Some stocks are benefitting from the market’s ‘risk-on’ surge more than others — and Bowlero Corp. (NYSE: BOWL) is one of them.

Some stocks are benefitting from the market’s ‘risk-on’ surge more than others — and Bowlero Corp. (NYSE: BOWL) is one of them.

Over the past two months, shares of the world’s largest bowling center operator have rallied more than 50%. Compare this to the S&P 500, which is up approximately 7%. Two years removed from its initial public offering (IPO), Bowlero is getting a second wind while many former special purpose acquisition companies (SPACs) continue to languish.

The resurgence may ‘strike’ some as odd given the myriad of high-tech entertainment options available these days — Dave & Busters, IMAX movies, and virtual reality (VR) headsets to name a few. In reality, bowling appears to be as popular as ever.

Last month, the U.S. Bowling Congress (USBC) announced that registrations for the 2024 U.S. Open Championships in Las Vegas surpassed 10,700 teams. It’s the most the event has seen since 2012. And it’s not just professionals who are enjoying the sport.

Over 30 million people visit a Bowlero location each year. A glance down the lanes reveals most are amateurs. The founder-led business is an under-the-radar beneficiary of the experiences over goods trend and Americans’ lasting thirst for out-of-home entertainment in the post-pandemic world.

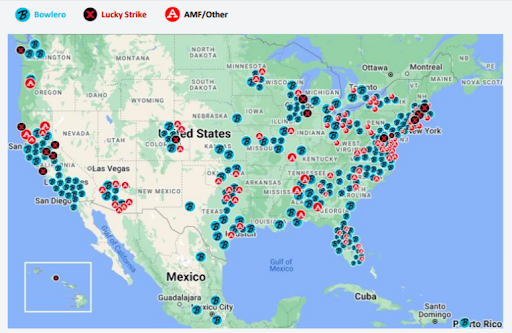

Bowlero owns and operates 350 bowling centers across North America through three core brands — Bowlero, Lucky Strike and AMF. This is roughly six times the number of centers owned by its next largest competitor, Main Event. Translation: Bowlero has a commanding share of the market, an attractive attribute for any equity investment.

The venues appeal to a broad audience that spans ages, income levels and other demographics. They offer consumers a fun, modernized experience at an affordable price. It makes for a resilient (albeit modest growth) business model that tends to perform well throughout the economic cycles.

For an activity that’s believed to have originated around 300 BC when German monks rolled rocks into a kegel (hence the bowler nickname ‘kegler’), bowling has come a long way. Neon lighting, automated scoring, booming music and engaging video screens are now the norm. Yes, bowling has become pretty high-tech itself. In fact, Bowlero is ‘aiming’ to become a digital-led business that attracts younger and older generations alike.

The company also owns the Professional Bowling Association (PBA), which it acquired in 2019. While other major league sports like the NFL and NBA boast eye-popping viewerships and marketing deals, bowling is holding its own. In 2023, more than 70 hours of original PBA programming was viewed by 13.6 million people on FOX and FS1. Ratings increased 10% including an 11% jump in interest from men ages 18 to 34.

Bowlero is not just your grandpa’s bowling league.

Revenues surpass $1 billion

Bowlero’s 57% run since November 7th coincides with the company’s fiscal 2024 first quarter earnings release. For the three months ended October 1, 2023, revenue decreased 1% year-over-year (YoY) to $227.4 million but increased 53% from pre-pandemic levels. After recording a $33.5 million loss in the prior year period, the Richmond, Virginia-based company swung to an $18.2 million profit.

What Bowlero lost in YoY revenue it gained in market insights. Since Q1 is the company’s seasonally weakest quarter, it tested new promotions and bundled pricing. Although this led to lower same-store sales, it allowed management to get a better understanding of how customer segments respond to nuances like midweek and weekend prices. Given the rising importance of data analytics in gaining a competitive edge, the experiment could prove to be time well spent.

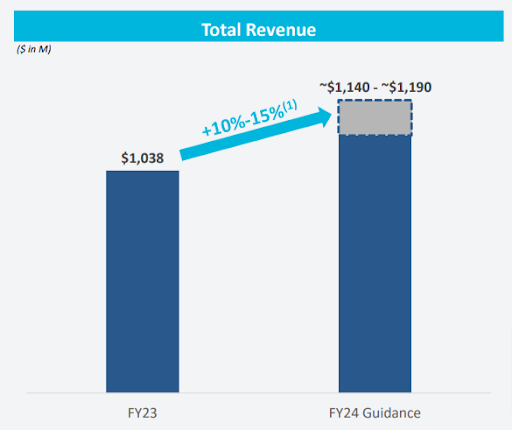

On top of a solid performance in a traditionally soft quarter, the market liked Bowlero’s outlook for the current year. Management expects revenue to grow 10% to 15% in fiscal 2024 to the $1.14 billion to $1.19 billion range. A key reason behind the anticipated growth is increasing revenue per location. After rising 14% to $3.2 million in fiscal 2023, average unit volumes started at a higher base in fiscal 2024. This is because the average revenue per customer is on the upswing. Guests are spending more on bowling, food and beverages and sideshow amusements.

