Mortgage REIT PennyMac Mortgage Investment Trust (NYSE: PMT) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 19.3% year on year to $87.1 million. Its GAAP profit of $0.48 per share was 20.7% above analysts’ consensus estimates.

Is now the time to buy PennyMac Mortgage Investment Trust? Find out by accessing our full research report, it’s free.

PennyMac Mortgage Investment Trust (PMT) Q4 CY2025 Highlights:

- Net Interest Income: -$6.46 million vs analyst estimates of -$5.85 million

- Revenue: $87.1 million vs analyst estimates of $99.85 million (19.3% year-on-year decline, 12.8% miss)

- Efficiency Ratio: 66% (1,703.3 basis point year-on-year decrease)

- EPS (GAAP): $0.48 vs analyst estimates of $0.40 (20.7% beat)

- Tangible Book Value per Share: $15.25 vs analyst estimates of $15.15 (5.2% year-on-year decline, 0.7% beat)

- Market Capitalization: $1.17 billion

“PMT delivered strong results in the fourth quarter, generating earnings per share of $0.48, above the dividend level for an annualized return on common equity of 13%,” said Chairman and CEO David Spector.

Company Overview

Operating as a real estate investment trust since 2009 to maintain tax advantages, PennyMac Mortgage Investment Trust (NYSE: PMT) is a specialty finance company that invests in mortgage-related assets and operates a correspondent lending business.

