Valued at a market cap of $8.9 billion, A. O. Smith Corporation (AOS) manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products. The Milwaukee, Wisconsin-based company offers its products under the A. O. Smith, State, Lochinvar, Hague, Water-Right, Master Water, Atlantic Filter, and Water Tec brands.

Shares of this water treatment solutions provider have considerably lagged behind the broader market over the past 52 weeks. AOS has declined 11.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 10.5%. Moreover, on a YTD basis, the stock is down 7.3%, compared to SPX’s 11.2% uptick.

Narrowing the focus, AOS has also underperformed the Invesco Global Water ETF (PIO), which has gained 6.4% over the past 52 weeks and 10.7% on a YTD basis.

On Oct. 28, shares of AOS plunged 2.6% after its Q3 earnings release, despite delivering a better-than-expected performance. Driven by higher water heater and boiler sales in North America, the company's total revenue improved 4.4% year-over-year to $942.5 million, slightly surpassing consensus estimates. Moreover, its EPS of $0.94 increased 14.6% from the year-ago quarter, beating analyst expectations of $0.89.

However, sales in China decreased by nearly 12% in local currency year-over-year. Additionally, the company anticipates continued headwinds in the Chinese market and expects the weakening new home construction market to impact residential water heating in North America. Because of this, it lowered its fiscal 2025 sales outlook to a projection of flat to up 1%, and lowered the midpoint of its EPS outlook to an anticipated range of $3.70 to $3.85, dampening investor confidence.

For the current fiscal year, ending in December, analysts expect AOS’ EPS to grow 1.6% year over year to $3.79. The company’s earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters, while missing on another occasion.

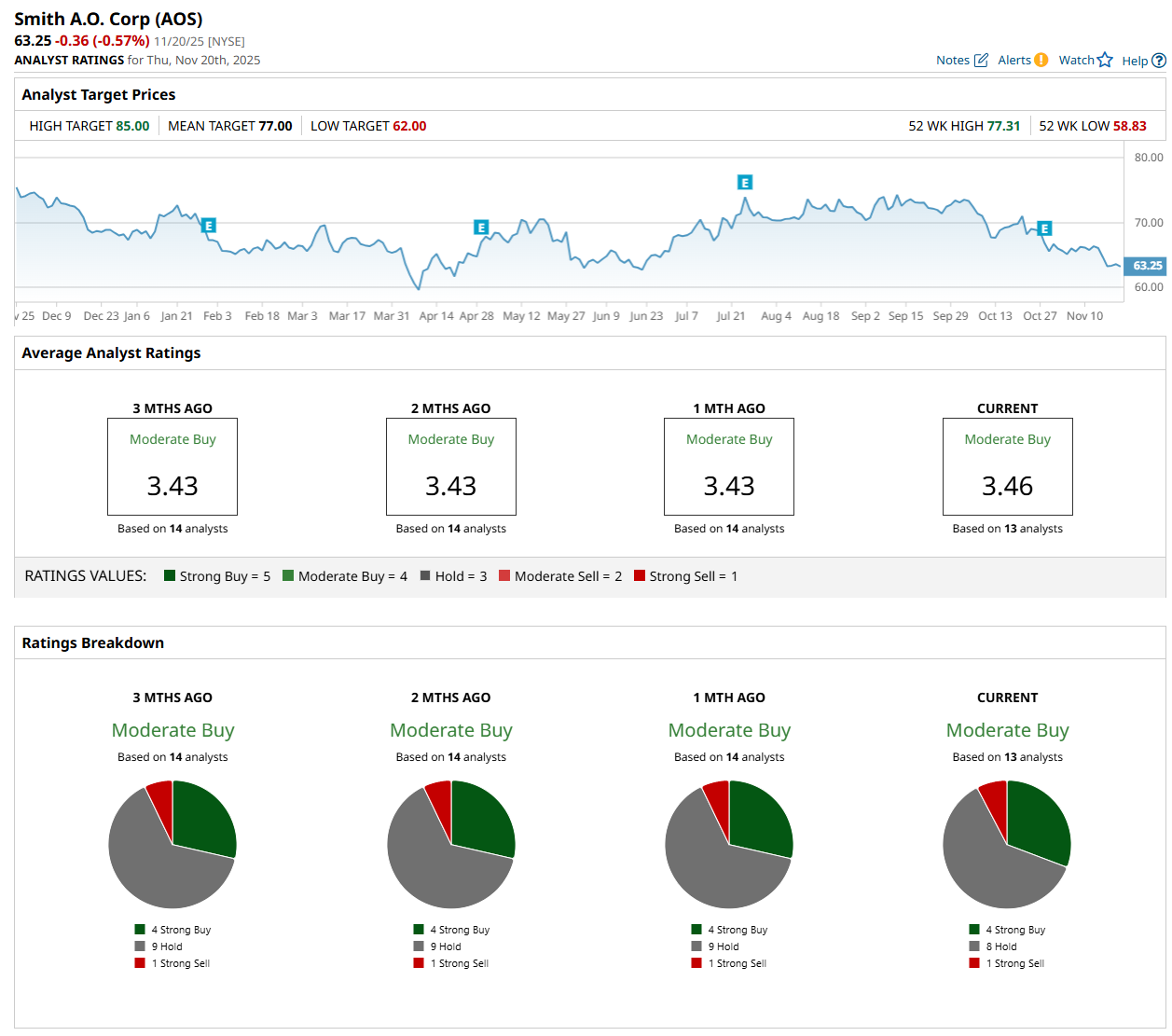

Among the 13 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on four “Strong Buy,” eight "Hold,” and one "Strong Sell” rating.

The configuration has remained fairly stable over the past three months.

On Nov. 13, Bryan Blair from Oppenheimer Holdings Inc. (OPY) maintained a “Buy” rating on AOS, with a price target of $85, the Street-high price target, indicating a 34.4% potential upside from the current levels.

The mean price target of $77 represents a 21.7% premium from AOS’ current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart