President Donald Trump is now openly pushing to make homeownership more attainable by calling for lower mortgage rates and directing the federal government to buy $200 billion in mortgage bonds, a step he argues will help pull borrowing costs down from current levels near 6% on a 30‑year loan.

He is also urging Congress to cap credit card interest rates at 10% for a year, down from an average near 21%, to help households save faster for down payments. At the same time, he is seeking to ban large institutional investors from buying single‑family homes so ordinary buyers are not competing with deep‑pocketed landlords.

Amid this news, one established homebuilder has been thrust into the spotlight — Lennar Corporation (LEN). Lennar shares jumped roughly 8% in the past month, following many of these headlines. Still, the bigger question is whether this income‑paying name now offers a compelling way to gain exposure. Let’s dive in.

LEN’s Income Backed by Real Numbers

Lennar Corporation is a Miami‑based homebuilder designing and constructing affordable, move‑up, and active‑adult homes across the United States. Its equity base stands near $27.9 billion, and it returns cash through a forward annual dividend of $2 per share, which currently implies a yield of about 1.8%.

At a share price of $115 as of this writing on Feb. 5, LEN is up about 11% year‑to‑date but down 10% over the last 52 weeks.

The forward price‑to‑earnings (P/E) multiple of 17.39x versus a sector median of 18.20x, alongside a price‑to‑book (P/B) ratio of 1.28x versus 2.67x, points to a modest discount.

Lennar's latest financial results, released on Dec.16, 2025, showed total sales of roughly $9.4 billion, up 6.33% year-over-year, while net income fell to about $490.2 million, down 17.04%. The company reported adjusted earnings per share (EPS) for the quarter of $2.03 versus a consensus estimate of $2.23, an 8.97% shortfall, which reflects tighter margins and incentives needed to keep homes moving.

The report indicated operating cash flow of roughly $216.8 million for November 2025, more than doubling with 114.05% growth. While overall net cash flow was negative at about $1.16 billion, it still represented a 64.14% improvement from the prior year as LEN invested heavily in land, communities, and its pipeline.

Lennar Expands Affordable Housing Footprint

Lennar is leaning directly into the affordability theme. The company recently began selling homes at River Bridge Ranch, a single‑family community in San Marcos, Texas, aimed at cost‑conscious buyers. Homes there range from 1,200 to 2,780 square feet, with three to five bedrooms and two to three bathrooms. Pricing starts in the mid‑$200,000 range. Each home comes with a standard features package included in the base price, which lines up with the kind of attainable product likely to benefit.

Lennar has also been active on the capital‑allocation side. On Nov. 26, 2025, it reported final results of an exchange offer covering up to 33,298,764 shares of Millrose Properties Class A stock, about 20% of Millrose’s outstanding shares, in exchange for Lennar Class A common stock. The offer, which expired on Nov. 21, 2025, was oversubscribed, with 85,296,924 Lennar shares validly tendered and not withdrawn; 84,518,299 were subject to proration, and 778,625 were “odd‑lot” shares accepted in full.

Lennar’s Outlook Through Wall Street’s Lens

Lennar’s next big check‑in with the market lands on March 19, when it will report results for the quarter ending February 2026. Expectations here are deliberately conservative. The current quarter EPS estimate sits at $0.96 versus $2.14 earned in the same period a year earlier, pointing to an estimated year‑over‑year decline of about 55.14%. Looking a step ahead, for the quarter ending May 2026, the average EPS estimate is $1.41, down from $1.90 last year and implying a year‑over‑year drop of roughly 25.79%.

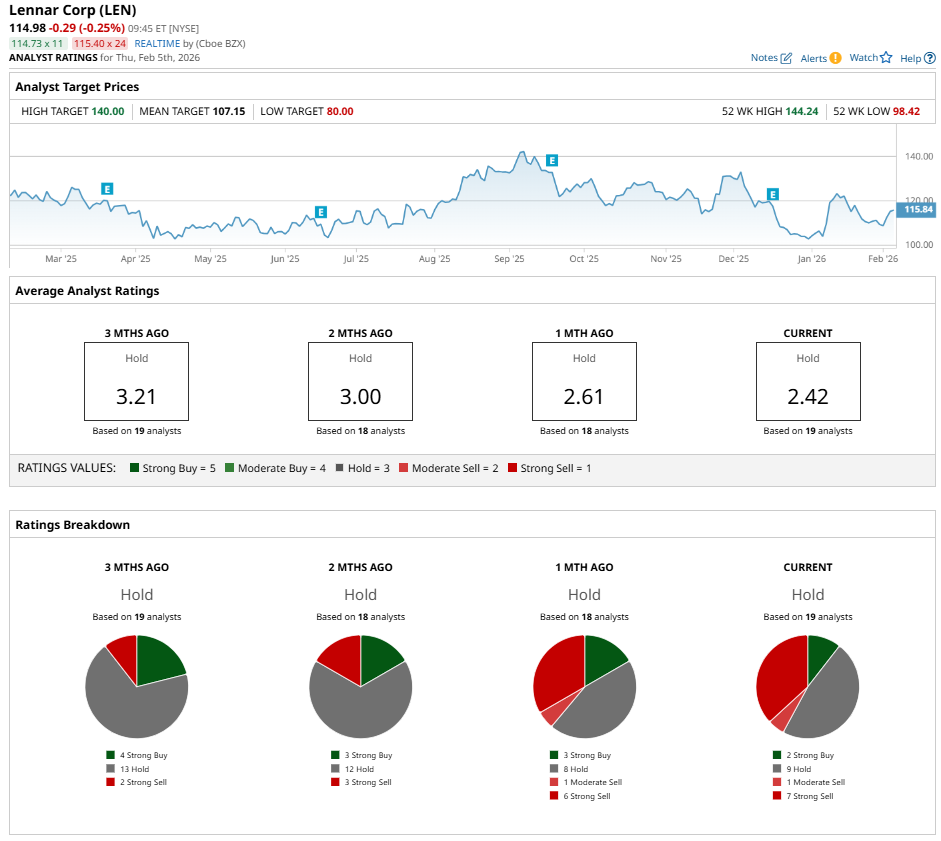

On the rating side, the consensus stance from 19 analysts is a “Hold” — not an outright bullish call but far from a bearish one. The average price target stands at $107.15, compared with the current share price, which implies downside from here.

Conclusion

Trump’s renewed focus on housing affordability makes Lennar look like a reasonable dividend name to own rather than avoid. The business is still growing, cash flow is improving, and the balance sheet moves plus affordable communities point in the right direction. Near term, the stock may cool or drift sideways after the recent jump on Trump home headlines. Over the next year or two, the risk-reward still appears tilted slightly higher as policy support and fundamentals gradually converge.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Dividend Stock to Buy Now as Trump Tackles Housing Affordability

- Nio Says Profitability Is Just Around the Corner. Should You Buy NIO Stock Here?

- As Analysts Forecast 50% Upside, Is Now the Time to Buy the Dip in AMD?

- Is There a Light at the End of the Tunnel for Qualcomm Stock? What Options Data, Technicals Tell Us.