Investors have been reminded lately that artificial intelligence (AI) infrastructure investments are not always straightforward. Oracle (ORCL) stock slid following mixed financial results and a sharp increase in its capital spending outlook to roughly $50 billion for fiscal 2026. Shares dropped 12% after earnings and then another 6% following reports that a key $10 billion funding plan for a new Michigan AI data center with Blue Owl Capital had stalled, raising fresh concerns about rising debt and ongoing cash burn.

This is happening even as the global data center market is projected to generate more than $527 billion in revenue in 2025, which helps explain why the biggest tech companies are moving quickly to secure capacity for AI workloads.

For Oracle, the Michigan project is a major part of that push, and the apparent breakdown of the Blue Owl deal has shifted what was supposed to be a headline AI partnership into a bigger debate about funding risk and balance-sheet pressure.

With ORCL now trading well below its 52-week high, the question is hard to ignore: If Oracle cannot confidently finance big AI data centers like Michigan, should investors treat this pullback as a rare buying opportunity, or is it a signal to sell the stock before the story gets worse? Let’s find out.

How Strong Is Oracle’s Foundation?

Oracle is a major enterprise tech company that sells business software and cloud services, including cloud applications, AI-based analytics tools, and database systems used by large companies and government agencies.

Over the past month, Oracle shares have slipped 14.9%, as investors have reacted to the funding setback for the Michigan data center. Still, over the past 52 weeks, the stock is up 13.7%, which shows the longer-term view on Oracle’s move deeper into the cloud is still strong.

In terms of valuation, Oracle trades at a forward price-to-earnings (P/E) ratio of 33x, which is higher than the tech sector average of about 24x. That indicates that investors are still pricing in strong growth. Oracle also returns cash to shareholders through dividends, with a 1.9% dividend yield, a most recent payout of $0.50 per share, and a forward payout ratio of 32.7%, supported by regular quarterly dividends.

Financially, Oracle’s fiscal 2026 second-quarter results were strong in several important areas. Total revenue rose 14% year-over-year to $16.1 billion, and cloud revenue jumped 34% to $8 billion. Cloud Infrastructure (IaaS) revenue grew 68%, while Cloud Applications (SaaS) revenue increased 11%. GAAP earnings per share (EPS) surged 91% to $2.10, and remaining performance obligations climbed to $523 billion, up 438%, pointing to a much larger backlog of future business. With $12.4 billion in annual net income and a $551 billion market capitalization, Oracle’s financial base still looks solid even after the recent stock drop.

What’s Driving Oracle Now

Oracle Health and Life Sciences is focusing on specific areas like cancer care, and its work with the Cancer Center Informatics Society (Ci4CC) makes that clear. The two organizations aim to move AI forward in oncology care and research by combining Oracle’s technology with Ci4CC’s Initiatives Program and its national network of NCI-Designated and Community Care Cancer Centers.

The plan is to co-design an electronic health record (EHR) for cancer care, while also creating programs that will connect day-to-day oncology care physicians with clinical research. That includes combining clinical and genomic data for personalized medicine, using AI to accelerate clinical trial innovation and drug development, building real-world evidence frameworks, and supporting precision oncology platforms.

On the enterprise software side, Oracle is also working on making it easier for customers to use AI inside the tools they already use. The company launched the Oracle Fusion Applications AI Agent Marketplace, which aims to help Oracle Fusion Cloud Applications customers find and deploy validated, partner-built AI agents directly in their own environments.

Oracle is also deepening its manufacturing and supply chain work through its collaboration with Microsoft (MSFT). The two companies announced an integration blueprint that links Oracle Fusion Cloud Supply Chain and Manufacturing (SCM) workflows with live production data captured through Azure IoT Operations and Microsoft Fabric. The goal is to automate key supply chain processes and improve data-driven decision-making by sending shop-floor insights straight into enterprise workflows.

What Lies Ahead for ORCL

At Oracle’s next earnings release, analysts are looking for quarterly EPS of $1.35. For the following quarter, that estimate rises to $1.55, and analysts expect EPS of $5.82 for the full fiscal year 2026. If those numbers pan out, that would reflect year-over-year EPS growth of 14.4% for the current quarter and 14.8% for the next quarter, with a much bigger 32.3% jump expected for fiscal 2026.

Even with concerns that the stalled Blue Owl funding could slow the Michigan data center build, Bank of America analyst Brad Sills is sticking with a “Buy” rating. He did lower his price target to $300, but he says Oracle is “entering its largest phase of AI infrastructure build‑out” and is basically “paying the price to invest in growth.” JPMorgan analyst Mark Murphy is more cautious, maintaining a “Neutral” rating and cutting his target to $230, but he still calls Oracle a “key beneficiary of AI infrastructure demand.” He points to remaining performance obligations now above $500 billion as a sign that hyperscalers and frontier AI customers are committing to long‑term Oracle Cloud capacity.