One way Bowlero is gamifying the bowling experience is through its proprietary MoneyBowl lane-side kiosks. The skill-based app allows guests to win real money and rewards by tracking bowling performance. The better you bowl, the more you earn. The result: increased user engagement and visitation.

A compelling ‘roll-up’ strategy

Just as a bowling ball has three finger-pinching holes, Bowlero has a three-pronged growth strategy. At the center of the strategy — acquisitions.

Most of the company’s bowling center portfolio was built through the purchase of well-known chains and standalone businesses. Its latest takeout was Lucky Strike, which it snagged in September 2023 for $90 million in cash. The deal expanded Bowlero’s footprint to 36 states and gave it a new presence in several major markets like Boston, Chicago and Los Angeles. In its latest earnings release, the company stated it plans to “heavily reinvest in the business” this year, with some $160 million earmarked for additional acquisitions.

Bowlero’s roll-up strategy is perhaps its most attractive investment attribute. This is because bowling is still a highly fragmented market. The company estimates that there are 3,500 independent centers in North America, many of which are ripe for acquisition. With this being 10 times Bowlero’s already dominant portfolio, expect its proven M&A formula to continue knocking down pins.

Another pillar of the growth strategy is conversions. This involves upgrading existing facilities to match Bowlero’s targeted upscale image. At least 150 centers remain to be converted to the upscale brand, a capital investment that is expected to generate returns of 25% or more. In fiscal 2024 alone, $75 million has been allocated to updated flooring, lighting, paint, sound systems, arcades, signage, bars and restaurants.

The third growth component is new builds. Bowlero estimates that it has 200 new build opportunities in untapped marquee markets, including Denver, Miami, San Jose and even Beverly Hills.

Falling share count, bullish analysts

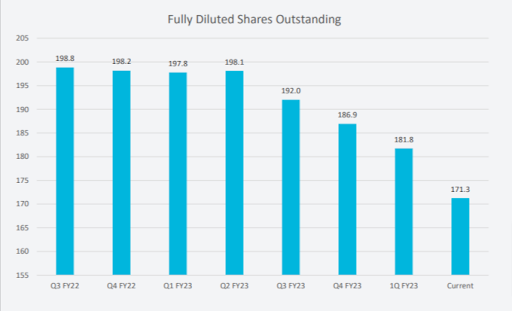

Bowlero does not currently pay a dividend but does provide shareholder value through stock buybacks. Since going public, the company reduced its share count by 14% to 171.3 million through the first quarter of fiscal 2024. As of November 1st, the share count was further reduced to 151.3 million. The current float, the number of shares available to trade, is significantly lower at 84.4 million. A decreasing share count offers value because it increases earnings per share (EPS).

Based on the consensus estimate for the current fiscal year EPS, Bowlero has a price-to-earnings (P/E) ratio of 28x. As far as profitable leisure facility companies go, this puts it in the middle of the pack. High-end gyms like Life Time Group Holdings and Xponential Fitness trade at 35x to 40x. Dave & Busters goes for 16x. Given Bowlero’s market leadership and vast opportunities to consolidate the space, a premium valuation closer to 35x to 40x is more realistic.

Bowlero’s undervalued nature has caught the attention of Wall Street. Last month, B.Riley Financial gave the company a Strong Buy rating and $19.00 price target, citing its sales track record and growth initiatives. That made it five firms in a row to call BOWL a buy since the fiscal Q1 report. In bowling lingo, that’s even better than a turkey!

Short squeeze potential

Typically, retail traders like to get behind a name that Wall Street loathes, but in the case of BOWL, they could easily jump on the bandwagon. That’s because the low float stock’s short squeeze potential is undeniable.

Approximately 21% of Bowlero’s float is held short. It is one of the most heavily shorted U.S. midcaps. Why are bears so down on bowling? Maybe it’s hard for them to fit their meaty paws into a ball. More likely, it could simply be a mistrust of former SPAC stocks, many of which have sunk below the key $10.oo share price level.

But for BOWL trading around $14.00, things are looking up — at least from a technical analysis perspective. On December 20th, a bullish megaphone bottom pattern emerged on the daily chart. Soon thereafter, the 20-day moving average crossed over the 200-day moving average (as shown in the chart below). If the news flow stays positive and trading volume picks up, BOWL could be in for a significant short-covering rally.

Bottom Line

As the bowling center ‘kingpin’, Bowlero is benefitting from demand for fun, out-of-home entertainment experiences and bowling’s digital rebirth. Its acquisition-driven growth strategy makes it a solid long-term investment strike, while its squeeze potential makes it a spare worth picking up.