Four years since launch, Daffy demonstrates both scale and impact—growing more than 4x faster than the industry as members give 3.3x more over time

Daffy, the modern donor-advised fund (DAF) platform designed to help people be more generous, more often, today released its 2025 Year in Review, reporting record growth across membership, contributions, assets, and charitable distributions. In just over four years since launch, Daffy now ranks among the top 10 donor-advised fund providers in the United States by number of accounts.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260129464209/en/

Daffy, the modern donor-advised fund (DAF) platform designed to help people be more generous, more often, today released its 2025 Year in Review, reporting record growth across membership, contributions, assets, and charitable distributions. In just four years since launch, Daffy now ranks among the top 10 donor-advised fund providers in the United States by number of accounts.

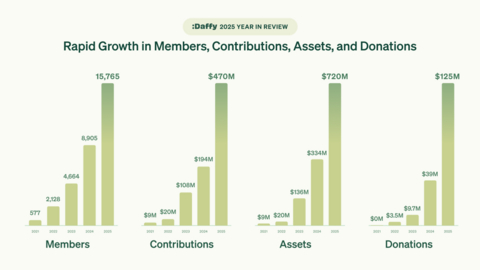

Daffy now supports more than 16,000 donor-advised fund accounts, making it larger than 99% of DAF providers nationwide and placing it ahead of many long-established providers such as Bank of America, Goldman Sachs, T. Rowe Price, and Raymond James.2 In 2025, Daffy members set aside more than $470 million for charity, bringing total charitable assets to over $720 million, and distributed more than $125 million to registered nonprofits.

"Daffy was built around a simple idea that when people set money aside for charity in advance, they give more," said Adam Nash, Co-founder and CEO of Daffy. "A little over four years in, the data is clear. A donor-advised fund platform designed from the ground up for giving can scale quickly and meaningfully increase giving over time.”

Record Growth Across Key Metrics

According to the 2025 Annual DAF Report from the Donor-Advised Fund Research Collaborative, donor-advised funds across the industry grew 18% year-over-year. Daffy grew more than four times faster than the industry average.

- Membership: Over 16,000 unique DAF accounts, placing Daffy in the Top 10 nationally

- Contributions: More than $470 million set aside for charity

- Assets: Over $720 million in charitable assets

- Donations: More than $125 million distributed to charities

Beyond topline growth, behavioral data shows sustained engagement. Across every quarterly cohort since Q1 2022, Daffy members have donated an average of 3.3 times more than in the quarter they joined. More than 45% of all donations are recurring, providing charities with predictable, ongoing support. Donations range from a median of $100 to single gifts of $5 million, demonstrating the platform’s ability to support giving at every level.

Daffy members also continued to give at a markedly higher rate than the broader DAF industry. In 2025, Daffy achieved a 55% payout rate, meaning that for every dollar members set aside in 2024, more than half was distributed to charities in 2025. This is more than double the 25% industry average reported by the Donor-Advised Fund Research Collaborative.3

Stock-Based Giving Fuels Record Growth

Total contributions to Daffy in 2025 reached $470 million, representing 141% year-over-year growth, driven primarily by stock contributions. In December 2025 alone, members contributed more than $200 million—exceeding total contributions for all of 2024 in a single month.

Daffy members contributed more than $213 million in publicly traded stock, a 230% increase from 2024, as awareness grows around the tax advantages of donating appreciated securities.

Private stock contributions also accelerated significantly. Through Daffy's Private Stock Donation Program and Daffy for Work, members contributed over $90 million in private company stock in 2025, expanding access to a form of giving historically limited to founders and senior executives.

"We believe that over the next decade, every private company conducting a tender offer or structured secondary transaction will add a private stock donation program," Nash said. "It costs the company nothing, helps employees with taxes, and could free up billions of dollars for charitable causes."