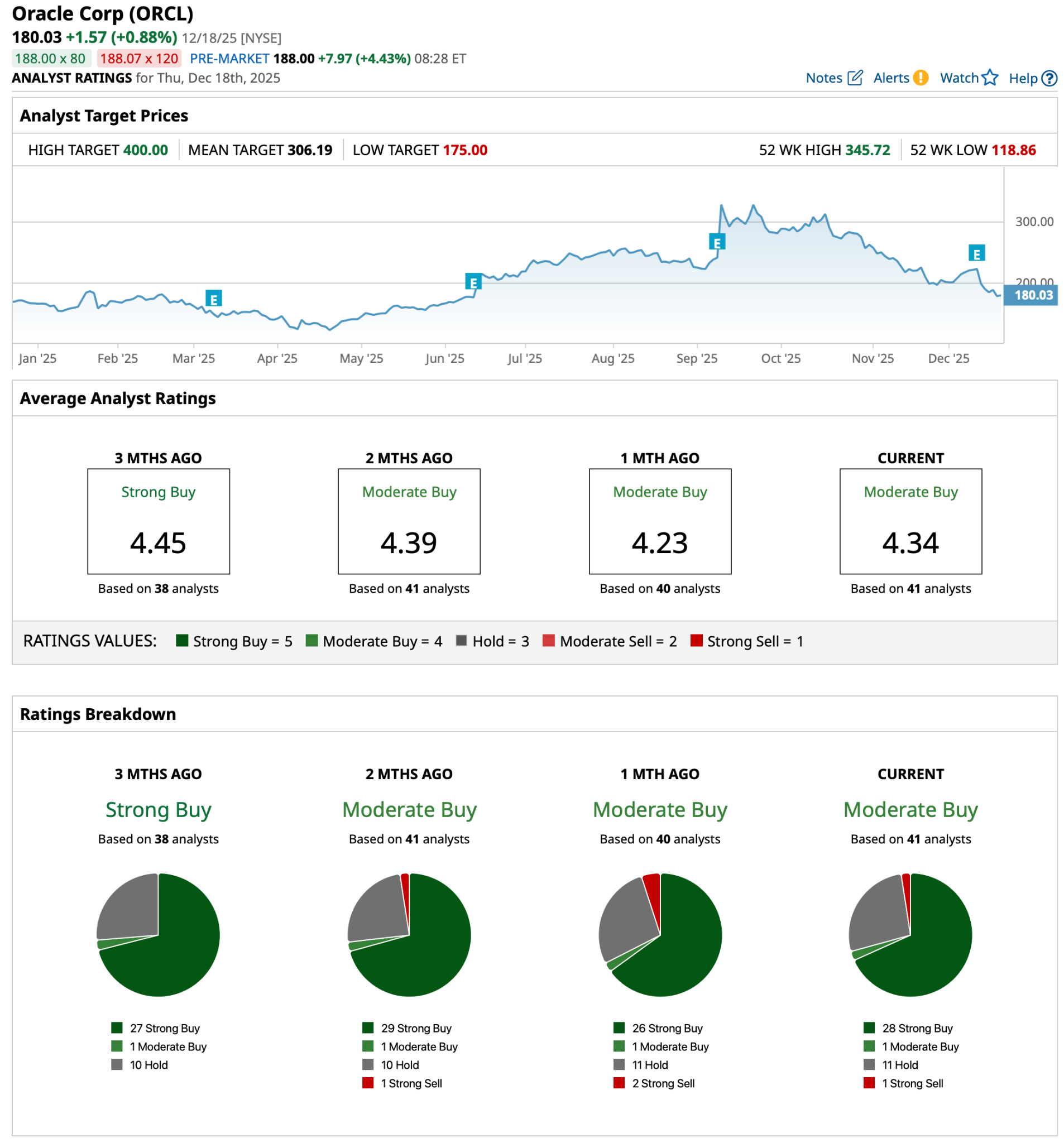

Stepping back, among 41 analysts surveyed, the consensus rating is a “Moderate Buy,” and the average price target is $306.19.

In Conclusion

Given the Michigan funding uncertainty and Oracle’s sharp capex ramp, this is not the kind of setup that demands an automatic sell, but it does argue against chasing the stock aggressively until financing and spending visibility improve. The business itself still appears fundamentally intact, with fast cloud growth and a massive backlog pointing to durable demand, and Wall Street still sees sizable upside, so a full exit looks premature unless the risk profile no longer fits. Most likely, shares will stay volatile in the near term and could drift sideways or lower on any new capex or funding headlines. However, the bias over the next six to 12 months still tilts higher if Oracle proves it can fund capacity expansion without stressing the balance sheet.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart