( click to enlarge )

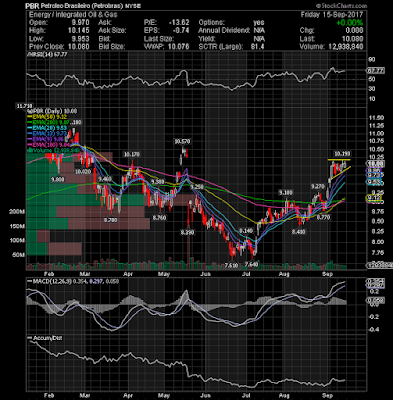

( click to enlarge )Petroleo Brasileiro SA Petrobras (NYSE:PBR) over the last 2 weeks has formed a bullish flag pattern with a key resistance in the 10.15 area, which could be broken in the next few days. If a breakout above the 10.15 area occurs, we could see a move toward the 11 level. On watch.

( click to enlarge )

( click to enlarge )Celgene Corporation (NASDAQ:CELG) Flagging here. Watch Monday's action for a possible breakout over $142.69

( click to enlarge )

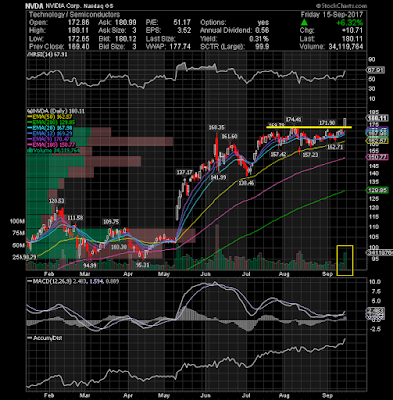

( click to enlarge )NVIDIA Corporation (NASDAQ:NVDA) On Friday, stock price broke out to a new all-time high accompained by a strong volume suggesting higher levels. The break of this resistance line confirms the beginning of new uptrend momentum, which could move the stock above the $185 area in short-term. Use the rising EMA50 as stop. Shorts continue to get squeezed.

( click to enlarge )

( click to enlarge )Bristol-Myers Squibb Co (NYSE:BMY) another Bullish flag formation here. Play accordingly.

( click to enlarge )

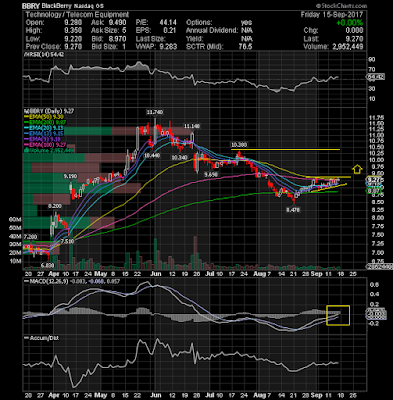

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) has consolidated in a large ascending triangle, whose upper trend line around 9.34 is now ready to be broken. Another good sign on chart that could help move the stock toward my first target range of $10.1-$10.38 would be a close above the declining 50-day exponential moving average, which is currently at 9.30. If the stock clears resistance the move may be powerful.

( click to enlarge )

( click to enlarge )Microbot Medical Inc (NASDAQ:MBOT) still on my watch list for next week. The stock had a very productive day on Friday as we saw gains of nearly 15% on volume well above average and I believe the stock has more room to run. A breakout over $1.34 (declining EMA50) with strong volume would send this flying.

( click to enlarge )

( click to enlarge )Celsion Corporation (NASDAQ:CLSN) deserves some consideration next week. The stock looks poised for a possible trend reversal after dropping to the $1.25 level forming a nice base on its daily chart. It is now recovering from its bottom with MACD, RSI and ADX moving upwards. The pattern needs to confirm by breaking above the $1.55 (Fridays high) resistance. If that break occurs, the price may rise to the 2.18-2.4 range in the short-term. I bought a lot of shares on Friday. This bottom pattern reminds me TRACON Pharmaceuticals Inc (NASDAQ:TCON) before the big rally this month.

( click to enlarge )

( click to enlarge )Watch carefully this rounding bottom pattern in Invivo Therapeutics Holdings Corp (NASDAQ:NVIV). For the first time in weeks the stock closed back above the EMA20. Expect price to rise next to test the declining EMA100 again followed by 1.65 resistance area. Technical indicators are also supporting a continuation of the move higher.

( click to enlarge )

( click to enlarge )Zosano Pharma Corp (NASDAQ:ZSAN) continued to show strength with another nice gain. Friday's rally put shares near the psychological resistance level of $1, which is a bullish sign. Current momentum is likely to continue towards the 1.25-1.30 area.

( click to enlarge )

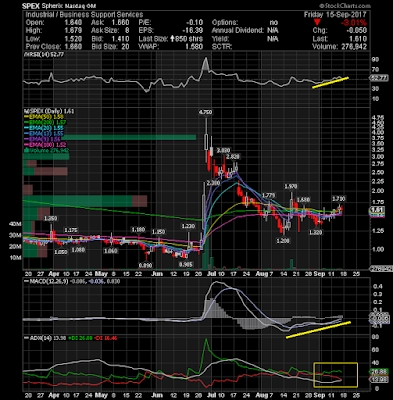

( click to enlarge )Spherix Inc (NASDAQ:SPEX) Still on my top long list (small caps). Could move toward $2 area if it breaks and closes above the 1.68 level. Technicals look Bullish to me. Momentum picking up with MACD climbing and RSI rising. Watch for continuation.

If you want to contact me for advertising opportunities on blog or twitter, then get in touch via email

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC