Valued at $274.3 billion by market cap, Lam Research Corporation (LRCX) is a leading California-based supplier of advanced semiconductor manufacturing equipment and services, specializing in critical wafer fabrication processes such as etching, deposition, and wafer cleaning. Founded in 1980, the company plays a central role in enabling the production of increasingly complex and miniaturized chips used across data centers, mobile devices, automotive electronics, and AI-driven applications.

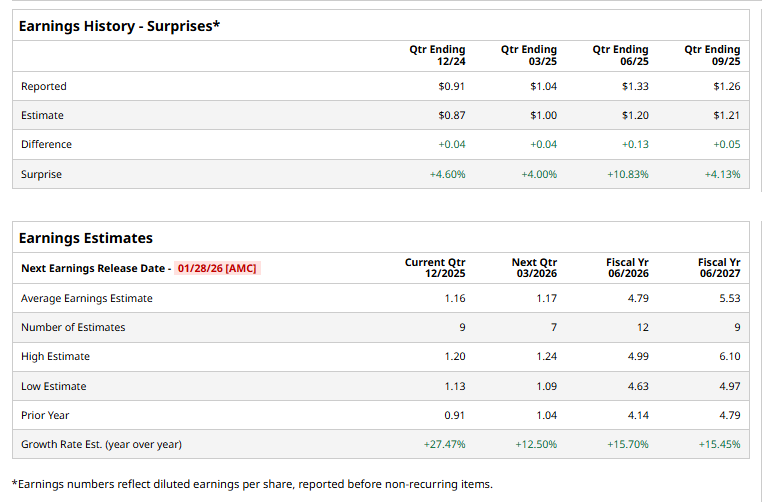

The semiconductor giant is expected to announce its fiscal second-quarter earnings for 2026 after the market closes on Wednesday, Jan. 28. Ahead of the event, analysts expect LRCX to report a profit of $1.16 per share on a diluted basis, up 27.5% from $0.91 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports, which is impressive.

For the current year, analysts expect LRCX to report EPS of $4.79, up 15.7% from $4.14 in fiscal 2025.

LRCX shares have surged a whopping 183.4% over the past year, significantly outperforming the S&P 500 Index’s ($SPX) 17.7% gains and the Technology Select Sector SPDR Fund’s (XLK) 25% gains over the same time frame.

Shares of Lam Research jumped 8% on Jan. 9 after The Goldman Sachs Group, Inc. (GS) lifted its price target to $180 from $160 and reiterated a “Buy” rating, citing improving fundamentals across the semiconductor industry. Sentiment was further bolstered by Mizuho Financial Group, Inc.’s (MFG), which highlighted wafer fabrication equipment as a key growth segment heading into 2026. The rally unfolded amid a broader surge in chip stocks, driven by reports of strong global semiconductor sales in late 2025 and optimistic industry forecasts.

Analysts’ consensus opinion on LRCX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 31 analysts covering the stock, 20 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and nine give a “Hold.” While LRCX currently trades above its mean price target of $173.01, the Street-high price target of $265 suggests an upside potential of 21.4% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart