Valued at a market cap of $2.8 billion, WeRide (WRD) provides autonomous driving products and solutions for mobility, logistics, and sanitation industries. Its product categories include robotaxis, robobuses, robovans, and robosweepers. The China-based company also offers advanced driver-assistance system solutions, and the WeRide Go app, an online ride-hailing platform.

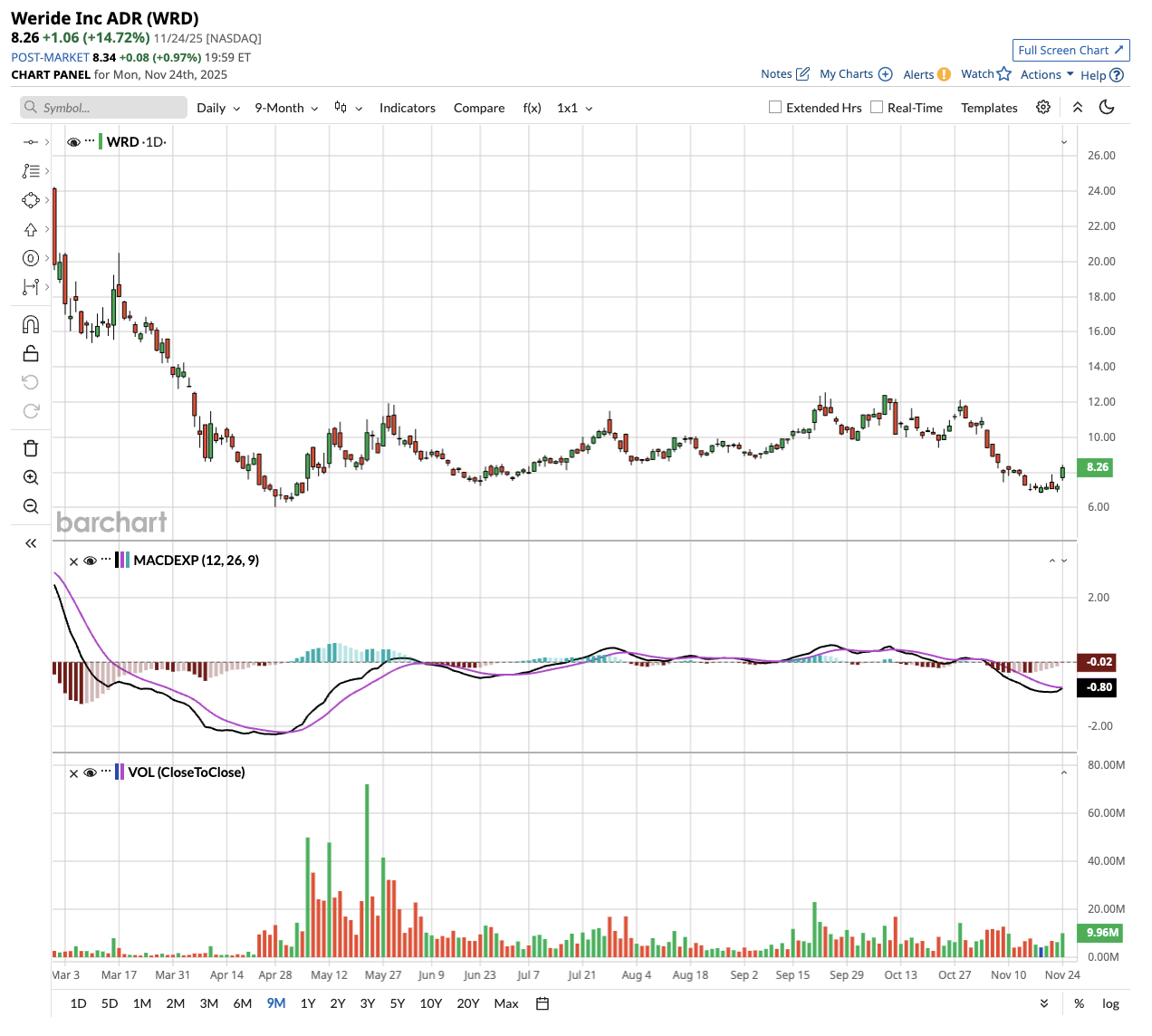

WeRide stock rose nearly 15% last week after the autonomous vehicle company delivered explosive third-quarter results, demonstrating its robotaxi business is gaining momentum.

