Smith Collection/Gado/Getty Images

Smith Collection/Gado/Getty Images

Amazon is using a tried-and-tested method as it plays catch-up to competitors in the grocery market: offering lower prices.

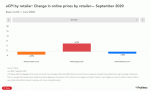

Amazon dropped its average grocery prices by 2.3% during the third quarter, the steepest cut among leading US grocery retailers, according to data from research firm Profitero. The study, based on prices of more than 700 grocery products, found that Walmart had dropped its prices by 1.5%, while groceries at Target were 6.7% more expensive over the three-month period ended in September.

Amazon's pricing strategy reflects the company's continued focus on growing share in the competitive grocery space by undercutting competitors. While Amazon is the largest e-commerce site in the US, it still lags far behind traditional retailers like Walmart, Kroger, and Target in the grocery market, as shoppers still prefer to touch and see the produce they buy.

"It reflects a commitment to the grocery category and to the overall value proposition to consumers that low prices are a fundamental reason to shop at Amazon, in addition to convenience and selection," Keith Anderson, Profitero's SVP of Strategy and Insights, told Business Insider.

Profitero

Profitero

Amazon's low-price strategy isn't just limited to the grocery space. A separate report by Profitero published this week shows Amazon offering an average of 15% discounts compared to other major retailers, and having the lowest prices in 18 of the 21 major consumer categories, including appliances, electronics, and household supplies.

But Amazon has reason to double down on grocery discounts, as online grocery is poised to grow exponentially in the coming years, driven by the lockdown-fueled demand increases. Online grocery sales in the US is expected to grow by nearly 53% this year, to $89.22 billion in sales, and reach $129.72 billion in sales by 2023, according to eMarketer.

"Amid the pandemic, millions of US consumers have dipped their toes into online grocery shopping for the first time," eMarketer's Rimma Kats wrote this week. "And we don't expect this habit to go away anytime soon."

Grocery has been a major investment area for Amazon in recent years. Besides the $13.7 billion acquisition of Whole Foods in 2017, Amazon has opened a number of different new grocery stores while expanding its product selection lately. It also started offering free grocery delivery to its Prime members last year.

RBC Capital estimates Amazon's grocery sales volume to grow to $88 billion by 2023, accounting for roughly 11% of the total value of the products sold on Amazon. That's roughly a third of Walmart's estimated grocery sales volume of $250 billion this year, according to RBC's research.

Amazon doesn't separately disclose revenue from its grocery or Whole Foods segments. Instead, it breaks out its physical store sales, mostly consisting of Whole Foods, which dropped by 10% to $3.8 billion in its most recent quarter. That number, however, doesn't include online and pick-up orders. Amazon's spokesperson declined to say whether its physical stores sales would have grown last quarter, if it had included online and pick-up orders.

Amazon's CFO Brian Olsavsky added a little more context without sharing any meaningful numbers during last month's earnings call. He said online grocery orders had "tripled" from the year-ago period, and that the year-over-year growth rate of online grocery sales "continued to accelerate."

NOW WATCH: A cleaning expert reveals her 3-step method for cleaning your entire home quickly

See Also:

- Jeff Bezos' top lieutenants drafted a fake press release for Amazon Pharmacy back in 2014. It's a strategy the company uses to help prioritize its next giant opportunities.

- EXCLUSIVE: Amazon's first-ever plan for its new pharmacy business, which included partnering with Pfizer and J&J, highlights the challenges and ambitions of the secretive business

- We got an exclusive look at the pitch deck buzzy health tech startup Levels used to raise $12 million from a16z