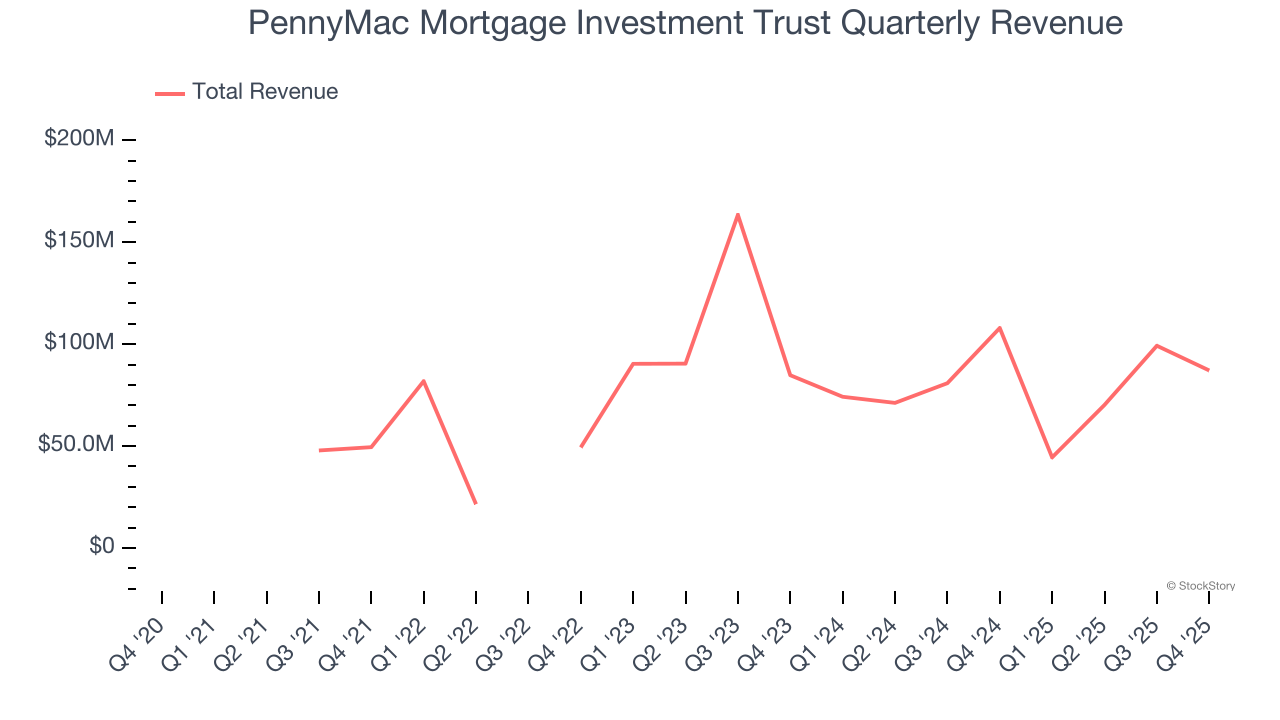

Sales Growth

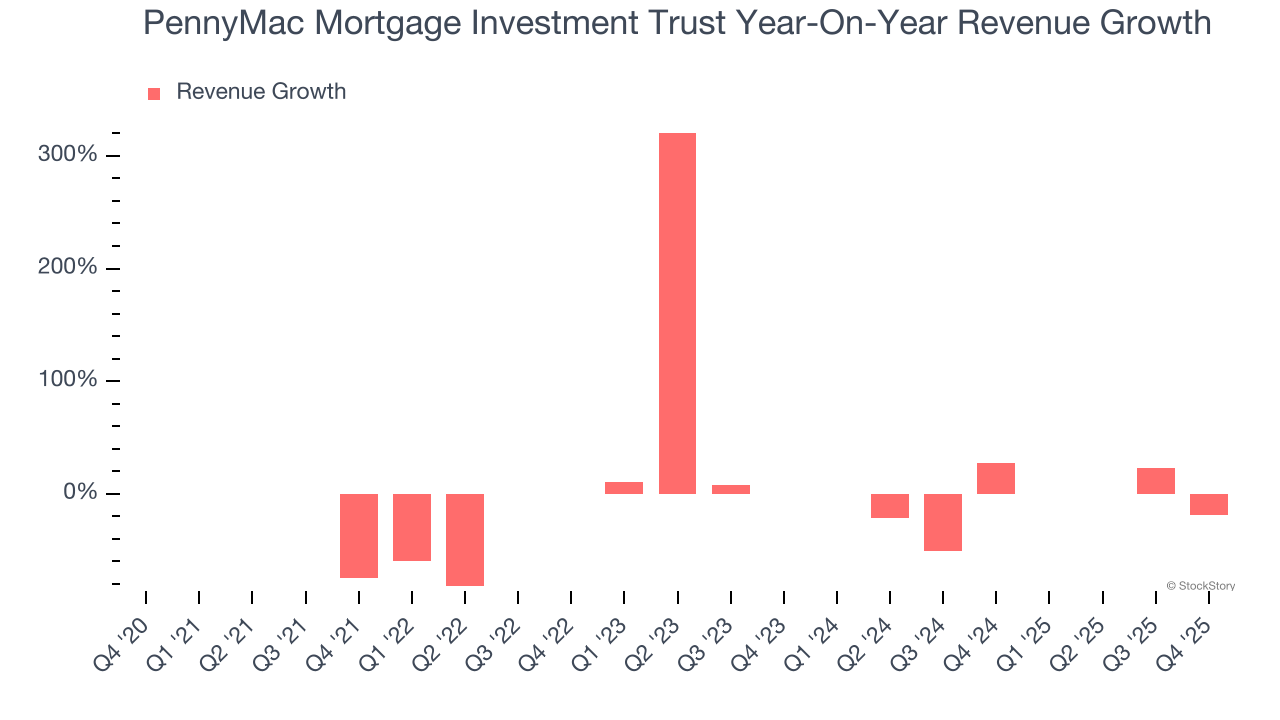

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Over the last five years, PennyMac Mortgage Investment Trust’s demand was weak and its revenue declined by 23.4% per year. This was below our standards and suggests it’s a low quality business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. PennyMac Mortgage Investment Trust’s annualized revenue declines of 16.2% over the last two years suggest its demand continued shrinking.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PennyMac Mortgage Investment Trust missed Wall Street’s estimates and reported a rather uninspiring 19.3% year-on-year revenue decline, generating $87.1 million of revenue.