The company stated its robotaxi revenue rose 761% year-over-year, while total sales rose 144% to $24 million in Q3 of 2025. While it continues to invest heavily in technology and global expansion, its net loss narrowed by 71% year-over-year.

WeRide’s product revenue rose 428% as it sold more robotaxis and robobuses to partners. Service revenue climbed 67%, driven by data services and autonomous driving operations. Robotaxi revenue now accounts for 21% of total revenue, up from just a fraction a year ago. The company also achieved a gross profit margin of 33%, demonstrating it can build a profitable business model as it scales.

WeRide Focuses on Global Expansion

WeRide operates more than 1,600 autonomous vehicles across 11 countries and 30 cities. It recently secured the world's first city-level fully driverless robotaxi permit outside the United States in Abu Dhabi, where it launched commercial service through Uber (UBER). WeRide now completes up to 20 trips per vehicle daily in the region and plans to extend service hours and boost utilization.

The company also announced its expansion into Switzerland with the country's first driverless robotaxi license and to Saudi Arabia through Uber. WeRide also noted continued growth in China, where it operates 300 robotaxis in Guangzhou and over 100 in Beijing.

WeRide's business model differs significantly between domestic and international markets. In China, it owns and operates vehicles through the WeRide Go app. However, in global markets, it has partnered with Uber and Grab (GRAB), keeping the model asset-light. This strategy allows WeRide to earn revenue by selling vehicles to partners, collecting annual licensing fees, and taking a commission on ride fares.

The company's CFO explained that a robotaxi completing 25 trips daily can generate over $90,000 in annual platform revenue. If WeRide takes a 30% cut, it can earn $30,000 per vehicle each year. This figure rises to $60,000 if the commission rate increases to 70%.

In Abu Dhabi, vehicles already average 12 trips per 12-hour shift. The company says 12 daily trips reaches the breakeven threshold, indicating profitability is within reach.

CEO Tony Han explained that WeRide's unique competitive advantage stems from its dual flywheel strategy. The company simultaneously develops Level 4 autonomous robotaxis and Level 2 advanced driver assistance systems for mass market cars.

This lets WeRide collect data from both sources to improve each system. The company's WePilot 3.0 system, comparable to Tesla's (TSLA) Full Self-Driving, just entered production with automaker Chery. WeRide also supplies advanced driver assistance systems to Guangzhou Automotive Group for multiple passenger car models.

Management projects reaching profitability in the near term by replicating its Abu Dhabi model in similar markets, including Dubai, Singapore, and European cities where taxi fares run high and driver shortages persist.

