The Dogs of the Dow has long been a simple, rules-based approach to equity investing, built around owning the highest-yielding stocks in the Dow Jones Industrial Average. Each year, investors rotate into the 10 Dow components with the highest dividend yields, based on the assumption that these stocks are temporarily out of favor and may rebound over time.

While the strategy has traditionally focused on dividends and capital appreciation, it can be enhanced by layering in options income. By systematically selling covered calls against these high-yielding, large-cap stocks, investors can potentially increase cash flow, reduce volatility, and create a more consistent income stream without abandoning the core Dogs of the Dow framework.

In this article, I’ll walk through how covered calls can be applied to the current Dogs of the Dow lineup, the types of strikes and expirations I typically look at, and the trade-offs investors should understand before implementing this approach.

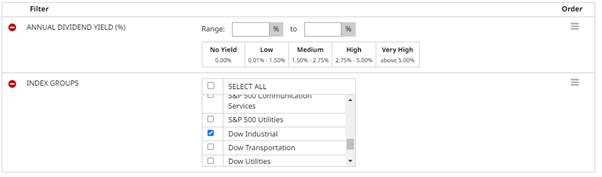

So, what are the 10 highest yielding stocks in the Dow right now? We can use the Stock Screener to find all the Dow stocks and include a column for Annual dividend yield.

Then for the results, we select Filter View and sort by Dividend Yield.

So our 10 Dogs of the Dow for 2026 are:

Verizon (VZ)

Chevron (CVX)

Merck & Company (MRK)

Proctor & Gamble (PG)

Amgen (AMGN)

Coca-Cola Company (KO)

Nike (NKE)

Unitedhealth Group (UNH)

Home Depot (HD)

Johnson & Johnson (JNJ)

As shown in the above table, there are some very healthy dividend yields on offer. One way to further enhance this yield is by selling covered calls.

Some people like to sell monthly covered calls, but that can require ongoing maintenance and monitoring. Today, we’re going to look at a yearly covered call for those that like a more set and forget approach.

Honeywell Yearly Covered Call Example

Let’s use the first stock on the list, Verizon, and look at an example.

Buying 100 shares of Verizon would cost around $4,00. The December 18, 2026, call option with a strike price of $40 was trading on Monday for around $2.75, generating $275 in premium per contract for covered call sellers.

Selling the call option generates an income of 7.3% in 361 days.

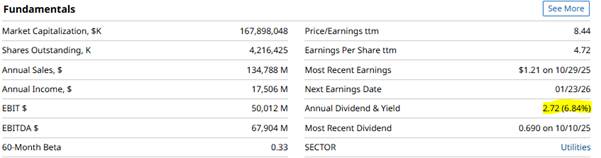

That doesn’t include dividends. Verizon is estimated to pay around $2.72 in dividends over the next 12 months which would increase the income potential by 6.84% per annum.

Let’s look at another example using Chevron.

Chevron Yearly Covered Call Example

Buying 100 shares of CVX would cost around $14,980. The December 19, 2026, call option with a strike price of $160 was trading yesterday for around $8.55, generating $855 in premium per contract for covered call sellers.

Selling the call option generates an income of 6.05% in 361 days, equalling around 6.12% annualized.

That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $160?

If CVX closes above $160 on the expiration date, the shares will be called away at $160, leaving the trader with a total profit of $1,875 (gain on the shares plus the $855 option premium received). That equates to a 13.27% return, which is 13.42% on an annualized basis.

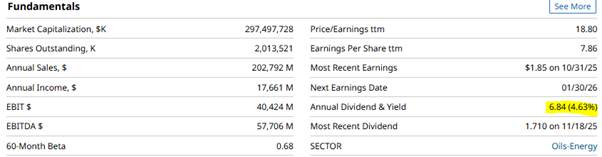

That doesn’t include dividends. CVX is estimate to pay around $6.84 in dividends over the next 12 months which would increase the income potential by 4.63% per annum.

Selling covered calls in 2026 on the Dogs of the Dow stocks, could be a great strategy for generating income and building long term wealth.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dogs of the Dow Enhanced Income Strategy with Covered Calls

- This Michael Burry Stock Spiked on a $1B Activist Stake. How Our Top Analyst Found the Trade Early.

- Palo Alto Networks Stock Is Down But Not Out - Worth Buying PANW Here?

- Valero (VLO) Stock Just Triggered a Rare Quant Signal the Options Market Is Missing