Tax-Free Investment Growth Creates Additional Charitable Assets

Daffy ended 2025 with more than $720 million in charitable assets, far exceeding its original goal. This growth was driven by a sharp increase in appreciated stock contributions and $41 million in tax-free investment growth.

Over the past four years, tax-free investment growth on Daffy has generated more than $100 million in additional charitable assets.

Daffy offers a unique and highly disruptive business model in the industry. Unlike most donor-advised funds, Daffy does not charge asset-based or investment management fees, allowing more money to go directly to charitable causes. Members can choose from 17 pre-approved portfolios, recommend custom portfolios from more than 500 ETFs, and through Custom Liquidation, even recommend holding individual stocks for a period of time before they are sold.

Daffy Reaches Top 10 Ahead of Legacy Providers

Daffy's rise to Top 10 status places it ahead of DAF providers including Bank of America, Goldman Sachs, T. Rowe Price, and Raymond James—all of which launched their platforms in the early 2000s.

Among the 1,485 DAF providers nationwide4, many legacy platforms serve relatively small numbers of high-net-worth donors. For example, Silicon Valley Community Foundation manages approximately $9.5 billion in charitable assets from an estimated 1,000 donors.5

Daffy's approach differs fundamentally, with no account minimums, flat-rate pricing, and innovative features such as native crypto, private stock donations, matching campaigns, custom portfolios, and custom liquidation that are not offered by traditional donor-advised funds. Since launch, Daffy has received more than $125 million in DAF transfers from other providers. The median transfer is approximately $10,000, though transfers exceeding $1 million are common.

About Daffy

Named one of Fast Company’s “Most Innovative Companies of 2024,” Daffy is the Donor-Advised Fund for You™—a modern, fast-growing platform for charitable giving that helps people be more generous, more often. Daffy removes the barriers to giving by making it simple for anyone to set money aside for charity, invest those funds tax-free, and donate to over 1.7 million U.S. charities, all with no minimums and industry-low fees. Like a 401(k) for giving, Daffy turns giving into a habit through recurring contributions, recurring donations, and innovative tools that inspire giving year-round. It’s also the first DAF to build family giving features and public matching campaigns, so the members can inspire their loved ones and friends to give. Since launching in September 2021, the Daffy community has grown to tens of thousands, with members’ account sizes ranging from $10 to over $50M. Daffy is a 501(c)(3) nonprofit (EIN: 86-3177440), like all donor-advised fund providers. To give with Daffy, visit daffy.org or search “Daffy” in the App Store.

Disclosures

All Daffy figures in our 2025 Year in Review are based on initial unaudited results from 1/1/2025 to 12/31/2025. Final audited financials will be available in our 2025 Form 990 later this year. Audited financials from 2021, 2022, 2023, and 2024 are available upon request.

1Rankings use account totals from The Annual DAF Report 2025 (Donor-Advised Fund Research Collaborative) and 2025 projections for other providers derived from their 2022–2024 CAGR. Daffy’s ranking is based on data through January 2026.

2Rankings use account totals from The Annual DAF Report 2025 (Donor-Advised Fund Research Collaborative) and 2025 projections for other providers derived from their 2022–2024 CAGR. Daffy’s ranking is based on data through January 2026.

3Heist, H. D., Vance-McMullen, D., Williams, J., Shaker, G. G., & Sumsion, R. M. (2025). The Annual DAF Report 2025. Donor-Advised Fund Research Collaborative. https://doi.org/10.4087/XUGU3656

4Total number of DAF providers by Heist, H. D., Vance-McMullen, D., Williams, J., Shaker, G. G., & Sumsion, R. M. (2025). The Annual DAF Report 2025. Donor-Advised Fund Research Collaborative. https://doi.org/10.4087/XUGU3656

5Silicon Valley Community Foundation data from The Annual DAF Report 2025.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260129464209/en/

In just four years since launch, Daffy now ranks among the top 10 donor-advised fund providers in the United States by number of accounts.

Contacts

Chelsea Paul

VP of Marketing & Communications

press@daffy.org