One such company making headlines in the eVTOL market is Archer Aviation (ACHR), and its new development is just another add-on to all these catalysts. A deal was struck between the company to deliver its proprietary electric powertrain technology to Anduril Industries and EDGE Group. This is the first time the company is integrating its powertrain system for any customer besides itself. The collaboration comes at a time when the company is associated with Anduril's Omen Autonomous Air Vehicle program and is also linked to delivering 50 systems, which may have further commercial applications for ACHR beyond passenger transport.

This is timely for Archer, as interest in the use of eVTOL aircraft is growing at the global level. The company's stock shows volatility considering concerns for FAA approval and high-growth expectations and high short interest of around 12%. On another front, interest in advanced air mobility technology is growing as governments and individuals consider the use of low-noise and zero-emission aircraft solutions for transport and defense initiatives. At this point, investors are considering whether this deal enhances its overall investment thesis at Archer.

Information on Archer Aviation Stock

Archer Aviation is a California-based company that develops electric vertical take-off and landing aircraft (eVTOL) designed for commercial air taxis. Archer is renowned for its quick turnaround and quiet electric aircraft and recently ventured into providing proprietary powertrains. It is based in Santa Clara, California, and operates under the aerospace and defense category while currently having over $2 billion in liquid assets because of successful funding rounds.

From a performance analysis point of view, shares of ARCH have ranged between $4.94 and $14.62 for the last 52 weeks and are currently at $6.83. This is depicted by its Relative Strength rating of 33.45 and Weighted Alpha of -30.03, which continues to negatively impact stock performance for the entire year-to-date (YTD) period. Over the last five market days, ACHR is down by 16% as compared to the S&P 500 Index's ($SPX) 3%. This volatility stems from reasons related to initial stages of aerospace certifications or funding cycles and general market volatility.

Valuation is also problematic at this point because it does not have significant or meaningful revenue or FPE or PS ratios since it does not have any earnings to speak of. It also does not have any P/E ratios because of its lack of earnings, but its price/book ratio is 2.94 and its book value is 2.54 because it is a growing developer of aircraft-related products and sells at premiums to its books at all points of development for such products. Profitability is also out of reach for now because its return on equity ratio is at -49.22%, but at least its debt/equity ratio is tiny at 0.04.

Archer does not pay any dividends for now.

Archer Aviation Records Notable Milestones and Strategic Gains

The most recent quarterly update from Archer illustrated several accomplishments toward achieving certification status. Midnight, their flagship aircraft designed for four passengers, broke 50 miles of range and 10,000 feet of altitude, the first significant milestones toward receiving FAA approval for commercial use. Additionally, it showcased its low-noise configuration at the California Airshow for tens of thousands of onlookers to experience and celebrate its viability for use in urban areas being achieved.

Although Archer does not yet break out EPS or earnings figures, its quarterly expenditures are on track according to management's projections, and it continues to solidify its financial base. A $650 million equity offering recently added to its cash balances to give it over $2 billion of total liquidity to pursue multi-year expansion into international markets.

Strategic updates have also ranged beyond tech achievements. Archer Aviation finalized an acquisition worth $126 million for Hawthorne Airport, which is to act as an operational base for its air taxi offering in Los Angeles and also as a testing ground for AI-equipped aviation technology. Another acquisition was for patent portfolios from Lilium for $21 million to add to its library of 1,000 patents or more.

Additionally, it reported accelerating momentum in its international business. Midnight aircraft have started flying operations in the UAE side by side with Abu Dhabi Aviation, while it is moving forward in discussing approval processes together with the General Civil Aviation Authority in the UAE. In Asia, it enhanced its position through commercialization agreements entered into in both Korea and Japan. The next earnings announcement date hasn't been announced yet.

What Do Analysts Expect for ACHR Stock?

