With a market cap of $17.2 billion, Packaging Corporation of America (PKG) is the third-largest producer of containerboard and uncoated freesheet paper. The company operates through its Packaging and Paper segments, supplying a wide range of corrugated packaging and paper products across North America.

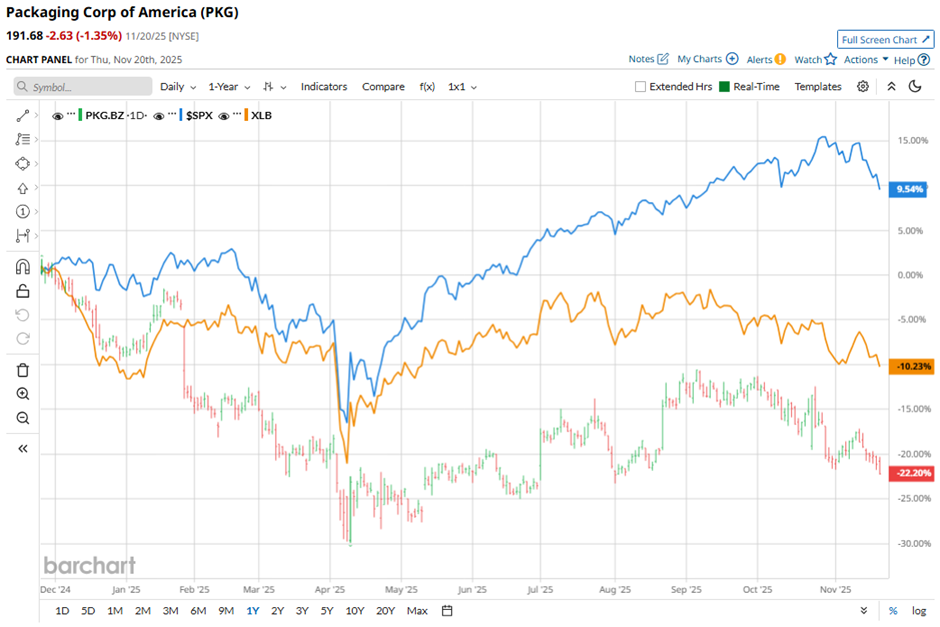

Shares of the Lake Forest, Illinois-based company have underperformed the broader market over the past 52 weeks. PKG stock has fallen 21.5% over this time frame, while the broader S&P 500 Index ($SPX) has increased 10.5%. Moreover, shares of the company have declined 14.9% on a YTD basis, compared to SPX's 11.2% return.

Looking closer, shares of the containerboard and corrugated packaging products maker have lagged behind the Materials Select Sector SPDR Fund's (XLB) 8.6% decrease over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $2.73 on Oct. 22, shares of PKG rose 2.2% the next day because revenue of $2.31 billion exceeded forecasts and improved from $2.2 billion a year earlier. Investors responded positively to strong operational performance, including $503.4 million in EBITDA excluding special items and solid Packaging segment operating income of $347.9 million. Additionally, management projected Q4 EPS of $2.40 excluding special items and highlighted expected improvements from the newly acquired Greif containerboard business.

For the fiscal year ending in December 2025, analysts expect PKG's adjusted EPS to grow 9.9% year-over-year to $9.93. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

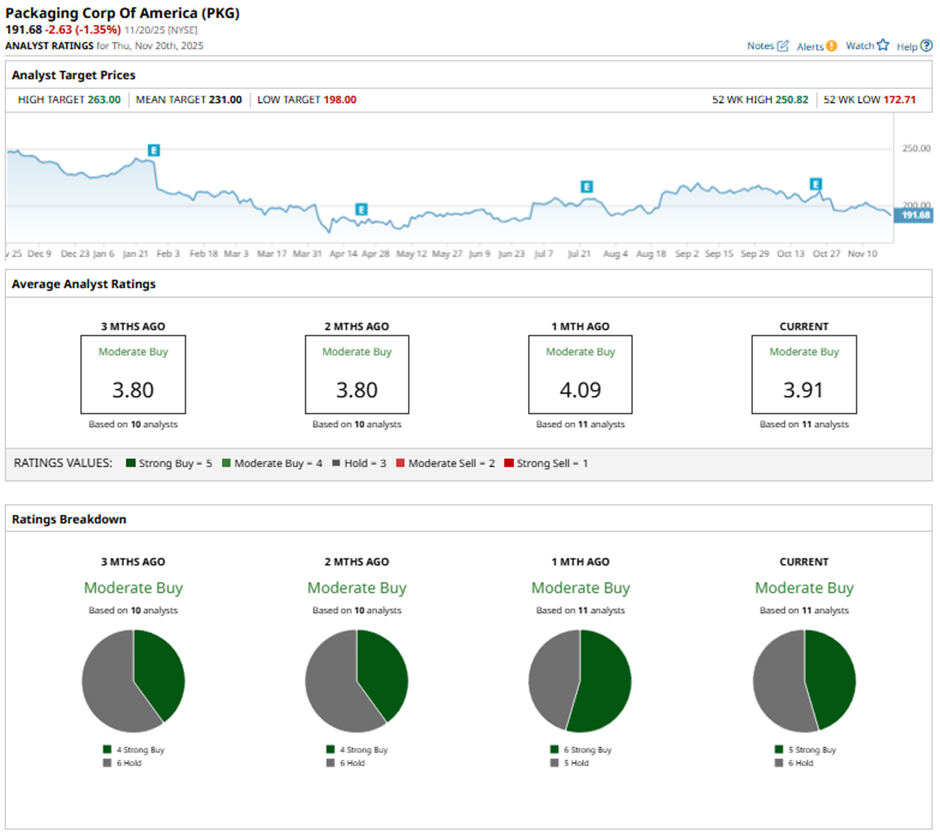

Among the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and six “Holds.”

This configuration is slightly more bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Nov. 18, Bank of America Securities analyst George Staphos maintained a “Buy” rating on Packaging Corporation of America and set a $240 price target.

The mean price target of $231 represents a 20.5% premium to PKG’s current price levels. The Street-high price target of $263 suggests a 37.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Buy DoorDash Stock Now for a ‘Banner’ 2026, According to Analysts

- Dan Ives Is Pounding the Table on Meta Platforms Despite a ‘Capex Super Cycle.’ Should You Buy META Stock Here?

- Should You Buy the Double-Downgrade Dip in Dell Stock?

- Walmart Is Getting a New CEO. Should You Buy, Sell, or Hold WMT Stock Here?