Marcus by Goldman Sachs Ranks Highest in Personal Loan Satisfaction

The personal loan marketplace has roared back to life after nearly grinding to a halt during the height of the pandemic. According to the J.D. Power 2022 U.S. Consumer Lending Satisfaction Study,SM released today, a combination of competitive rates, easy access and a variety of options has driven widespread consumer adoption of personal loans, with some of the most significant growth occurring among financially vulnerable1 consumers who are accessing these products to get through a challenging economic period.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220525005188/en/

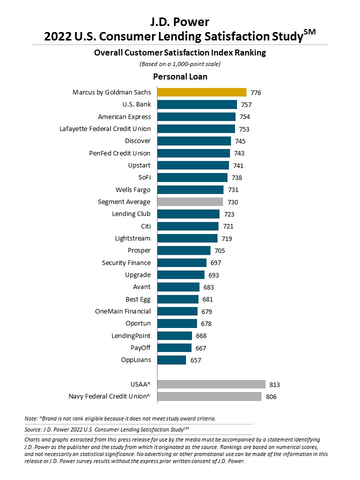

J.D. Power 2022 U.S. Consumer Lending Satisfaction Study (Graphic: Business Wire)

"Increasingly, personal loans are filling the void left by the end of pandemic-era relief efforts, which introduces some important new dynamics for the banks, credit card companies and FinTechs at the center of this marketplace,” said Craig Martin, managing director and global head of wealth and lending intelligence at J.D. Power. "While customers are largely satisfied with these products and the market is continuing to grow, it is important for lenders to ensure the experiences they deliver are matching the promises they are making to support improved financial health.”

Following are key findings of the 2022 study:

- Personal loans as lifelines for financially vulnerable: Nearly two in five (38%) of personal loan customers are classified as financially vulnerable. The top three reasons for obtaining a personal loan focus on addressing debt (including debt consolidation), lower interest rate on current debt and lower monthly payment on existing debt. Some brands that cater to higher risk customers have nearly double the average number of financially vulnerable customers.

- Gateway to other financial products: Overall customer loyalty with personal loan products is high, with 61% of loan customers indicating that they are likely to use their lender again. This could create expanded opportunities for lenders that historically only offered loans as these companies expand their product offerings with checking, savings, credit card and investment options.

- Advertising plays key role in adoption, but not all ads created equal: Nearly half (47%) of consumers indicate that an advertisement prompted them to consider a personal loan. However, the range of advertising effectiveness is wide, with some brands driving just 31% of new business through advertising and others generating 56% of their business through advertising.

- Men and women respond differently: The study also finds significant differences in the responses of men and women to specific brand experiences. At the individual brand level, overall satisfaction with lenders varies by at least 25 points (on a 1,000-point scale) between men and women among more than half of the lenders in the study and by more than 50 points for nearly one-fourth of the brands.

“As the personal loan market continues to grow rapidly, it is critical to note that there is not a one-size-fits-all option that can deliver all things to all consumers,” said Tom Lawler, head of consumer lending intelligence at J.D. Power. “We’re seeing a clear phenomenon in which industry-level averages give one perspective, but the experience of certain customer groups at the brand level can be materially different. The most successful firms have a clear understanding of the different needs and expectations of their target clients and optimally invest resources to meet or exceed the expectations of those different groups.”

Study Ranking

Marcus by Goldman Sachs (776) ranks highest among personal loan lenders in overall customer satisfaction. U.S. Bank (757) ranks second and American Express (754) ranks third.

The U.S. Consumer Lending Satisfaction Study was redesigned for 2022. It measures overall customer satisfaction based on performance in four factors (in alphabetical order): application; loan management; shopping; and terms. The study is based on responses from 5,269 personal loan customers and was fielded from January through March 2022.

For more information about the J.D. Power U.S. Consumer Lending Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-consumer-lending-satisfaction-study

See the online press release at http://www.jdpower.com/pr-id/2022056.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power measures the financial health of any consumer as a metric combining their spending/savings ratio, creditworthiness and safety net items like insurance coverage. Consumers are placed on a continuum from healthy to vulnerable.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220525005188/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com