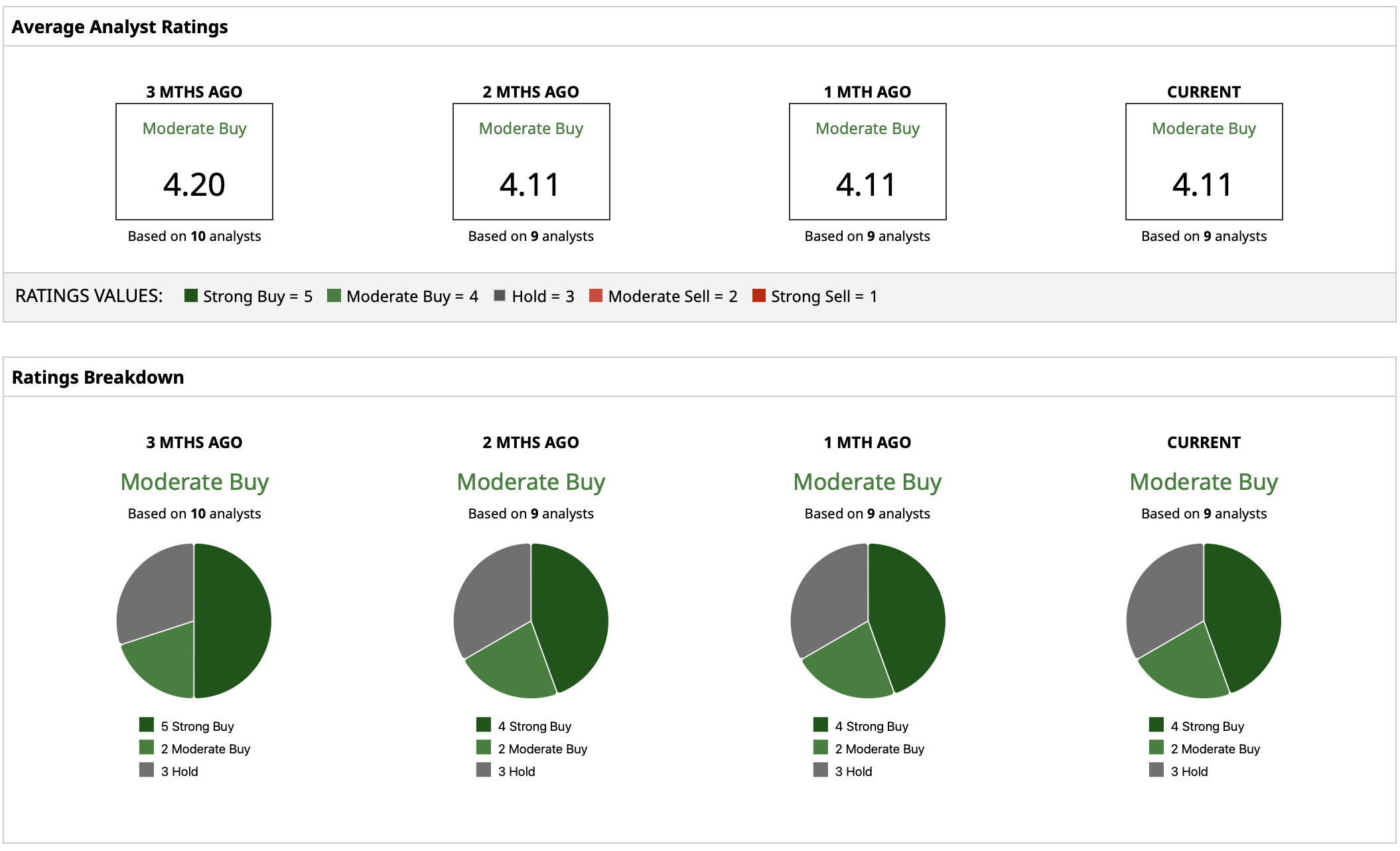

Analyst sentiment for Archer is cautiously optimistic with a “Moderate Buy” rating and an average price target of $11.56, while others range between a high of $18 to as low as $4.50. Given its current market price of $6.83, analysts have around 69% possible growth for the company based on its median target, while others have higher hopes for its commercialization timeline to push through.

On the date of publication, Yiannis Zourmpanos had a position in: ACHR . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’

- Cathie Wood Keeps Buying the Dip in Circle Stock. Should You?

- Meta Platforms Just Lost Its Chief AI Scientist. Does That Make META Stock a Sell Here?

- Eli Lilly Stock Joins the $1 Trillion Club as LLY Hits New All-Time Highs