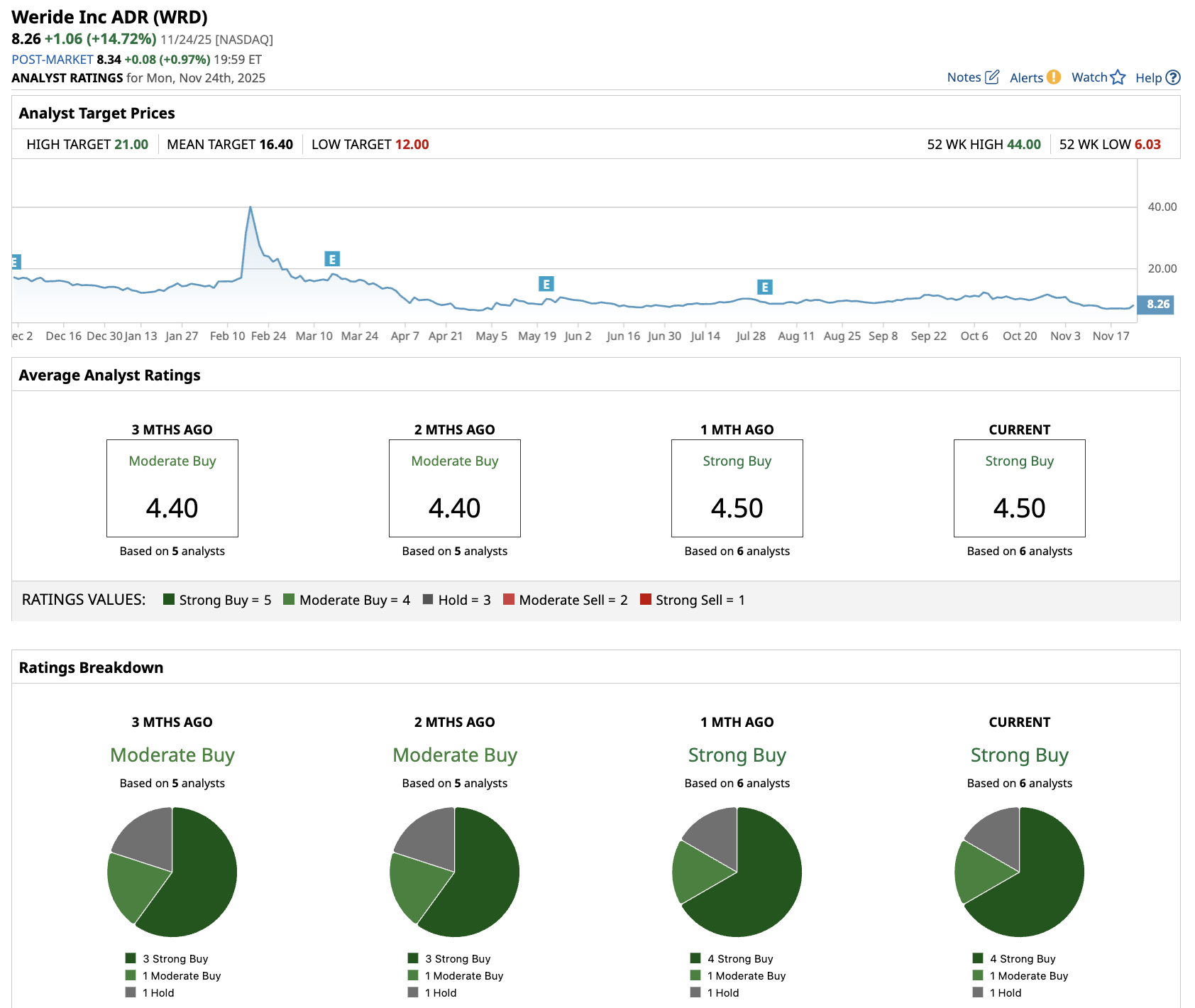

What Is the Price Target for WeRide Stock?

WeRide stock offers exposure to the robotaxi revolution at an early stage. However, the company remains unprofitable and faces intense competition from better-funded rivals like Waymo. The explosive revenue growth is encouraging, but investors should recognize this remains a speculative bet on the acceleration of autonomous vehicle adoption. WeRide maintains strong liquidity with 4.5 billion yuan ($633 million) in cash and has recently completed a Hong Kong listing, which provides additional capital for growth.

Analysts tracking WeRide stock forecast sales to increase from $50 million in 2024 to $533 million in 2027. The company is forecast to report adjusted earnings per share of 4 cents in 2027, compared with a loss per share of 42 cents this year.

Out of the six analysts covering WeRide stock, four recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Hold.”

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Just Named This Stock a Top Semiconductor Pick. Should You Buy Shares Now?

- AMD Stock Drops 15% in a Month: Should You Buy, Sell, or Hold?

- Is XPEV Stock a Buy for 2026 as XPeng Targets Breakeven and Pivots to Physical AI?

- Cathie Wood Is Buying GOOGL Stock as Alphabet Approaches $4 Trillion. Should You?