GE Vernova (GEV) is back in the spotlight after securing its first international wind-repower upgrade contract. GEV shares have remained under pressure following a mixed Q3 performance. However, that changed on Nov. 19, when the stock closed 7.3% higher, hinting that the market is beginning to price in the company’s expanding global footprint.

Notably, GE Vernova reached an agreement with Taiwan Power Company to supply 25 repower upgrade kits. This is more than a routine contract win. It extends GE Vernova’s dominant U.S. repowering business, where the company has modernized over 6,000 turbines, into a new international market. The move signals that GE Vernova is well-positioned as a reliable partner for utilities looking to extend the life and performance of their renewable assets.

The project stretches across several years, with initial component deliveries scheduled for late 2025 and retrofit work continuing through 2026 and 2027. Beyond the upgrade kits, GE Vernova will oversee a five-year operations and maintenance program.

Repowering has become an essential lever for countries and utilities seeking to increase renewable output without the cost and complexity of building a new project. By modernizing turbines nearing the end of their design life, GE Vernova helps customers boost reliability, enhance performance, and accelerate clean-energy deployment, all while leveraging existing infrastructure. This combination of operational and economic advantages explains why repower projects and international expansion could become a meaningful long-term growth driver for the company.

GE Vernova’s installed base, nearly 57,000 turbines and close to 120 GW of global capacity, gives it a substantial platform to scale these services. With deep customer relationships and a global supply chain that supports efficient deployment, the company is poised to capitalize on the rising demand for affordable, sustainable wind energy solutions worldwide.

GE Vernova to Deliver Strong Growth

GE Vernova’s latest move signals the beginning of a broader international push. Meanwhile, the energy equipment and service provider is benefiting from robust orders, a swelling backlog, and widening margins, which reflect its ability to scale profitably across its core segments, including Power, Electrification, and Wind.

In its most recent quarter, the company reported $14.6 billion in orders, representing a 55% increase from a year earlier. Equipment orders nearly doubled, driven in large part by notable momentum in both the Power and Electrification businesses, while services orders advanced steadily across all segments. This strength pushed the company’s total backlog to $135 billion, highlighting sustained demand for its technologies and long-cycle service contracts.

The composition of this backlog is improving as well. Equipment backlog rose to $54 billion, up about $12 billion from the previous year, and maintained healthy margins thanks to disciplined pricing and underwriting. The services backlog also expanded to $81 billion, providing the company with recurring, higher-margin revenue visibility.

Although the Wind segment continues to face pressure, GE Vernova is making progress in improving its profitability. Onshore Wind margins expanded, supported by better project execution and cost controls. The company remains focused on navigating its more complex Offshore Wind backlog, but early signs in Onshore are encouraging. Wind orders rose 4% year-over-year, and services activity in Onshore Wind was strong, up 27% so far this year. Improvements in fleet availability, reductions in downtime, and lower per-job costs indicate that operational discipline is beginning to pay off.

Overall, GE Vernova is likely to deliver profitable growth led by a durable backlog and growing demand for electrification and grid modernization worldwide.

Is GE Vernova Stock a Buy?

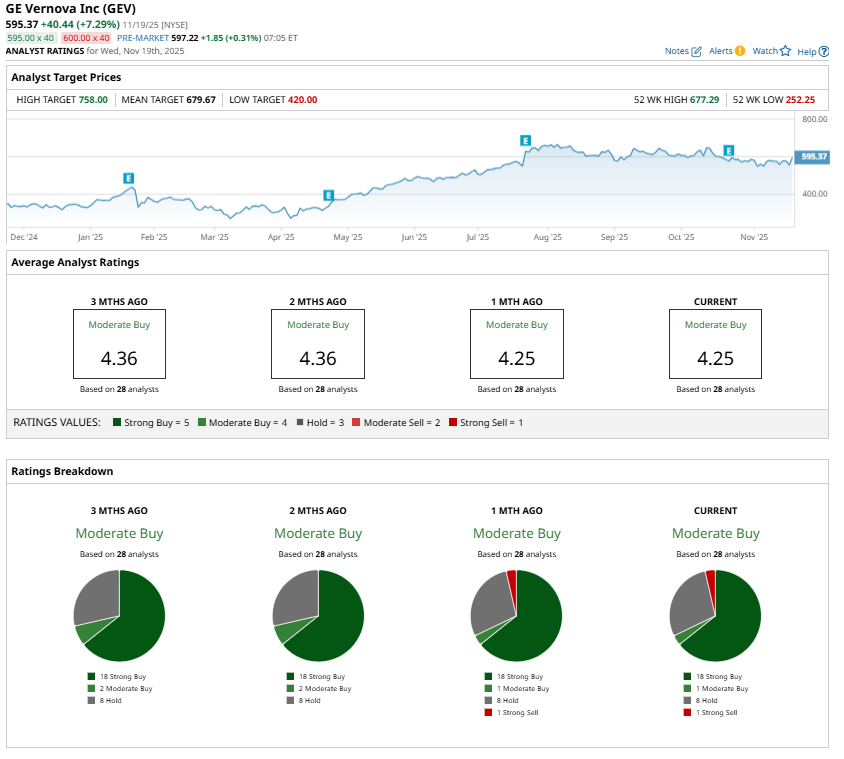

Analysts remain somewhat cautious on GEV due to the stock’s strong performance this year. While analysts maintain a “Moderate Buy” consensus rating, strong demand for its equipment and services, driven by electrification, grid upgrades, and the need for reliable power, along with improving margins and a solid growth outlook, make GEV a compelling long-term investment.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?

- Exact Sciences Stock Pops on $21 Billion Deal. Is It Too Late to Buy EXAS Here?