Nvidia (NVDA) has once again reminded us why it sits at the center of the artificial intelligence (AI) boom. The company reported another solid quarter, driven by strong ongoing demand for its chips powering advanced AI systems.

Adding to the positives, Nvidia CEO Jensen Huang reaffirmed strong bookings for its next-generation Blackwell and Rubin platforms. These chips have already locked in $500 billion in bookings through 2026, offering solid visibility into future growth and indicating that the momentum in its business is unlikely to slow down anytime soon.

Thanks to a robust product pipeline and its full-stack computing approach, Nvidia has widened its lead in the race to supply the massive infrastructure behind generative AI. The company’s management highlighted that global AI infrastructure spending could reach between $3 trillion and $4 trillion annually by the end of 2030. Nvidia, with its dominant position in GPUs, networking, and software, is likely to capture a significant share of that investment.

All of this translates into a long runway for growth. Demand for AI compute remains high, and Nvidia continues to outpace competitors with faster upgrade cycles and a stronger ecosystem. For long-term investors, those tailwinds are hard to ignore.

While Nvidia is set to deliver solid growth, will concerns around the AI bubble and valuation temper the stock’s upside from here?

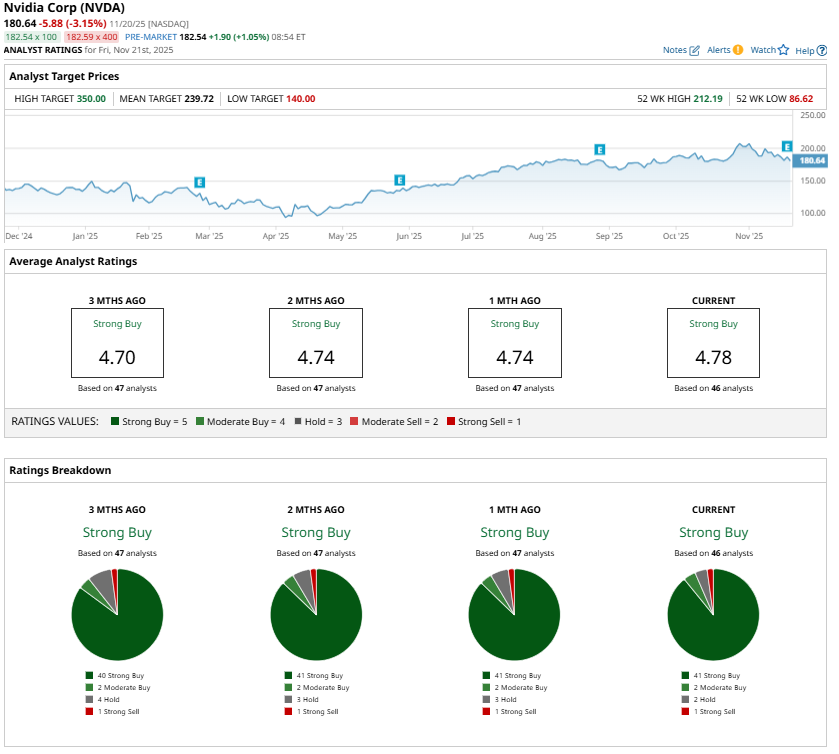

Analysts See Significant Upside for Nvidia Stock

Nvidia’s latest results have given fresh reasons to believe the company’s extraordinary run led by AI is far from over. In its most recent quarter, Nvidia generated $57 billion in revenue, a 62% year-over-year increase and a record sequential increase of $10 billion. The company’s performance continues to counter the narrative that AI is entering bubble territory. Instead, Nvidia’s bookings and demand patterns suggest that the build-out of AI infrastructure across cloud and enterprise environments is still in its early stages.

Management stated that the demand environment remains exceptionally strong, with its GPU installed base spanning Blackwell, Hopper, and Ampere chips fully utilized.

Notably, the data center segment, the core of Nvidia’s business, reported $51 billion in revenue for the quarter, up 66% year over year. This growth comes despite difficult comparisons after last year’s explosive growth. Compute demand surged 56%, driven by the rapid ramp of the GB300 series, while networking more than doubled as cloud providers accelerated NVLink deployments and saw strong adoption across Spectrum-X Ethernet and Quantum-X InfiniBand solutions.

Momentum behind the new Blackwell architecture remains solid. The GB300 has already overtaken the GB200 and now accounts for roughly two-thirds of Blackwell's revenue. Shipments to major cloud service providers have begun, and Blackwell is still in its early innings, implying it will continue to boost data center revenue in the upcoming quarters.

Nvidia’s older platforms are also generating solid revenue. Hopper, now more than three years old, still generated about $2 billion in quarterly revenue. Meanwhile, Nvidia is preparing for its next major leap, the Rubin platform. Scheduled to ramp in the second half of 2026, Rubin is likely to deliver solid revenue.

Given this solid growth backdrop, it’s no surprise that Wall Street remains bullish about NVDA. Analysts maintain a “Strong Buy” rating on Nvidia. At the same time, the highest price target of $350 suggests a significant 94% upside from the stock’s recent close of $180.64.

Nvidia’s Valuation Looks Compelling

With demand for AI computing accelerating across industries, Nvidia’s growth outlook remains solid, making its valuation compelling. Its next-generation chips are selling fast, driving exceptional revenue momentum. As Nvidia’s GPUs are becoming foundational to everything from data-center transformation to autonomous systems and next-gen software platforms, the company’s addressable market keeps widening, providing a solid platform for long-term growth.

Nvidia stock trades at about 42.5 times forward earnings, a multiple that might look rich in isolation but appears far more reasonable when set against expected earnings growth of more than 43% in fiscal 2027. Another factor supporting the investment case is the substantial revenue pipeline tied to Nvidia’s Blackwell and Rubin architectures. With roughly $500 billion in cumulative revenue potential projected over the coming quarters, the company’s growth runway could exceed even the more optimistic estimates on Wall Street. Even when treated conservatively, these projections point to financial upside that is still not fully reflected in the current share price.

Taken together, Nvidia’s valuation looks more like an opportunity than a premium. Nvidia's dominance in AI computing and visibility into future demand make the stock one of the most attractive long-term investments.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This 1 Company Is the Nvidia of Quantum Computing. Should You Buy Its Stock Now?

- Nvidia Just Waved a Big ‘Green Flag’ for Taiwan Semi. Buy TSM Stock Here, Says Wedbush.

- Nvidia’s Growth Engine Is Running Hot — Should You Get On Board?

- Nvidia Stock Breaks 100-Day Moving Average on Q3 Earnings Selloff. Should You Buy the NVDA Dip?