First Growth Funds RNAV 75%+ Above Current Share Price According to Zero One Investment Research

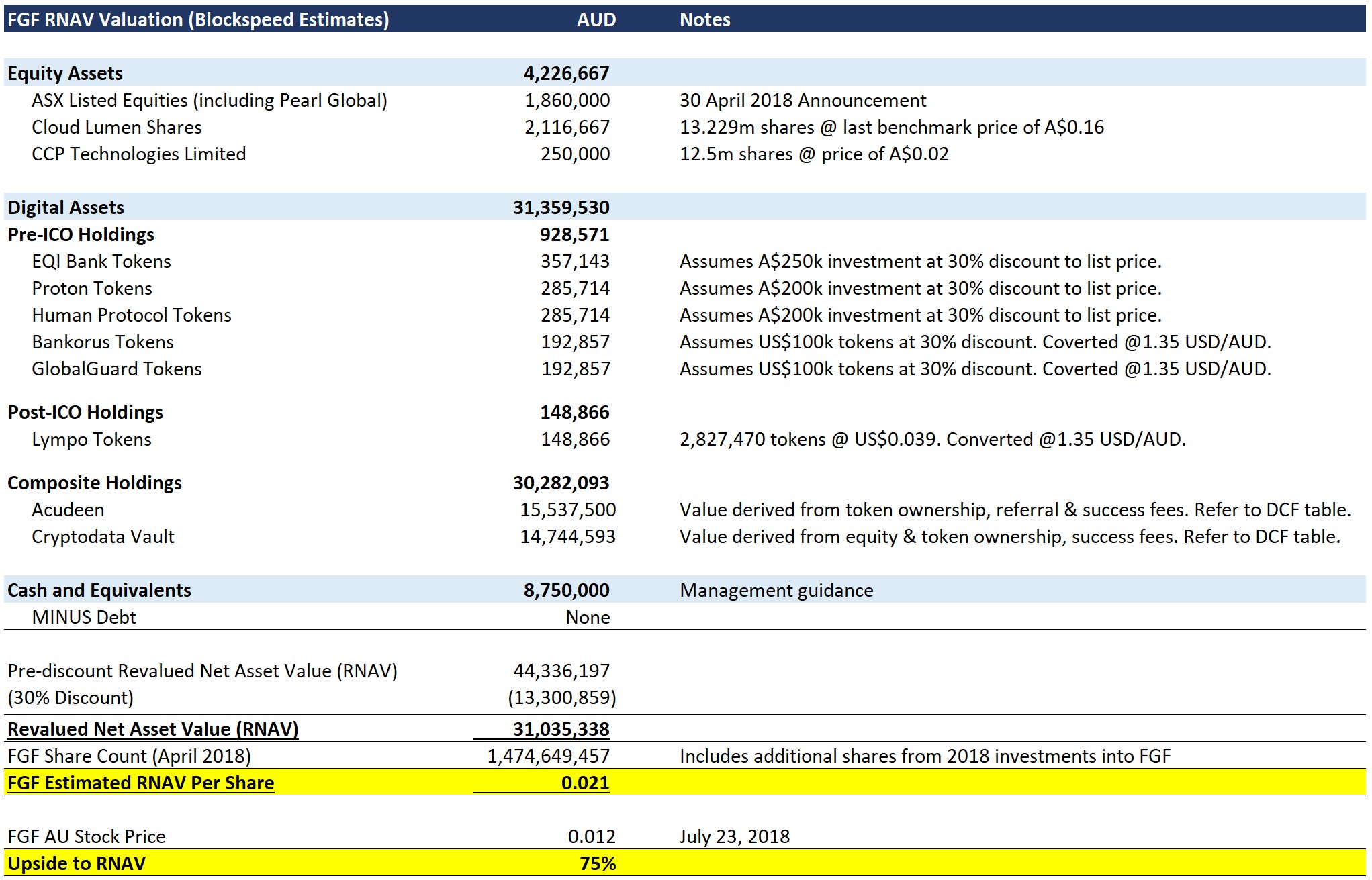

SINGAPORE / ACCESSWIRE / August 14, 2018 / Zero One Investment Research has released an in-depth research report valuing First Growth Funds (ASX: FGF) shares at A$0.021 per share, which is 75%+ higher than the company's recent market price.

FGF is an alternative assets fund diversifying into cryptocurrencies and blockchain. In January 2018, it received a strategic investment from Blockchain Global (BCG), allowing FGF to leverage BCG's network to gain initial access to pre-ICO digital assets.

"FGF offers investors the potential for significant alpha given it is under-covered by the research community, has transformed its investment model dramatically in the last six months, and has been making new potentially lucrative additions to its portfolio," said Vincent Fernando, CFA, Head of Research at Zero One.

FGF is differentiated by it being one of the only ASX-listed investment funds that can provide investors with cryptocurrency investment exposure. Among its diversified strategies, the fund employs an innovative investment model whereby it identifies early stage investments into digital currencies before they list at significant discounts to expected listing price. FGF also benefits from a proprietary deal flow where the fund can become one of the largest shareholders prior to a token listing.

Zero One Investment Research calculated its RNAV using estimates of latest benchmark valuations, expected listing prices, and expected cash flows for FGF's portfolio holdings and then applied a 30% discount to the total to arrive at a Revalued Net Asset Value (RNAV) of A$0.021 for FGF.

Full details of Zero One's FGF valuation and company analysis can be found in the Zero One research report here.

ABOUT ZERO ONE

Zero One Investment Research is a disruptive investment research company specialized in identifying under-followed investment opportunities ahead of mainstream investment community. The company aims to increase transparency and understanding in the market for both companies and investors.

To find out more, contact: research@01.co

SOURCE: Zero One Investment Research