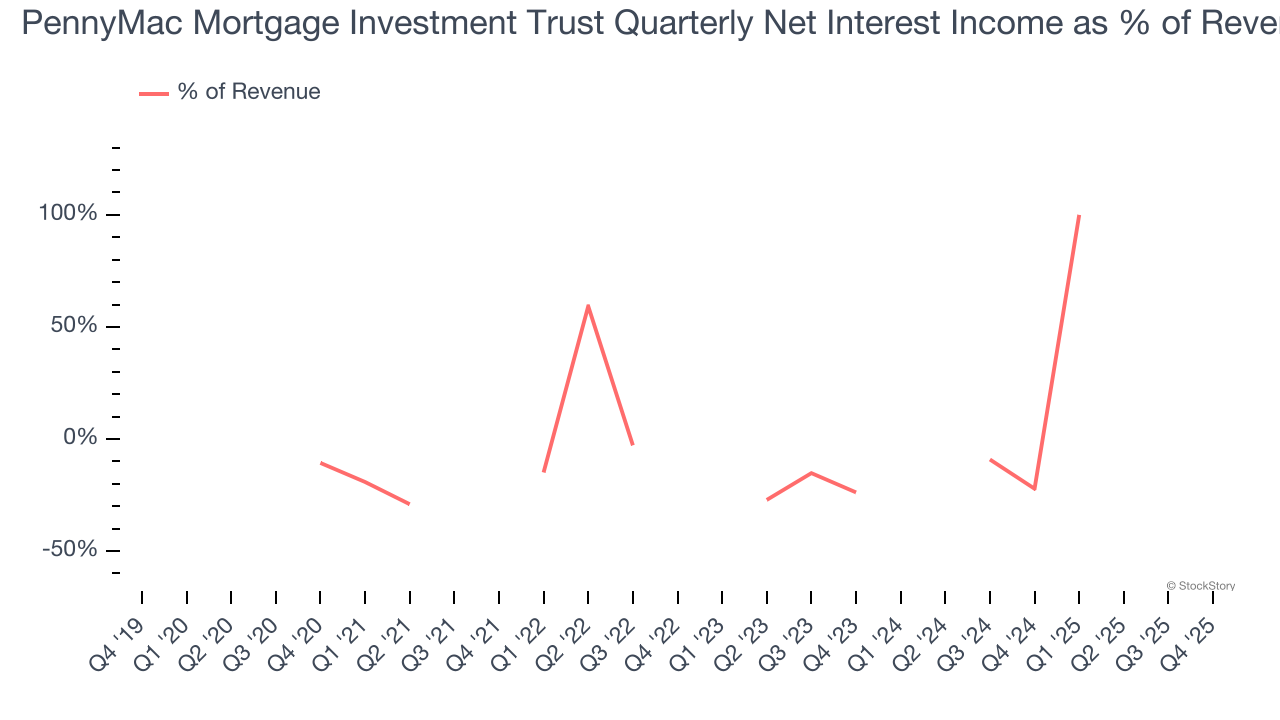

Net interest income made up -1.1% of the company’s total revenue during the last five years, meaning PennyMac Mortgage Investment Trust is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

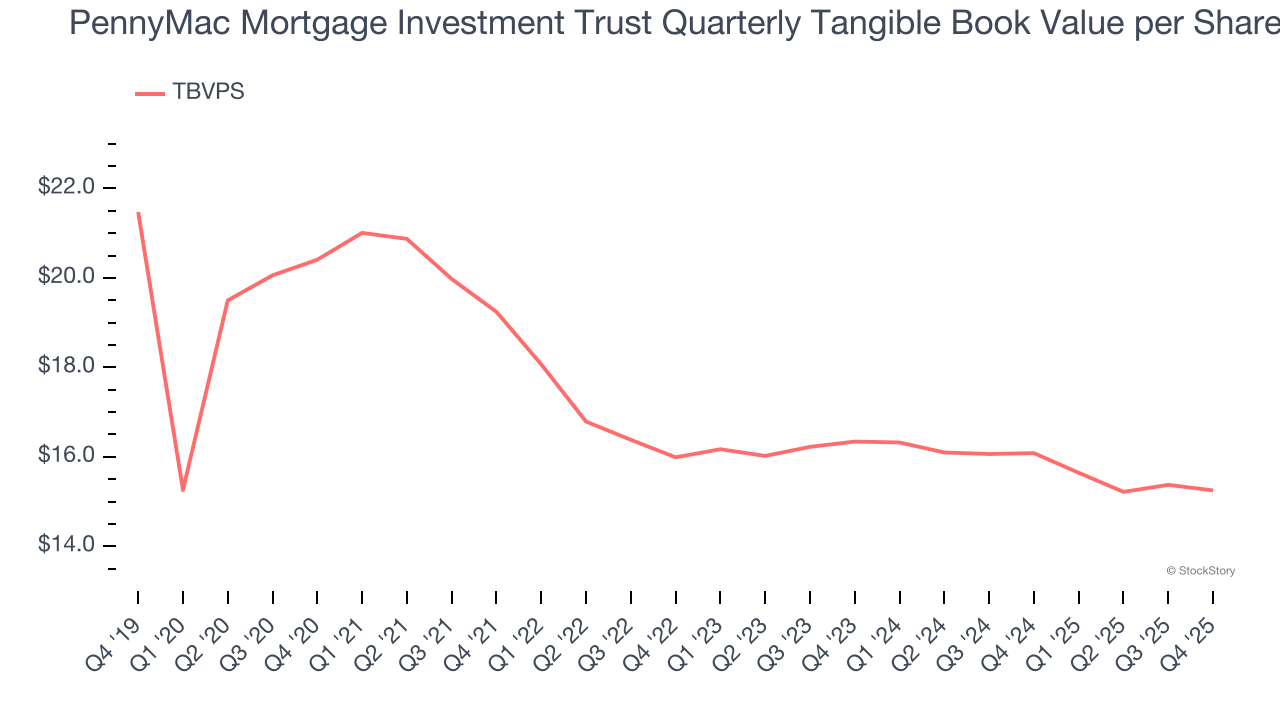

Tangible Book Value Per Share (TBVPS)

Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability.

This is why we consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

PennyMac Mortgage Investment Trust’s TBVPS declined at a 5.7% annual clip over the last five years. On a two-year basis, TBVPS fell at a slower pace, dropping by 3.4% annually from $16.34 to $15.25 per share.

Over the next 12 months, Consensus estimates call for PennyMac Mortgage Investment Trust’s TBVPS to remain flat at roughly $15.16, a disappointing projection.

Key Takeaways from PennyMac Mortgage Investment Trust’s Q4 Results

It was good to see PennyMac Mortgage Investment Trust beat analysts’ EPS expectations this quarter. We were also happy its tangible book value per share narrowly outperformed Wall Street’s estimates. On the other hand, its revenue missed and its net interest income fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.1% to $13.36 immediately following the results.

The latest quarter from PennyMac Mortgage Investment Trust’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).