It’s hard to imagine Berkshire Hathaway (BRK.A) without Warren Buffett as CEO, but that’s today’s reality. The legendary “Oracle of Omaha” retired at the end of 2025 at age 95, capping a magnificent 60-year career in running the famed conglomerate.

Buffett is still around, of course, as the Chairman at Berkshire Hathaway, but he no longer has day-to-day responsibilities, as those have been passed down to new CEO Greg Abel. And it’s only natural to wonder how the company’s investment philosophy will change — or if the company will alter some of its long-time positions.

For example, one of Berkshire Hathaway’s biggest positions is American Express (AXP). Berkshire owns a 22% stake in the credit card company, accounting for 151.6 million shares. The position, which is valued at $58.1 billion, accounts for about 18% of Berkshire Hathaway’s mighty $316 billion investment portfolio.

What’s the investment thesis for American Express in 2026? Let’s take a closer look.

About American Express Stock

New York-based American Express is a credit card company that caters to higher-end travelers and business clients. It has the distinction of being one of Buffett’s earliest and best bets — Buffett invested in 1964 after a scandal regarding salad oil inventories caused the stock price to plummet. Buffett invested $13 million in the company when shares were valued at $30 and gained a 124% return in two years.

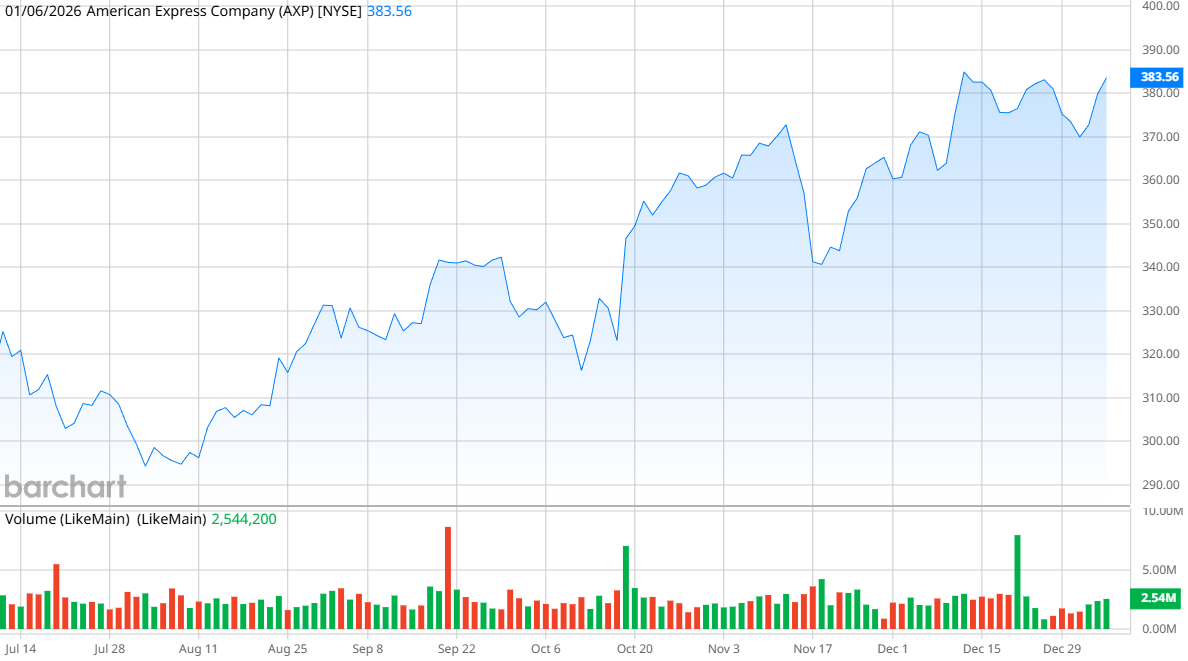

Shares of American Express are up 27% in the last year, outperforming competitors Mastercard (MA) and Visa (V), which are both up 13% over the same period. AXP stock has also performed better than the S&P 500 ($SPX), which has shown a 17% gain over the same period.

Interestingly, American Express is also cheaper than both Mastercard and Visa. AXP has a price-to-earnings (P/E) ratio of 25.7 times versus a P/E of 36 times for Mastercard and 31 times for Visa. Therefore, you can achieve better performance with American Express stock at a more affordable valuation.

American Express also pays a dividend of $3.28 annually, with quarterly payments that are currently $0.82 per share. The dividend yield is only 0.87%, but American Express’ dividend has grown notably in the last three years.

American Express Beats on Earnings

American Express reported solid earnings for the third quarter, with revenue of $18.4 billion up 11% from a year ago. Net income of $2.9 billion was up 16% year-over-year (YOY), and EPS of $4.14 beat analysts' expectations of $3.86, up 19% from a year ago.

Earnings were fueled by the company’s relaunch of its business and consumer platinum cards, which carry an annual fee of $895, an increase of $200 per year. American Express offers $3,500 in annual benefits on purchases to cardholders to make up for the fee, including credits with Uber (UBER), Lululemon (LULU), Adobe (ADBE), and more.

