Valued at a market cap of $16.2 billion, Gartner, Inc. (IT) is a global research and advisory firm that provides insights, data, and support to leaders across various industries. Operating through its Research, Conferences, and Consulting segments, the company helps organizations make informed decisions and drive business performance.

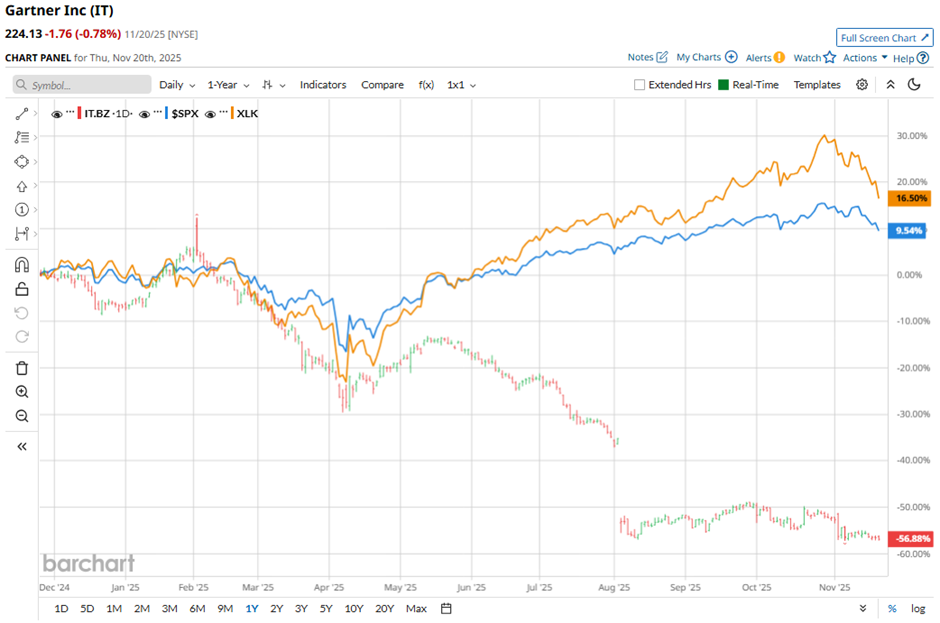

Shares of the Stamford, Connecticut-based company have significantly lagged behind the broader market over the past 52 weeks. IT stock has dropped 56.7% over this time frame, while the broader S&P 500 Index ($SPX) has risen 10.5%. Moreover, shares of the company have decreased 53.7% on a YTD basis, compared to SPX's 11.2% gain.

Looking more closely, shares of the technology information and analysis company have underperformed the Technology Select Sector SPDR Fund's (XLK) 17.8% increase over the past 52 weeks.

Despite Q3 2025 adjusted EPS of $2.76 beating estimates and revenue of $1.52 billion meeting forecasts, shares of IT tumbled 7.6% on Nov. 4. Investors were discouraged by weakness across operating segments, including a 3.2% decline in Consulting revenue, a 1.6% decline in Conferences revenue, and negative free cash flow of $269 million.

For the fiscal year ending in December 2025, analysts expect Gartner's adjusted EPS to decline 9.2% year-over-year to $12.79. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

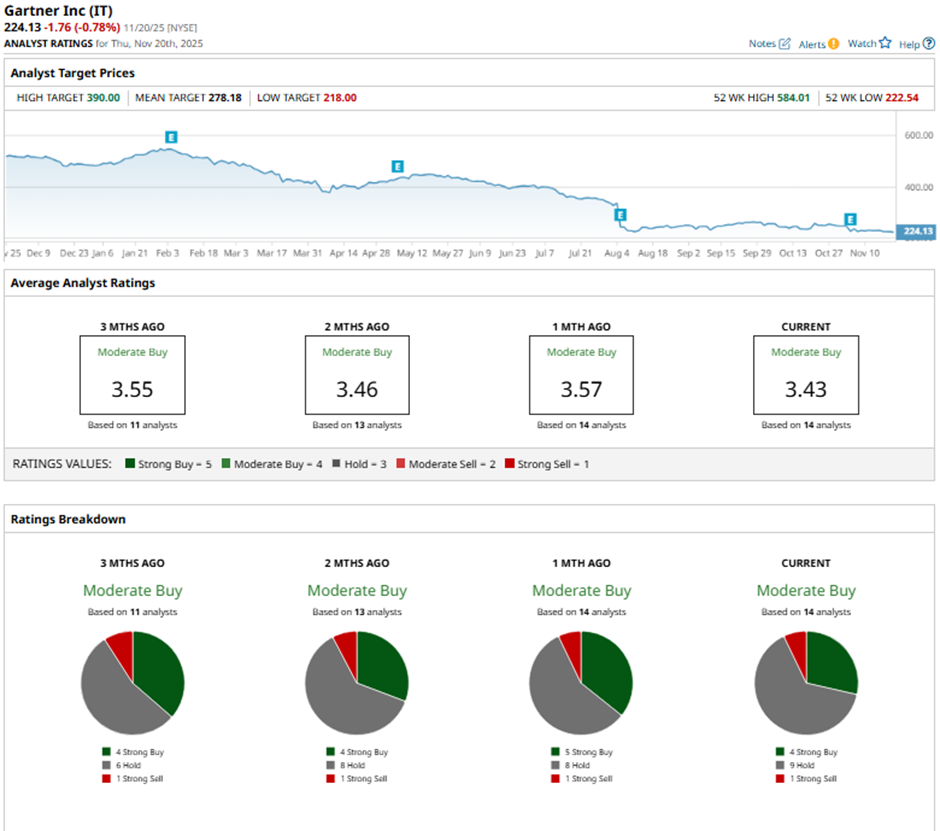

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, nine “Holds,” and one “Strong Sell.”

On Nov. 05, Barclays cut its price target on Gartner to $260, maintaining an “Equal Weight” rating.

The mean price target of $278.18 represents a 24.1% premium to IT’s current price levels. The Street-high price target of $390 suggests a 74% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Learn How to Read These Smart Money Warning Signs as Commitments of Traders Data Comes Back Online

- ConocoPhillips' 3.84% Dividend Yield Implies COP Stock Could be 24% Undervalued

- Is This Outstanding AI Stock Under $250 Ready to Soar?

- UnitedHealth Stock: ‘Big,’ ‘Fat,’ and ‘Rich,’ or an Undervalued S&P 500 Buy Here?