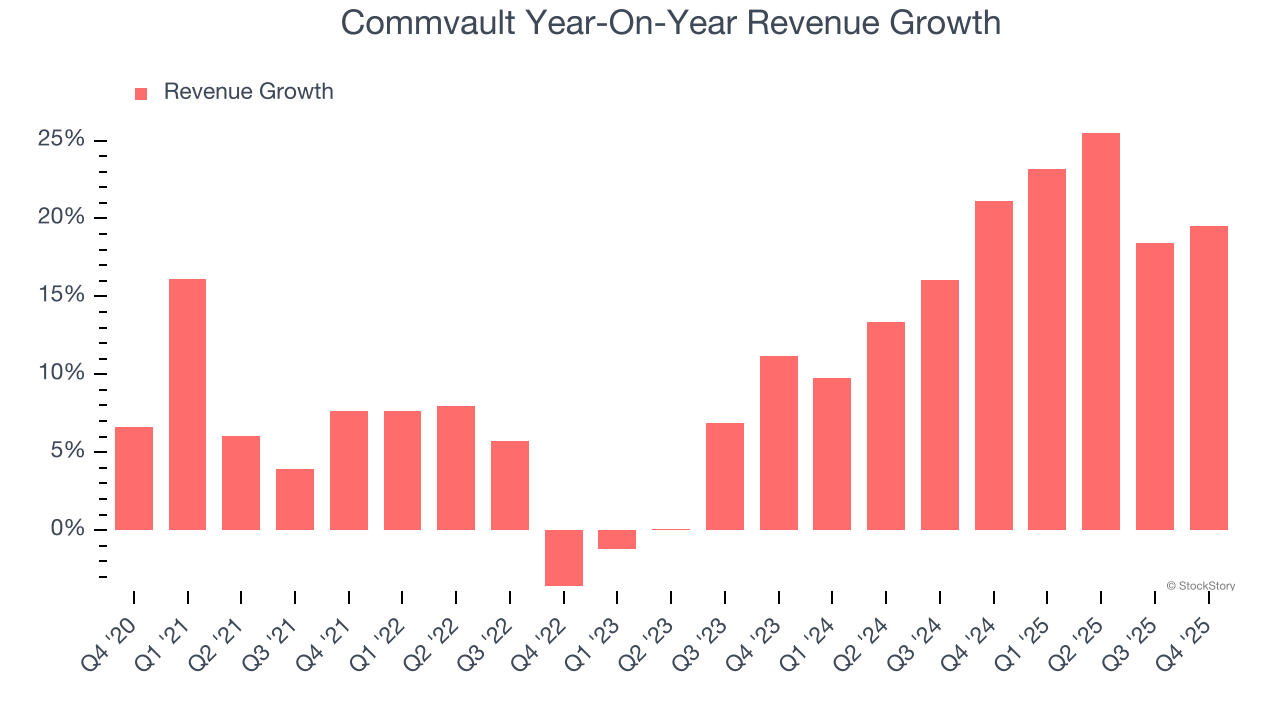

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Commvault grew its sales at a 10.5% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Commvault.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Commvault’s annualized revenue growth of 18.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Commvault reported year-on-year revenue growth of 19.5%, and its $313.8 million of revenue exceeded Wall Street’s estimates by 4.9%. Company management is currently guiding for a 11.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

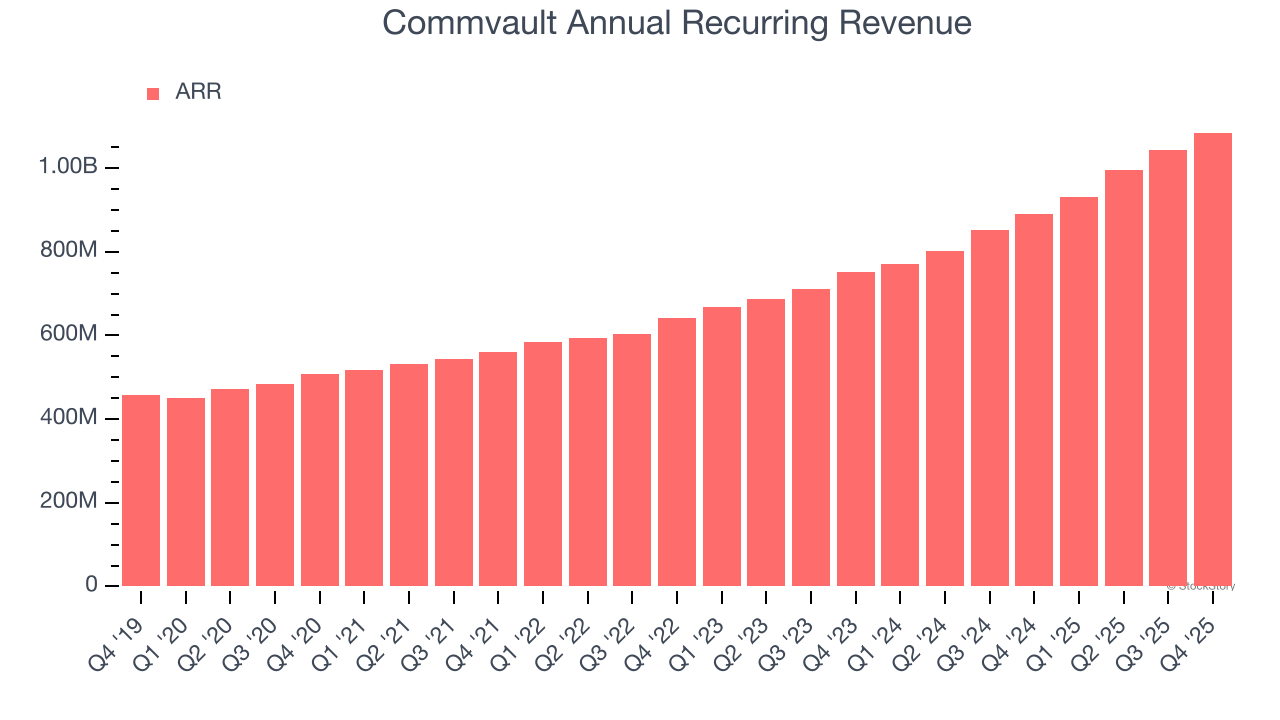

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commvault’s ARR punched in at $1.09 billion in Q4, and over the last four quarters, its growth was impressive as it averaged 22.3% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Commvault a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Commvault is extremely efficient at acquiring new customers, and its CAC payback period checked in at 7.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Commvault more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Commvault’s Q4 Results

We were impressed by how significantly Commvault blew past analysts’ billings expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 8.7% to $118.10 immediately following the results.

Is Commvault an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).