One goal of the refresh was to target younger cardholders — specifically millennial and Gen Z customers — an effort that seems to be paying off. American Express reported that it saw a 10% YOY increase in transactions, but the number of transactions per customer was 25% greater for millennial and Gen Z customers.

“The successful launch of our updated U.S. consumer and business platinum cards reinforces our leadership in the premium space,” CEO Stephen Squeri said. “The initial customer demand and engagement exceeded our expectations, with new U.S. platinum account acquisitions doubling compared to pre-refresh levels.”

American Express also profits from another revenue stream not available to either Mastercard or Visa — it provides direct loans to its customers.

Management issued full-year guidance for revenue growth between 9% and 10%, up from its previous guidance of growth from 8% to 9%. It also projected EPS in a range from $15.20 to $15.50.

What Do Analysts Expect From AXP Stock?

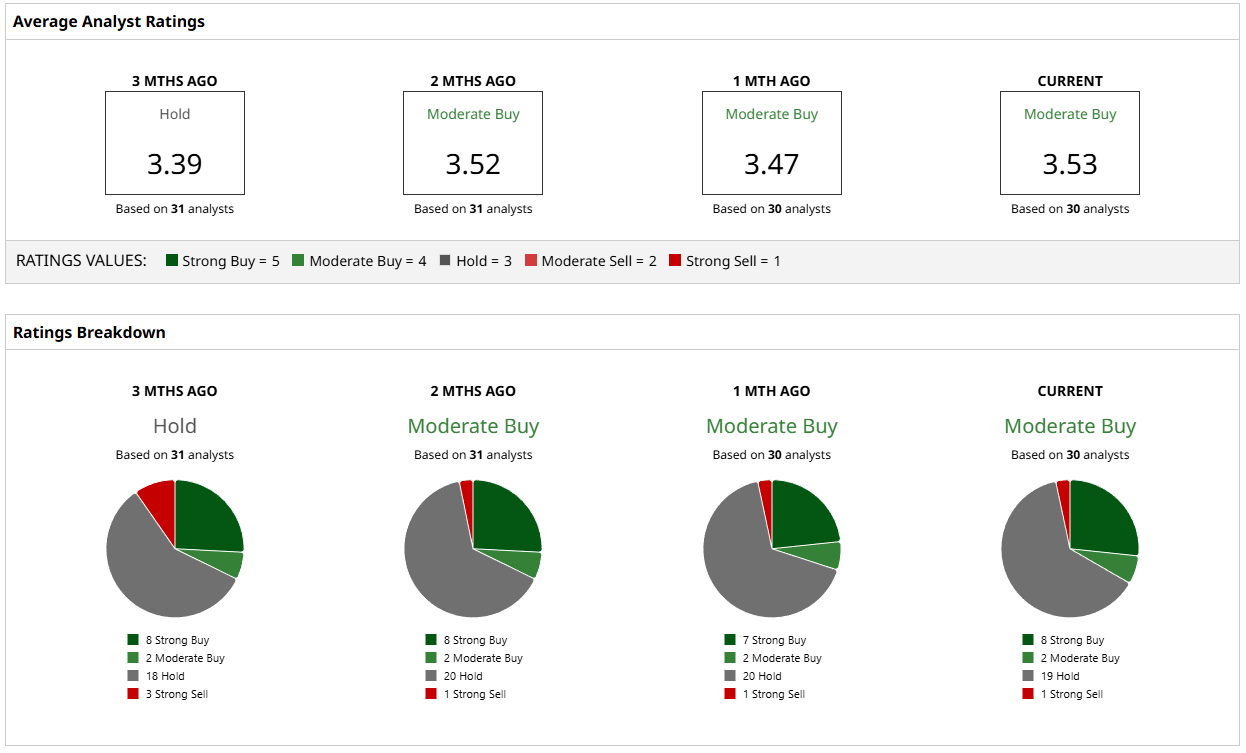

Analysts are generally bullish on AXP, but there’s some caution as well. Of the 30 analysts covering American Express stock, eight analysts have a “Strong Buy” rating, two analysts have a “Moderate Buy,” 19 suggest a “Hold” rating, and only one has a “Strong Sell” rating.

Notably, the mean price target of $366.04 represents a 5% potential drop from the current stock price. The most bullish price target of $462 suggests a 20% potential gain, while the low target of $280 warns of a possible 27% drop from here.

The Bottom Line

How should you play AXP stock now? Considering that this is a core holding, I wouldn’t expect Berkshire Hathaway to back away from the stock now. It has been too profitable, too consistent, and there are too many tailwinds to ignore — particularly in today’s economy. Moody’s Analytics reports that consumers in the top 10% income bracket account for about half of total spending, and American Express is ideally situated to benefit from that spending.

American Express’ multiple revenue streams — card fees, transactions, and loans — make it an ideal credit card stock to own for the long term.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart