Block, Inc. (XYZ), headquartered in Oakland, California, builds ecosystems focused on commerce and financial products and services. With a market cap of $34.5 billion, the company develops a payments platform aimed at small and medium businesses that allows them to accept credit card payments and use tablet computers as payment registers for a point-of-sale system.

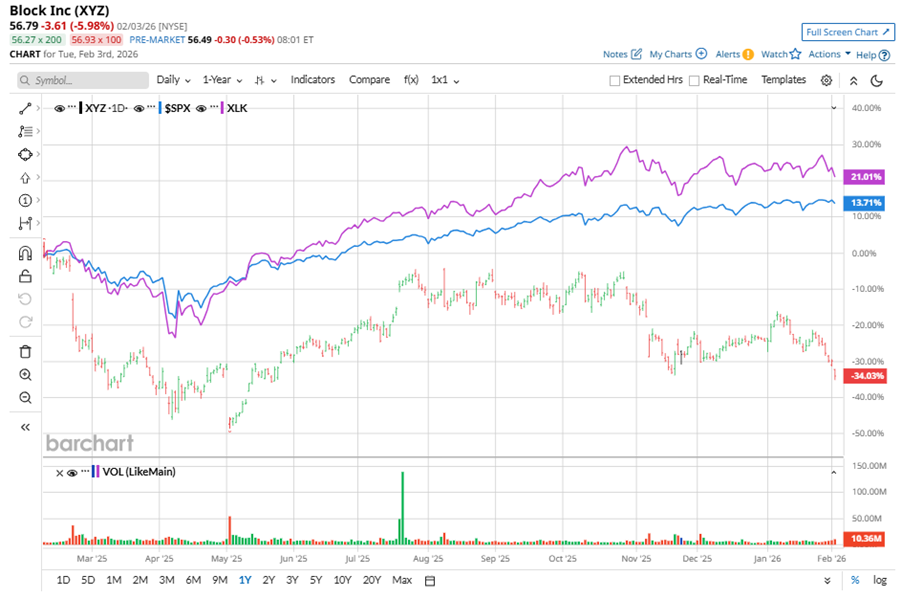

Shares of this payments platform have notably underperformed the broader market over the past year. XYZ has declined 37% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, XYZ’s stock is down 12.8%, compared to the SPX’s 1.1% rise on a YTD basis.

Narrowing the focus, XYZ’s underperformance is also apparent compared to the Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained about 24.8% over the past year. Moreover, the ETF’s 1.3% losses on a YTD basis outshine the stock’s double-digit dip over the same time frame.

Block's shares have struggled, weighed down by soft consumer spending in its Cash App business. Weak discretionary spending, tough competition, and a tricky macro environment have investors worried about growth picking up pace.

For the current fiscal year, ended in December, analysts expect XYZ’s EPS to decline 75.1% to $0.84 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

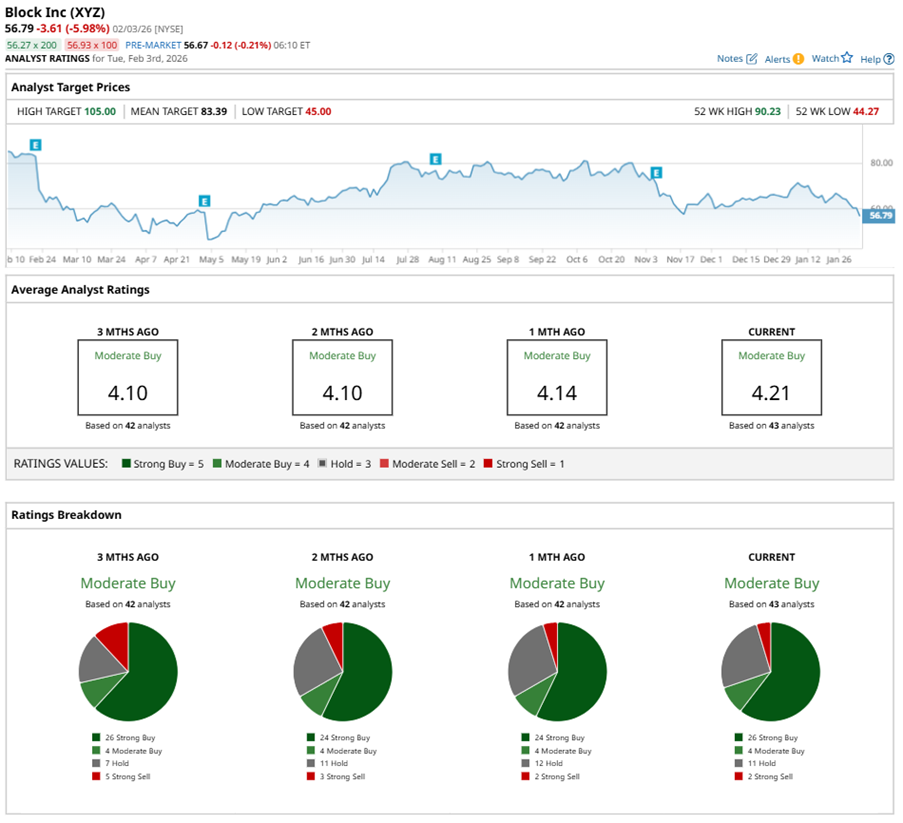

Among the 43 analysts covering XYZ stock, the consensus is a “Moderate Buy.” That’s based on 26 “Strong Buy” ratings, four “Moderate Buys,” 11 “Holds,” and two “Strong Sells.”

This configuration is more bullish than a month ago, with 24 analysts suggesting a “Strong Buy.”

On Jan. 26, Cantor Fitzgerald initiated coverage of XYZ with an “Overweight” rating and $87 price target, implying a potential upside of 53.2% from current levels.

The mean price target of $83.39 represents a 46.8% premium to XYZ’s current price levels. The Street-high price target of $105 suggests an ambitious upside potential of 84.9%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Palantir CEO Alex Karp Says ‘Inexplicable Growth in Revenue, but Not Inexplicable Growth in Customers’ Is Ahead. What Does That Mean for PLTR Stock?

- FuboTV Stock Plunges Deep Into Oversold Territory on Reverse Stock Split News. Should You Buy the Dip?

- Even More Layoffs Are Coming at Amazon. What Does That Mean for AMZN Stock?

- Dear Google Stock Fans, Mark Your Calendars for February 4